At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on March 12th, 2026 | 07:15 CET

Nuclear power comeback in the EU! Solid returns with American Atomics, Amazon, and E.ON

Since the EU nuclear summit in Paris a few days ago, it has become clear that nuclear energy is once again socially acceptable in Europe. At the meeting, the European Commission described the former move away from nuclear power as a strategic mistake and launched a comprehensive offensive for small modular reactors (SMRs). According to the EU strategy, an SMR capacity of up to 53 GW is to be built up by 2050 in order to reduce the persistently high electricity prices and stop the impending exodus of industry. At the same time, a new factor is driving global electricity demand: artificial intelligence (AI). The International Energy Agency (IEA) predicts that the share of nuclear and renewable energy in the global electricity mix will rise to 50% by 2030. Tech giants such as Amazon increasingly want to satisfy the energy hunger of AI data centers themselves. E.ON is also likely to benefit from this historic strategic shift by operating stable grids. However, at the source of the new boom is the up-and-coming exploration company American Atomics, which is searching for urgently needed uranium and closing a strategic gap in the supply chain. We highlight where investors can find the most attractive opportunities.

ReadCommented by Nico Popp on March 12th, 2026 | 07:00 CET

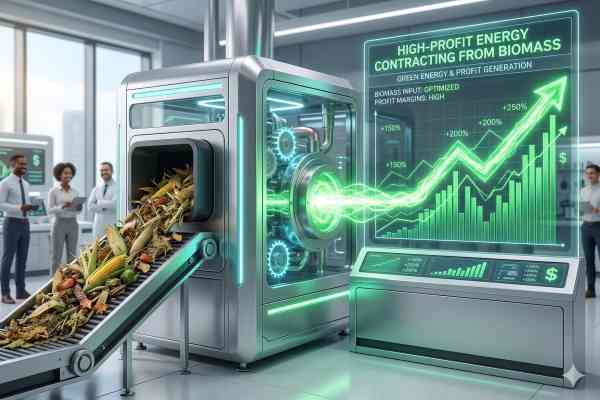

Solutions instead of energy crisis: The potential of CHAR Technologies, Linde, and DuPont

The German economy is under enormous pressure. After years of rising energy prices and an increasingly complicated supply of raw materials, the population and industry are gripped by fears of a creeping decline. Electricity prices for energy-intensive companies remain at a level that is significantly higher than in previous years. Industry experts have long warned of a permanent exodus of production capacities to cheaper regions such as the US, where electricity costs for industry last year were less than half those in the European Union. To ensure the survival of industry, new approaches are coming into focus. Solutions are needed that break the dependence on fossil fuel imports and make supply more flexible. Different approaches are being taken here: While Linde and DuPont prefer to partner with the big players, Canadian innovator CHAR Technologies is occupying the exciting niche of decentralized energy generation.

ReadCommented by Nico Popp on March 11th, 2026 | 07:30 CET

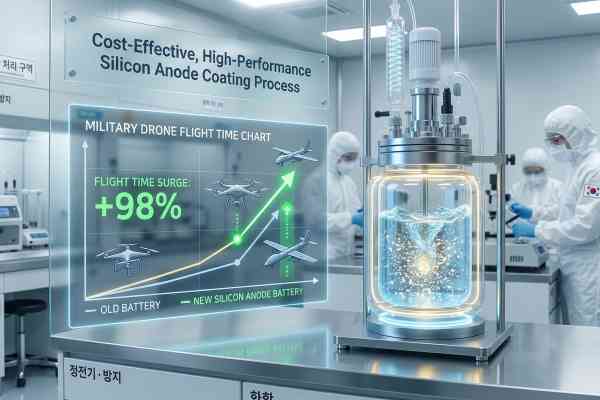

A new drone contender: The potential of NEO Battery Materials, DroneShield, and Amprius Technologies

Energy efficiency and defense capabilities are two sides of the same coin. This is especially true in the rapidly growing drone business, where powerful batteries are crucial. While global demand for batteries continues to rise sharply, according to McKinsey's analysis, the military sector is focusing on a highly specialized niche: maximizing energy density while eliminating dependence on Asian supply chains. The US National Defense Authorization Act (NDAA) for fiscal year 2026 requires that batteries for the Department of Defense be subject to strict criteria in the future in order to end the influence of rival states. In this environment, Amprius Technologies sets the standard with its enormous energy density for long-range drones (UAS). But there is promising competition with its own advantages: NEO Battery Materials' NBMSiDE technology ensures that the batteries in demand can be manufactured independently of China. The technology, which has only been validated in field tests for a few weeks, is entering a market environment in which drone defense is more important than ever. Although the global market leader DroneShield, with its AI-powered defense solutions, is considered the obvious answer to the new threats, drones are increasingly being countered directly by other drones. In this constellation, NEO Battery Materials is coming into the focus of investors.

ReadCommented by Nico Popp on March 11th, 2026 | 07:15 CET

Mining comeback in Europe: Solid returns with Group Eleven Resources, Boliden, and Glencore

The European raw materials landscape is undergoing a realignment. For decades, the industry relied on cheap imports from overseas. But those days of largely unchallenged globalization are coming to an end. In order to end dependence on uncertain supply chains and ensure the survival of the industry, the focus is shifting to domestic extraction of critical metals. The European Commission has defined clear goals with the Critical Raw Materials Act and the ambitious RESourceEU Action Plan: By 2030, 10% of the mining and 40% of the processing of critical metals should occur within the EU. In this environment, the European zinc and silver sector is making a comeback. While zinc has historically been in demand primarily in the construction industry, it is now indispensable for the corrosion protection of wind turbines. Silver is even becoming a critical industrial metal due to the tremendous boom in artificial intelligence (AI) and the construction of data centers. Ireland, in particular, is establishing itself as a raw materials region in this phase. The country has one of the world's most productive geological provinces for high-grade base metals and boasts excellent geoscientific data from the Tellus program. Established mining giants such as Boliden and Glencore are setting standards, while up-and-coming explorers such as Group Eleven Resources are shining with spectacular discoveries and offering investors extremely lucrative entry opportunities.

ReadCommented by Nico Popp on March 10th, 2026 | 07:15 CET

Valuation anomaly in the drone sector: Solid returns with Volatus Aerospace, Hensoldt, and DroneShield

The global security architecture has been facing a turning point since well before the outbreak of the conflict involving Iran. Developments on NATO's eastern flank show that the dominance of heavy weapon systems is increasingly being challenged by low-cost, unmanned aerial vehicles. In this new reality, a drone costing USD 500 can destroy a battle tank worth USD 10 million. This development is forcing the defense industry to rethink its approach. Conventional air defense systems are often overwhelmed by the sheer number and low radar signature of enemy drones. Innovative solutions are needed to detect, assess, and neutralize threats. So-called interceptor drones for the targeted neutralization of hostile aerial targets are becoming the focus of attention for the military and procurement authorities. Hensoldt, DroneShield, and Volatus Aerospace have positioned themselves as innovative solution providers in this highly specialized niche. We show where the most attractive opportunities lie for investors and pay particular attention to an up-and-coming company from Canada.

ReadCommented by Nico Popp on March 10th, 2026 | 07:05 CET

Running out of ammunition? The key role of Antimony Resources, Rheinmetall, and Boeing

The arms industry is facing a severe test amid the war in the Middle East. The enormous consumption of ammunition is pushing already limited Western production capacities to their limits. While the US has raised its defense spending for 2026 to a record level of USD 901 billion, the intense exchange of fire in the Middle East and the use of modern defense systems are depleting stockpiles at a record pace. In this environment, the critical semi-metal antimony is becoming a focus of national security. The element is irreplaceable as a hardening agent for lead alloys in armor-piercing projectiles and for high-precision infrared sensors. According to the US Geological Survey (USGS), the global supply situation is becoming increasingly tense. This is mainly due to strict export restrictions imposed by China, which dominates global mining with a market share of just under 60% and has long used the metal as a strategic weapon. To guarantee defense capabilities, industry giants such as Rheinmetall and Boeing must ramp up their production. The problem is that raw materials are finite. This is where players such as Antimony Resources come into play, securing the coveted antimony in Canada.

ReadCommented by Nico Popp on March 9th, 2026 | 07:50 CET

Africa's hardest currency: New perspectives from Barrick Mining, Compass Gold, and Desert Gold

A noticeable shift is currently taking place in African mining, as mineral resources are increasingly being viewed as the continent's hardest currency. This trend was highlighted at the African Mining Indaba in Cape Town in February, where the concept of a "Bank of African Settlements" was discussed. The stated goal of this initiative is to establish mineral resources as bankable assets to reduce dependence on volatile fiat currencies such as the US dollar. For many African nations, this is a direct response to the harsh reality that some local currencies have depreciated by as much as 900% against the US dollar over the past two decades. At the same time, market data supports this trend, with foreign central banks' gold reserves exceeding their holdings of US government bonds for the first time since 1996. Combined with growing efforts toward political self-determination and the expansion of reliable infrastructure, this shift is opening up attractive opportunities for investors. In this environment, industry heavyweight Barrick Mining is consolidating its industrial base in Mali, while emerging explorers such as Compass Gold and Desert Gold are actively searching for new deposits.

ReadCommented by Nico Popp on March 9th, 2026 | 07:30 CET

Energy Shock? Linde, Veolia, and AHT Syngas Offer Strategic Solutions

The stock market and economy are more volatile than ever. The reasons for this are the military escalation in the Middle East and the de facto closure of the Strait of Hormuz. With crude oil prices exceeding USD 90 per barrel and, according to analysts, potentially rising to over USD 150 in a prolonged crisis scenario, the industry is facing a serious challenge. In this environment, the dynamics of the energy transition are also changing: decarbonization is no longer just a regulatory goal for companies, but has become a survival strategy for their own competitiveness. While the industrial gases group Linde forms the technological backbone of decarbonization with its expertise in hydrogen logistics, Veolia Environnement secures resources and even generates crisis-proof cash flows through the management of global material cycles. A.H.T. Syngas is also a good fit with the companies mentioned above. Its gasification plants convert industrial waste streams directly at their source into cost-effective synthesis gas and green hydrogen – a decentralized technology that is more relevant today than ever before.

ReadCommented by Nico Popp on March 6th, 2026 | 07:25 CET

"Security energies" – how to invest: RWE, Iberdrola, and RE Royalties as stable sources of returns

The energy debate has been conducted differently for some time now than it was in the 2010s. While decarbonization was long considered an ecological necessity, it has now become a question of national sovereignty under the banner of "security energies." This new perspective is being fueled by current geopolitical upheavals and the de facto blockade of the Strait of Hormuz, which once again reveals the fragility of our supply chains. With around 20% of global oil consumption passing through this bottleneck, prices for crude oil and liquefied gas have already risen significantly. In this context, German Federal Environment Minister Carsten Schneider coined the term "security energies" to emphasize the decentralized nature of renewable energy as a shield against exogenous shocks. Renewable energy projects are not subject to the logic of geopolitical conflicts and also generate added value in the region, as a wind farm, for example, can generate annual revenues of around EUR 200,000 for a municipality. Renewable energy can also become a safety anchor for investors thanks to stable cash flows.

ReadCommented by Nico Popp on March 6th, 2026 | 07:10 CET

Uranium ensures energy sovereignty: How investors can profit with Stallion Uranium, NexGen Energy, and Constellation Energy - which stock is the favorite?

In times of war, uranium rises from a cyclical commodity to a strategic asset. Even in Germany, people are aware of the dilemma that the energy policy of recent years has maneuvered them into: either they are dependent on imports, or they have to think more openly about technology, for example, nuclear power. The Canadian Athabasca Basin is considered the center for securing the West's supply of uranium. Reports from the International Energy Agency (IEA) show that market dynamics are no longer driven solely by traditional demand from utilities. Tech giants such as Microsoft, Meta, and Google have long seen nuclear power as one of the few scalable solutions for the base load requirements of their AI data centers. As a result of this surge in demand and years of underinvestment in exploration, spot prices for uranium exceeded the USD 100 per pound mark in January. The combination of Stallion Uranium's exploration potential, NexGen Energy's industrial implementation, and Constellation Energy's hunger for energy illustrates how investors can benefit from securing the Western energy chain. We present the companies and our favorites.

Read