December 23rd, 2025 | 10:10 CET

Top tips for 2026 – Critical metals and armaments! DroneShield, Pasinex, RENK, and Heidelberger Druck in focus

In 2025, there was a pronounced rally in critical metals starting in the summer. This was largely triggered by China, which imposed export restrictions on rare metals and strategic raw materials in response to arbitrary tariff demands from the White House. The metal markets reacted with strong upward movements, and the procurement centers of Western industry reacted even more severely. In view of the needs of the near future, a large number of properties would have to be brought into production in the areas of copper, graphite, lithium, uranium, zinc, and rare earths. However, it takes around 10 years to set up a mine, including all permits and preliminary investigations. Because this is far too long for the current needs, the market is looking at projects that are about to start production or are already producing. We offer a few ideas from the supply chain and potential customers.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

DRONESHIELD LTD | AU000000DRO2 , PASINEX RESOURCES LTD. | CA70260R1082 , RENK AG O.N. | DE000RENK730 , HEIDELBERG.DRUCKMA.O.N. | DE0007314007

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Pasinex Resources – Turkish mining projects secure stable margins and growth potential

Zinc is becoming increasingly important strategically in the wake of the global energy transition, evolving from a long-underestimated industrial metal to a critical raw material for infrastructure, mobility, and energy storage. The metal is known for its role in protecting steel from corrosion, and in recent years, it has also been increasingly used in innovative battery technologies, which are considered a safe and sustainable alternative to lithium. At the same time, natural supplies are structurally declining as many high-grade deposits are depleted and new discoveries remain rare.

Against this backdrop, Pasinex Resources is increasingly attracting the attention of investors. The Canadian company is pursuing a business model in Turkey that clearly stands out from the global industry average. While many zinc mines operate with ore grades of only 4 to 6%, Pasinex regularly achieves grades of over 30% and peaks of up to 50%. This exceptional quality allows the ore to be sold directly to smelting complexes without the usual cost-intensive processing. This enables Pasinex to limit production costs to around USD 200 to 300 per ton, which ultimately leads to stable margins in the range of 30 to 50% despite volatile zinc prices.

A significant milestone was reached in December 2025 when the Turkish mining authority MAPEG approved the complete transfer of the Horzum shares. Pasinex now holds 100% of the producing Pinargozu mine and can independently control its strategic development. Among other things, an extensive 1,000-meter development program is planned, which will provide access to deeper, high-grade sulfide zones and offer significant discovery potential during tunneling.

At the same time, Pasinex has expanded its project portfolio with the complete acquisition of the Sarikaya project, which also has high-grade zinc content and is expected to contribute to production from 2026. The combination of ongoing cash flows, low investment costs, and organic growth is exceptional in the junior mining sector. With a still modest market capitalization of approximately CAD 18 million, Pasinex offers direct leverage to a zinc market that could rapidly materialize in 2026.

Pasinex Chairman Dr. Larry Seeley spoke with IIF moderator Lyndsay Malchuk about the plans for 2026.

DroneShield – Doubles in 3 weeks

Unbelievable – what a move! We have been focusing heavily on DroneShield shares in recent weeks, as internal sales by employees and executives led to a price slump of almost 80%. Now there has been a series of positive announcements. First, the Australian defense company won a AUD 49.6 million contract in Europe. The contract is for C-UAS technology, which has proven highly effective in drone defense. The Company benefits from its market-leading position and years of operational experience, which has recently generated recurring demand. DroneShield is benefiting from a booming global defense spending pipeline, particularly in Europe. In September, EU President Ursula von der Leyen called for more investment in drone defense. Due to the high liquidity of the stock, it was recently added to the S&P/ASX 200 Index. Analysts at Bell Potter and Shaw and Partners have issued "Buy" recommendations with 12-month price targets of AUD 4.40 and AUD 5.00, respectively. The stock is currently trading at AUD 2.88. Despite existing governance risks, speculators could drive the stock up again. Casino!

RENK and Heidelberger Druck – Second-tier defense fantasies

RENK and Heidelberger Druck are also mentioned in the second breath as beneficiaries of the European security architecture. RENK only returned to the stock market in 2023 after the private equity firm Triton divested itself of significant shareholdings. The tank manufacturer KNDS is now one of the major shareholders. RENK had a spectacular start on the stock market and reached its previous high of EUR 90.25 in October 2025. A sharp consolidation brought the overvalued stock back down to below EUR 50. Currently, 11 out of 15 analysts on the LSEG platform assign the company a 12-month price target of EUR 68.80. From today's perspective, this represents a potential upside of 30%. With a 2026 P/E ratio of over 30 and a revenue valuation of 4.5, the comparatively low growth of the Augsburg-based company is overpriced.

At the long-established company Heidelberger Druck, the strategy is gradually shifting away from sheetfed offset printing presses toward new ventures in the defense sector. The agenda also includes areas of activity such as automation, robotics, software, and green technologies. A key component of the planned diversification is the strategic partnership with defense specialist Vincorion Advanced Systems, under which the Company will develop and manufacture energy and power management systems for military applications in the future. This cooperation is not only intended to deliver initial projects, but also to position Heidelberg as a reliable partner for security-related products in the defense sector. In addition, the Heidelberg-based company is also exploring further collaborations, for example with specialists in drone defense and autonomous systems, in order to address additional segments of the defense market. The share price initially rose from EUR 1.40 to over EUR 2.50 since the summer, but consolidated again to EUR 1.85 by December. With estimated revenue of EUR 2.35 billion in 2026, an enterprise value (EV) of EUR 635 million at prices around EUR 2 is not too much. Let's see what the new strategy can deliver to investors from 2026 onwards. Interesting!

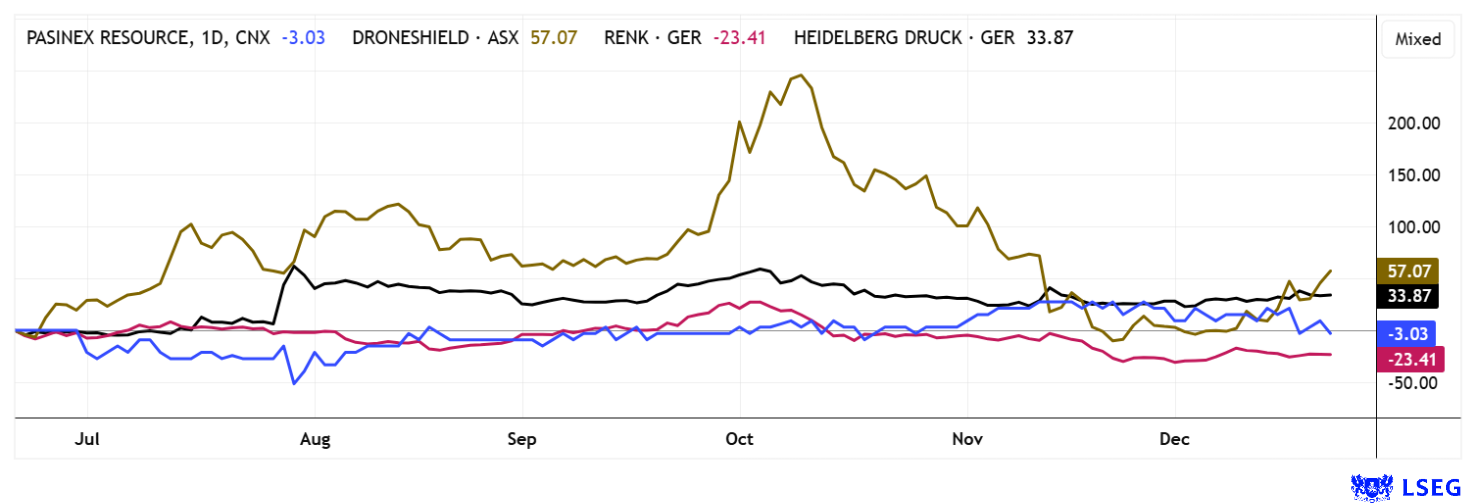

The stock markets are now entering somewhat calmer waters towards the end of the year. As can be observed every year, valuations are trending strongly upwards again in the final sprint. DroneShield is poised to smooth out the heavy losses from November's crash, and RENK has also experienced a decent correction. Things are particularly exciting for Pasinex, as a further increase in production is planned for 2026. Heidelberger Druck also plans to sharpen its strategy in the defense sector next year.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.