April 3rd, 2024 | 07:25 CEST

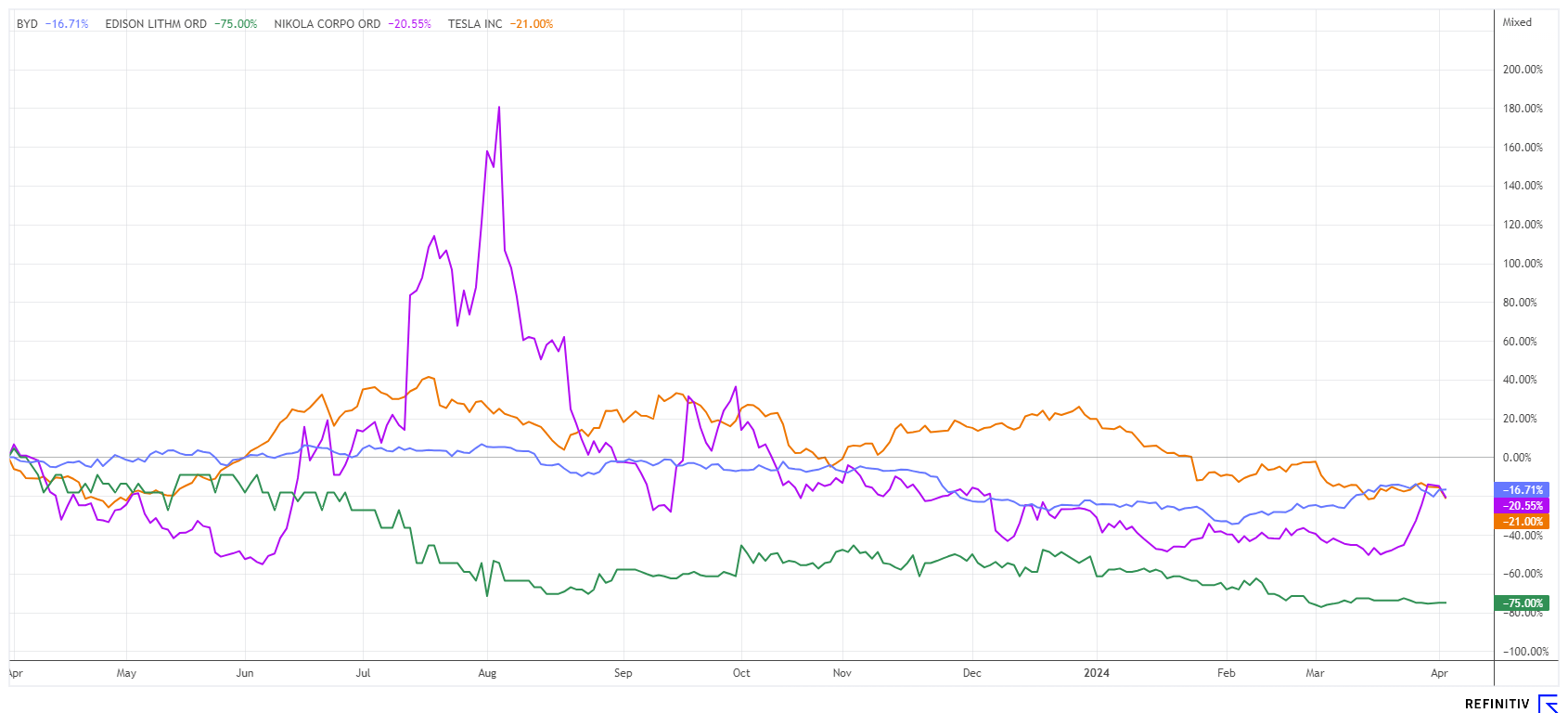

Bitcoin and Stromer need the energy transition! BYD, Edison Lithium, Nikola - Is it time to buy low?

Despite recent declines in electric mobility, the development of traction batteries is breaking new ground. Sodium is under discussion to replace toxic lithium. The new technologies also mean that cobalt and nickel are no longer required. Former lithium companies are changing their business models, but the raw material will still be urgently needed for at least another decade. We are looking at a market that is about to change course. Where do the opportunities lie for agile investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , Edison Lithium Corp | CA28103Q2080 , NIKOLA CORP. | US6541101050

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Is lithium consolidating now?

After a spectacular two-year price rally until the end of 2022 with increases of over 600%, the lithium price has now been consolidating for 15 months in the face of lower-than-expected sales of electric vehicles. Just as the German government phased out the environmental bonus at the end of 2023, orders for electric vehicles collapsed at dealerships. Buyers of electric vehicles had always openly admitted their tax incentive motivation, yet Berlin believed that e-mobility could become a surefire success; far from it. However, there are now increasing signs that demand is gradually outpacing supply and that producer margins will return. According to recent studies, the deficit is likely to rise from 25,000 tons of lithium carbonate to over 50,000 tons in 2028, as many mining projects in recent years have simply disappeared from the market due to a lack of financing.

Edison Lithium - Getting into restructuring at a bargain

Alongside copper, lithium remains one of the most critical raw materials in the mobility transition. However, fewer new suppliers are currently entering the market, especially for lithium, because the price is visually too low to attract more significant investments. The lithium and cobalt explorer Edison Lithium Corp. (EDDY) owns claims covering an area of around 100,000 hectares in Argentina. After years of uncertainty regarding lithium mining from salt lakes, proponents now seem to be gaining the upper hand. Under the new President Javier Milei, the situation is changing noticeably, as he has already announced far-reaching deregulation measures to combat the economic crisis in order to attract investors such as mining companies to the country.

A good opportunity to resell the claims and break new ground. An alternative technology for batteries is currently leading to increasing interest in sodium brine concessions. Edison has secured access in the Canadian state of Saskatchewan, as the Canadians are focusing on the raw materials required for the next generation of traction batteries in their new core business. The new sodium-ion technology is seen as a more environmentally friendly alternative to lithium-ion batteries. The first vehicle manufacturers are already conducting intensive research and have started the initial test series. Due to public aversion to lithium technologies, the topic could become established more quickly than many currently believe.

Edison Lithium has already found solutions for lithium and, as an add-on, also owns 100% of Edison Cobalt Corp. This valuable subsidiary will soon be listed on the stock exchange. Nevertheless, a price of only CAD 0.11 is currently being asked for the almost 20 million outstanding EDDY shares. This means that the Company is valued at a low CAD 2.2 million, a mere pittance for the ample opportunities offered by the reorientation.

BYD - Analysts express skepticism

The Warren Buffett-backed share "Build Your Dreams" (BYD) cannot escape the spotlight. Although sales have grown steadily since 2022, the first quarter of 2024 saw a steep decline. BYD sold just over 300,000 electric vehicles from January to March, a 43% decrease compared to the record volume in the previous quarter, and likely indicates a reversal in trend. Analysts expect Tesla to sell an average of just over 458,000 vehicles in the first three months of the year, surpassing its Chinese competitors once again. However, BYD's management remains committed to its goal of achieving a 20% sales growth this year, reaching 3.6 million vehicles.

Ambitious, according to Goldman Sachs. Although the recently published research confirms the "Buy" rating, the price target for the share has been lowered again. BYD managers were too skeptical at the quarterly conference after the great optimism of recent months. The Chinese company would like to compensate for the anticipated decline through mergers and acquisitions. However, this usually costs a premium over the current market valuation. BYD plans to sell around 500,000 vehicles abroad in 2024, and one million vehicles in 2025, and prices have been lowered again. Therefore, Goldman Sachs is revising its profit forecast for BYD for 2024 to 2026 by 11 to 15% to take account of the price war in the Chinese market and the pressure on margins. A further 34 analysts on the Refinitiv Eikon platform are formulating a "Buy" recommendation. Slight changes are now likely to follow the quarterly report. In terms of the chart, the share price must first exceed the EUR 26 mark again in order to trigger buy signals.

Nikola Motors - Textbook volatility

One rarely sees greater fluctuations than in penny stocks. The shares of the dazzling electric vehicle producer Nikola Motors have fluctuated between USD 0.60 and USD 3.40 over the past 15 months, yesterday they were trading at USD 0.99. So far, the startup still has a market value of USD 1.35 billion, although the Company still owes the first product. Hope is now rekindled as, following the failed collaboration with General Motors on the Badger PickUps, a new player enters the field. It is none other than Dave "Heavy D" Sparks, one half of the well-known reality TV duo "Diesel Brothers" and founder of the new company Embr Motors.

According to media reports, Embr Motors is not only taking over the intellectual property of the Badger pickup truck, but also the assets associated with Nikola's discontinued off-road vehicle and watercraft projects. In addition, the only two prototypes of the Badger will become the property of Embr. The Badger pickup truck will be powered by a combination of battery and hydrogen technology, promising impressive range and performance. In return, Nikola will receive a 30% stake in the new Embr Motors. Nikola's flamboyant founder Trevor Milton will have no direct or indirect involvement in Embr's projects. Sounds like another straw to grasp, after all, the Nikola gambler's stock reacted with a 75% share price premium in just 2 weeks. Casino at its finest!

Electromobility is breaking new ground. This is shaking the lithium market and causing technological changes of a long-term nature. Investors should keep a close watch, as vehicle manufacturers also have changes in the pipeline. Edison Lithium is breaking new ground and undergoing restructuring. Whether Nikola can take off together with Embr Motors remains questionable.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.