August 18th, 2022 | 13:07 CEST

An explosive mixture is emerging here: Airbus, Defense Metals, NIO

Hydrogen, electromobility, armaments - they still exist, the trends that bring investors double-digit returns within a very short time. But where is the line between a bull market and a bear market rally? Instead of betting on yesterday's high flyers, investors can invest in stocks where scarcity and the spirit of the times coincide. We outline three possible investments and get to the bottom of the related stocks.

time to read: 3 minutes

|

Author:

Nico Popp

ISIN:

AIRBUS | NL0000235190 , DEFENSE METALS CORP. | CA2446331035 , NIO INC.A S.ADR DL-_00025 | US62914V1061

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

Airbus: Big player with certain advantages

The Airbus share is currently trading at roughly the same level as a year ago. In view of the war in Ukraine, this development is surprising at first glance. At a second glance, however, it becomes clear that the defense sector, which accounts for around 20% of Airbus' revenues, does not play a major role. The latest quarterly figures were nevertheless positive due to encouraging orders for aircraft from the A320 family. This aircraft type, which is used mainly for shorter routes, is popular with many airlines. The poor image of Boeing's main competitor, the 737 MAX, which used to be known as the "breakdown plane", is also likely to play a role in this context.

In addition, some airlines want to ramp up their fleets again after weak Corona quarters and are relying on fuel-efficient models. Airbus is also well positioned in this area. The aviation group also benefits because it deliberately tightened its belt during the pandemic and put many things to the test. Today, Airbus is highly profitable and can even afford a crisis cushion, which will be maintained at EUR 10 billion. Even if space and defense play a subordinate role, both areas are "nice to have" for Airbus: The divisions will not slow down the group in the long term. However, suppliers could put the brakes on Airbus' irrepressible thrust: The general shortage and problems in the supply chains are omnipresent.

Defense Metals: ifo experts warn about rare earths

The Canadian company Defense Metals wants to play a significant role in the realignment of supply chains. The Company operates the Wicheeda rare earths project in the Canadian District of British Columbia. Recently Defense Metals announced that it is preparing for a preliminary feasibility study and plans to present compelling data. It will include a more concrete assessment of key economic data based on available drilling results and general conditions on-site. An initial economic assessment in the form of a so-called PEA has already been available for some time. The Wicheeda project benefits from the general trend of economies becoming less dependent on China. In Germany, the ifo Center for Foreign Trade warned in July of Germany's heavy dependence on imports, explicitly citing the "high market concentration in terms of suppliers" in China.

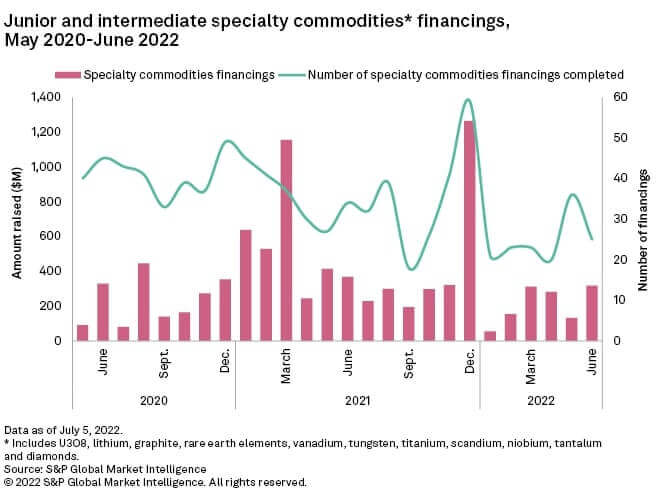

China is considered the most important rare earth exporter in the world. The elements are used in smartphones, LEDs, motors for electric cars, large magnets for industry and wind turbines. Rare earths are also considered critical in the defense sector, where dependence on China is doubly serious. Defense Metals still managed a small capital increase last May, although the market for financing for special metals weakened in May, according to data from S&P Global. Financing volumes in the group, including uranium, graphite, vanadium, tungsten, diamonds and other metals, and rare earths, also remained weak in June compared with last year. For already advanced projects, this can be a positive sign - after all, limited supply means rising prices. The Defense Metals share has stabilized around EUR 0.15. Investors with staying power can take another look at the stock.

.

NIO: Courageous step into Europe

Investors also need patience with the shares of the electric car startup NIO. The Chinese company's stock suffered losses of 36% over the course of a year. Recently, however, the share price recovered a little. This could be due to the planned launch of NIO in several European countries in the second half of the year. In addition to Sweden and Denmark, Germany and the Netherlands are also included. The Company already positioned itself in the e-car country of Norway last year. The unique feature of NIO is that the carmaker has the batteries of its cars exchanged at battery exchange stations. That means customers do not have to wait for charging. A factory for these exchange stations is to be built in Hungary. NIO plans to operate 4,000 exchange stations worldwide by 2025.

The share price is recovering, but there is still no sign of a positive trend. While the market for electric cars is hotly contested and companies like NIO could get a bloody nose in Europe, companies like Airbus and Defense Metals are quite relaxed. The former group is a global leader - moreover, the aircraft business is not exactly the main field of activity for resourceful founders. Defense Metals benefits from the location of its project in safe Canada, the scarcity of rare earths, and low competition in the wake of a depressed financing market.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.