At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on January 27th, 2026 | 07:25 CET

Double dividends for Amazon & Co.: How CHAR Technologies combines the business models of Clean Energy Fuels and Carbon Streaming

The global energy landscape is currently undergoing a quiet but tremendous change. While electric trucks are still often discussed in the headlines, the titans of the logistics industry have long been making progress on a completely different track. Driven by the need to improve their carbon footprints immediately, giants such as Amazon and UPS are investing heavily in renewable natural gas (RNG). This trend has triggered strong demand for green molecules that can use existing infrastructure without having to wait for the expansion of the power grids. But parallel to this physical market, a second, purely financial sector is booming in the background: trading in certificates for the permanent removal of carbon dioxide. Investors are now willing to pay premiums for verified, high-quality certificates. The Canadian company CHAR Technologies is positioning itself in both of these markets. CHAR combines the best of both worlds. Its plants produce the RNG urgently needed by the logistics industry and, at the same time, generate the premium certificates that are currently the most expensive on the carbon market through the production of biochar.

ReadCommented by Nico Popp on January 27th, 2026 | 07:10 CET

Perpetua Resources and Mandalay as role models: How Antimony Resources is closing China's antimony gap

There are raw materials that have led a shadowy existence for decades, only to suddenly become a matter of national security overnight. Antimony is just such a case. The shiny silver semi-metal was invisible to investors for a long time, but geopolitical shifts have catapulted it into the spotlight. Without antimony, there would be no armor-piercing ammunition, no night vision devices, and no high-performance batteries for the energy transition. Alarm bells have been ringing in Western defense ministries ever since China, which dominates the market, drastically restricted exports of this strategic material, effectively using it as a geopolitical weapon. In this scenario, where physical availability is suddenly more important than price, a huge supply deficit is emerging. While the big mining companies often ignore this niche market, Canadian raw materials company Antimony Resources is positioning itself precisely in this gap. With a strategic project in stable Canada, the Company offers the answer to the question of where the West should source its antimony in the future.

ReadCommented by Nico Popp on January 26th, 2026 | 07:05 CET

Silver boom for First Majestic & Co.: How Silver Viper Minerals could become the next big takeover story following the Vizsla playbook

The silver market is experiencing a structural supply deficit so severe that it threatens the industrial supply chains of the future. While the photovoltaic and electric vehicle industries are absorbing every available ounce of the precious metal, geologists and investors are looking intently at the Sierra Madre Occidental in Mexico. This mountain range is not only historically the heart of global silver production, but it is also still the place where exploration successes can make investors rich. There is a dynamic reminiscent of the great gold rush: anyone who strikes high-grade veins here can multiply the value of their company in no time. But the easy deposits have long since been found. Today, the key to success lies in applying modern geological models to forgotten or overlooked districts. In this environment, Silver Viper Minerals is positioning itself as an explorer that has precisely the ingredients that have already led to spectacular price gains for its competitors in recent years. While the market is still focused on the big producers, Silver Viper is preparing the next big discovery story in the shadow of the giants.

ReadCommented by Nico Popp on January 23rd, 2026 | 07:15 CET

Revolution in agricultural chemistry: How MustGrow Biologics is benefiting from the plight of Bayer and Corteva

Global agriculture is at a historic turning point, driven less by a belief in technological progress than by regulatory necessity. For decades, global food security has been based on synthetic pesticides and fertilizers, but that era is rapidly coming to an end. Authorities from Brussels to California are tightening the screws and banning established active ingredients one after the other because their ecological collateral damage is no longer tolerated. For the agricultural giants, this poses an existential threat: their full warehouses are in danger of becoming worthless if they do not find effective biological alternatives quickly enough. In the current extremely hectic environment in industry, which is characterized by billion-dollar acquisitions and strategic alliances, new power structures are emerging. While Corteva Agriscience is aggressively buying market share with its chequebook and Bayer is pushing ahead with its portfolio restructuring, the Canadian company MustGrow Biologics has carved out a position that is considered the "sweet spot" in the industry. The Company is the technology partner whose active ingredients have already been validated and licensed by the market leaders.

ReadCommented by Nico Popp on January 23rd, 2026 | 07:05 CET

The battle for resources is being fought in the data room: How Aspermont Uses AI to Boost the Returns of Rio Tinto, Alamos Gold & Co.

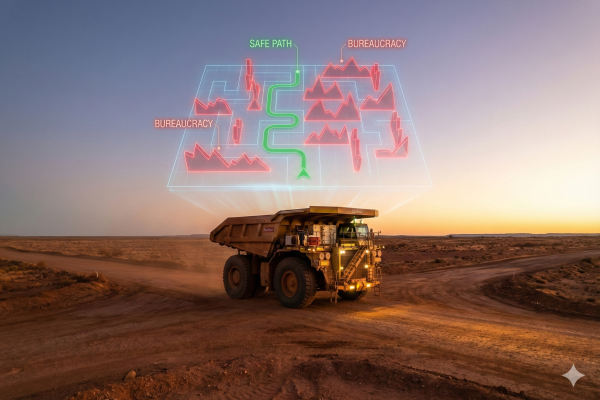

It is the greatest paradox of the modern economy: while demand for copper, lithium, and rare earths is exploding due to trade wars and the insatiable appetite of the AI industry, building a new mine has never been more difficult. Large mining corporations are increasingly failing not because of geology, but because of bureaucracy, environmental regulations, and, in remote regions of the world, geopolitical pitfalls. In this new era, where a legally binding permit is often more valuable than spectacular drilling results, validated information is becoming the most critical resource in the commodities sector. Analyst firms such as McKinsey and the International Energy Agency (IEA) warn of a massive structural supply deficit, as the development of new mines in the West often requires more than a decade of legal wrangling. It is precisely in this area of tension that the Australian media and tech company Aspermont is positioning itself as the decisive problem solver. With a treasure trove of data spanning centuries of industrial history and a new alliance with industry giant Rio Tinto, the Company is transforming itself from a media company into a kind of "Google of mining" – offering investors an opportunity based on intelligence rather than luck.

ReadCommented by Nico Popp on January 22nd, 2026 | 07:20 CET

Gas boom Down Under: Omega Oil + Gas and Elixir Energy becoming increasingly expensive – balance sheet treasure at Pure One Corporation

There is a strange discrepancy in the global energy markets that is nowhere more tangible than on Australia's east coast. While politicians and ESG funds have been rehearsing the demise of fossil fuels for years, reality is now hitting the economy with full force. Sentiment in trading rooms from Sydney to Perth has shifted markedly. A gold-rush mood has returned – this time for natural gas. In its "Gas Statement of Opportunities 2025," market operator AEMO warns in an almost alarmist tone of an impending supply gap. Gas explorers such as Omega Oil & Gas and Elixir Energy have already risen sharply. But away from the obvious investments, hydrogen company Pure One presents a classic arbitrage opportunity that is still largely ignored by the broader market. The Company is preparing to spin off its gas division, and a detailed comparison with its peers suggests that investors can currently acquire this asset at virtually no cost – a gift for anyone who knows how to read balance sheets.

ReadCommented by Nico Popp on January 22nd, 2026 | 06:55 CET

AI and the uranium comeback: How American Atomics is becoming the winner of the energy transition and what that has to do with Meta Platforms and Infineon

The era of artificial intelligence (AI) is not only an era of enormous productivity gains, but above all an era of infrastructure and gigantic energy consumption. While the last decade was dominated by software, the future will be all about hardware. Generative AI and the path toward artificial general intelligence (AGI) are transforming data from an intangible asset into a massive consumer of power. Analysts at Goldman Sachs estimate that investments by major US tech companies in energy infrastructure could reach the astronomical sum of over USD 500 billion by 2027. This new reality is forcing a two-pronged energy strategy: on the one hand, the massive expansion of storage and efficiency technologies, and on the other, the inevitable return to the only CO2-free energy source that reliably provides base load – nuclear power. We explain what tech titan Meta Platforms and chip manufacturer Infineon have to do with this development and why American Atomics is considered a highly speculative but strategically brilliant bet on the uranium comeback.

ReadCommented by Nico Popp on January 21st, 2026 | 07:10 CET

Nuclear fusion fantasy at Almonty, Chevron, Cenovus Energy: Why tungsten is the key to infinite energy

Until now, when investors thought of tungsten, they usually pictured hardened steel for armor-piercing ammunition or high-performance drill bits for industrial use. But this perception is on the verge of changing fundamentally. The latest physical breakthroughs in nuclear fusion, particularly at the Chinese experimental reactor EAST, often referred to as the "artificial sun", are placing the high-melting metal at the center of an energy revolution. While oil multinationals such as Chevron and Cenovus Energy are managing the present with record profits, a new market is emerging in the background for materials that must withstand the most extreme conditions. In this scenario, Almonty Industries is evolving from a traditional mining company into a strategic technology enabler – after all, there can be no fusion energy without tungsten. For investors willing to look beyond the fossil fuel world, this opens up an opportunity that goes far beyond cyclical commodity trading.

ReadCommented by Nico Popp on January 21st, 2026 | 07:00 CET

SGS Canada confirms world-class results: Why Power Metallic Mines is becoming indispensable for Mercedes-Benz, Ford & Co. after a metallurgical breakthrough

There are events that change everything—turning points where hopes become certainty. Often, these shifts take place away from the headlines, in laboratories and testing facilities, where the feasibility of the future is decided. For Power Metallic Mines, such a moment has arrived now. The recently published metallurgical test results for the Lion Zone are far more than just technical data – they are proof that the Company holds an asset capable of sustainably securing supply chains for automotive giants such as Mercedes-Benz and Ford. At a time when the global economy is desperately searching for stable sources of copper and platinum group metals, Power Metallic Mines is now delivering the hard currency of the mining industry: validated extraction rates at world-class levels. For investors, this virtually eliminates the most significant risk faced by an explorer – the question of technical feasibility – and opens the door to a fundamental revaluation of the stock.

ReadCommented by Nico Popp on January 20th, 2026 | 07:05 CET

Antimony shock for Airbus and BASF: China's export restrictions make Antimony Resources a strategic winner

2025 will go down in economic history as the year when a largely unknown semi-metal sent global industry into a state of alert. Antimony, long overshadowed by popular battery metals such as lithium and cobalt, suddenly emerged as one of the most strategically critical and supply-constrained metals. Aggressive export restrictions imposed by China, which historically controlled over 80% of global processing capacity, have put Western supply chains under significant pressure. What market observers refer to as the "antimony shock" is no longer a theoretical threat, but a harsh economic reality. According to industry analyses, market participants were already talking about significant supply deficits in 2025 – estimates are in the high five-digit ton range. We analyze the market and present a potential beneficiary.

Read