March 20th, 2024 | 07:30 CET

Entry prices or Sell? BioNTech, Defence Therapeutics, Lufthansa and Nvidia in focus

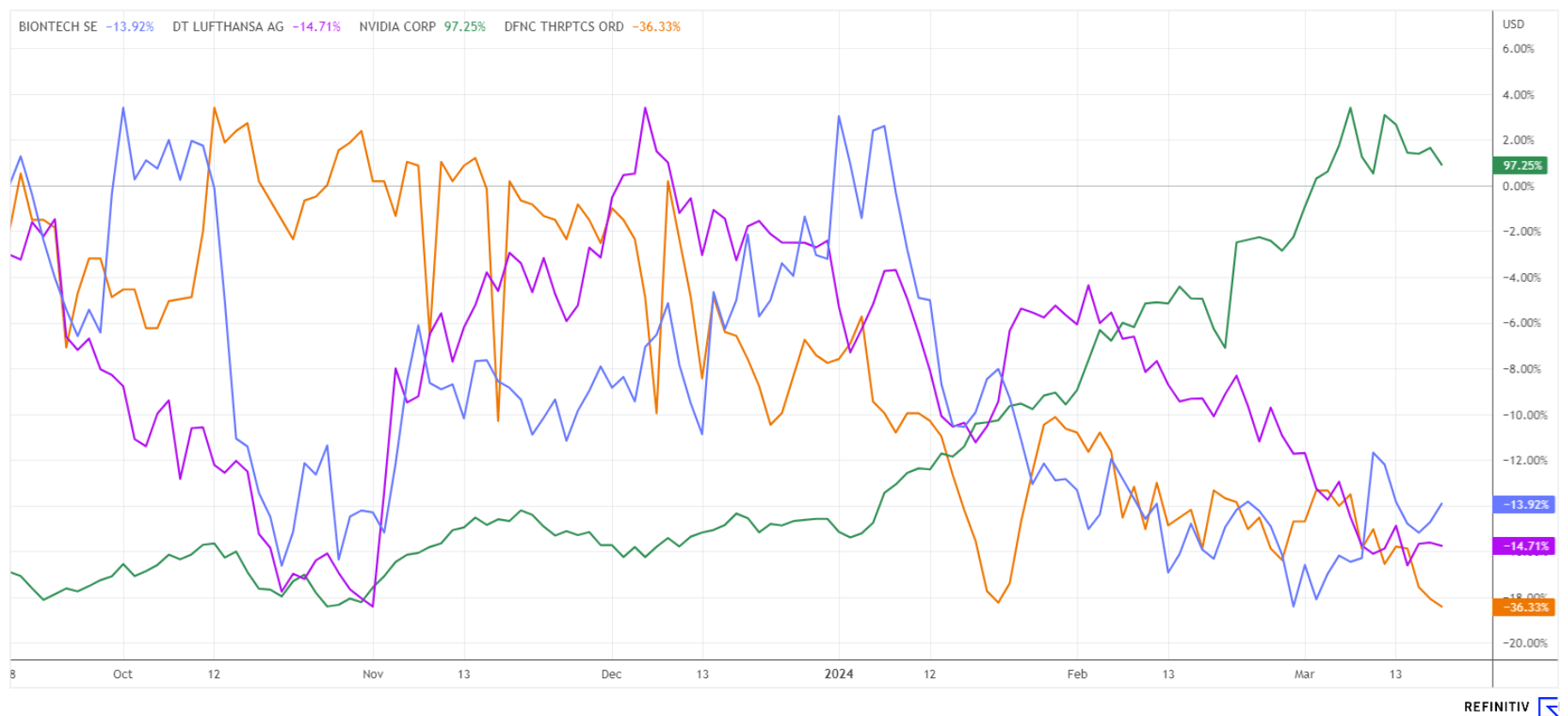

The stock market keeps running and running - but in reality, it is just a handful of stocks that make waves every day. Investors should now be vigilant because, like the recent correction in Bitcoin, the major indices could also fall by 10%. Of course, nobody is thinking about this at the moment; the mood is too good, almost euphoric, considering Germany's precarious economic situation. We analyze technical trends and fundamental assessments to ensure everything in your portfolio goes smoothly. In our view, BioNTech, Defence Therapeutics, and Lufthansa are on the runway, but when it comes to Nvidia, you should start deploying the parachute slowly. What is next here?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , DEFENCE THERAPEUTICS INC | CA24463V1013 , LUFTHANSA AG VNA O.N. | DE0008232125 , NVIDIA CORP. DL-_001 | US67066G1040

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BioNTech - What is happening in Mainz?

Although the lawsuits in connection with the controversial coronavirus vaccinations never really came to light, investors are still wondering why the innovative company from Mainz is not getting anywhere. However, this reticence could make sense in the run-up to this year's annual American Association for Cancer Research ("AACR") meeting, which will take place in San Diego from April 5 to 10, 2024. That is because the Mainz-based company will be presenting clinical trial data for selected candidates from its oncology pipeline. They include investigational compounds from BioNTech's mRNA-based cancer vaccine approaches as well as innovative approaches for antibody-drug conjugates. "Our mRNA cancer vaccine approaches in clinical trials are an important pillar in our oncology portfolio. They aim to eliminate residual tumor foci and reduce tumor burden by targeting multiple antigens simultaneously," said Prof. Dr. Özlem Türeci, co-founder and Chief Medical Officer of BioNTech recently. Caution: Study data can also turn out negative.

However, it will be exciting even before that, as BioNTech will present its balance sheet for 2023 today, March 20, when CEO Ugur Sahin will certainly also look to the future and reveal his options for using the EUR 17 billion in cash. Resourceful investors could also push for a distribution of the cash. After all, BioNTech is one of the few "pandemic winners" and earned over EUR 20 billion from the sale of vaccines. This is exactly where the Company's market capitalization is today. If the oncology sector can demonstrate success, the long sideways trend would soon be history. Listen carefully today! If the market reacts positively to the outlook, jumping in quickly with increasing momentum could be sound advice.

Defence Therapeutics - AccoTOX® platform receives US patent

Canadian biotech specialist Defence Therapeutics has dedicated itself to the fight against cancer. With its Accum platform and the active substance ACCUM-002TM dimer CDCA-SV40, commonly referred to as "AccuTOX®", Defence has now been granted the "Study May Proceed" status by the FDA. The Company is working successfully with the City of Hope University Hospital near Los Angeles, which submits around 50 FDA applications a year and has so far been an excellent partner in this collaboration. This collaboration can be worthwhile for investors and, above all, for patients seeking help. The approval of AccuTOX® as one of the Company's first First-in-Class therapies is a huge step forward for Defence in the field of immuno-oncology.

A Notice of Allowance (Patent No. 11,890,350 ('350)) broadly covering the breakthrough AccuTOX® technology has been received from the US Patent and Trademark Office. The '350 patent, which contains valuable claims to the composition of matter, protects a portfolio of therapeutically active molecules that essentially form the AccuTOX® platform. This provides Defence with potential market exclusivity until the end of 2042, sufficient time for further studies and achieving a solid market position.

The antibody-drug conjugate (ADC) field has long been the focus of the pharmaceutical industry, making Defence Therapeutics a classic takeover target at the current stage of development. There are already excellent relations with the French nuclear medicine group Orano, but there are likely already further inquiries. Following the MorphoSys takeover, the market has become very sensitive to promising technologies. **After all, the entire research effort of Defence from recent years can currently be bought on the market for just EUR 53 million. Rapid increases in the DTC share price should, therefore, come as no surprise. Buy in!

Lufthansa is coming back, but watch out for Nvidia

Rarely is an airline as busy as Lufthansa after the Corona Crisis. The government aid was repaid within 16 months and the airline is now heading for a record year. The earnings swing could not be greater: After posting a loss of EUR 8.93 per share in the catastrophic year of 2020, it was back to a profit of EUR 0.66 in 2022. Last year, earnings almost tripled to EUR 1.44 per share. At EUR 35.4 billion, revenue returned to the 2017 level and analysts are now forecasting record revenue of EUR 38.9 billion for the current year. The current P/E ratio for 2024 is a low 4.7 and there will also be a dividend again. Despite this, the share price is still only EUR 6.83 - the Crane Line has never been so cheap. 23 experts on the Refinitiv Eikon platform expect a 12-month target price of EUR 9.05, which offers the risk-conscious investor 32% upside potential.

The situation with Nvidia is entirely different. The highly-hyped high-tech and AI darling is now ranked third in the titan list behind Apple and Microsof, with a market capitalization of USD 2.2 trillion. The Company is trading at a 2024 P/E ratio of 74 and a price/sales ratio of 22. Such valuations were only seen during the tech bubble in 2000. However, Nvidia must be credited with the fact that the Company is highly profitable and can currently cover the entire range of AI, crypto and autonomous driving. With a net margin of 48.8% and a return on equity of 91%, the tech giant outperforms every other Nasdaq 100 stock. In chart terms, the share has now bumped its head three times in the USD 930 to 970 zone. It should come as no surprise if a little uncertainty brings the share price down by 10 to 15% from just under USD 900, as the momentum is currently weakening. As fund managers worldwide still want to show the share in their quarterly reports, we do not expect a technical sell-off before early April. Stay alert - our stop is at USD 860.

The stock market gives and takes. The biotechnology sector is currently receiving little attention, but high-tech and AI are on investors' buy lists. However, this scenario could change quickly due to falling interest rates in the middle of the year and emerging sector rotations. Lufthansa and Defence Therapeutics currently offer an excellent risk/reward ratio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.