June 17th, 2024 | 06:45 CEST

Acute threat? Armaments and high-tech in the crosshairs: Aixtron, Almonty Industries, Rheinmetall and Hensoldt

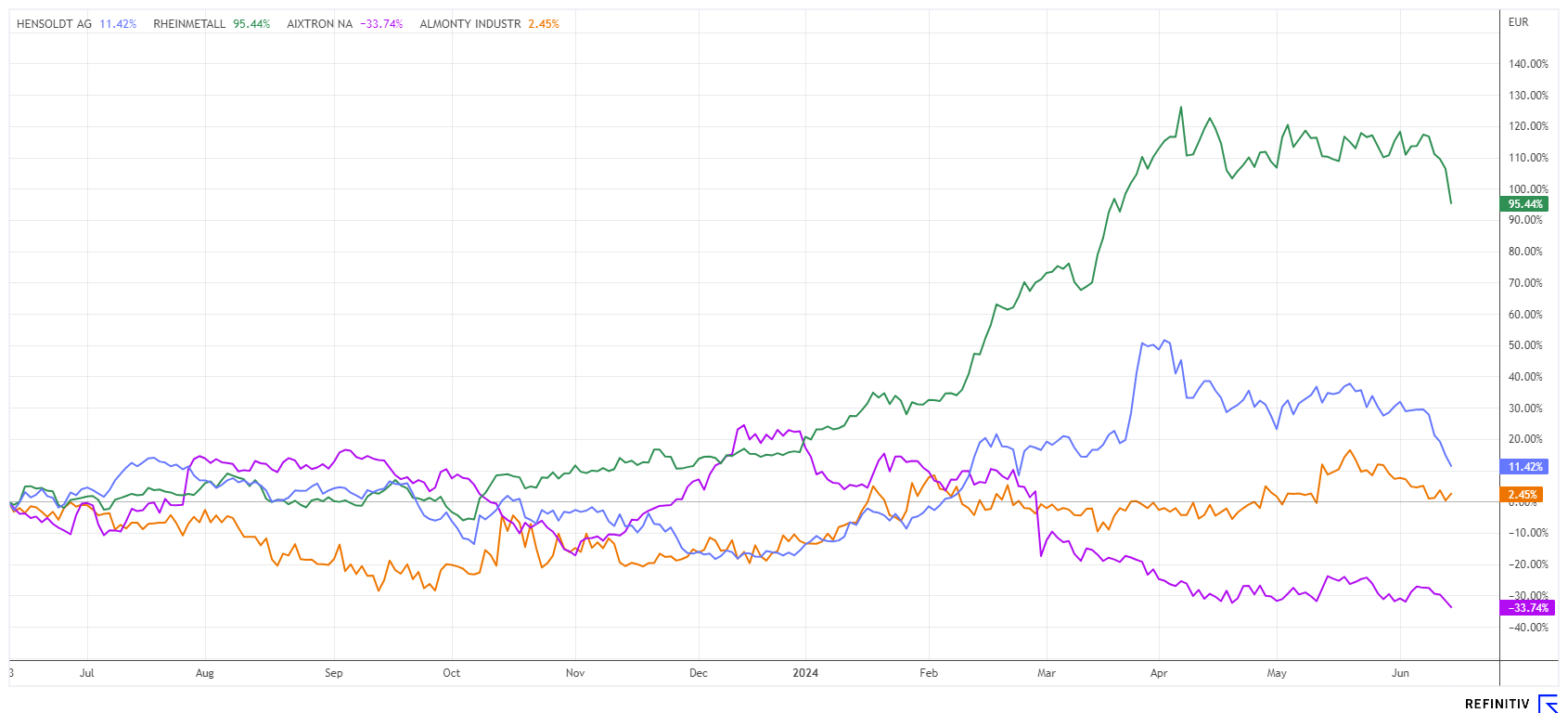

The recent European elections have enabled the conservative camp to make significant gains. Undoubtedly, a whole bouquet of issues has led to the so-called "shift to the right". In times of war, however, the neutral observer may not be surprised that the self-proclaimed peace parties, represented by the colours red and green, have lost considerable ground. After all, the competence for peacemaking and security in Europe tends to be found in the conservative camp. The capital markets currently favour high-tech and armaments, orders are booming, and growth is assured for years to come. It is now crucial for stock market players to take a closer look at these sectors, as the high-yield performers of the first half of the year appear to be correcting more strongly. What will happen here in the medium term?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

AIXTRON SE NA O.N. | DE000A0WMPJ6 , ALMONTY INDUSTRIES INC. | CA0203981034 , RHEINMETALL AG | DE0007030009 , HENSOLDT AG INH O.N. | DE000HAG0005

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Aixtron - Almost halved at the half-year mark

With a near-halving of its value by mid-year, Aixtron shareholders have been disappointed so far. Short sellers, such as Qube Research, have now also set their sights on the share, currently holding a short position of 1.37% of the issued capital. There are several fundamental reasons for the price decline. At the PCIM fair in Nuremberg, Aixtron CEO Felix Grawert struck a more cautious tone. According to his statements, 2024 could develop into a year of transition, with significant growth in key areas likely not on the cards. It is also normal for lower expected growth rates in the near future to negatively impact the stock price.

However, with the share price down almost 50% since January, sentiment seems even worse than the business outlook. The analysts at Warburg, Deutsche Bank, and Jefferies are not letting themselves be boxed in at the moment and confirm their "Buy" recommendations with 12-month price targets of EUR 31 to 40. Only Hauck Aufhäuser is stepping out of line and lowering its price target to EUR 29. The consensus estimates for the coming years are somewhat too high for the Frankfurt experts. Nevertheless, they continue to back the quality company with its historically favourable valuation. **If the sales growth of 3% is achieved, the P/E ratio in 2024 is currently around 17.5, falling to around 14 in 2025. With the recently depressed prices of around EUR 20, the stock is not too expensive. Collect!

Almonty Industries - Mine opening in Korea on the horizon

The development of the tungsten market in the coming years will be influenced by several factors. Firstly, demand will remain high due to its importance in various industries, including electronics, aerospace, and the automotive industry. Tungsten is used here to produce superalloys, filaments, and electronic components. However, it is also crucial as a heat-resistant hardening metal in defense technology. Given the political tensions between the US, Russia, and China, the supply of this vital metal is more uncertain than ever. The punitive tariffs recently imposed on China's electrical exports are further clouding the wishful thinking of free global trade. This is accompanied by a bleak outlook for the procurement departments of entire industries.

The Canadian company Almonty Industries owns four properties of the rare metal tungsten and is focusing on increasing global production. Western countries have high hopes for the rapid availability of additional tungsten in order to reduce their dependence on market leader China. The revitalization of the Sangdong mine in South Korea, the largest property for the metal outside of China, is likely to be promising. The mine construction in Sangdong is well advanced, but with the usual delays, the start should be successful in Q1-2025 at the latest.

The availability of strategic metals remains very important for the fragile Western-style high-tech industry as geopolitical uncertainties continue to strain international supply chains. Almonty Industries has an important role to play, as it is creating capacity in secure jurisdictions and already has off-take agreements with major industry players such as the Austrian Plansee Group. The Almonty share will, therefore, remain in high demand this year, with the mine opening in Sangdong likely to result in a dramatic upward revaluation.

Rheinmetall and Hensoldt - Fundamentally strong, but technically in correction

Not a good end to the week for defense stocks. For the first time since the start of the war, Vladimir Putin has made clear statements on the conditions under which a ceasefire or even an end to the war can be considered. Although the demands are not acceptable to Ukrainian President Volodymyr Zelensky, there is still a chance that the Western states will make progress in their debates at the upcoming summit in Switzerland and at this week's G7 meeting.

An end to the war is more than desirable. However, for investors who have been enjoying lavish gains in defense stocks for several months, it is also a sign to turn the significant increases into hard cash. Therefore, it should come as no surprise that prominent "war stocks" such as Rheinmetall, Renk, and Hensoldt are testing their support levels. We had previously advised for this early on; all stocks have broken through our stop lines at EUR 495, EUR 29, and EUR 37.50, respectively, and consequently fell further. In the meantime, up to 30% is already missing from the top.

Anyone who did not want to accept the obvious scenario must now work out how long it will take defense stocks to regain the lavish valuations of 2026. In the worst-case scenario, this could take two years, corresponding to the typical valuation trend of hyped stocks. The inflated prices of recent months are now deflating. However, only 50% of the possible downside potential has likely been realized in the current correction. Therefore, be careful at the platform's edge; things could get worse. On the Refinitiv Eikon platform, there is only one"Buy" recommendation for Hensoldt, while 13 out of 17 analysts remain positive on Rheinmetall. The average price targets stand at EUR 37.50 and EUR 570, respectively, and were already reached or exceeded in April 2024. Now, it will be interesting to see how things progress.

After the first peace offers from Russia, the fantasy for defense stocks is limited for the time being. After price multiples in the last 2 years, the direction seems to be pointing downwards. In the overall context of strategic metals and complex supply chains, Almonty Industries can offer very good prospects.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.