July 3rd, 2024 | 07:15 CEST

100% possible with hydrogen! Keep an eye on Plug Power, Nel, First Hydrogen, nucera, and Cavendish

Football is the dominant topic at the moment. Even in ancient Rome, bread and circuses worked quite well to distract the people from the essentials. Investors should pay attention to the progress made in the hydrogen sector. Cavendish shares have brought new momentum to a sector that has been badly beaten up since 2021. Can the Nel subsidiary initiate a change in sentiment? We analyze the situation like Ronaldo at the penalty spot. But it should definitely go in!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , NEL ASA NK-_20 | NO0010081235 , First Hydrogen Corp. | CA32057N1042 , THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001 , CAVENDISH HYDROGEN ASA | NO0013219535

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA and Cavendish Hydrogen - Will the subsidiary bring new momentum?

Since the listing of the spun-off hydrogen refueling station subsidiary Cavendish, investors are once again increasingly looking at the Norwegian H2 pioneer Nel ASA. The parent company has had a difficult three years, with a share price loss of 85%. The operational breakeven point has been repeatedly postponed, and market experts now predict it will be reached by 2028. The development costs for a European H2 infrastructure are weighing heavily on the balance sheet, and large government contracts are still lacking.

The markets are, therefore, looking to Cavendish as a beacon of hope. With an initial listing price of EUR 2.05, the first few days saw a lively upward and downward trend. Things have now calmed at EUR 2.36, and turnover is falling again. The website states ambitiously: "Our goal is to end emissions from heavy commercial vehicles. For more than two decades, we have been at the forefront of the development of hydrogen refueling solutions for road vehicles." The 33.8 million shares issued by the Company are currently valued at EUR 77.7 million. However, a loss of EUR 6 million was made again in the first quarter and the order backlog currently amounts to EUR 28 million. Worryingly, the cash on hand of EUR 5.8 million does not have much reach, so the next capital increase is likely already being prepared. At present, neither the parent company nor the subsidiary appear particularly promising. Technically oriented investors should keep an eye on the EUR 0.48 to 0.52 support zone for Nel ASA. If it turns around, it will be here!

First Hydrogen - If not now, then when?

The Canadian hydrogen specialist First Hydrogen is in an even better position. The Quebec-based company is building an integrated site for the assembly of hydrogen-powered delivery vehicles (FCEV) and the associated refueling station infrastructure. Extensive tests have already been successfully completed, and talks are now underway with Amazon and a major logistics provider from Mexico. The British gas supplier Wales & West Utilities (WWU) was also enthusiastic after the test series. For the WWU trial, First Hydrogen has teamed up with Protium Energy Solutions and Hyppo Hydrogen Solutions, and the "ready-to-go" hydrogen ecosystem is already underway here. First Hydrogen is also working with the well-known Fuel Cell to establish operations in North America.

The feasibility study for the combined 35-megawatt H2 production site, including the assembly plant in Shawinigan, Quebec, has started. The starting points for investors are manifold because, on the one hand, First Hydrogen can support the goals of a "Net Zero Carbon Strategy"; on the other hand, ESG-compliant complete packages can be acquired, which can put many large corporations miles ahead in their climate strategy. Offensive countries such as Germany, Italy, and Austria are now also accelerating the development of a hydrogen corridor from North Africa. In May, they signed a declaration of intent in Brussels to set up import pipelines, as announced by the German Federal Ministry of Economics. Once implemented, green hydrogen can flow to Europe. Think big, not small!

It can be assumed that North America will also take further steps in its decarbonization strategy as part of the IRA (Inflation Reduction Act). First Hydrogen is on the ground to initiate corresponding projects. The share is currently trading with good volume at around EUR 0.40. The low price is likely due to the current industry trend, which is taking smaller stocks into custody. A good opportunity for risk-conscious investors.

Plug Power and nucera - Why does every report fizzle out here?

A major tragedy is currently unfolding for Plug Power's share price, which has been going downhill since the US Department of Energy promised USD 1.65 billion in cover for the construction of 6 giga-hydrogen power plants. On the day of publication, the share price reached the USD 5 mark again; yesterday, it stood at USD 2.30. Last week, it was announced that Plug Power is seeking further development in the area of Basic Engineering and Design Package (BEDP) contracts. Since the launch of the offering two years ago, the New York-based company has increased the volume of BEDP contracts worldwide to a capacity of 7.5 GW. With revenues of at least USD 500 million per gigawatt, Plug aims to more than triple its turnover by 2028. Sounds ambitious, but the share should be put back on the watchlist at USD 2.30.

thyssenkrupp nucera is the European counterpart to Plug Power. Large-scale electrolysers are also built here. Despite a good pipeline due to auction rounds by the European Commission, the scenario has not yet been fully reflected operationally. However, sales are expected to double to EUR 1.35 billion by 2026 and profits will continue to be generated. 9 of 14 analysts on the Refinitiv Eikon platform issued a "Buy" recommendation. The consensus target price is EUR 18.35, which is exactly 100% of the current level of around EUR 9.20. Collect!

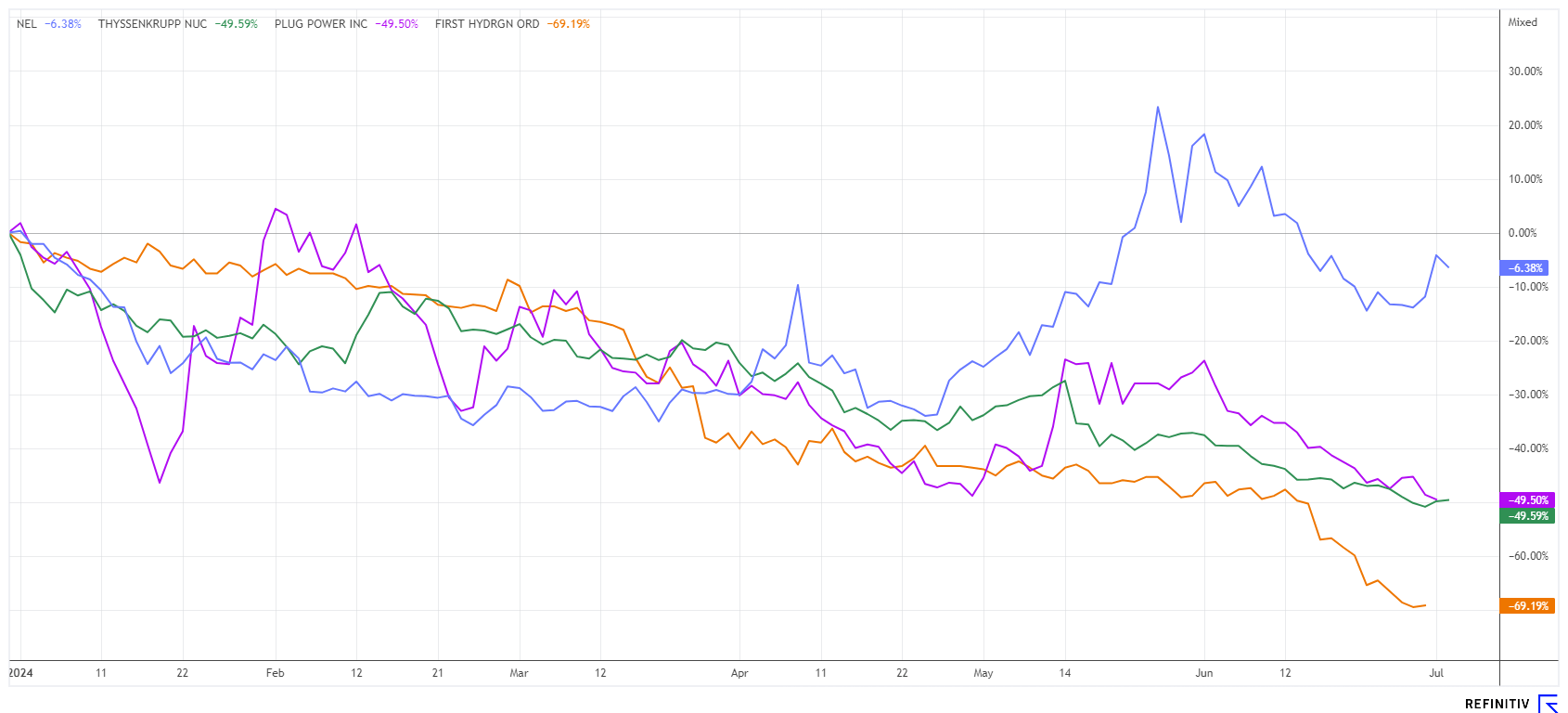

The big stock market rally in 2024 has so far been without the hydrogen sector. Nevertheless, Nel and Cavendish are bringing a breath of fresh air to the sector. Plug Power, thyssenkrupp nucera, and First Hydrogen are fundamentally favourable at current levels. The charts are all so low that it only takes a small rotation movement in the market for the first candidates to double. We therefore recommend regular monitoring of the H2 watchlist.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.