At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on January 12th, 2026 | 07:15 CET

The USD 200 billion poker game: Why a merger between Glencore and Rio Tinto could pave the way for Pasinex Resources

The 2026 stock market year began with a rumor that could shake the foundations of the global commodities industry. In trading rooms from London to Toronto, there were increasing signs that industry giants Rio Tinto and Glencore were once again considering a merger. It would be a historic mega-merger, creating a hegemony with an estimated value of USD 200 billion. Initial exploratory talks between the two companies have now been confirmed. But while analysts are still discussing the antitrust hurdles, the "smart money" is already looking to the second tier. After all, such a mega-merger would have one primary goal: absolute control over the critical metals of the energy transition, above all, copper and zinc. In the shadow of these giants, flexible, high-grade players such as Pasinex Resources are emerging as the real winners, as they deliver precisely the agility and production quality that the cumbersome large corporations lack.

ReadCommented by Nico Popp on January 12th, 2026 | 07:05 CET

USD 16 trillion in transition: How Finexity is rewriting the rules of Wall Street alongside Deutsche Bank and Bank of America

2025 marked a historic turning point for global capital markets. What was long considered a futuristic experiment is now a harsh economic reality: the tokenization of assets, known in technical jargon as "real world assets" (RWA), is breaking down the entrenched structures of the old economy. According to recent studies by leading consulting firms such as the Boston Consulting Group, this market is heading for a gigantic volume of USD 16 trillion by 2030. Two worlds are colliding in this new ecosystem. On the one hand, there are the established top dogs such as Deutsche Bank and Bank of America, which are posting record results and using blockchain to become even more profitable. On the other hand, Finexity AG, a German disruptor, is challenging the status quo. Since its IPO in September 2025, it has been proving that the future belongs not to the management but to the democratization of wealth. For investors, the question arises: Should they bet on the gentle evolution of the giants or on the radical innovation of the challenger?

ReadCommented by Nico Popp on January 9th, 2026 | 07:15 CET

Nuclear comeback: How AI is revitalizing the sector and American Atomics is becoming a key player alongside General Electric and Siemens

The year is 2026, and global energy markets are evolving rapidly. The narrative of nuclear power as a thing of the past is history – CO2 neutrality and energy security increasingly depend on reliable base-load generation. Driving this change is the rapidly growing energy demand of artificial intelligence. Hyperscalers and data centers require stable, 24/7 power that wind and solar alone cannot guarantee. In this new nuclear era, technology giants such as General Electric and Siemens are central as they build the reactors and grids of the future. However, the most attractive niche may lie at the start of the value chain: American Atomics is addressing uranium supply challenges with new technologies and secure US locations.

ReadCommented by Nico Popp on January 9th, 2026 | 07:00 CET

Silver shock 2026: Why JinkoSolar and AMD are buying up the market, and Silver Viper Minerals is becoming a key strategic stock

It is January 2026, and global commodity markets are experiencing a tectonic shift that has surprised even seasoned market observers. Silver, long derided as gold's sedate little brother, has thrown off its historical shackles. After an unprecedented price explosion of 147% in 2025, the precious metal is now trading at over USD 74 per ounce. But unlike in previous cycles, this rise is not primarily driven by speculation, but is based on physical scarcity. Industry, led by solar giants and the AI hardware sector, is sucking the market dry. In an environment where companies such as JinkoSolar and AMD are fighting for every gram of conductive material, explorers such as Silver Viper Minerals are moving into the spotlight. They possess what the global economy is desperately seeking: new, high-grade deposits in secure jurisdictions.

ReadCommented by Nico Popp on January 8th, 2026 | 07:25 CET

Defense in a stranglehold: Why Lockheed and Boeing are grounded without antimony - and Antimony Resources holds the strategic solution

It is a chemical element with the atomic number 51 that has long led a shadowy existence on the world's stock exchanges, but whose strategic importance is now keeping security policymakers at the Pentagon awake at night: antimony. What sounds like a footnote in the periodic table is, in reality, the invisible glue holding together the modern defense and aviation industries. But this glue is becoming scarce. China, which dominates the global market with a share of more than 50% in production and nearly 80% in processing capacity, has begun to tighten the reins on exports. Trade barriers and opaque export restrictions are fueling real fears of a supply stoppage. In this high-risk geopolitical scenario, giants such as Lockheed Martin and Boeing are finding themselves in a bind, while small Western explorers such as Antimony Resources are suddenly becoming owners of assets that could prove indispensable to the national security of NATO countries.

ReadCommented by Nico Popp on January 8th, 2026 | 07:10 CET

Gold rush without toxins: Why Newmont and Equinox are under pressure, and RZOLV Technologies could become the key stock of the new super cycle

Gold is back on the big stage. Driven by geopolitical hot spots, structural weakness in the US dollar, and the insatiable appetite of central banks, the precious metal is racing from one all-time high to the next. But while prices are rising, the situation for mine operators is deteriorating: dependence on highly toxic cyanide is becoming more and more of a problem. Environmental regulations are becoming stricter, approval procedures are dragging on for decades, and social resistance is blocking billion-dollar projects. The technology company RZOLV Technologies is positioning itself in this area of tension between record prices and ecological dead ends. While industry giants such as Newmont and Equinox Gold are looking for ways to secure their production in a sustainable manner, RZOLV is providing the long-awaited technological answer: gold extraction that does not require any toxic chemicals and thus has the potential to reshuffle the cards in global mining.

ReadCommented by Nico Popp on January 7th, 2026 | 07:10 CET

The clean solution to the dirty nickel problem: How Power Metallic Mines could save the supply chains of Mercedes-Benz and Volkswagen

The automotive industry faces a paradoxical situation in 2026. While sales figures for electric vehicles have stabilized and the technology is becoming increasingly mature, the threat now comes not from demand but from the supply side of the value chain. The supply of raw materials, especially the critical battery metal nickel, is coming under massive pressure due to geopolitical shifts and drastically tightened environmental regulations in Asia. German flagship companies Mercedes-Benz and Volkswagen, which have invested billions in their electrification strategies, are faced with the challenge of reconciling their ethical promises with the physical reality of the market. In this area of tension between regulatory constraints and industrial needs, Canadian explorer Power Metallic Mines is evolving from a raw materials explorer into a potential strategic enabler with its NISK project.

ReadCommented by Nico Popp on January 7th, 2026 | 07:00 CET

Trade war over batteries: China's export restrictions force the West to act – and position NEO Battery Materials as a potential game changer for AeroVironment and DroneShield

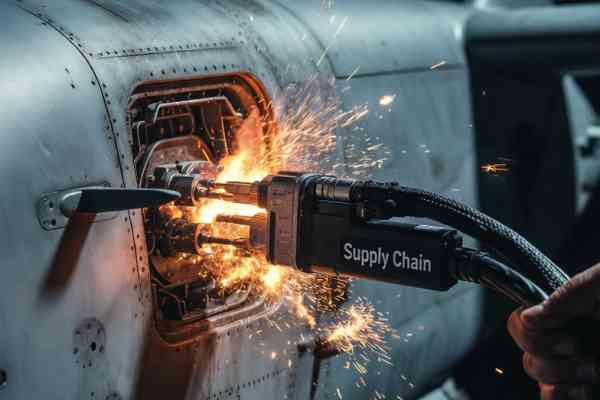

The geopolitical map of the technology sector is currently being redrawn. After China drastically tightened export controls in recent weeks on critical drone components and high-performance batteries, Western defense companies are increasingly facing supply chain risks. In this strategic environment, the Canadian company NEO Battery Materials is evolving from a pure technology developer into a strategically relevant industrial partner. With the recently announced market readiness of its silicon-based battery technology, NEO offers a non-Chinese alternative that could become highly attractive for drone manufacturers such as AeroVironment and counter-drone specialists like DroneShield, as they seek to reduce dependence on Asian supply chains and secure long-term production reliability.

ReadCommented by Nico Popp on January 6th, 2026 | 07:20 CET

Alternative to Barrick Mining and Equinox Gold: Why Maduro's fall could drive gold prices higher and make LAURION Mineral a strategic target

The 2026 stock market year is beginning with a geopolitical earthquake whose tectonic shifts will be felt across global commodity markets for a long time to come. The direct intervention of the United States in Venezuela and the effective removal of President Nicolás Maduro have redefined the global security architecture virtually overnight. While Washington celebrates the move as a necessary restoration of democracy in the Western Hemisphere, geopolitical rivals Beijing and Moscow are responding with sharp rhetoric and brusque diplomatic protests. Uncertainty is spreading like wildfire – from the shores of Cuba, where the regime fears for its survival, all the way to Greenland, where major powers are increasingly competing aggressively for strategic spheres of influence. With gold already rising for months amid mounting uncertainty and monetary policy concerns, investors continue to flee to the safe haven. However, while established producers such as Barrick and Equinox absorb the first wave of panic-driven inflows, strategic investors are turning their attention to the few remaining safe jurisdictions such as Canada. Here, specialized explorers like LAURION Mineral Exploration hold precisely the kind of assets that are becoming the most valuable currency in an uncertain world.

ReadCommented by Nico Popp on January 6th, 2026 | 07:00 CET

The new world order after the Venezuela shock: Why Rheinmetall and Bank of America are betting on North America, and Globex Mining is the big winner

The spectacular arrest of the Venezuelan president by US authorities marks another historic turning point that has repercussions far beyond South America. It is the ultimate proof that the era of diplomatic kid gloves is over and that the law of the jungle is increasingly prevailing on the international stage. For global financial markets and strategic investments, this move means a radical reassessment of country risks. If heads of state are no longer safe, then investments in mines and infrastructure in politically unstable regions are certainly not. In this new climate of hard power politics, security of supply is becoming the only currency that counts. That is why the spotlight is now turning to a company that exemplifies North America's commodity security: Globex Mining. With a gigantic portfolio of over 200 projects in the world's safest jurisdictions, Globex offers precisely the geopolitical protective shield that the market is now desperately seeking.

Read