October 15th, 2024 | 07:00 CEST

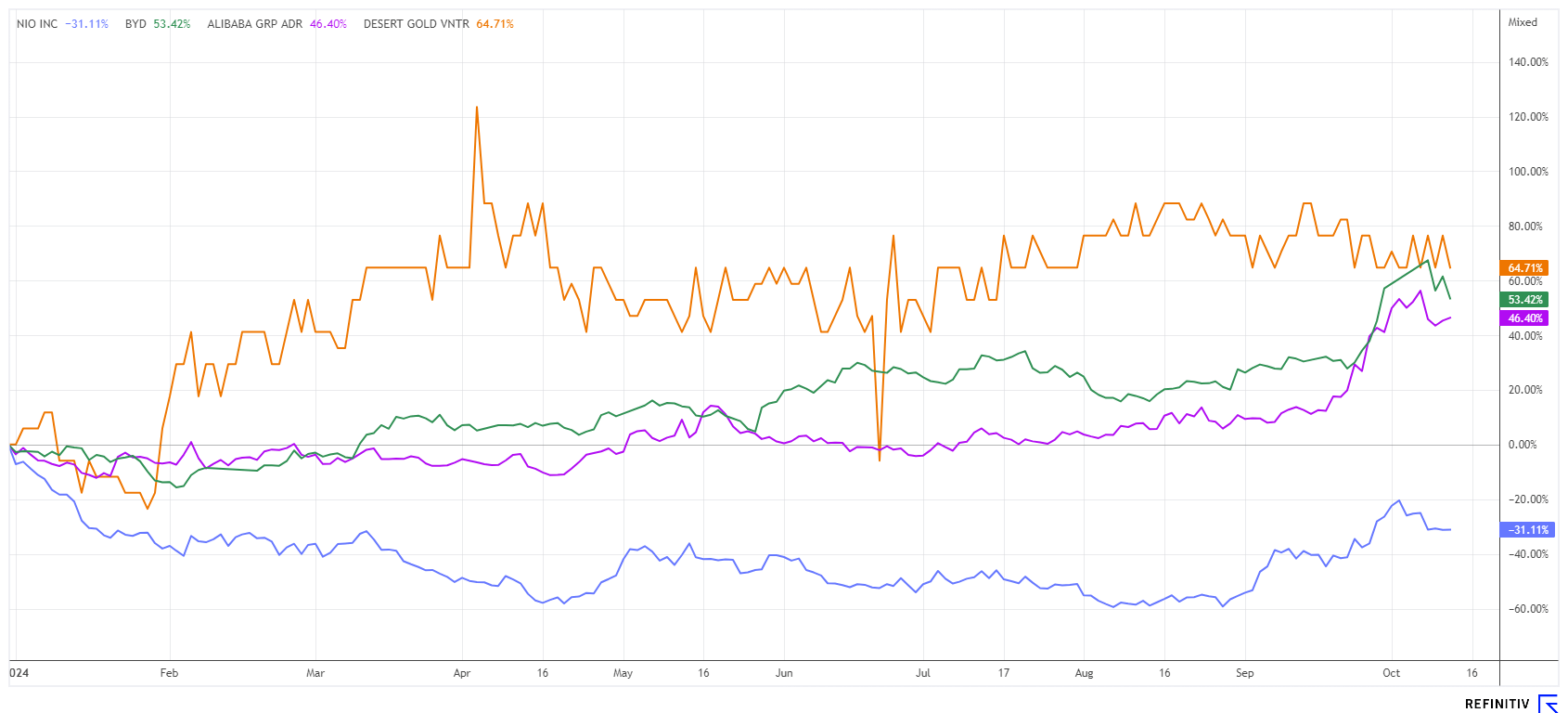

After the China rally, is it now time for a gold rush? Important stock check with Alibaba, BYD, Nio, and Desert Gold

The global stock rally is quite impressive, given the current geopolitical situation. However, only a few stocks are actually rising - around 25% of listed stocks, to be precise. The higher valuation of stocks is mainly driven by inflows into the large standard ETFs, which receive monthly inflows via a savings program. In the third quarter of 2024, global ETF assets grew by USD 390 billion, reaching a total of USD 12.4 trillion in assets under management. Stock-picking, therefore, only makes sense today if you are well-informed or possess strong analytical skills. We highlight a few investment opportunities for a handpicked portfolio.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

DESERT GOLD VENTURES | CA25039N4084 , NIO INC.A S.ADR DL-_00025 | US62914V1061 , BYD CO. LTD H YC 1 | CNE100000296 , ALIBABA GROUP HLDG LTD | KYG017191142

Table of contents:

"[...] The transaction offers benefits to all parties: Shareholders now have three promising projects in their portfolio. [...]" Bradley Rourke, President, CEO and Director, Scottie Resources Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Alibaba – Long overlooked, now in turbo mode

For a long time, the market had shied away from the tech protagonists from the Far East due to the imponderables associated with Chinese equities. Now, it is slowly becoming clear that there will be no sanctions against Chinese equities in the US, as the US justice system is treading on very thin ice here. Officially, China has condemned the war in Ukraine and called on Moscow to exercise moderation, but unofficially, the strong alliance between Putin and Xi Ping is, of course, well known.

After an appreciation of the NASDAQ 100 index of over 30% in 2024, international investors are looking for new high-tech stocks. Jack Ma's Alibaba Group was one of the stock market stars in 2020 before its valuation fell by around 75%. Wrongly so, because the B2B e-commerce platform is growing consistently at around 10% per year and now has a P/E ratio of just 8 for 2025. Even the revenue of around EUR 160 billion is valued at only 1.5 times. Amazon, on the other hand, is growing at a comparable rate and has a 2025 P/E ratio of 52 and a P/S ratio of more than 3. So, there is plenty of room for Alibaba to close the valuation gap. The recovery rally has been underway for four weeks now, but a third of the price increase should only be the beginning of the revaluation.

Desert Gold – Moving steeply upwards with the upcoming drilling results

For years, precious metals were sidelined, but they have made significant gains in recent months. Gold recently marked a new all-time high of USD 2,670, while its little brother Silver quickly crossed the USD 32 line again. The focus is now returning to the explorers, also known as juniors. They do not have to make any major efforts at the moment because whoever sits on the right property automatically attracts larger producers' attention. Africa, a continent rich in precious metals and resources for centuries, holds vast potential in critical metals and minerals. The long-standing connection with Western investors continues to be a driver of investment on the continent.

For several years, the Canadian explorer Desert Gold Ventures has had its sights set on the Senegal-Mali Shear Zone (SMSZ). Here, 1 million ounces of gold have already been identified near the surface. CEO Jared Scharf and his team of geologists are confident that they will soon be able to bring potential strategic partners on board. A pre-feasibility study is already in progress, and the low-cost heap leach plant is expected to start in 2025. This process allows near-surface gold mineralization to be mined at a cost of less than USD 700 per ounce. The Barani East and Gourbassi West gold deposits are ideally suited for further drilling, with several results expected by the end of the year.

In the immediate vicinity, interest is rising as CEO Scharf is publicly discussing the immense potential for a major if the Desert Gold properties are integrated. Should the gold price continue to rise, a swift response from neighboring companies seems likely. After all, the neighbors are none other than the well-known names such as Barrick, B2 Gold, and Allied Gold. Allied Gold, for example, had recently spoken of wanting to consolidate some properties in Africa. If not now, then when? Desert Gold, with its SMSZ project, is therefore in pole position for a quick takeover deal. With a market capitalization of around EUR 10 million, this is like a jackpot for speculative investors at a current price of 0.075 Canadian dollars.

CEO Jared Scharf will provide an update on Desert Gold today at 5:00 PM CET during the 12th International Investment Forum. Click here to register.

NIO – Doubling in the shadow of BYD

The Chinese electric carmaker BYD expects a significant increase in sales in Germany within the next few months. No details were given regarding the exact sales target, with reference made to the Q3 reporting date of October 31. The newly introduced EU import tariffs on Chinese e-vehicles, which could take effect as early as next month, have been heavily criticized. At least Germany had vetoed the resolutions. So far, efforts to conquer the German market have been rather sobering for BYD. BYD shares have gained around 50% since the lows of EUR 24, but this is mainly due to the China boom that has been evident since mid-September.

The start-up NIO also benefited from the steep upward movement of Chinese high-tech stocks. Since the last low in August at EUR 3.33, the price almost doubled to over EUR 6.50 and is currently back down at EUR 5.60. The rapidly growing manufacturer celebrated the delivery of its 600,000th vehicle on October 11; in 2023, the total was just 160,000. BYD's shares have already reached analysts' median price targets and, at a P/E ratio of 25, are not exactly cheap. NIO is not expected to make money until 2028, but its explosive growth makes it the hottest bet on the e-mobility market of the future.

High-tech stocks on the NASDAQ have performed well in 2024, but there is still catch-up potential for the recently rediscovered Chinese stocks. BYD and Alibaba have already gained 50% in just four weeks. The innovative e-mobility specialist NIO offers a battery exchange system that could soon be introduced in the EU. If the gold price continues to rise, Desert Gold should be unstoppable. Good diversification significantly reduces portfolio risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.