data

Commented by Nico Popp on February 26th, 2026 | 07:40 CET

From penny stock to tech pioneer: How Aspermont is transforming the commodity data market with Rio Tinto – Informa as a role model

Data is the raw material for tomorrow's decisions. In an economy where algorithms and large language models (LLMs) rely on verified and structured information, access to high-quality archives determines competitiveness. Aspermont has recognized this need and is transforming itself from a traditional media company into a technology company in the field of data intelligence. With a cumulative brand archive covering over 200 years of mining history, the company has a comprehensive data set on the global commodities industry. With its Mining IQ platform, Aspermont is digitizing this historical knowledge and structuring it for AI applications. This realignment completes the company's fourth phase of technological development, which builds on 180 years of print publications and the digital media and content-as-a-service models. The quality of the data is ensured by more than 100 specialist journalists and analysts who provide qualitative input for the platform.

ReadCommented by Stefan Feulner on February 10th, 2026 | 07:05 CET

Glencore, Aspermont, and Barrick Mining – Golden prospects

Failed mega-deals, strategic divestments, and quiet transformations away from the spotlight: the balance of power is currently shifting in the commodities sector. While one global industry heavyweight has abandoned its consolidation plans and is instead responding to geopolitical realities through targeted portfolio management, another player is working behind the scenes on an entirely new business model. At the same time, after several turbulent weeks, the gold market is once again sending clear signals, supported by surprisingly strong quarterly figures and high cash flow. For investors, this combination creates compelling opportunities spanning revaluation potential, defensive stability, and long-term structural tailwinds.

ReadCommented by André Will-Laudien on February 3rd, 2026 | 11:30 CET

Sell-off or healthy correction? Quality stocks in focus: SAP, D-Wave, and Aspermont

Market activity has picked up noticeably in recent days. Upswing here, sharp pullback there! Volatility is back, driven by political statements and economic uncertainties. While the sudden 30% crash in silver is unsettling commodity investors, and SAP shares are undergoing a significant correction, many investors are fleeing to defensive sectors and tangible assets. Crypto markets remain in a downward spiral, and the perennial topic of AI is being viewed with increasing selectivity. Against this backdrop, Australian media and commodities specialist Aspermont is leveraging its long-established network and data assets to accelerate growth using AI. At the same time, it remains to be seen whether there is still hope for higher valuations after the sell-off at SAP and D-Wave. Time to get out the magnifying glass, Sherlock Holmes style.

ReadCommented by Armin Schulz on January 28th, 2026 | 12:00 CET

In the eye of the commodities storm: How Aspermont, with its 190-year history, is becoming the data center of the mining industry

Gold is breaking records, copper is driving the energy transition, and critical raw materials such as rare earths are becoming a geopolitical currency. While investors are considering direct commodity investments, a company that has transformed itself into an indispensable architect of this new era is operating in the background: Aspermont. Once a traditional specialist publisher, the Company has quietly evolved into a data-driven control center for global mining. In a market characterized by resource nationalism and supply chain stress, reliable information is the most valuable commodity. Aspermont delivers just that, not as a cyclical player, but as a provider of critical infrastructure for decision-making. This transformation is complete, financially sound, and meets with a perfect environment.

ReadCommented by Nico Popp on January 23rd, 2026 | 07:05 CET

The battle for resources is being fought in the data room: How Aspermont Uses AI to Boost the Returns of Rio Tinto, Alamos Gold & Co.

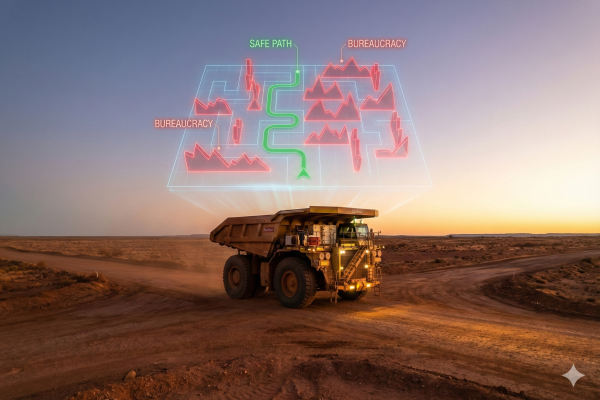

It is the greatest paradox of the modern economy: while demand for copper, lithium, and rare earths is exploding due to trade wars and the insatiable appetite of the AI industry, building a new mine has never been more difficult. Large mining corporations are increasingly failing not because of geology, but because of bureaucracy, environmental regulations, and, in remote regions of the world, geopolitical pitfalls. In this new era, where a legally binding permit is often more valuable than spectacular drilling results, validated information is becoming the most critical resource in the commodities sector. Analyst firms such as McKinsey and the International Energy Agency (IEA) warn of a massive structural supply deficit, as the development of new mines in the West often requires more than a decade of legal wrangling. It is precisely in this area of tension that the Australian media and tech company Aspermont is positioning itself as the decisive problem solver. With a treasure trove of data spanning centuries of industrial history and a new alliance with industry giant Rio Tinto, the Company is transforming itself from a media company into a kind of "Google of mining" – offering investors an opportunity based on intelligence rather than luck.

ReadCommented by Carsten Mainitz on January 14th, 2026 | 07:10 CET

With these data-driven and scalable business models, investors are on the winning side: Aspermont, Palantir, and SAP!

Data is a fundamental part of the economy and our everyday lives. Companies that not only collect data but can also systematically refine, monetize, and scale it are creating business models with enormous leverage. Palantir transforms fragmented information into decision-relevant intelligence for corporations and governments. SAP's software maps corporate data in real time and makes it usable. The often overlooked specialist Aspermont transforms data in the commodities sector into high-margin digital subscription models. All three companies are united by a scalable platform mindset. Where are the biggest opportunities?

ReadCommented by Nico Popp on December 23rd, 2025 | 07:10 CET

From publisher to data company: Why Aspermont needs to close the valuation gap with Glacier and Informa

There is a clear two-tier society on the stock market when it comes to the valuation of information providers. Traditional media companies that depend on advertising revenue are often traded at low single-digit multiples. Data providers, on the other hand, which retain their customers through subscriptions and proprietary databases, enjoy the high valuations of the tech sector. Aspermont, the Australian market leader for B2B information in the commodities sector, is currently undergoing this lucrative transformation. A look at the competition reveals where the journey could lead. While the Canadian company Glacier Media shows how to profitably combine news and data, the British giant Informa proves that specialized B2B information is a billion-dollar business. Aspermont is currently aggressively adapting these successful models, but is still valued by the market like an old-fashioned newspaper publisher. Yet the Company has long since proven that it can win over wealthy customers in the B2B segment.

ReadCommented by André Will-Laudien on December 17th, 2025 | 07:25 CET

Can AI extend its marathon into 2026? Broadcom, Oracle, Aspermont, and Alibaba now in the portfolio?

Despite all the doom and gloom, the AI sector could once again perform strongly on the stock market in 2026, as the ongoing investment cycle in AI infrastructure is expected to lead to transformative monetization, according to Wedbush analysts. They anticipate high-tech stocks to gain a further 20%. Fidelity analysts calculate positive earnings growth in the IT sector of around 25%, supported by rising profitability driven by AI. Vanguard expects AI to offset negative shocks and drive US growth above widespread consensus forecasts with an 80% probability, thanks to enormous productivity gains. Only Barclays has recently expressed "bubble fears," deeming the hype overblown. How will it really play out? Here are a few indicators.

ReadCommented by Armin Schulz on December 8th, 2025 | 07:15 CET

Leveraging AI revenue potential: The master plan from Novo Nordisk, Aspermont, and Deutsche Telekom

Artificial intelligence is permeating the economy and creating an unprecedented productivity boost. Efficiency gains of 25% in manufacturing and savings of one trillion dollars by 2030 in supply chains are just the beginning. This growth potential of up to 0.8 percentage points per year leverages the profitability of pioneers and clearly separates them from the rest of the market. Who are the pioneers who are already applying this disruptive force today and will translate it into concrete profits in the future? Three companies are leading the way: Novo Nordisk, Aspermont, and Deutsche Telekom.

ReadCommented by Nico Popp on December 4th, 2025 | 06:55 CET

How suppliers like Aspermont, CATL, and Continental turn the world's complexity into profit

"During a gold rush, don't sell shovels - sell treasure maps." In a world driven by technological disruption, geopolitical tensions, and the trend toward decarbonization, investors need to think one step ahead. Often, it is not the end manufacturers who benefit most, but the specialized suppliers and service providers operating behind the scenes. They take the complexity off their customers' hands – whether it is building an electric vehicle, optimizing tyre compounds, or deciding where to build the next billion-dollar mine. Those who understand this principle will find exciting options on the stock market right now. We present three companies.

Read