May 25th, 2023 | 07:10 CEST

Is national bankruptcy looming, or is the US debt ceiling a cinch? Deutsche Bank, Tocvan Ventures, PayPal - Financial system under tension!

Once again, the so-called "debt ceiling" in the US has been reached. Consequently, reports about the US financial system are filling the global headlines, with insolvency being painted on the wall. Meanwhile, it is common knowledge that the US has been printing money for a good three decades because its budget is chronically in deficit. Unfortunately, however, the House of Representatives and the Senate have approved raising the debt ceiling conditional on a number of demands that cannot be easily met. The financial markets are visibly trembling. However, seasoned participants know that this debt limit has been raised 78 times since 1960, so why should it fail on the 79th occasion? Is it all just a show? We take a closer look.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

DEUTSCHE BANK AG NA O.N. | DE0005140008 , TOCVAN VENTURES C | CA88900N1050 , PAYPAL HDGS INC.DL-_0001 | US70450Y1038

Table of contents:

"[...] We have built one of the largest land packages of any non-producer in the belt at over 440 sq.km and have made more than 25 gold discoveries on the property to date with 5 of these discoveries totaling about 1.1 million ounces of gold resources. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

The debt ceiling issue

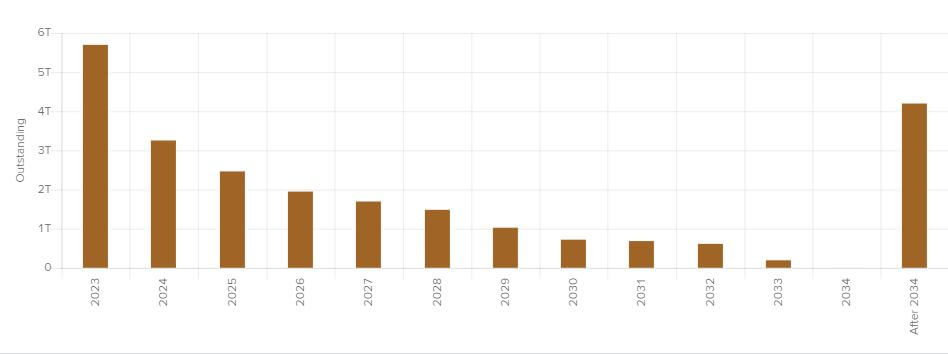

There is still no solution in sight in the deadlocked dispute over raising the debt ceiling in the US. If Congress fails to reach an agreement, the USA will be insolvent in just a few days. This would have a devastating impact on the global economy, as the US national debt has increased almost every year since the technology bubble in 2000. It currently stands at more than USD 31.4 trillion. In the fiscal year 2023, the government is expected to spend an additional USD 1.4 trillion more than estimated tax revenues allow. In perspective, the deficit is, therefore, likely to be almost twice as large in 10 years, according to a non-partisan Congressional Budget Office report. Although the US debt ratio is currently less than 130%, it is alarmingly high among the top economies. It is topped only by Japan with almost 270%, and Italy and Greece with more than 150%.

Deutsche Bank - Further interest rate hikes necessary due to high inflation

Increasing capital market interest rates due to high inflation are becoming a problem for the US government. Five banks have already been forced to pull the plug in 2023 because of dramatic imbalances in their investment portfolios. So far, the financial system has been able to wind down these companies relatively ripple-free. But if the problems worsen due to rising interest rates, a domino effect like the one in 2007/2008 could occur. However, the saving shore in the form of falling interest rates is within reach due to weak economic developments.

However, the head of Deutsche Bank, Christian Sewing, is in favour of further interest rate hikes by the ECB to bring inflation, which is at its highest level in decades, under control. Sewing stressed that high inflation has a massive impact on consumers and that at least 30% of bank customers could no longer meet their normal expenses from their disposable income. Inflation weakens consumption in the long term and prevents growth opportunities in the long term. At the same time, the current environment is significantly affecting the economy's willingness to invest. Necessary expansion investments are increasingly taking place abroad as a matter of political will.

The Deutsche Bank share sees itself on a record course in 2023. Experts expected an after-tax profit of more than EUR 4 billion, meaning the bank will earn more than it has in 15 years. From a chart perspective, however, the EUR 12.50 level would have to fall before a real rally can be expected.

Tocvan Ventures - Further discoveries in Sonora give wings

Precious metal investments could provide a good hedge against turbulence in the financial system. As spot prices are currently fluctuating very strongly, an investment in promising explorers may be successful. Gold has so far been able to meet expectations with an annual gain of 5.6% in 2023, and at times it has been over 9.5%. At a current price of USD 1,970, the way would be clear for an initial technical movement above the old high of around USD 2,050. However, this will probably only happen if the US debt ceiling is not raised as expected.

Meanwhile, the positive news is piling up at the Canadian gold explorer Tocvan Ventures (TOC). The latest update on a bulk sample at the Pilar gold-silver project in Sonora showed encouragingly consistent gold and silver grades. A total of 148 samples were collected with an average value of 1.87 g/t AU and 13 g/t AG. The first batch of 32 out of 111 samples taken from the fine fraction of screened material actually has slightly higher gold and silver grades, averaging 2.02 g/t AU and 15.6 g/t AG.

"Pilar continues to surprise with excellent gold and silver values," CEO Brodie Sutherland said recently. "The results clearly indicate that the average grade of the bulk sample material is well above our expectations for gold and silver. This is evident in the data and gives us confidence that Pilar can be advanced towards production." Tocvan is one of the most prospective explorers in the Mexican state of Sonora with its Pilar and El Picacho properties. TOC's share price has been moving quite dynamically in the CAD 0.52 to CAD 0.76 range, but developments around the US financial system could spark the long-neglected mining explorer stocks.

PayPal - Under pressure

Currently under heavy pressure is the online payment service PayPal. The share has lost as much as 21% in the last 12 months and even 45% from its high of around USD 100. The reason for the weakness is the continuing decline in user numbers. The Company is now trying to counteract this with an offer for 13 to 17-year-olds. We are talking about a new function of the US subsidiary Venmo, which is aimed specifically at young people. In the future, they can set up their own account and use it to make payments to friends and relatives. A debit card with parental access for consumer-related retail payments and cash withdrawals will also be provided. This target group will probably not ensure exploding sales, but the number of active users could rise again. In any case, the last quarterly results suggested a lack of growth and sent the price down another 10%.

At a price of USD 61.70, the current 2023 P/E ratio is only 12.5, with growth figures of about 10% in the next 3 years. With a 2x sales valuation, the share is not cheap but not overpriced either. Should the Californians grow more strongly than expected, the median price target of USD 94.50 is also achievable again. Currently, the experts on the Refinitiv Eikon platform seem overly optimistic, considering we are facing declining consumer numbers worldwide.

The banking crisis at the beginning of the year could spread even further to the entire US financial system because nothing will work here without new debt. Consequently, the outcome of the debates in Congress is to be expected as a digital event: Zero or one! If the outcome is positive, financial stocks will take off; if negative, precious metal stocks will likely make a considerable leap upwards. But then the stock market will have a number of other problems to deal with.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.