March 26th, 2024 | 07:30 CET

The race begins! Beating DAX records with BYD, Altech Advanced Materials, Hensoldt and Rheinmetall

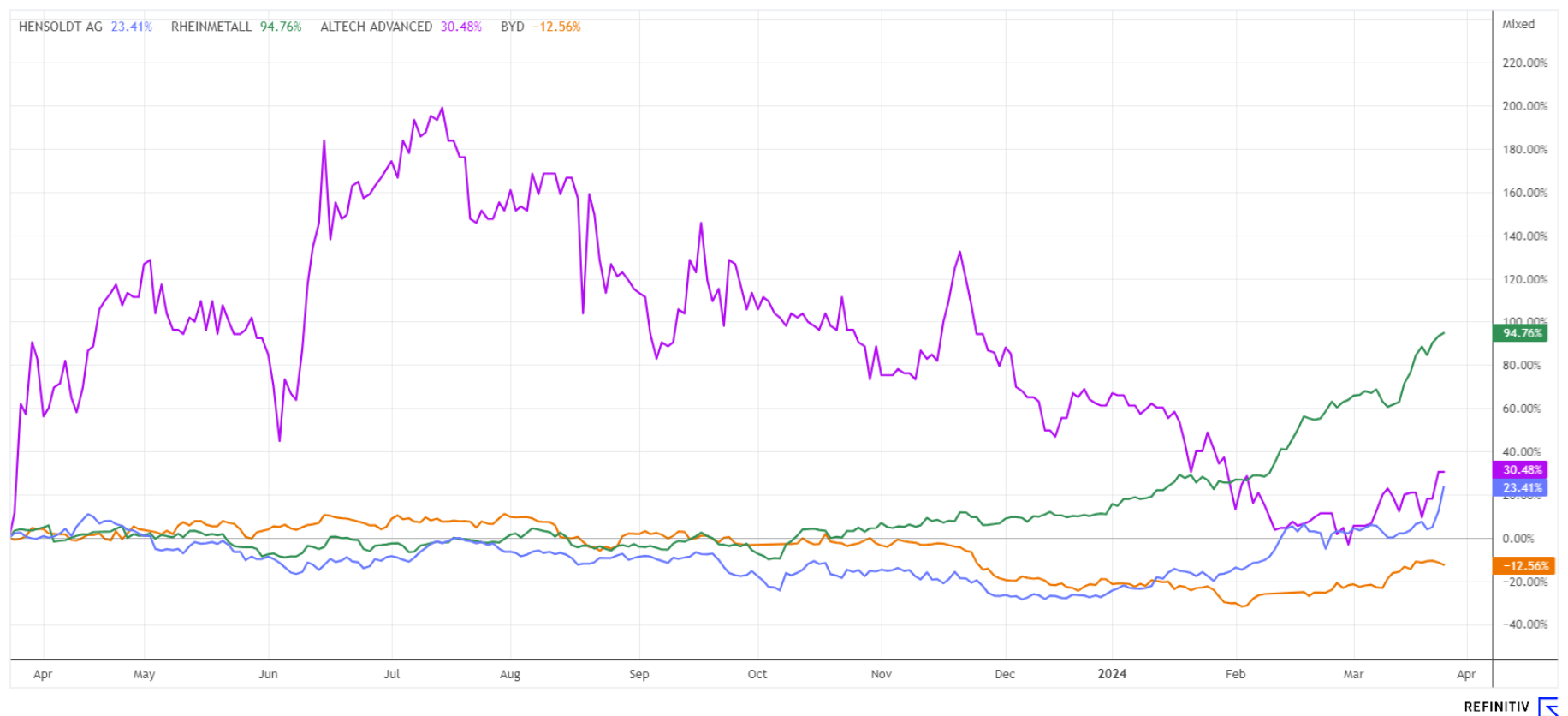

The DAX 40 index is setting new records almost daily, following the bullish lead from the US. Artificial intelligence (AI), armaments, crypto and high-tech are the top themes on the stock markets. Nobody wants to know anything more about hydrogen, and e-mobility has also seen better days. It can be profitable to examine the sought-after stocks with a fundamental magnifying glass. Often, hints about where the journey is heading can be found there. We focus on some of these stocks.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , ALTECH ADV.MAT. NA O.N. | DE000A31C3Y4 , HENSOLDT AG INH O.N. | DE000HAG0005 , RHEINMETALL AG | DE0007030009

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - The competition never sleeps

Chinese EV specialist BYD has made a good start to 2024, but the entire sector is still in the midst of an energy-sapping price war. Now, competitor XPeng is entering the China EV 100 forum with new products and forcing competitors to reduce their margins. In the meantime, the price war among e-car manufacturers has intensified in recent months, with Europe being the main arena alongside China. After three price cuts in a row, industry leader Tesla has also come under severe pressure.

XPeng is now planning to introduce a more affordable model series after rival BYD recently lowered its prices. According to CEO He Xiaopeng, vehicles costing EUR 13,000 to EUR 20,000 will be launched on the market and equipped with advanced driver assistance. The current Smart EVs from XPeng are still priced at over EUR 25,000. The EV manufacturer's announcement comes at an inopportune time, as BYD and other competitors have already made several price cuts this year. However, BYD is well positioned as the market leader in China and has sufficient reserves due to accumulated profits. **The figures for 2023 are being published today and are likely to be in line with analysts' estimates. Hopefully, the CEO also has a good outlook in store. Otherwise, there is a risk of trouble.

Altech Advanced Materials - Now, financing can be pursued

The Heidelberg-based technology holding company Altech Advanced Materials AG has made further progress in recent months. It may already have the game changer for the mobility revolution in its pocket. Current investments are focused on a new type of solid-state battery with sodium chloride-based technology and the name CERENERGY®. CEO Uwe Ahrens is focusing on the Schwarze Pumpe site in southeast Brandenburg. According to him, this location is becoming a new "hotspot" for the development of state-of-the-art batteries.

The Company has now announced the results of the definitive feasibility study (DFS) for the planned CERENERGY® battery plant of Altech Batteries GmbH in Schwarze Pumpe with a planned annual production capacity of 120 MWh. Based on current price and cost calculations, this results in a sales potential of EUR 106 million per year at full capacity utilization. The free cash flow before tax is expected to be EUR 51 million per year, accompanied by an EBITDA margin of approximately 47%. The net present value (NPV) is EUR 169 million and the capital repayment of the investment costs of EUR 156 million amounts to only 3.7 years with continuous operation. The highlight: According to the calculations, the total operating costs of the sodium chloride solid-state battery CERENERGY® amount to EUR 0.06/kWh over the entire service life and are therefore significantly lower than those of conventional lithium-ion batteries at around EUR 0.13-0.16/kWh. No external cooling or heating units are required, as the innovative battery is non-flammable. Analysts expect strong growth averaging 28% per year for the global grid storage market until 2040. Altech could really come up trumps here as a German niche player.

With the expected profitability of the project, the project partners Altech Advanced Materials AG, Altech Batteries Ltd and the joint venture partner, Fraunhofer-Gesellschaft zur Förderung der angewandten Forschung e.V., now intend to enter the financing phase in order to enable realization as soon as possible. To this end, Altech has also submitted funding applications at the federal and state levels. Since reaching a high of around EUR 15, a number of capital measures have diluted the share price to around EUR 7. However, the market capitalization has risen sharply to EUR 54 million since the initial listing. The share remains highly interesting as a German high-tech hopeful.

Hensoldt and Rheinmetall - Soaring to new heights

Anyone investing in defense stocks such as Rheinmetall should keep in mind that important strategic metals could continue to pose a bottleneck in the processing of new orders. Investors anticipate a blue-sky scenario for Hensoldt and Rheinmetall over several years. Meanwhile, the 2024 revenue valuation is already at a factor of 2, and the P/E ratio has also risen to over 24 with a 70% increase in the share price. For Rheinmetall, the revenue parameter is already 2.5, and the P/E ratio is also 24. A few years ago, a P/E ratio of just 7 was paid for mechanical engineering companies such as Rheinmetall and Renk; now 30 is likely also possible.

However, the armaments fantasy is now leading to significant premiums, especially as the Company's own sales and earnings estimates have had to be adjusted upwards several times by the accompanying analysts. The experts on the Refinitiv Eikon platform expect Rheinmetall to reach EUR 505 and Hensoldt EUR 34.80 in 12 months. Both stocks reached new all-time highs yesterday at EUR 520 and EUR 41.80, respectively. There is no doubt that the NASDAQ shows how inflationary share prices can become. Therefore, stay invested and set profit-protecting stops accordingly.

The stock market is currently somewhat capricious. It loves its AI, defense and high-tech stocks, but second-tier stocks from other sectors are being conspicuously punished in some cases. While Rheinmetall and Hensoldt are rushing from one high to the next, the Altech share is consolidating for the time being after its brilliant rise in 2023. BYD shares have recently been able to catch up. A good mix makes for good portfolio performance.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.