At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on December 17th, 2025 | 07:30 CET

The Pentagon gets serious for Boeing and Co.: US government backs Korea Zinc and ignites the turbo for Antimony Resources

Antimony was long a metal that attracted little attention. But that has changed abruptly with China's recent export restrictions and geopolitical escalation. The semi-metal is indispensable for the defense industry, from ammunition to high-tech alloys used by Boeing. To break its dependence on Beijing, Washington is now digging deep into the state coffers and supporting the development of domestic capacities through the industrial giant Korea Zinc. This government intervention is fundamentally changing the rules of the market and bringing North American explorers, such as Antimony Resources, which could supply the urgently needed raw material in a few years, into the spotlight of strategic investors.

ReadCommented by Nico Popp on December 17th, 2025 | 07:15 CET

Gold rush: After producers Barrick Mining and Equinox Gold, it is now the turn of explorers – why Desert Gold is a takeover candidate

Forecasts for the gold market in 2026 are clear and point to a continuing supercycle. However, while producers such as Barrick Mining and Equinox Gold have already benefited massively from higher gold prices in recent months and expanded their margins, the valuation of exploration companies is still lagging behind. This historical divergence is likely to close in the coming year. Experience shows that capital flows cyclically: first, investors buy the security of cash flows, then they seek the leverage of resource development. In this environment, Desert Gold Ventures is coming into focus. The Company controls one of the largest non-producing land packages in West Africa, and is active precisely where industry giants are urgently searching for new supply.

ReadCommented by Nico Popp on December 16th, 2025 | 07:35 CET

AI and energy hunger: Why Microsoft, Cameco, and American Atomics are part of a megatrend

Artificial intelligence is not only changing the way we work, but also posing enormous challenges for the physical infrastructure of the global economy. Data centers for AI applications require round-the-clock power, a so-called base load that renewable energy such as solar and wind cannot consistently provide due to their volatility. And the response of the major tech companies to this problem - nuclear power! This is currently leading to a historic reassessment of the entire nuclear value chain. We present three companies positioned to benefit from this energy megatrend: Microsoft, Cameco, and American Atomics.

ReadCommented by Nico Popp on December 15th, 2025 | 07:05 CET

The Wall Street leverage: What Bank of America's entry really means for Almonty - the MP Materials blueprint

Capital on the stock market is not all the same. There is "dumb" money that chases short-term trends, and there is "smart" money that actually shapes markets. The alliance between Almonty Industries and Bank of America is therefore far more than a simple financing round. It is an institutional seal of approval that, via access to the wealth management arm Merrill, opens the door to US private capital and enables a re-rating. Analysts such as D.A. Davidson had already confirmed this potential before the most recent capital increase with the high-profile lead bookrunner, issuing concrete price targets of USD 12 and pointing to massive revenue growth through 2028.

ReadCommented by Nico Popp on December 12th, 2025 | 07:15 CET

US banks declare a golden age: JPMorgan, Goldman Sachs, Kobo Resources and the maximum leverage

Wall Street's gold price forecasts for 2026 are unusually clear. Both JPMorgan and Goldman Sachs have raised their price targets significantly and see the precious metal on the verge of a historic breakout. But while the big banks primarily manage their business through volume and hedging, the market offers additional opportunities for speculative investors. Small explorers like Kobo Resources could become particularly interesting precisely because the big institutional players have not yet invested here.

ReadCommented by Nico Popp on December 11th, 2025 | 07:10 CET

Pasinex, thyssenkrupp, Umicore: How industry and smart mining are benefiting from zinc's comeback

Zinc leads a shadowy existence in many investors' portfolios – unjustifiably so. While lithium, rare earths, and copper are often hailed as the only raw materials of the future, a quiet but significant shift is taking place in the zinc market. Zinc is essential for modern infrastructure, indispensable for the energy transition and the refinement of steel. We shed light on why zinc should now be back on the watch list and how three completely different players, thyssenkrupp, Umicore and Pasinex Resources, are accompanying this dynamic.

ReadCommented by Nico Popp on December 10th, 2025 | 07:05 CET

Second hydrogen wave with Linde, BASF, dynaCERT: Why 2026 will be the year of truth

fundamentally from the hype cycles of 2020 and 2021. Back then, enthusiasm was driven largely by visionary PowerPoint presentations rather than real-world progress. The transition to 2026, however, marks the start of a new industrial reality. Investors who have followed the sector for years now recognize a clear shift in market dynamics - one based less on hope and more on regulatory certainty and technological maturity. As Der Aktionär correctly notes, a new tailwind is emerging for industry. We explain what improved framework conditions and the market launch of large-scale plants in Europe could mean for the shares of Linde, BASF, and dynaCERT.

ReadCommented by Nico Popp on December 9th, 2025 | 07:05 CET

Attacking the fuel that feeds tumors: Why Roche, Pfizer, and Vidac Pharma are redefining oncology

Modern cancer therapy is no longer about blunt-force attacks, but rather precise, targeted interventions. While oncology in recent decades has been dominated by non-specific cell toxins, today's research resembles surgical intervention in the biological software of a disease. Industry heavyweights, Roche and Pfizer, are securing their market positions with gigantic portfolios of immunotherapies. But away from the corporate headquarters of Basel and New York, agile biotech pioneers are working on approaches that attack the very foundation of cancer cells: their energy supply. Those who pull the plug on cancer cells could be among the big winners in the biotech sector in 2026.

ReadCommented by Nico Popp on December 8th, 2025 | 07:00 CET

True sustainability in the portfolio: JinkoSolar, Nordex, and the smart niche player RE Royalties

"Green" is no longer a mark of quality on the stock market, but rather a minimum requirement. However, those who mindlessly invest in anything with a solar panel or wind turbine in its logo will often have learned a costly lesson by 2025. The sector is becoming more differentiated: on the one hand, the industrial heavyweights are struggling with price wars and supply chains. On the other hand, specialized financiers are emerging who are closing precisely these gaps and often operating more profitably than the manufacturers themselves. Anyone seeking real returns must now make a clear selection: between mass-market players, turnaround candidates, and intelligent niche specialists.

ReadCommented by Nico Popp on December 8th, 2025 | 07:00 CET

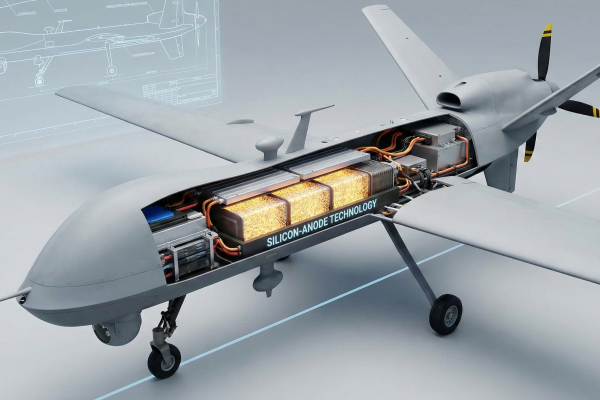

Even in times of peace, these defense stocks have a future: NEO Battery Materials, Hensoldt, DroneShield

There is a lot at stake for Ukraine these days: Will there be a dictated peace, will the war continue, or is a long-term viable solution in sight after all? Some defense stocks have fallen in recent weeks. However, regardless of the current peace negotiations, it looks as if Europe in particular will have to invest heavily in military capabilities in the coming years. We explain why and present some exciting stocks.

Read