March 19th, 2024 | 06:30 CET

Pay attention now - 100% performance possible with BioNTech, Bayer, Cardiol Therapeutics or HelloFresh

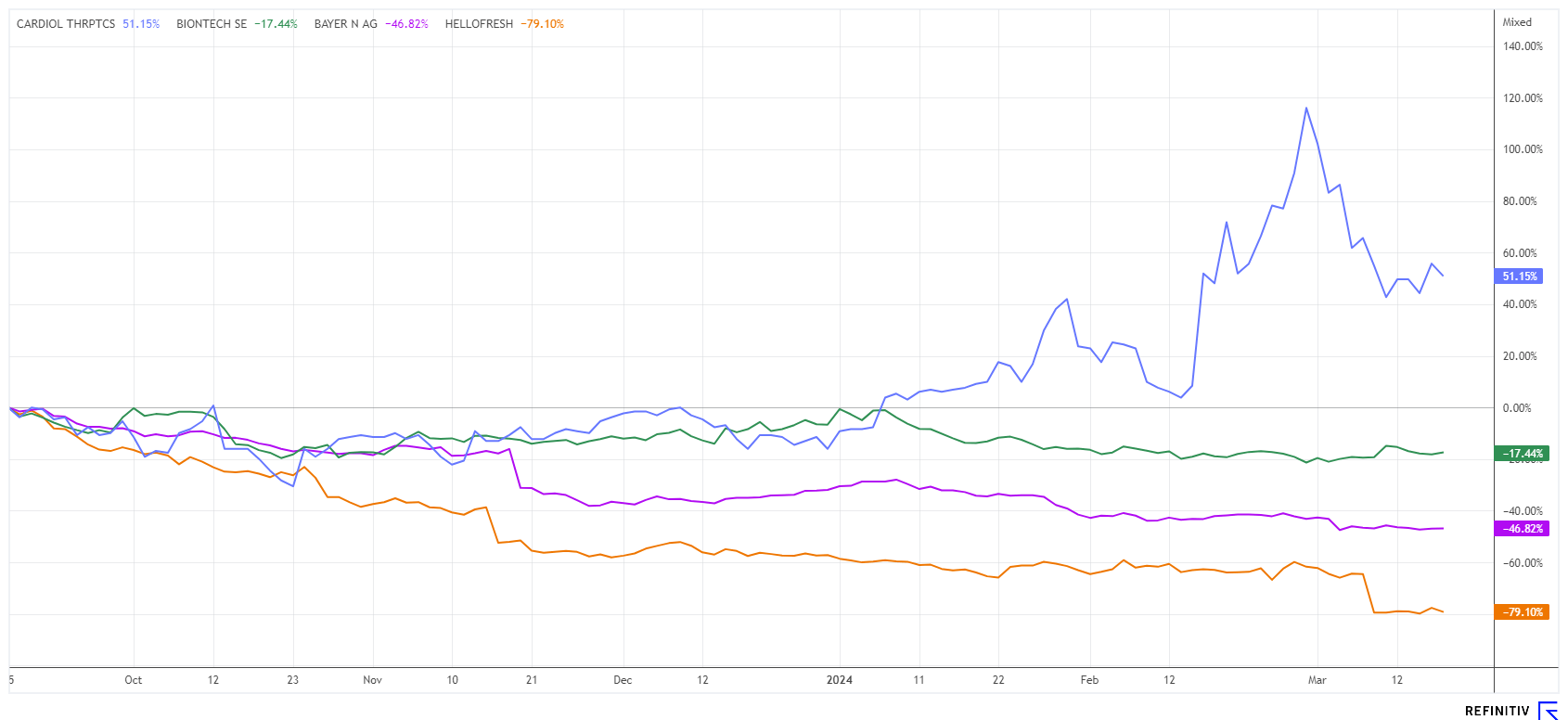

For investors in the biotech sector, 2024 is starting much like the previous year ended. Everyone is waiting for the big bang, which has yet to materialize. However, now that there is no longer a pandemic and cancer research is still stuck in a rut, selection has become crucial. Investing only in the future is no longer a guarantee of profit; instead, it is much more important to identify the most innovative business models and follow them. BioNTech does not currently have a blockbuster but has a good EUR 17 billion in its coffers. Bayer has seen its share price drop fivefold since 2019, and HelloFresh is also unable to keep its promises. By contrast, Cardiol Therapeutics has experienced a true rally. What lies next here?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , BAYER AG NA O.N. | DE000BAY0017 , CARDIOL THERAPEUTICS | CA14161Y2006

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BioNTech versus Bayer - Where is it worth investing?

There are currently two major problem children in the German biotech sector. There are significant question marks on the faces of Bayer analysts, who have been constantly revising their price targets downward for months. Most recently, there was a "shock lawsuit" in the US for USD 2 billion concerning glyphosate-related illnesses. Bayer then had to report a fall in profits in the pharmaceuticals division, and, most recently, the dividend of EUR 2.40, which was considered a certainty, was slashed to just 11 cents.

Only 3 out of 24 analysts now have the confidence to issue a "Buy" recommendation, and the 12-month price expectation has fallen from just under EUR 80 in mid-2023 to the current EUR 34.50. Since the Monsanto takeover, EUR 100 billion in valuation has been wiped out. There are now increasing calls for a group split, with the Crop Science division taking on the debt from the Monsanto takeover. According to Adam Riese, this is not possible from today's perspective because Bayer is only keeping the Company alive with its still profitable pharmaceuticals division. Fitch has already lowered its long-term rating to BBB+, and legal options under the Texas partial insolvency law are now being examined. However, the US companies 3M and Johnson & Johnson have already failed with this approach. Bayer is only for speculative investors, as the problems could worsen.

Things look better for BioNTech shares. The lawsuits in connection with the controversial coronavirus vaccinations never really came to light. Nevertheless, investors are wondering why the innovative company from Mainz is not getting anywhere. Investors should receive clarification on March 20, when the balance sheet for 2023 is presented. CEO Ugur Sahin will then certainly also look to the future and reveal his options for using the EUR 17 billion in cash. Given the never-ending sideways downward trend, long-term investors may even want a distribution of the historical profits generated by the coronavirus vaccination. In order to sweep these desires off the table, management should provide a tangible outlook for growth. Only 50% of the experts on the Refinitiv Eikon platform still give a "Buy" recommendation with an average price expectation of EUR 108. Exciting!

Cardiol Therapeutics - Will the rally continue?

Cardiol Therapeutics Inc. has been developing its promising drug candidate, CardiolRx™, in the midst of the COVID-19 pandemic. With its oral solution formulation, the Company is on track to helping people around the world who suffer from recurrent pericarditis and acute myocarditis. CardiolRx™ blocks the activation of the inflammasome signalling pathway, which plays an important role in inflammation and fibrosis associated with pericarditis, myocarditis, and heart failure. For years, therapeutic options have been sought after to alleviate the suffering of those affected by these rare diseases, with little progress. In February, the Canadian company received Orphan Drug Designation from the US Food and Drug Administration (FDA), and they recently announced the completed recruitment of their Phase II clinical trial in recurrent pericarditis, with results expected as early as the second quarter of 2024.

CRDL shares are highly interesting, as they traded below book value no less than 6 months ago. In October 2023, however, the market shook off its lethargy, and the share price rose rapidly from around CAD 1.00 to CAD 2.90. A tripling in the biotech sector is a rarity and only really takes place when the Company can present significant progress. Experts now see CardiolRx™ as having the potential to provide a more effective and significantly cheaper treatment alternative to conventional methods for dangerous heart diseases. The first step towards revaluation has now been taken, with analysts on the Refinitiv Eikon platform predicting a further 100% increase in the share price over the next 12 months. With corresponding study results, however, this does not have to be the end of the story.

HelloFresh - Back to reality

The MDAX-listed company HelloFresh is coming under further pressure due to a decline in the number of active customers and the announcement that it is withdrawing its medium-term targets. The Company has reacted and wants to focus on new performance indicators in future to regain investor confidence. The positive swing is to be achieved through efficiency improvements and a reduction in expenditure. In Q4 of last year, the meal kit provider recorded a 6.5% decline in active customers compared to the same period in the previous year. However, this figure is likely misunderstood on the market; in future, the focus will now shift to metrics such as the number of orders or the average order value. According to CFO Christian Gärtner, these are much more meaningful indicators for real company growth.

The share took a dive for the time being and is now below the IPO price from 2017. Since reaching its peak around EUR 94, the share has fallen by a staggering 90%. On the Refinitiv Eikon platform, only 9 out of 23 experts still vote to "Buy". The average price expectation is EUR 9.80. However, not all analysts have adjusted their forecasts following the latest publication. It is advisable to let the share price settle for a while, but the stock is only suitable for risk-conscious turnaround speculators.

The stock market gives and takes. Selection has been the trump card, especially since the beginning of 2024. While IT and AI-heavy companies are igniting a veritable bubble, meal-kit delivery company HelloFresh is currently doing very poorly. BioNTech and Bayer are still trading in the lower valuation band on a 12-month view, but the situation is different for Cardiol Therapeutics! The Company, with ample cash on its balance sheet, is solidly positioned and is performing exceptionally well in an overall weak sector. The story should provide a lot of excitement in the medium term.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.