June 4th, 2024 | 07:30 CEST

Banks double 100%; now comes the gold rally! Deutsche Bank, Commerzbank, Desert Gold and Lufthansa

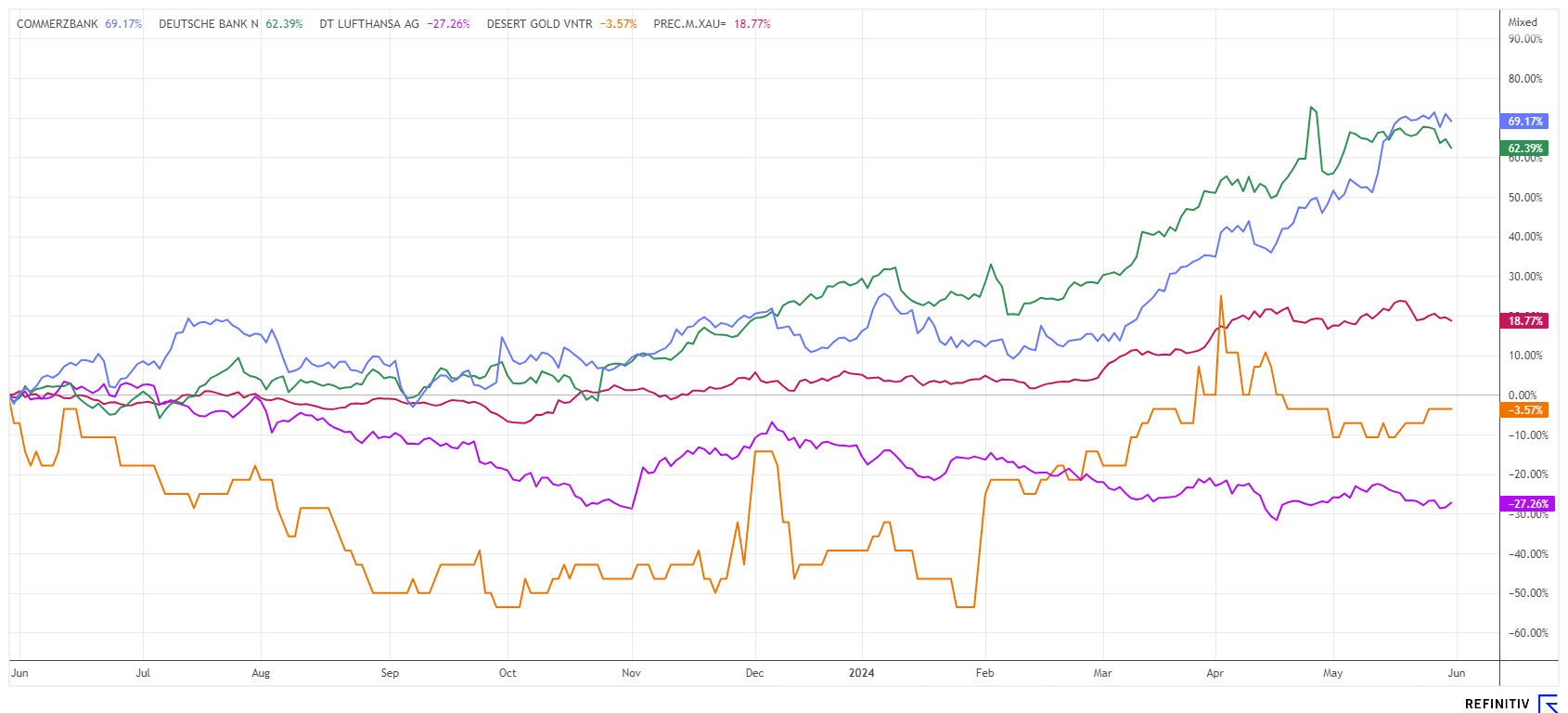

The stock market keeps climbing, as evidenced by the ever-new highs of prominent indices like the NASDAQ 100, Dow Jones, Nikkei, or the DAX 40 index. While international high-tech stocks are setting the tone, financial stocks have now also returned to pre-pandemic profit levels. This is due to the return of interest margins. However, due to the poor economic situation, write-downs in loan portfolios now threaten. The generally depressing situation is also weighing on tourism companies. The situation is quite different for gold and silver. They finally reached new highs in May, and the momentum is likely to continue rapidly. What should investors pay urgent attention to now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

DEUTSCHE BANK AG NA O.N. | DE0005140008 , COMMERZBANK AG | DE000CBK1001 , DESERT GOLD VENTURES | CA25039N4084 , LUFTHANSA AG VNA O.N. | DE0008232125

Table of contents:

"[...] The transaction offers benefits to all parties: Shareholders now have three promising projects in their portfolio. [...]" Bradley Rourke, President, CEO and Director, Scottie Resources Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Deutsche Bank and Commerzbank - Return to profitability achieved

After a sharp price reversal last October, the two financial institutions Deutsche Bank and Commerzbank were able to stage an impressive 60% price rally due to the margin on loans established at the end of 2022, which had not previously existed during the negative interest rate period. The enormous price premiums on the international stock markets have also led to a sharp increase in income from the investment business. Deutsche Bank now estimates declines in bond and currency trading for the second half of the year, while total revenue in investment banking is expected to rise from EUR 30 billion this year to EUR 32 billion in 2025. CEO Christian Sewing aims to complete the Company's transformation and the integration of Postbank in 2024.

The German government still holds a 16.5% stake in Commerzbank. Initially seen as an obstacle, the German government is now a stable anchor shareholder. With the appointment of Manfred Knof as CEO in January 2021, the new Board of Managing Directors is finally set to work on getting the Company back on track. The starting position was extremely poor, as the cost-to-income ratio (CIR) was still an impressive 81.5% in 2020. It is a measure of efficiency in the industry and expresses how much has to be invested in order to generate one euro of revenue. After three years, this key figure was reduced to 61.4% in 2023. In the first quarter of 2024, it fell further to just 58%. Knof has now set a new target of 55% for 2027, which, according to current estimates, should be achievable with a little discipline.

On the Refinitiv Eikon platform, the bank shares are still rated positively, with average price targets of EUR 16.27 (DBK) and EUR 16.48 (CBK). However, due to a number of downgrades, the number of "Buy" recommendations fell to 10 out of 21 for Deutsche Bank and 12 out of 20 for Commerzbank. Anyone who has doubts about the German economic landscape should, therefore, slowly take profits, as the analysts' price targets are no longer far away.

Desert Gold - More than 1 million ounces in West Africa

In addition to the well-performing bank stocks, gold has gained more than 20% in the last 12 months. The eternal resistance at USD 2,150 was broken in March; the closing mark for May was USD 2,328. A high of USD 2,425 was even reached in the meantime. During the same period, little brother Silver managed to gain a good 30% and increased its price from USD 22 to around USD 30. At one point, it even reached USD 32.15 on the scoreboard. Gold is currently attracting increasing interest again due to ongoing geopolitical uncertainties and ongoing currency devaluation. The cumulative loss of purchasing power over the last 3 years has now amounted to over 25%, and it is precisely this gap in real value that precious metal owners have been able to close successfully.

Africa has been a precious metals and commodities continent for several hundred years. Huge potential lies dormant there in important metals and minerals. Traditionally, the connection to Western investors has also been a guarantee for investments on the continent. The Canadian explorer Desert Gold Ventures has been focusing on the Senegal-Mali Shear Zone (SMSZ) for several years. Here, 1 million ounces of gold have already been identified close to the surface. Further drilling is currently underway, and a feasibility study is being prepared. New discoveries should greatly expand the current resource, and the report could also document the profitability of mining the oxide and transition mineral resources in the Barani East and Gourbassi West gold deposits. This could make low-cost heap leach production conceivable starting in 2025.

However, outstanding results will also provide the basis for sales talks. CEO Jared Scharf and his management team have recently attracted the attention of several majors on the claim, and interest from the major mining companies is high. If the gold price continues to make waves, it should be possible to quickly secure a good price for Desert Gold shareholders. Comparable projects have been sold for between USD 70 and USD 150 per ounce of gold in the ground in gold boom years. Assuming USD 100 per ounce as a plausible price, the enterprise value would be at least USD 100 million or CAD 0.65 per share. Based on a market capitalization of USD 11 million, this is an outright 1000% opportunity for speculative investors.

Lufthansa - Breakout attempt failed

Poor industry prospects, pressure on the cost side, and downgrades by analysts. The Crane Line share price is having a challenging time at the moment. Last week, American Airlines was extremely cautious about the year's first half and lowered its profit expectations. There are also disputes over the planned takeover of ITA Airways, the successor to the bankrupt Alitalia. According to a media report, EU Competition Commissioner Margrethe Vestager is adamant in her demands to keep ITA Airways out of Lufthansa's transatlantic alliance. For Lufthansa, however, this is precisely where the "red line" runs. In the long term, ITA should definitely be part of the Star Alliance group's intercontinental offering. The EU fears higher prices and poorer flight coverage. In a first step, the takeover envisages a 41% stake, for which ITA's equity is to be increased by EUR 325 million. Under clearly defined conditions, the Frankfurt-based airline will acquire 49% in two steps and then the remaining 10% by 2027.

Due to declining demand, the US investment bank JPMorgan believes that the industry is facing a burden that only the low-cost airlines RyanAir and EasyJet could cope with. Exactly 7 out of 22 experts on the Refinitiv Eikon platform see an entry opportunity for Lufthansa; they expect an average price target of EUR 8.33, and JPMorgan only votes for EUR 5.70. A 2024 P/E ratio of 5.2 is not yet an attractive buy level for the analysts. With a book value of EUR 8.80, the LHA share is currently very cheap at EUR 6.30. Conclusion: Buy between EUR 6.00 and EUR 6.50 and hold for at least 2 years. The sector is very cyclical.

The stock market is currently very selective. While the major indices are performing well, 85% of all shares are still far from their highs. So far, the bull market has developed selectively via high-tech, defense, and financial stocks. Precious metals have also recently attracted positive attention, while the tourism sector has not yet been able to generate any joy.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.