May 15th, 2023 | 07:20 CEST

Thanks to Macron: Special boom for fuel cells? Plug Power, First Hydrogen, Volkswagen

It is a bombshell announcement that is expected to be made by the French Cabinet in Paris this week. As reported by Handelsblatt, in the future, emissions generated during the production of electric vehicles will be taken into account when promoting these vehicles. Until now, France, similar to Germany, has provided incentives for each electric vehicle priced below EUR 47,000. With the new law, Chinese manufacturers could be left out. We look at what this means and why hydrogen could be heading towards a special boom.

time to read: 3 minutes

|

Author:

Nico Popp

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , First Hydrogen Corp. | CA32057N1042 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

France wants to get serious: No subsidies for dirty e-cars

Under certain conditions, the French state has paid up to EUR 5,000 to anyone who bought an e-car - until now. Chinese makes could soon no longer be subsidised. The reason: in China, 60% of electricity comes from coal. That alone would disqualify Chinese cars. Western manufacturers might also have to make an effort in the new regulatory framework. Many basic products and raw materials for e-cars still come from less sustainable sources. Companies with a clear ESG profile are likely to benefit. This is especially true if the French move catches on and other important markets, such as Germany, follow suit. Under the guise of climate protection, economies that pursue a similar strategy to France's are killing two birds with one stone: they favour domestic manufacturers and send a clear signal to many sectors to do more to protect the climate.

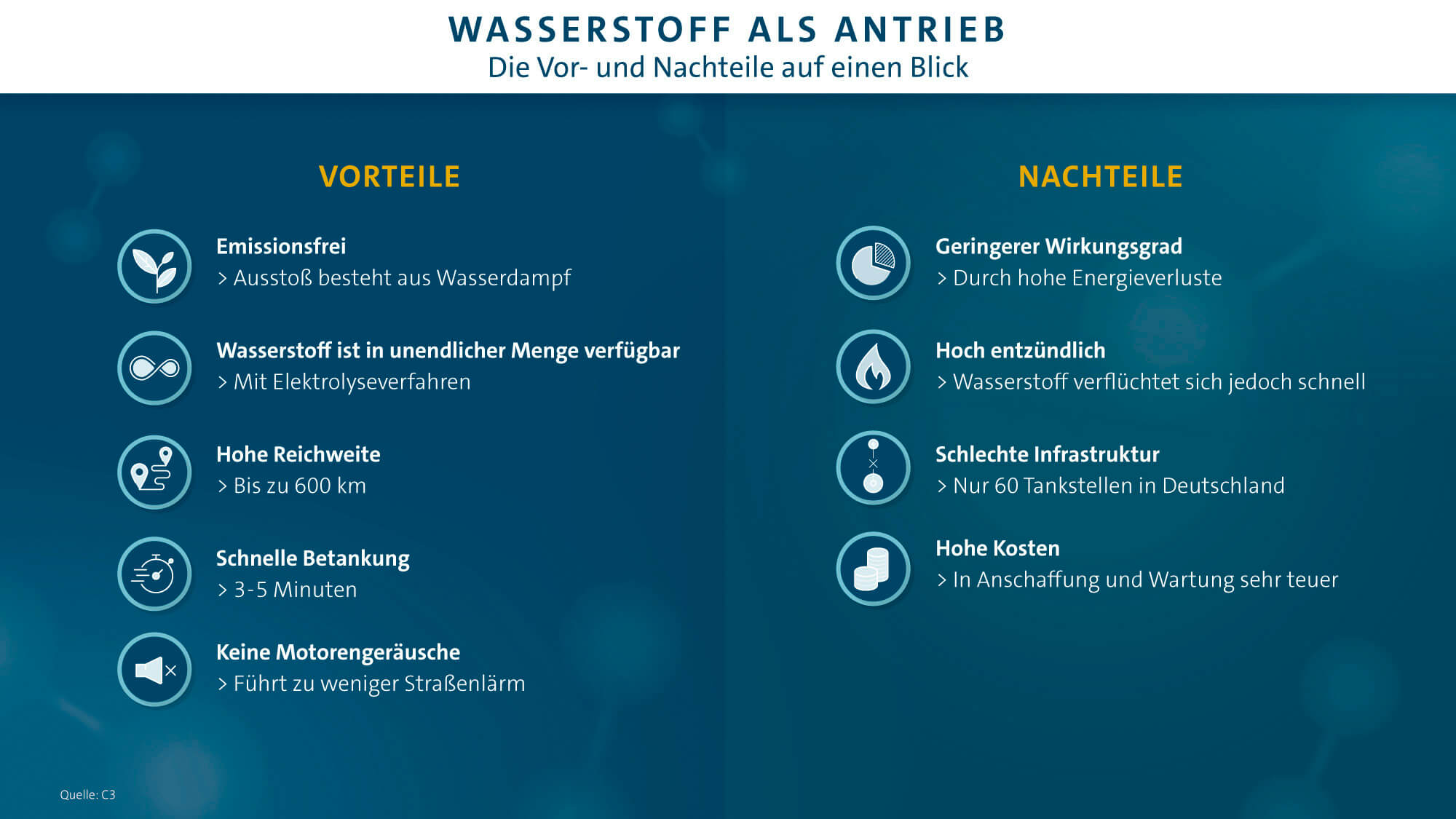

To what extent this form of protectionism can be crowned with success, given the significant cost advantages that Chinese car manufacturers have, remains an open question. However, hydrogen companies and fuel cell manufacturers could benefit. Although this technology requires about twice as much energy as classic battery-powered cars, the production of the vehicles is much less costly and requires fewer raw materials - a hydrogen tank made of carbon is much less complex than a modern battery. But which companies could benefit?

Plug Power: Suffers from loss of confidence

When it comes to hydrogen, the first thing that comes to mind for many investors is the Plug Power share. The Company is considered a pioneer in its field but also a "capital destroyer": recently, disappointed shareholders even filed class action suits because, according to the suing shareholders, the management made positive statements in public while weak figures were already to be expected. Last week, the Company reported weak figures again, sending its shares down. However, the outlook remains positive. The Company expects business to pick up in the coming years. But will it succeed in doing so? The list of disappointments for Plug Power shareholders is long.

First Hydrogen: Agile strategy as a recipe for success

Shareholders of First Hydrogen should be in a better mood. The Company operates in a niche that is expected to benefit from a growing interest in hydrogen vehicles even sooner than the passenger car market. Light delivery vehicles currently form large fleets for delivery services and logistics companies. Since it makes sense to operate these vehicles emissions-free within cities and towns and to refuel them quickly, the vehicles could be a good option for First Hydrogen to enter the market successfully. The Company pursues a "best-of strategy" and is flexible with the components installed. This should also make it possible to install exactly those components that are also produced in a climate-friendly way. At a time when emissions from production are a relevant factor, this can be an advantage over large corporations with established supply chains.

Only months ago, Stellantis, the parent company of Opel, Peugeot and Citroën, announced its intention to build light commercial vehicles in France from 2024. There is talk of 5,000 units per year. The market is much bigger. First Hydrogen reports 29 million vans on EU roads at the end of 2021. In the UK, there were a further 3.9 million. The market for alternative drive systems in the light commercial vehicle sector appears to exist. First Hydrogen, which most recently announced a research partnership with the University of Quebec and whose prototypes are currently rolling along British roads, should be well positioned to secure a slice of this enormous pie.

Volkswagen and hydrogen: Patents for the drawer

And what are established companies doing? Even though Volkswagen now has a clean image as an e-car maker, fuel cell technology is far from being shelved in Wolfsburg. At the end of 2022, it became known that Volkswagen, together with the Saxon company TUBES GmbH, had applied for a patent for a fuel cell that does not require platinum or lithium and is expected to achieve ranges of up to 2,000 km. However, it may take some time before it is ready for the market. Additionally, the corporate structures at VW are likely to ensure that the Company does not deviate from its current electric vehicle strategy too quickly.

So, what do these current developments mean for investors? The fact that emissions during production are considered when it comes to government subsidies is good and right - buyers of electric vehicles do not want any deception. The legislative initiative from France could also set a precedent. Hydrogen vehicles are likely to experience a special boom. Companies in promising niches like First Hydrogen can benefit from this.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.