March 28th, 2024 | 09:00 CET

Attention: Uranium despite the energy transition! Does this fit together? Plug Power, Nel ASA, Kraken Energy and Renk Group in focus

It feels like a paradox. The EU aims to be largely climate-neutral by 2050. The main focus is on mobility, heat and energy generation. As a core country of the EU, Germany is taking the political lead in the necessary measures. While France, Poland, Finland and the Czech Republic are actively expanding nuclear energy, this form of energy is virtually taboo in many other countries. Germany has been able to increase its renewable energy sources to over 50% with billions in subsidies at the expense of the taxpayer and the price of energy. Yet, Berlin still has to buy cheap electricity from abroad and also use coal and gas to stabilize the grid. It all sounds kind of crazy, but it gets really interesting when the wind isn't blowing and the sun is only to be found behind the clouds. Which shares should be considered in this mixed situation?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , NEL ASA NK-_20 | NO0010081235 , KRAKEN ENERGY CORP | CA50075X1024 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] When we acquire something, we want to make sure that the acquisition fits with our strategy and has the potential to be successful for our shareholders. [...]" John Jeffrey, CEO, Saturn Oil & Gas Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

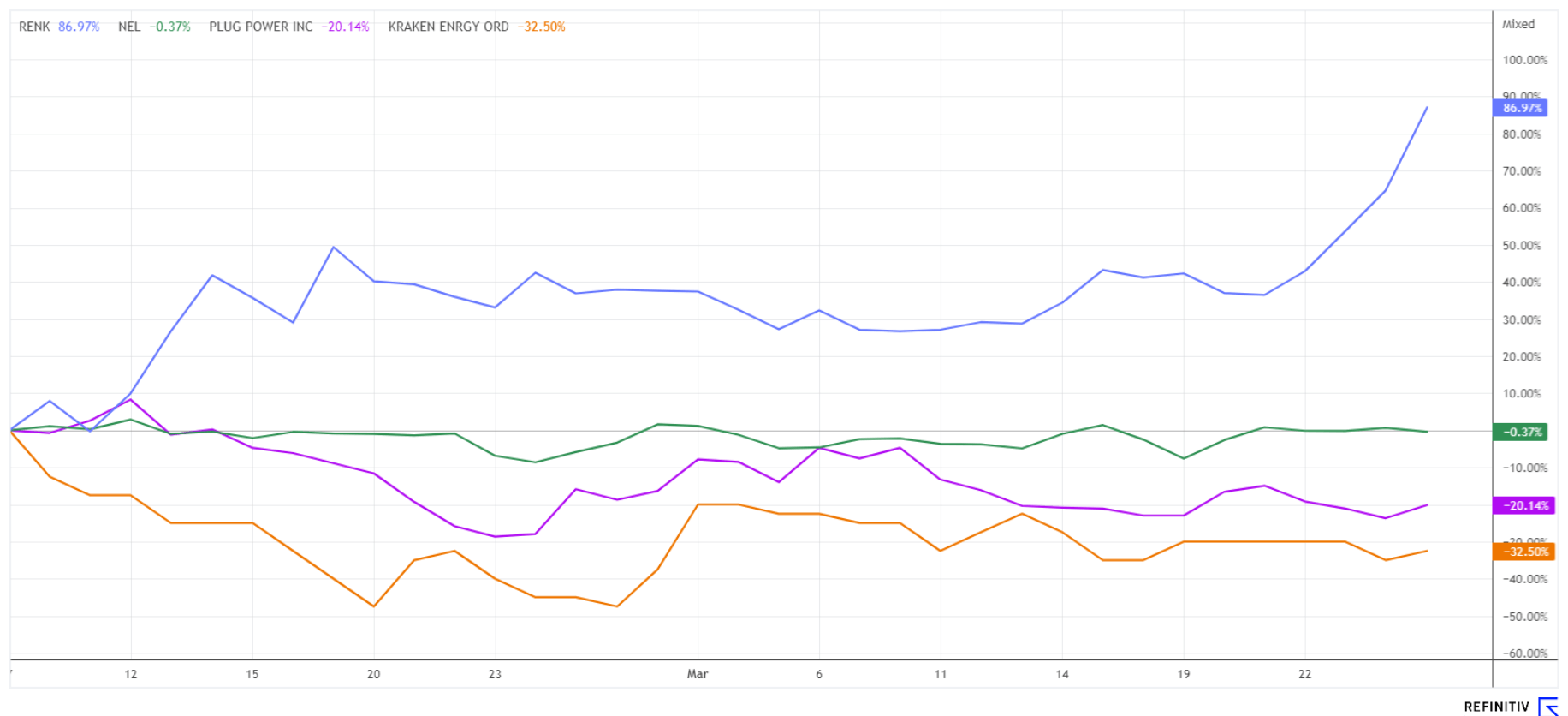

Nel ASA and Plug Power - The charts do not speak a good language

This is how cruel the stock market can be. The major indices have been bullish for weeks, especially the Nasdaq 100 and the DAX 40 index. Both are now solidly above the 18,000-point mark; profit-taking or corrections remain a rarity. However, the hydrogen sector has experienced a sharp sell-off with losses of up to 90% in the last three years. The sector was briefly celebrated as an alternative energy supplier on a grand scale, but the reality is somewhat different. Hydrogen solutions will remain isolated solutions with specific areas of application and sectors. Rapidly combustible gas will never achieve the status of natural gas or even oil; the global infrastructure alone is not an affordable investment.**

All that remains is to look at the bare figures. Nel ASA and Plug Power fell short of analysts' expectations in their 2023 reports. The few private orders are still a burden compared to an initial flood of government promises, some of which did not materialize. Analysts on the Refinitiv Eikon platform have become very skeptical about Nel ASA, with only 5 buy recommendations from 25 published studies. On average, they expect a 12-month price target of NOK 6.45, which is still around 30% above the last price. Plug Power has only 8 buy recommendations from 29 studies. Price expectations are broadly diversified, with an average of USD 5.25 and a current price of USD 3.43. The price/sales ratio of 2 is now even strikingly favorable. Technically, both stocks must rise by 50% to trigger buy signals.

Kraken Energy - First drilling program started in Utah

Since the major commitment of some countries such as France, Poland, the US, China, the Czech Republic and Finland in favor of nuclear energy, the investment community has been on the lookout for uranium producers. Because already today it is known that the suppliers Russia and Kazakhstan will be removed from the list of suppliers at some point, the distortions between the Western industrialized countries and the rich raw material countries in Asia are too great. Global uranium production is already below the demand of energy companies and, according to the World Nuclear Association, will reach a critical phase as early as 2025. The current demand can only be met through recycling and stockpile sales of strategic stocks. In the future, there will be a shortfall of around 25% of demand by 2030. There may currently be around 10 viable projects worldwide, but exploration is progressing. The uranium market is dominated by Kazakhstan, Canada, Namibia and Australia; the major players Cameco and Kazatomprom can still expand their production slightly, but more is needed to close the gap. The uranium price has consolidated slightly on the futures markets to USD 82, but was already back at just under USD 89 yesterday.

The Canadian explorer Kraken Energy has four promising properties in the US and has now started exploring in Utah. The uranium-bearing bedrock of the Chinle Formation has already shown increased radioactivity in three historical oil wells. A 2,622-hectare area called Harts Point, located in the middle of the Colorado Plateau, is being developed. This top property has produced over 590 million pounds of U3O8 with a grade of 0.2 to 0.4% since the 1950s. Kraken holds a 75% option on the property. Initial results have now been announced. The Phase I drill program tested two targets 5 km apart to confirm the presence of uranium mineralization. "Our team is very pleased with the initial results from our maiden drill program at Harts Point," said CEO Matthew Schwab. "The Lisbon Valley discovery, from the first 7 holes over a strike length of 1.5 km, where 3 holes have already intersected radioactivity, gives us great confidence in the property."

The Company also announced that it has granted incentive stock options to purchase a total of 700,000 common shares at an exercise price of CAD 0.20 per share for a period of five years. This is not a problem, as there are already 54.35 million shares, and the value is currently significantly lower at CAD 0.13. The dilution is, therefore, small and will bring cash back to the Company when the CAD 0.20 mark is reached. That would be a price increase of over 50%. The share's rally is likely just beginning. Therefore: Keep accumulating!

Renk Group - Taking off

Despite all the euphoria currently surrounding the defense sector shares, when taking a closer look, a strange insistence of the opinion that wars will last forever is noticeable. Of course, local companies are blessed with orders, and their balance sheets will improve. However, the mechanical engineering company Renk is a rather inconspicuous returnee to the trading floor, and the accompanying major investors are beating news drum. The fact that incoming orders are then increased by around a third to EUR 1.3 billion today is well above expectations.

The former Volkswagen transmission subsidiary now has orders worth EUR 4.6 billion on its books, which can be processed over the next few years. This requires operating capital and new specialist staff, both of which, as we all know, do not fall from the sky. Following yesterday's increase, the Augsburg-based company is now valued at three times its 2024 turnover. CEO Wiegand pointed out that the current supply bottlenecks are not only affecting Renk, but the entire industry.

The operating margin is expected to rise from 16 to 18% to a full 20%. No wonder, as the buyers are governments with endless resources, they need a lot of military equipment due to extensive international commitments. Renk will likely continue to rise due to the "defense stocks euphoria", but in the medium term major investor Triton will likely cash in. Funds also like to buy well-performing stocks at the end of the quarter to show off top allocations to their fund subscribers. In the short term, it is too steep, so the value will likely correct more sharply in April despite growth. So, there is still one more day to set the stop prices intelligently.

Armaments, yay - hydrogen, nay! This is how the price chart in Frankfurt reads. However, caution and attention are required in both sectors because just as the eternal sell-off will turn at some point, the armament trend will also end. Just imagine if there were peace talks in Ukraine. Kraken Energy is heading in the right direction amidst a longer-term supply shortage for uranium.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.