July 4th, 2024 | 07:45 CEST

20,180 in the NASDAQ 100, the next record high is within reach! Breakout also at TUI, Saturn Oil + Gas, Lufthansa and dynaCERT

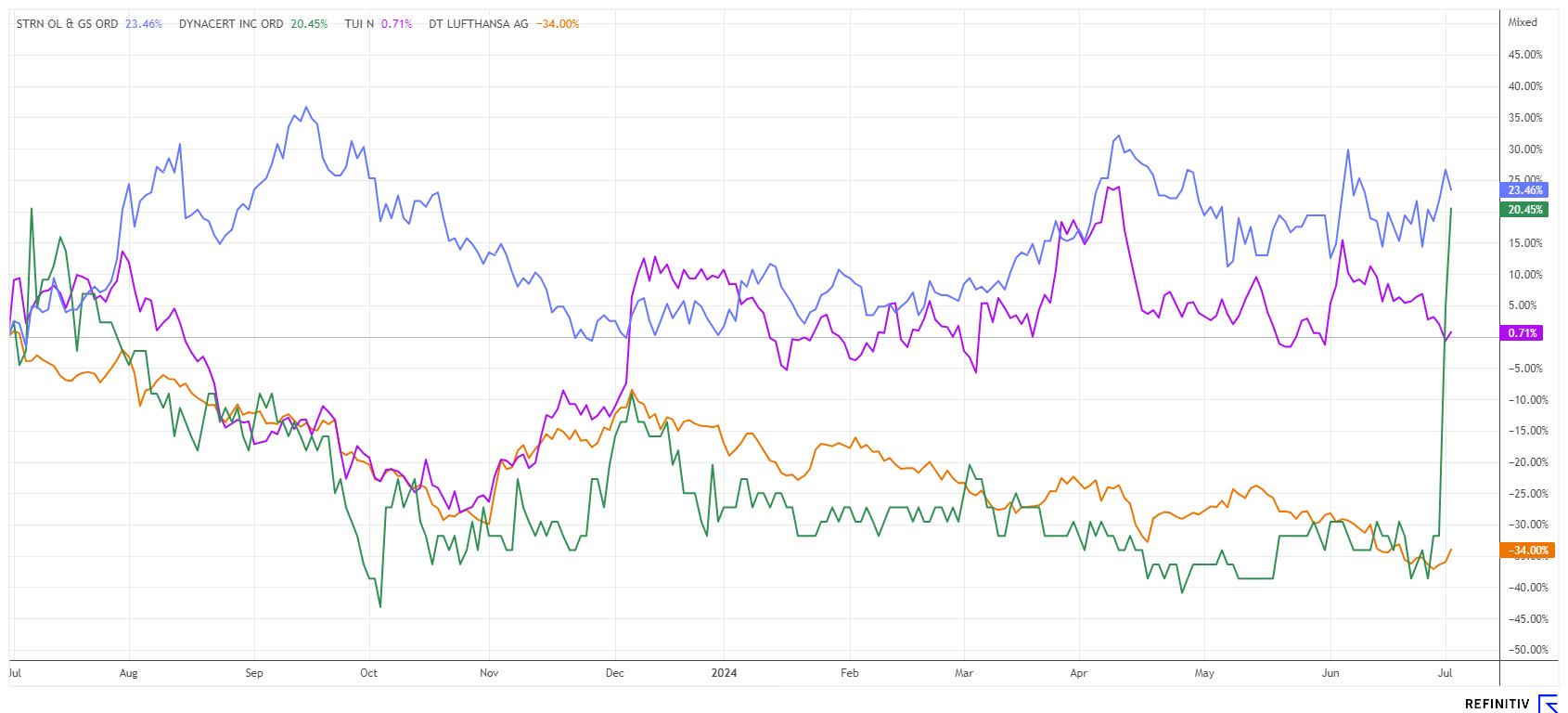

Sometimes, it takes a little longer, but sometimes, it happens without one even noticing. The travel stocks on the share price list are heading for a fully booked summer season, and debts have long since been repaid. Nevertheless, the mood is depressed - why is that? Saturn Oil & Gas has already made its third acquisition, and the share price is still moving sideways at a P/E ratio of 1.5! And the share price of dynaCERT, the long-criticized Canadian provider of hydrogen add-on devices for optimizing diesel combustion, for almost a year has bobbed between CAD 0.12 and CAD 0.15 - yesterday, it peaked at CAD 0.29, a premium of nearly 100% for loyal shareholders. Now, a detailed analysis is needed.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

Saturn Oil + Gas Inc. | CA80412L8832 , DYNACERT INC. | CA26780A1084 , TUI AG NA O.N. | DE000TUAG505 , LUFTHANSA AG VNA O.N. | DE0008232125

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

TUI and Lufthansa - Nobody understands the current weakness

The shares of the European tourism market leader TUI lost a lot of ground in June. Specifically, the vacation stock lost around EUR 1 from EUR 7.45 to EUR 6.45. Meanwhile, market participants thought the Hanover-based company had now put the worst behind it. The unrest surrounding the share price could also be the relocation from London to Frankfurt, as the investment banks Barclays and Deutsche Bank placed a total of 7.38 million TUI shares with new investors. This usually happens at a discount to the share price. The proceeds from the sale will go as compensation to those shareholders who have yet to exchange their British depositary receipts for original shares in the travel group in good time during the change of stock exchange. Short sellers are also said to have been spotted again. However, things are already looking better again in July. The shares are recovering slightly and preparing for the next breakout. The resistance line around EUR 6.80 is important.

The crane airline from Frankfurt has completely lost ground. The 12-month review shows a minus of 37%. At EUR 5.94, the share price is currently only 6% above the 3-year low of EUR 5.63. Then yesterday came the go-ahead from Brussels for the investment in the Italian airline ITA, but subject to conditions. Lufthansa's investment in the successor to the former Italian state airline Alitalia must not give it a dominant market position at Milan's Linate airport. Therefore, Lufthansa undertakes to relinquish some take-off and landing permits in Milan to give preference to other airlines. With this approval, the Lufthansa Group is further expanding its dominant position as the largest airline in Europe. At current prices of EUR 6.54 for TUI and EUR 5.94 for Lufthansa, we see attractive medium-term entry levels for both stocks.

Saturn Oil & Gas - A midsize producer has emerged here

The acquisition of the assets in Saskatchewan has been completed since mid-June. The deal size for Canadian Saturn Oil & Gas this time was CAD 525 million, increasing daily production by a further 10,000 barrels of oil equivalent (BOE) per day, bringing it to a new level of 38,000 to 40,000 BOE. The highlight is that the latest drilling fields are directly adjacent to the Company's existing plant base, which enables major operational savings and increases synergies in the logistics area.

With this acquisition, Saturn is taking the next development step towards becoming a "midsize producer" and catapulting itself into a CAD 1.5 billion strong oil and gas company. The financing is secured, providing the Canadians with significant interest relief. Calculated with a sharp pencil, the Company's interest expense remains more or less constant, but the amount borrowed has more than doubled. This results in substantial net savings over the next five years, money that can be used to develop new drilling sites. This will further increase production volumes and boost cash flow. With a WTI price forecast of USD 80, the Company continues to operate on sight. 75% of production is subject to financial derivatives, which ultimately correspond to the necessary interest expenditures.

Analysts have calculated that the total debt of CAD 856 million is roughly 1.5 times operating earnings for 2024. This means the Company can significantly reduce its debt in less than two years. Of course, certain parts of the cash flow should go into new development to secure the cash flow profile. All in all, there are hardly any oil and gas stocks in North America as undervalued as Saturn. Consequently, the analysts at Eight Capital have a "Buy" rating and a target price of CAD 7.35. First Berlin also has a positive opinion with a target of CAD 6.50, and Echelon Capital even raised its price target to CAD 7.50 at the end of June. As a reminder: SOIL shares are still trading at CAD 2.72 - that leaves a potential of almost 200%, according to the experts.

dynaCERT - A German manager sparks euphoria

Why dynaCERT has become the shooting star of hydrogen stocks in just one week can be counted on five fingers. First, it must be recognized that the stock has been trading in a narrow sideways range of CAD 0.12 to 0.16 for almost a year. The market is patiently awaiting the important VERRA certification, which is still in progress. In order to accelerate certain things, an experienced German manager, Bernd Krüper, was recently brought on board. In addition to a heavily oversubscribed capital increase at CAD 0.15, dynaCERT was also able to agree on a 15% equity stake with its important cooperation partner, Cipher Neutron. Last but not least, the sales department announced an order for 84 new HydraGEN™ units, which the sales partner Simply Green was able to place. So the sails are set, and the ship left the harbour in turbo mode - a 100% premium in just 72 hours. The shares are particularly in demand again in Germany, where twice as many shares were traded yesterday as on the Canadian home exchange. The fan base of the hydrogen-diesel expert with a lot of ESG charm seems to be growing. It will be exciting to see where the share price will end up; the buying frenzy had calmed down again by the close of trading.

The stock market gives and takes. In the case of TUI and Lufthansa, shareholders will likely need more patience. At the Canadian oil and gas specialist, the Company's expansion is entering the next stage, and the share price of hydrogen specialist dynaCERT has doubled within 72 hours. This has been long-awaited and could be the beginning of a complete revaluation.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.