April 5th, 2024 | 07:15 CEST

AI, Defense, and Hydrogen - The explosive mix: Super Micro Computer, First Hydrogen and Renk Group

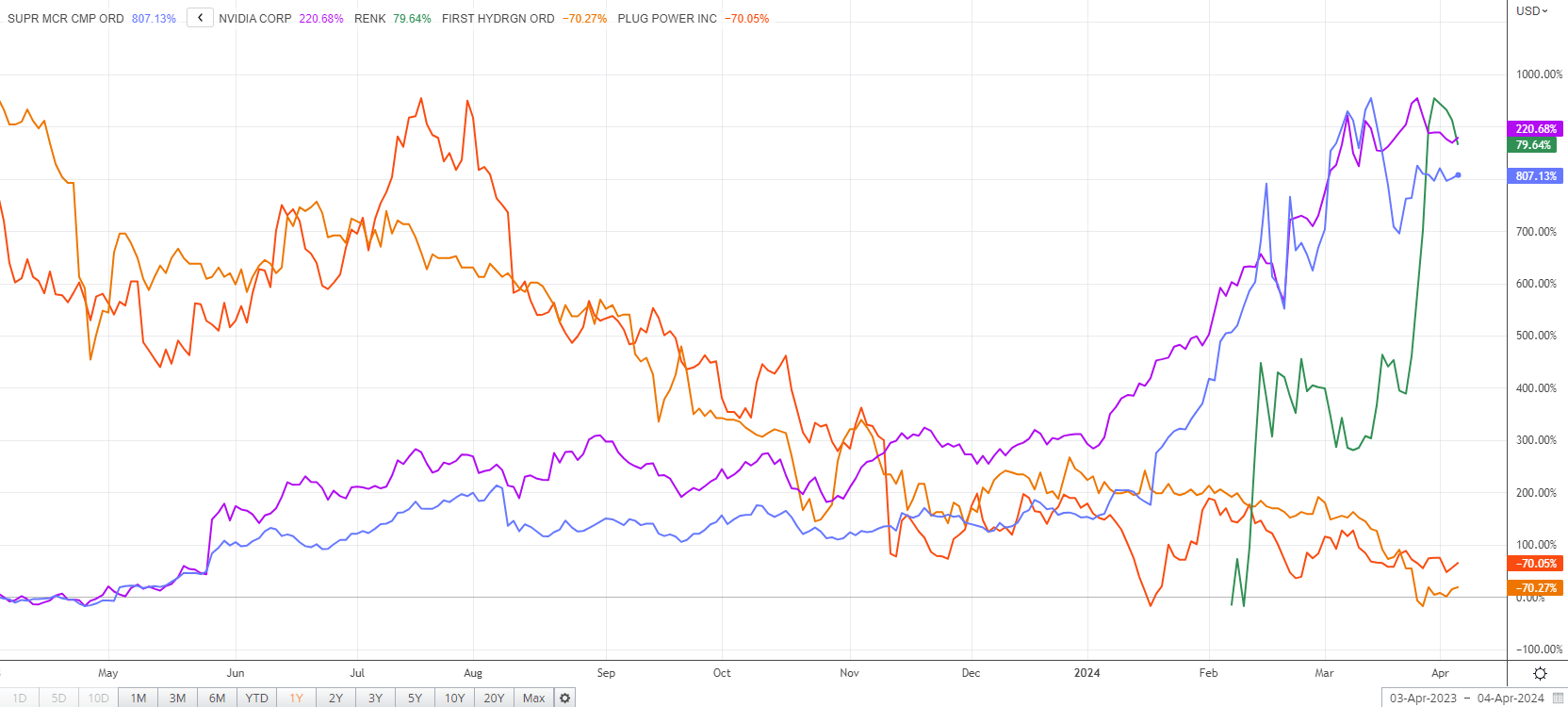

After an extended rally on the NASDAQ, in the DAX-40 and most recently in the Nikkei 225, sector rotations are now setting in. The next few weeks will show whether the AI sector has already turned around. Only once in stock market history has there been a stronger first quarter for a particular sector. The hydrogen hype in the transition from 2020 to 2021 was when Plug Power saw its share price increase twentyfold. It is hard to believe what liquidity-spoiled stock markets can achieve. Now, however, investors should keep their eyes open, as the artificial intelligence and defense sectors are similarly overinvested, just as H2 stocks were a few years ago. The time for reallocation has likely come.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

SUPER MICRO COMPUT.DL-_01 | US86800U1043 , First Hydrogen Corp. | CA32057N1042 , RENK AG O.N. | DE000RENK730

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Renk Group - With a tailwind into the new year

The Renk Group's IPO was timed perfectly to coincide with the armed conflicts in Ukraine and Israel. There could not have been better timing for the former machinery and gear experts from the VW Group. Since the initial listing, the value has more than doubled, and with it, the valuation. Admittedly, the business model now has contemporary strengths after years of dismantling in peacetime. There is now an endless supply of public money, and orders are springing up like mushrooms.

The figures presented for 2023 have even exceeded investors' expectations by a small margin, as Renk recorded incoming orders with a volume of EUR 1.3 billion last year, setting a new record. Meanwhile, revenue climbed by 9% to EUR 926 million, and adjusted EBIT reached EUR 150 million. At the bottom line, net profit doubled to EUR 32 million. Only the outlook for the future is even more optimistic, as the Augsburg-based company expects business to remain strong. The order backlog has now increased to EUR 4.6 billion, and large-scale modernization of defense systems is currently taking place in the home market of Europe. New sales records are therefore forecast for 2024, which are expected to be in the range of EUR 1.0 to 1.1 billion, representing growth of 7 to 15%. In the longer term, sales are expected to increase by around 10% annually with rising margins.

Security in Europe is at risk; an investment in defense stocks makes sense over the longer term. In the case of Renk, however, the appropriate valuation for 2026 has already been reached today. With a price/sales ratio of 3.5, the share is more expensive than ever. It should, therefore, come as no surprise if the share price slips below the EUR 30 mark once again to catch its breath. Yesterday, the share weakened further after hitting EUR 37 again, and from a technical standpoint, a stop at EUR 34 is currently advisable. As momentum is already shifting, there is no time for hesitation.

First Hydrogen and Plug Power - Green future at best entry prices

The pressure to reduce harmful greenhouse gases is high. The current US administration's Inflation Reduction Act (IRA) under Joe Biden includes several programs aimed at the energy transition. They primarily include investments by public authorities and transportation facilities. Internet giants like Amazon are also talking to the media about the need to implement a "zero carbon strategy" or global package delivery. Additionally, numerous ESG funds worldwide are searching for companies that can incorporate positive climate effects into their business models.

The Canadian specialist for hydrogen-based vans and prospective producer of a green hydrogen ecosystem in Quebec has already made great strides in the first quarter. The tests of the hydrogen-fuel-cell-powered light commercial vehicles (FCEV) have already been successfully completed three times, most recently with the major gas supplier Wales & West Utilities (WWU). Talks are currently being held with various companies and public institutions about adding FCEVs to their fleets or converting existing vehicles to hydrogen-powered fuel cells using the Company's powertrain. At the same time, the feasibility study for the combined 35-megawatt H2 production site, including the assembly plant in Shawinigan, Quebec, was launched. The first vehicles are expected to roll off the production line there in a few years. First Hydrogen anticipates that fleet operators like WWU will drive the sale of emission-free vehicles forward, as they must align their decarbonization strategies with government mandates to phase out fossil fuel propulsion systems by 2035. Pioneers in the energy transition are currently receiving the highest attention from investors.

DataHorizzon Research reports that the global market for hydrogen fuel cell vehicles will explode from USD 2.2 billion in 2023 to around USD 82 billion by 2032. The First Hydrogen share has finally completed its consolidation. Yesterday, the share price peaked at EUR 0.81 on Tradegate, and the volume increased significantly. The innovative company is now valued at just under EUR 57 million. This is nothing compared to the outstanding prospects in a booming market with a forecast annual growth rate (CAGR) of over 45%. Collect now!

On April 17 at 15:30 CET, Francois Morin (VP Corporate and Business Development) will appear in front of the camera at the 11th International Investment Forum and report on the latest developments. It should be exciting. Click here to register.

The Plug Power share also showed the first signs of life again yesterday. As this share has benchmark status, allocations favouring hydrogen could come back into play in the coming days. In the last interim rally in January, Plug Power gained an incredible 140% in just one month. The price/sales ratio has been reduced from 25 to the current 1.5 in 3 years of bear market. With comparable revenue, Plug Power is now only worth half as much as Renk.

Super Micro Computer - This could be a Head and Shoulders reversal formation

We have been reporting on the Super Micro Computer share for several weeks now. After reaching a multiple high of just under USD 1,200, the stock is currently trying to secure the USD 1,000 zone from a technical perspective. Of course, the multiplication since December 2023 was due to a pronounced super bull market in the artificial intelligence sector. As is so often the case, however, a large part of this revaluation has now taken place, and the courageous investors are sitting on huge profits. As was the case with hydrogen or lithium shares, they should close the door quickly if the value starts to tumble or the sector rotation goes against artificial intelligence. In the technical chart picture, the share should not fall below USD 1,000 because then the Head and Shoulders reversal formation with a first support line at around USD 700 will be completed. A stop line can be identified technically at USD 995.

It has become more difficult to find leading stocks. The AI sector appears to be on the verge of a major consolidation. This gives standard stocks plenty of room to close valuation gaps. The hydrogen sector has been in the doldrums since the boom years of 2020/2021. But here, too, things have not been going down for weeks. Time for well-defined reallocations.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.