December 17th, 2025 | 07:25 CET

Can AI extend its marathon into 2026? Broadcom, Oracle, Aspermont, and Alibaba now in the portfolio?

Despite all the doom and gloom, the AI sector could once again perform strongly on the stock market in 2026, as the ongoing investment cycle in AI infrastructure is expected to lead to transformative monetization, according to Wedbush analysts. They anticipate high-tech stocks to gain a further 20%. Fidelity analysts calculate positive earnings growth in the IT sector of around 25%, supported by rising profitability driven by AI. Vanguard expects AI to offset negative shocks and drive US growth above widespread consensus forecasts with an 80% probability, thanks to enormous productivity gains. Only Barclays has recently expressed "bubble fears," deeming the hype overblown. How will it really play out? Here are a few indicators.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BROADCOM INC. DL-_001 | US11135F1012 , ORACLE CORP. DL-_01 | US68389X1054 , ASPERMONT LTD | AU000000ASP3 , ALIBABA GR.HLDG SP.ADR 8 | US01609W1027

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Alibaba focuses on AI – Growth driver and B2B revolution

Artificial intelligence "Made in China" is catching on! Stock market star Alibaba is demonstrating the wealth of operational opportunities and is constantly developing its B2B platform through AI Mode. Its own AI agent is now being integrated directly into the procurement process. This technology automates tasks such as supplier search, quotation preparation, market analysis, and translations, enabling corporate customers to reduce time, costs, and complexity significantly. The AI B2B search engine Accio analyzes unstructured data such as sketches, certificates, and production capacities to identify specialized suppliers. This creates a seamless, data-driven, and fully automated trading experience that optimizes existing supply chains and accelerates innovation.

The CoCreate event in London impressively demonstrated that European SMEs are increasingly reliant on fast, transparent, and AI-supported purchasing processes. Alibaba takes over routine tasks such as quality assurance, certificate checks, and smart contracts, allowing companies to maintain full control even as the number of active suppliers and order volume increase. Analysts see this as the first major productivity gains from the use of AI. Japan's Nomura raised Alibaba's price target from USD 170 to USD 215, reflecting the positive growth outlook. Overall, Alibaba is pursuing a dual growth approach: technological leadership at home coupled with the modernization of global B2B processes. AI is not only used as an efficiency measure, but also as an infrastructural element that makes procurement, innovation, and supply chains resilient. AI Mode demonstrates how digital platforms relieve operational burdens on companies, promote growth, and make the complexity of global markets manageable. Analysts on the LSEG platform see USD 200 as the target for the next 12 months. This means that the stock may still have a good 30% potential after its 54% rally in 2025.

Aspermont Ltd. – Strong figures and a promising outlook

Australian media specialist and XaaS provider Aspermont is successfully transferring its strength from the old economy to the online world. The annual figures for 2025 show a successful transformation into a data-driven B2B media and intelligence provider. This leap forward was achieved despite volatile commodity markets and geopolitical uncertainties. Formerly a traditional publishing house, today it is a technology company with a global reach in over 190 countries. What once began with specialist publications such as the Mining Journal is now a scalable digital business model that offers content, data, and analysis as a service. The focus is on mining, energy, and agriculture, where Aspermont provides millions of professionals with information, events, and marketing solutions.

The figures are impressive. Membership fees grew by 4% to AUD 10.2 million and now account for 66% of total revenue of AUD 15.4 million. The business has now enjoyed 37 quarters of uninterrupted growth. The amount of recurring revenue (ARR) rose to a new high of AUD 11.5 million. At the core of the AI-driven business is a unique database of over 8 million high-level industry contacts and historical information from over 200 years of trade publications, fully digitized and available for data-based platforms.

CEO Alex Kent's outlook is exciting. 10% ARR growth, with revenue per customer expected to increase by 15%. Version 2 of the AI product Mining IQ is expected, more events are to be organized, and AI data analysis is to be multilingual in the future. Risks such as cyber threats, execution, and cyclicality are managed through proprietary platforms, diversification, and phased rollouts. The picture is an exciting one for investors, as the current wave of appreciation in the commodities sector is bringing a lot of money into the coffers of potential customers. Given the increasing complexity of global commodity markets, Aspermont's data intelligence could become an indispensable tool for strategic decision-making in the future. With a market capitalization of around EUR 12 million, the revaluation of the Australian company is only just beginning!

Broadcom and Oracle – Buy or sell?

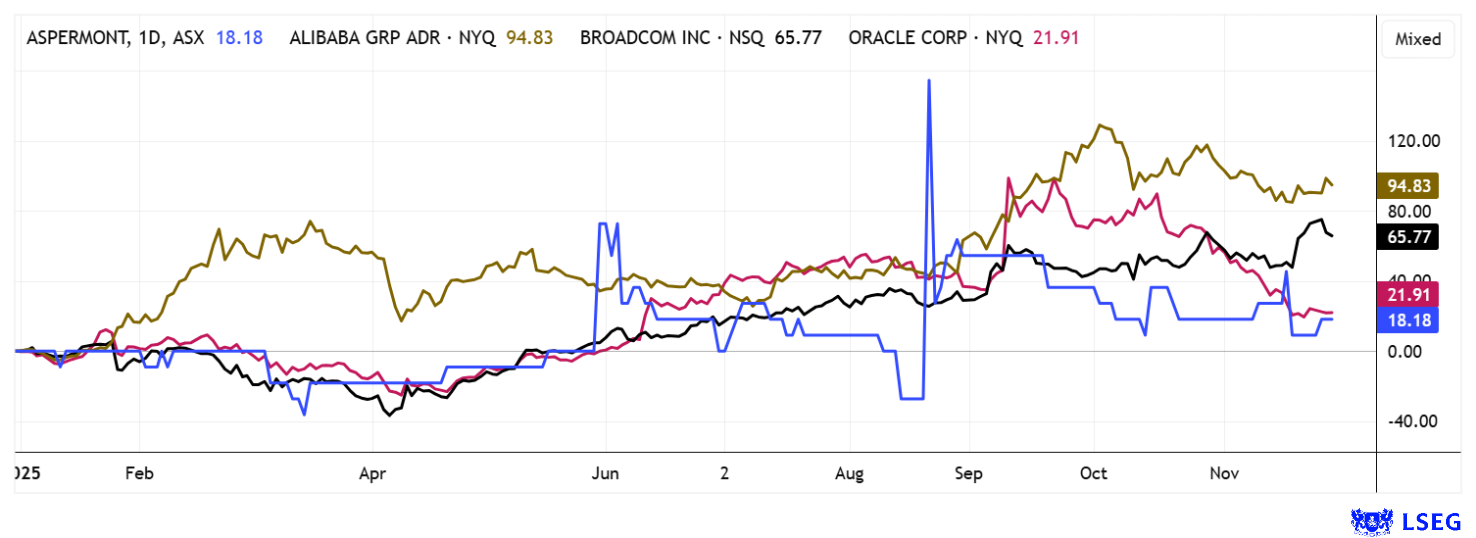

For assistance with allocations in the volatile AI sector, it is worth taking a look at the broker databases on the LSEG platform. This is because industry data is carefully collated here, and relative valuation models are created. Oracle's share price had already reached its all-time high of around USD 294 in September. Analysts currently fear that the costs of integrating AI models are too high and will not translate into profits to the same extent in the future. The same applies to Broadcom. Although both companies are closely linked to AI infrastructure, which is one of the hottest commodities this year, the market is currently scrutinizing whether their increased spending on data centers and AI clusters will actually generate profitable returns. Chip giant Broadcom warned that costly infrastructure measures would lead to a decline in gross margins despite rising AI revenue. It is noteworthy that AI now accounts for more than half of Broadcom's semiconductor revenue, with the Company highlighting that revenue from AI semiconductors has increased by 74% year-on-year. Analysts on the LSEG platform offer a mixed assessment. For Oracle, with current prices around USD 188, a price target of USD 297 is being suggested, while for Broadcom, currently at USD 338, the target price is set at USD 443. Those who want to bet on the next stage of AI expansion will find good potential in Oracle and Broadcom. Hopefully, the experts will not collectively backpedal after the current price corrections!

**The stock markets are going through wild ups and downs. The turbulence in the commodities sector shows how important it is to have a deep understanding of market dynamics. Aspermont stands out as a premium address here, highly technical and effective in outputting sector-relevant information. The technology companies Alibaba, Oracle, and Broadcom have great AI appeal, but investments should always be made with the expectation of volatile price swings, especially when figures are published.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.