April 2nd, 2024 | 06:55 CEST

AI shares in takeover frenzy, further gains of over 100% possible with Nvidia, Exasol, Palantir and Super Micro Computer

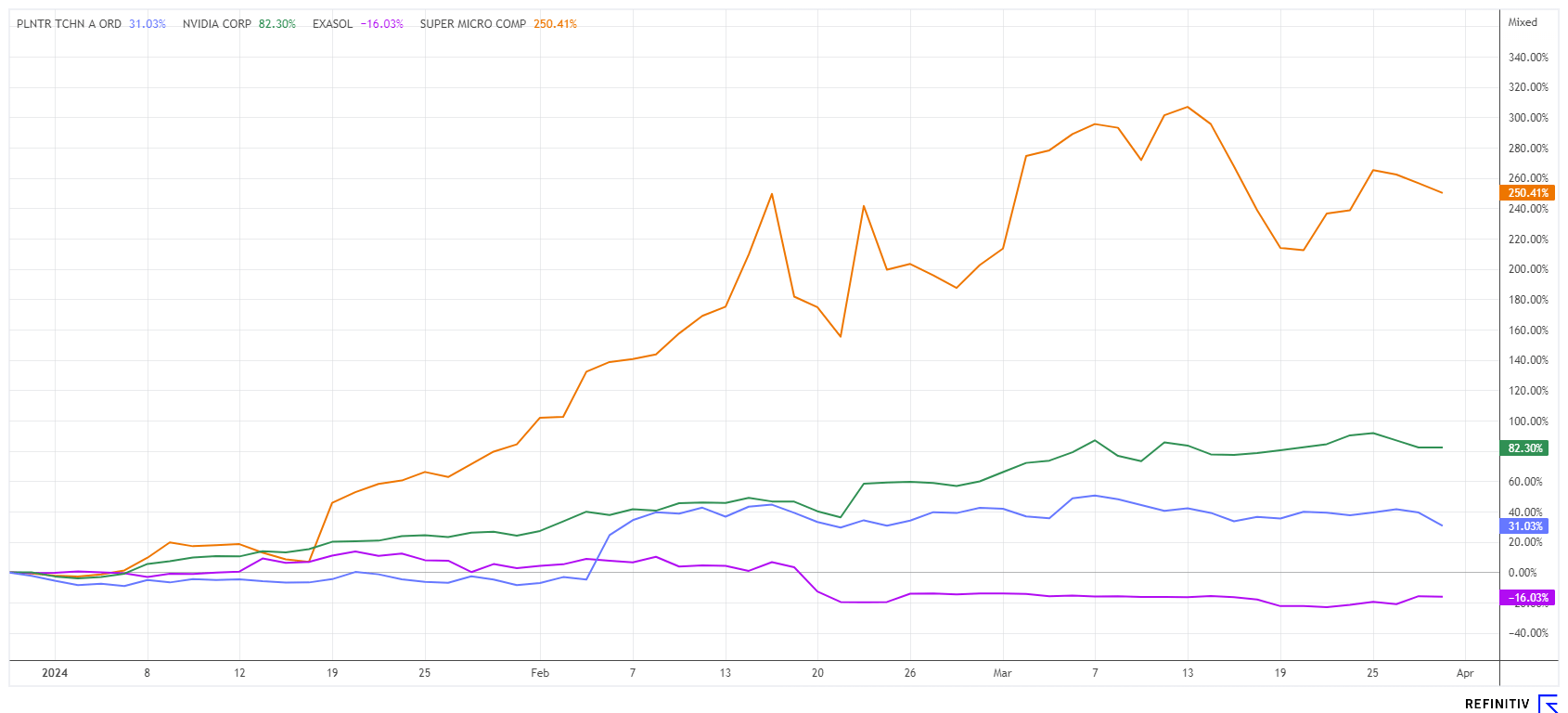

In the first quarter of 2024, the stock markets were at their friendliest, but the focus was almost exclusively on Bitcoin, Artificial Intelligence and high-tech. Meanwhile, the market leader in fast chips, Nvidia, has become the epicenter of future Big Data and AI applications. Productivity increases of over 20% per year are expected worldwide through the use of artificial intelligence in businesses, but commercial market penetration is still in its infancy. Therefore, it can be assumed that the rally will continue or even accelerate in the current environment. In addition to the well-known crowd-pullers, there are also latecomers with huge potential, including in Germany.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , EXASOL AG NA O.N. | DE000A0LR9G9 , PALANTIR TECHNOLOGIES INC | US69608A1088 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nvidia and Super Micro Computer - Nothing works without the Californians

Nvidia shares rose by 83% in the first quarter of 2024, making the market leader in fast chips for artificial intelligence (AI) the second-best performer in the S&P 500 index, behind Super Micro Computer. This server specialist also benefited from the strong demand for AI products and services and saw an impressive 360% increase. While it is not out of the question for Börse.de to wake its German readership from their Easter vacation with a takeover announcement, it is still just a nice April Fool's joke in the current environment.

Both companies have made themselves indispensable with their products in recent years. For investors who jumped on the bandwagon early, it is a celebration. Nvidia supplies super-fast chips and architectures for analysing Big Data, a basis for using AI. Super Micro Computer was founded in 1993 in San José, California, and is now one of the world's leading providers of high-performance server solutions, storage systems and data center technologies. Since its inception, it has been working with leading chip companies Intel, AMD and Nvidia. Nvidia CEO Jensen Huang recently emphasized the great importance of this collaboration, as high-performance graphics cards require sophisticated liquid cooling systems to unleash their maximum performance.

A takeover could make sense, as Nvidia has a sound bargaining chip: its own shares. 53 out of 57 analysts on the Refinitiv Eikon platform recommend Nvdia as a "Buy"; the average price target is USD 977. The valuation is astonishing: in the next two financial years, revenues are expected to rise from USD 26.9 billion to USD 60.9 billion and further to USD 110.6 billion. This is an extreme growth rate, which can at least explain a price/sales ratio of 36 for the year 2024. Super Micro Computer is only followed by 16 experts, with an expected target price of USD 1024. With a market capitalization of only USD 59 billion, Nvidia shares are worth 38 times more. **A further rise in both stocks would be a continuation of the current super bull market: The trend is your friend.

Exasol - Major investors betting on the takeover of Big Data specialist

Back to Germany. On the fringes of the NASDAQ high-tech bull market, it is also worth watching for promising stocks on the local scoreboard. A tried-and-tested indicator for the positioning of insiders and major investors is reported insider buying. In the case of the German AI company Exasol, Supervisory Board member Petra Neureither has been buying via her family office, PEN GmbH, for several weeks now. This follows the purchase by CEO Jörg Tewes at the end of February. Coincidence? No.

Petra Neureither is no stranger to the industry, as she was co-founder of SNP Schneider-Neureither und Partner SE, a specialist in digital transformation processes. Exasol AG develops databases for analytics and data warehousing and offers solutions for the retail and e-commerce, financial analysis and healthcare sectors. If you want to gain a foothold in the German industry with IT services, there is no way around integrative transformation solutions, as they provide the basis for the introduction of new AI-driven business processes. Exasol has excellent data analysis tools that can be used to their full potential on hardware from Nvidia & Co. With new customers from the financial sector, the Nuremberg-based company is expanding in Europe and the US, putting it on the radar of the tech giants.

In 2023, Exasol already recorded recurring revenue of over EUR 41 million and aims to grow by around 10 to 15% in 2024 with intensified product initiatives. At EUR 13.3 million, there are sufficient liquid funds to pursue a steep expansion course. At a share price of EUR 2.65, the Company is only valued at EUR 69 million, which is only a factor of 1.7 to revenue. AI shares are rarely so affordable. Trading volumes are rising steadily, and the technical momentum is pointing upward. Those who get in now are riding the bow wave.

Palantir - Analysts have their doubts

Much higher valued is the US data specialist, Palantir Technologies. The Company, founded by Peter Thiel, made the leap to the NASDAQ at the end of 2020 after a bumpy ride. Headquartered in Denver, Palantir is considered a partner of governments and the military and is also said to have provided important reconnaissance services during the war in Ukraine. With its two data software systems, Gotham and Foundry, Palantir provides services in data tracking, cybercrime and defense.

**In the last financial year, 2023, the Company achieved an operating profit of over USD 119.9 million for the first time, with a turnover of just under USD 2.23 billion. Over the next few years, analysts at Refinitiv Eikon expect revenue growth of 15 to 20%. However, only 5 of 18 experts still recommend the share as a "Buy". With a price/sales valuation of 20 and a noticeable increase of over 30% in the current year, the potential seems to be well exhausted.

Nvidia is clearly setting the tone at the moment. If the takeover fantasy continues to run riot, second and third-tier stocks will become the focus of speculators. Super Micro Computer and Palantir Technologies are attractive but already have very advanced valuations. The AI and data specialist Exasol AG from Germany is still completely unnoticed. However, trading volumes in the share have already increased considerably in the past week.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.