April 4th, 2024 | 07:30 CEST

React now: Reap armaments soon and reinforce hydrogen! Rheinmetall and Hensoldt versus Plug Power and dynaCERT

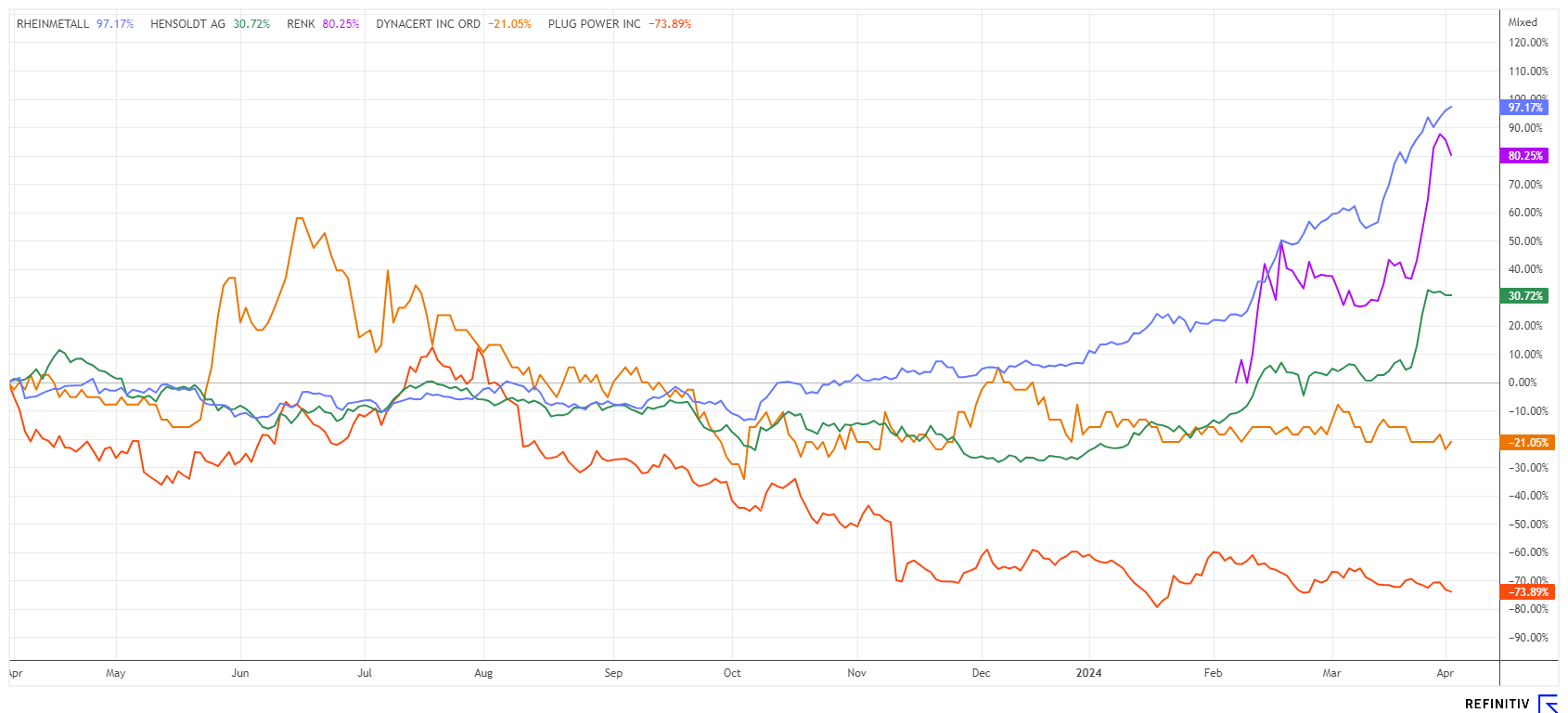

The stock market is currently very selective. Artificial intelligence and armaments will continue to be favored, while hydrogen and lithium stocks remain unpopular even after Easter. That is just the way it goes; the market gives and takes. All sectors under consideration have already generated several hundred percent returns over the past two years, but timing has always been crucial. We analyze the current situation based on trends and indicators. The time for a tactical reallocation seems imminent.

time to read: 3 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , HENSOLDT AG INH O.N. | DE000HAG0005 , PLUG POWER INC. DL-_01 | US72919P2020 , DYNACERT INC. | CA26780A1084

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power - Bottoming out becomes a test of patience

The use of AI requires vast amounts of data and computing capacity on a scale that cannot really be measured for several years. This increasing demand for data centers and IT power is currently accompanied by political decarbonization discussions. Hydrogen, as a possible energy supplier, appears to be an effective means of reducing the environmental impact of digitization. Plug Power has recently positioned itself successfully in this environment. For some time now, the Company has been working with Microsoft on optimal solutions for reducing greenhouse gases from the world's ever-expanding data centers.

Information on this pilot project is somewhat hidden on Plug Power's homepage. The fact that fuel cell solutions are also being considered by well-funded potential IT giants could give Plug Power additional fantasy. The bottoming out of the share is taking place slowly and is now far removed from the followers of the last bullish movement. With a market capitalization of USD 2.4 billion, 2025 revenues are valued at only 1.5 times. PLUG shares have never been this cheap, but the stock is likely more than out of favor.

dynaCERT - Awaiting the next rally

Unlike many hydrogen companies, dynaCERT already has a patented solution for diesel fuel savings. As part of the growing global hydrogen economy, HydraLytica's technology produces hydrogen and oxygen on demand through a unique electrolysis system. A small add-on device on the vehicle feeds these gases through the air intake to improve combustion. Long-term user tests prove that carbon emissions are reduced and fuel efficiency is significantly improved. The technology is designed for use in many types and sizes of diesel engines, serving all known applications such as transportation, mining, energy and forestry. More than CAD 70 million has already been invested in the development of the systems, and now certification by VERRA, a globally recognized verifier for the approval of pollution certificates, is pending.

dynaCERT recently carried out another private placement at CAD 0.15 to pre-finance the upcoming ramp-up and internationalization. A real sales push is expected once the VERRA label has been issued, as users will then be able to receive CO2 credits. Until the announcement, however, the share is likely to continue to be speculatively traded back and forth. Nevertheless, getting in at CAD 0.16 is now possible without stress; after all, the market capitalization is currently only CAD 66 million, and the liquidity in the share is high.

CEO Jim Payne will report on the latest progress at dynaCERT on April 17, 2024 at the 11th International Investment Forum at 16:30 CET and will be available to answer questions live. Click here to register

Rheinmetall and Hensoldt - Over the horizon

Yesterday, there were further price increases for the already well-performing armaments stocks Rheinmetall and Hensoldt. Both companies have now reached market capitalizations of twice their projected revenues for 2025. The P/E ratios have also left the 22 mark behind. If it were not for the war in Ukraine and the ongoing threat to Europe from Russia's sabre-rattling, the picture would likely be different. The crux of the matter: fund managers must keep buying these stocks to remain popular with investors. However, because all portfolio strategists are chasing the same allocation desire, the result is this never-ending, unidirectional rally.

Fundamentally, both companies need to get back on their feet logistically after significant downsizing in the years leading up to 2022. This involves hiring qualified personnel and purchasing land, buildings, and machinery. Therefore, the harvest curve of the current order intake will shift to the years 2026 to 2028. However, as the capital market is already looking euphorically to the finish line in 2028, shares are being bought today, whatever the cost. Experts estimate that the Bundeswehr's EUR 100 billion special fund can only be invested by 2030. And 70% of the sum will go to foreign companies, especially in the US. For those invested, while you can continue to ride the sector's continuous inflows with relative ease, it is advised to consistently adjust the stop loss upwards. The trend is your friend!

The hydrogen sector is currently dreaming of the returns from the defense sector. There are currently no signs that the established trends are turning. Nevertheless, after a long bull market, a sector rotation is also on the agenda. To reduce risk, diversify across different sectors and countries. Stop-loss limits serve as a good hedge against sudden reversals.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.