At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on January 20th, 2026 | 07:05 CET

Antimony shock for Airbus and BASF: China's export restrictions make Antimony Resources a strategic winner

2025 will go down in economic history as the year when a largely unknown semi-metal sent global industry into a state of alert. Antimony, long overshadowed by popular battery metals such as lithium and cobalt, suddenly emerged as one of the most strategically critical and supply-constrained metals. Aggressive export restrictions imposed by China, which historically controlled over 80% of global processing capacity, have put Western supply chains under significant pressure. What market observers refer to as the "antimony shock" is no longer a theoretical threat, but a harsh economic reality. According to industry analyses, market participants were already talking about significant supply deficits in 2025 – estimates are in the high five-digit ton range. We analyze the market and present a potential beneficiary.

ReadCommented by Nico Popp on January 19th, 2026 | 07:25 CET

Armored steel meets swarm intelligence: Why Rheinmetall and Hensoldt must retool - and why NEO Battery Materials could become a hidden winner of the drone war

The war in Ukraine has shattered military doctrines that were considered irrefutable in NATO headquarters for decades within a matter of months. The shocking realization: even the most modern battle tank is an easy target for a drone that costs less than a tank of fuel for the colossus. We are witnessing a tectonic shift in warfare away from classic weapons such as tanks and howitzers toward asymmetric threats that are decided by software, sensors, and, above all, range. In this new environment, established defense giants such as Rheinmetall and Hensoldt must reinvent themselves to avoid becoming obsolete. But while these corporations are slow to turn their tankers around, NEO Battery Materials is positioning itself as an agile player at the critical interface of modern warfare: batteries for drone swarms, independent of Chinese supply chains.

ReadCommented by Nico Popp on January 19th, 2026 | 07:15 CET

The Netflix of car washing: How Mister Car Wash is reinventing the market, and WashTec is sounding the charge against Dover

The North American vehicle care market is currently undergoing a development that, in its radical consequences, is reminiscent of the transformation of the software industry ten years ago. The old model of weather-dependent individual car washes, where revenue falls when it rains, is being replaced by the predictable profitability of the "subscription economy." This trend is being driven by the phenomenal success of the US chain Mister Car Wash, which has proven that Americans are willing to sign up for a monthly subscription for clean cars, similar to streaming services. But this gold rush is putting massive technological pressure on gas station operators and independent car washes. They have to upgrade to stay competitive. In this battle for infrastructure supremacy, German hidden champion WashTec is now challenging US market leader Dover Corporation on its home turf. The Augsburg-based company supplies precisely the digital technology that enables the broader market to copy Mister Car Wash's successful model – and could thus shift the balance of power in the industry in the long term.

ReadCommented by Nico Popp on January 16th, 2026 | 07:20 CET

Green Capital 2.0: How RE Royalties is closing the gap between Hannon Armstrong and Altius

The end of cheap money is forcing wind and solar park developers into a new reality: traditional banks are withdrawing from risk financing, but the investment pressure for the energy transition remains high. Specialized royalty financiers are stepping into this vacuum. While established players such as Hannon Armstrong and Altius Renewable Royalties already dominate this segment, the still largely undiscovered player RE Royalties now offers investors the opportunity to be at the beginning of a similar growth curve. The massive gap between developers' capital requirements and what banks have to offer is the ideal breeding ground for this business model.

ReadCommented by Nico Popp on January 16th, 2026 | 07:00 CET

Trash to gas: How A.H.T. Syngas, EQTEC, and 2G Energy are making companies self-sufficient

German industry is undergoing one of its toughest trials. The "trilemma" described by analysts - volatile energy prices, rising CO2 taxes, and the physical uncertainty of the power grids - has driven production costs to a level that poses a massive threat to competitiveness. While politicians debate hydrogen pipelines that will take years to complete, innovators are already creating a new reality: decentralized energy supply from waste materials. Three players are emerging in this booming sector, working together to solve the puzzle of energy self-sufficiency. While CHP market leader 2G Energy provides the hardware for a green future with its engines and British supplier EQTEC validates gasification technology worldwide, Germany's A.H.T. Syngas Technology closes the crucial gap for small and medium-sized enterprises. With compact plants, A.H.T. transforms industrial waste into the clean gas that keeps the engines running – regardless of Putin's war or price jumps on the Leipzig energy exchange EEX.

ReadCommented by Nico Popp on January 15th, 2026 | 07:25 CET

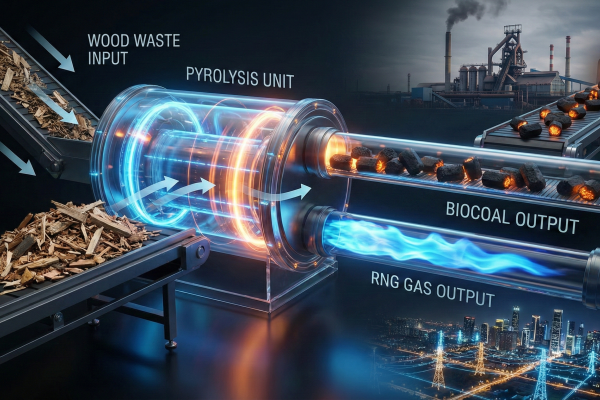

Double returns: How CHAR Technologies is closing the gap between ArcelorMittal's coal hunger and Montauk's gas profits

We are witnessing a historic turning point for global heavy industry. We are currently seeing not only a technological evolution, but also a fundamental revaluation of industrial assets, driven by two parallel megatrends: the decarbonization of primary steel production and the monetary revaluation of waste streams for energy security. While regulatory constraints are forcing steel giants such as ArcelorMittal to reinvent their blast furnaces, and specialists such as Montauk Renewables are demonstrating the enormous valuations possible in the renewable natural gas (RNG) market, CHAR Technologies is positioning itself at the intersection of these two worlds. With its proprietary high-temperature pyrolysis technology, the Canadian company provides the answer to both questions at once: it produces biochar for the steel industry and RNG for the energy grid – from a single waste source.

ReadCommented by Nico Popp on January 15th, 2026 | 07:00 CET

The USD 88 shock: Are UBS and Citigroup forcing the silver market to its knees, or are we witnessing the ultimate short squeeze? Opportunities at Silver North Resources

The year is still young, and a drama is unfolding on the precious metals markets that could go down in history. The price of silver has shattered historical resistance levels and is trading above the USD 88 per ounce mark. What was long dismissed as the wild fantasy of "gold bugs" is now a harsh reality: a sudden decoupling of physical scarcity from paper-based pricing mechanisms. As the spot market explodes, all eyes are on the big players in the financial world. Rumors are growing louder that major banks such as UBS and Citigroup may have gotten themselves into dangerous trouble through massive short positions. In this toxic environment of mistrust and panic, investors are seeking refuge in unencumbered assets - and finding it in junior explorers such as Silver North Resources, which owns exactly what the banks are said to have shorted: physical silver in the ground, high-grade and safely located in Canada.

ReadCommented by Nico Popp on January 14th, 2026 | 07:20 CET

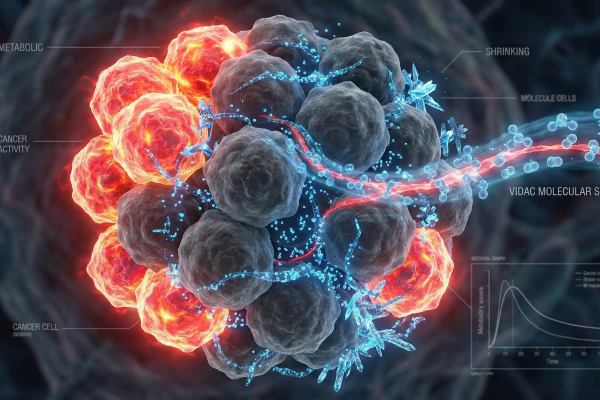

Targeting cancer metabolism: Why Bayer and Pfizer are restructuring - and why Vidac Pharma is filling a scientific gap

The investment year 2026 marks a decisive turning point for the global biotechnology and pharmaceutical sector. After a period of macroeconomic uncertainty, we are witnessing a renaissance in the life sciences, driven by two fundamental forces: the urgent need for big pharma players to replace their expiring patents with innovation, and the scientific breakthrough of novel mechanisms of action in agile biotech small caps. While industry giants such as Pfizer and Bayer are attempting to steer their cumbersome tankers onto a new course through massive restructuring, the as-yet little-noticed biotech company Vidac Pharma is delivering the technological innovation the market is looking for. With an approach that directly addresses cancer metabolism and reverses the "Warburg effect," which has been known for almost a century, Vidac is positioning itself as a disruptive force in oncology and dermatology. For investors, this constellation offers a rare opportunity: to observe the stability of the giants while betting on the explosive potential of a technological innovator that analysts say is massively undervalued.

ReadCommented by Nico Popp on January 14th, 2026 | 07:05 CET

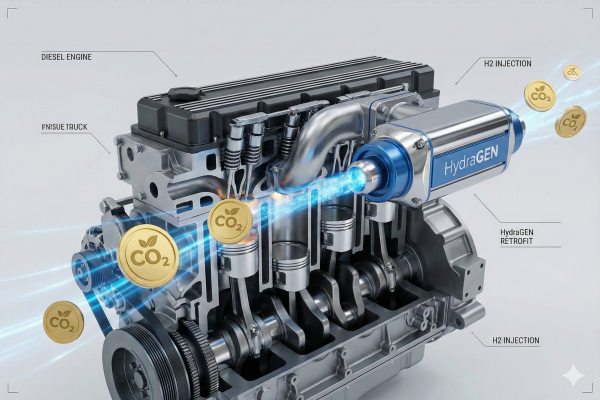

Between euphoria and industrial realism: How Linde, Hapag-Lloyd, and dynaCERT are defining the new reality of the hydrogen economy

We are witnessing a decisive turning point in the global hydrogen economy: The phase of speculative euphoria that characterized the beginning of the decade has given way to a phase of industrial realism and technocratic implementation. In investor circles and industry analyses, the term "mean reversion" has become established – a return to reality, away from unrealistic hyper-growth scenarios and toward physically feasible projects. According to the International Energy Agency's (IEA) Global Hydrogen Review 2025, the hydrogen sector continues to grow steadily and reached demand of nearly 100 million tons in 2024, but the structure of this growth is more complex than previously forecast. In this new environment, where regulatory interventions such as FuelEU Maritime and emissions trading (EU ETS) set the pace, three distinct winner profiles are emerging: infrastructure giant Linde, logistics heavyweight Hapag-Lloyd, and technology bridge builder dynaCERT, which occupies a highly compelling niche.

ReadCommented by Nico Popp on January 13th, 2026 | 07:10 CET

Gold records, Sibanye Stillwater, Equinox: Why the USD 5,000 scenario is becoming reality, and Africa is turning into a jackpot for AJN Resources

January 12, 2026, marks a psychological turning point in financial history. With the Handelsblatt article discussing a potential rise in the price of gold to USD 5,000 per ounce, a scenario that was long considered the domain of apocalyptic optimists has entered the mainstream. But unlike previous cycles, this price increase is not only driven by fear, but by a fundamental realignment of the global monetary architecture and an unprecedented supply shortage. We are in a phase that Goldman Sachs, according to its analyses, describes as the "perfect storm": a mixture of geopolitical fragmentation, an aggressive interest rate turnaround, and structural underinvestment in new mines. While the price of gold already climbed to all-time highs of over USD 3,600 in 2025, indicators for 2026 point to an acceleration. In this environment, a continent that has long been neglected is coming into focus: Africa. While established producers such as Sibanye Stillwater and Equinox Gold are consolidating their positions, explorer AJN Resources offers the leverage that risk-tolerant investors are looking for in the early stages, thanks to its unique structure in Congo and Ethiopia.

Read