Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Commented by André Will-Laudien

Commented by André Will-Laudien on December 22nd, 2025 | 07:40 CET

Boom 2026 – Energy transition now! Which stocks are convincing in the long term? Power Metallic, Nordex, Siemens Energy, or JinkoSolar

The year is drawing to a close. Will next year see the losers of 2025 really take off? And even more interesting: can the blockbuster stocks from the artificial intelligence, high-tech, big data, and raw materials sectors repeat their historic returns? We think it is wise to expect somewhat lower returns. But here, too, everyone could be wrong. Tesla provides one example. Elon Musk's visionary company is selling fewer and fewer vehicles, and competition is growing. However, with topics such as robotics and autonomous driving, the dazzling founder always has new aces up his sleeve, and the stock keeps rising. We can provide some assistance in the energy sector, but there are also clear overvaluations here.

ReadCommented by André Will-Laudien on December 22nd, 2025 | 07:15 CET

Mega rally in 2026 with artificial intelligence, chips, and storage solutions: Oracle, Graphano Energy, Broadcom, and Infineon

The year 2025 is drawing to an end. This year, the focus was clearly on the shares of AI providers in the areas of storage solutions, infrastructure, and databases. Investment banks see this sector as a potential driver of rising stock markets in 2026 as well. Will there be a correction in the first quarter? No one knows, because apart from the minor customs uncertainty in April 2025, there has been no serious decline in the international capital markets so far. This is surprising, because inflation remains high, interest rates are rising, and commodity prices are galloping away. These are all indications of higher input prices and falling margins. Which stocks are still making good money?

ReadCommented by André Will-Laudien on December 22nd, 2025 | 06:55 CET

Will 2026 start with another surge? We evaluate BYD, NEO Battery Materials, and DroneShield

In December, many market participants start thinking about the next investment period – in this case, the year 2026. The 2025 investment year was one of the best periods of the past 20 years for both the DAX and the NASDAQ, with gains of 18.7% and 20.8%, respectively. Even the Trump tariff crash in April was offset entirely within just two weeks. The drivers of the upswing remain the US administration's policy, which is perceived as "supportive," as well as ongoing geopolitical conflicts and still tolerable interest rates between 2.7% (Bund) and 4.0% (USD Treasury) in the ten-year range. For the coming year, some experts expect another wave of inflation, high commodity prices, and rising energy costs. These are all factors that could once again stifle the economic upturn and bring additional volatility to the markets. And let's not forget: AI and defense seem to be at their peak — so who will lead the next revaluation of the stock markets?

ReadCommented by André Will-Laudien on December 18th, 2025 | 08:00 CET

Silver boom and critical metals on the rise! Keep a close eye on Rheinmetall, Infineon, Hensoldt, and Antimony Resources

International conflicts and competition for physical silver are leading to increasing uncertainty surrounding critical metals. Since the defense industry and the high-tech sector are particularly dependent on intact supply chains, increased volatility is also measurable in these sectors. For risk-conscious investors, the time has come to scan their portfolios for potential risks and, after one of the best upward cycles of the last 20 years, to close one or two doors. We can help with the analysis.

ReadCommented by André Will-Laudien on December 18th, 2025 | 07:20 CET

Turnaround with a 100% chance in 2026! Novo Nordisk, TeamViewer, Equinox, and Laurion Mineral on the launch pad

The 2025 stock market year did not go well for everyone involved. The stocks in our selection today can tell us a thing or two about how it feels to be at the bottom of the rankings. But sometimes the stock market gets it wrong, because although Novo Nordisk has issued three profit warnings, the Company is still making good money. The situation is similar at TeamViewer, where there have been some disappointments in terms of growth, but the EBIT margin is still above 30%. It is completely incomprehensible that Laurion Minerals is at the bottom of the chart compared to other explorers. The drill results from Ontario show good mineralization values in gold not far from Equinox's Greenstone Mine. With gold prices at USD 4,300, the stock should soon see a surge. We do the math.

ReadCommented by André Will-Laudien on December 17th, 2025 | 07:25 CET

Can AI extend its marathon into 2026? Broadcom, Oracle, Aspermont, and Alibaba now in the portfolio?

Despite all the doom and gloom, the AI sector could once again perform strongly on the stock market in 2026, as the ongoing investment cycle in AI infrastructure is expected to lead to transformative monetization, according to Wedbush analysts. They anticipate high-tech stocks to gain a further 20%. Fidelity analysts calculate positive earnings growth in the IT sector of around 25%, supported by rising profitability driven by AI. Vanguard expects AI to offset negative shocks and drive US growth above widespread consensus forecasts with an 80% probability, thanks to enormous productivity gains. Only Barclays has recently expressed "bubble fears," deeming the hype overblown. How will it really play out? Here are a few indicators.

ReadCommented by André Will-Laudien on December 17th, 2025 | 07:00 CET

Year-end rally ahead! Selected positioning for 2026 in Almonty, DroneShield, thyssenkrupp, and TKMS

Incredible volatility at year-end. No surprise - the past stock market year will go down in history as one of the best for the DAX and NASDAQ. And this despite shrinking economic growth and rising inflation. But seasoned investors already know that inflation boosts stock prices, and what drives them even more is defense spending. War is terrible, but it fills the coffers of financiers - led, as always, by the US. Donald Trump likes to sell himself as a peacemaker to the outside world, yet the US remains the world's largest producer of offensive and defensive technology. Business is booming, NATO is among the biggest customers, and demand runs into the trillions. Whether 2026 will continue in the same vein is doubtful, but conflicts at least continue to enable hyperinflationary money printing. As a result, the gigantic debt flywheel spins ever faster – this is how FIAT money systems have functioned for millennia! Where do opportunities lie for risk-aware investors?

ReadCommented by André Will-Laudien on December 16th, 2025 | 07:20 CET

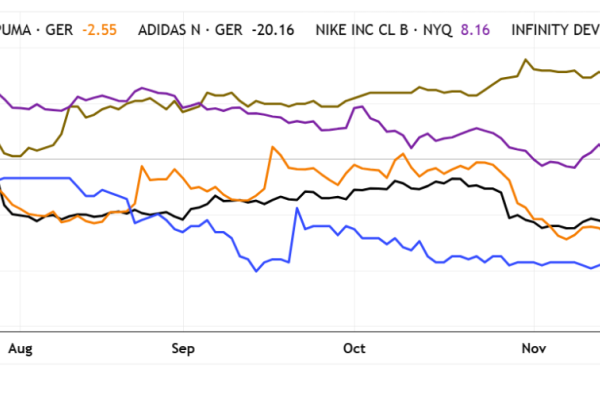

Impact investing, with super dividends into 2026 – Nike, RE Royalties, Adidas, Puma, and Infinity Development

Impact investing has become increasingly important in recent times as investors increasingly recognize that capital flows generate not only returns but also social and environmental impacts. In light of climate change, resource scarcity, and social imbalances, many market participants are no longer satisfied with using financial metrics alone as a benchmark. Regulatory authorities are promoting this development through stricter ESG requirements and greater transparency requirements for companies and financial products. At the same time, younger generations are demanding that their assets be consistent with their values and have a measurable positive impact. If you are looking for something, you will find suitable investments!

ReadCommented by André Will-Laudien on December 15th, 2025 | 07:15 CET

Gold, AI, and Bitcoin – A record year in 2026? Strategy, B2Gold, Kobo Resources, and Allied Gold

In mid-December, investors are keeping a close eye on the coming year 2026. Will the old winners also be the new ones? Bitcoin was a disappointment in 2025, as the cryptocurrency is actually down slightly to date. Artificial intelligence and sought-after high-tech suppliers were the focus of attention, with returns of several hundred percent, with Palantir and quantum computing specialist D-Wave, for example, achieving extreme performance. But how will things proceed next year? The majority of analysts believe that the highest-valued high-tech segment will cool down. The primary focus is on NVIDIA, which, with a 1,250% increase since 2021, is now one of the most expensive stocks in the world. The outlook is challenging, as a significant correction or even a crash would also be long overdue. Gold has gained over 60% in the last 12 months, and the trend is fully intact. Could it soon reach USD 5,000?

ReadCommented by André Will-Laudien on December 15th, 2025 | 07:00 CET

Silver soon at USD 100 – has the defense rally now stalled? Silver North, Rheinmetall, and DroneShield in focus

Unbelievable – who would have thought it? Last week, silver reached the USD 64 per ounce level for the first time, reflecting a pronounced imbalance between supply and demand. In contrast to the bubble surrounding the Hunt brothers, who effectively bought up the silver market to nearly USD 50, today's rally is based on a global structural deficit driven not only by industrial demand but also by geopolitical tensions, rising government debt, and a weak US dollar. Physical silver availability is declining worldwide due to low production levels. At the London Metals Exchange (LME) in particular, inventories have fallen by roughly one third since 2021, while ETFs have reduced the freely available supply by more than 75%. The situation is coming to a head! Where should investors start paying closer attention?

Read