March 12th, 2024 | 07:15 CET

Profit-taking in Defense and AI - What else is going on? Rheinmetall, Almonty Industries, Renk and Hensoldt

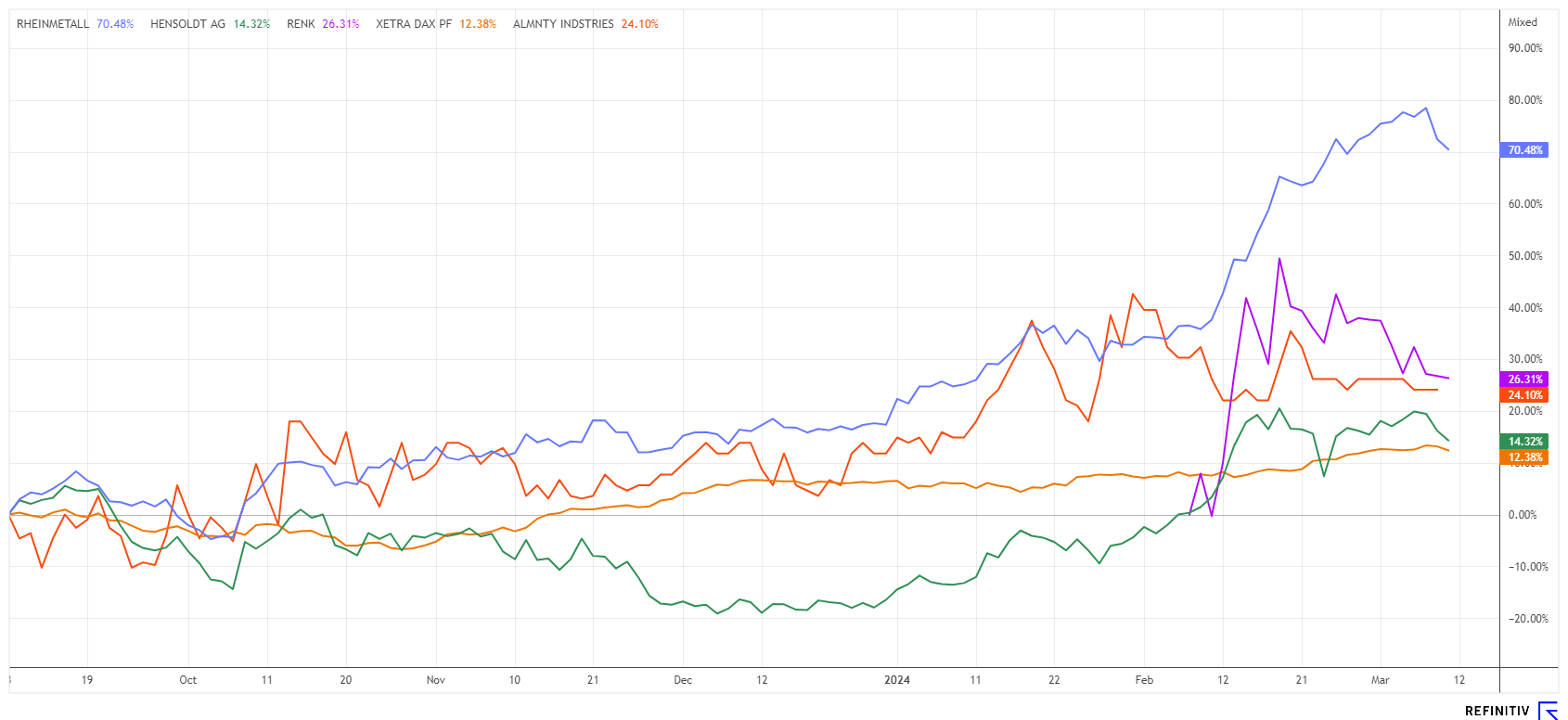

Armaments stocks have been on the sunny side in the current year, 2024. Investors in this segment clearly outperformed the DAX 40 index. Due to the geopolitical situation and a redefined EU security policy, investors have rediscovered the sector. NATO member states are being called upon by the US to strictly adhere to or further increase their percentage of gross domestic product invested in defense. Donald Trump, who may return, wants to deny renegade allies the backing of the US in an emergency. Although nobody believes in this scenario, the announcement has had the effect that orders for new armaments technology have reached a new all-time high. Which shares are still in focus?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , ALMONTY INDUSTRIES INC. | CA0203981034 , RENK AG O.N. | DE000RENK730 , HENSOLDT AG INH O.N. | DE000HAG0005

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall - Strong order situation, but weak market technicals

Now things are getting exciting for the best performer in the DAX 40 index. On March 14, the Company will report on Q4 2023. Analysts believe that earnings per share of EUR 7.96 are possible, which would be over EUR 13 for the year as a whole. However, sales of over EUR 7.3 billion should be just as convincing. Rheinmetall's share price has risen by over 60% in the last 6 months, so expectations are high. Hopefully, in addition to a good order situation, the management will also be able to provide a plausible explanation for how they plan to achieve the necessary capacity expansions despite the shortage of skilled workers.

The Rheinmetall share is currently struggling to break through the EUR 440 mark. The share repeatedly falls back, and yesterday, an article in the Bild newspaper caused a shock. Allegedly, the German Armed Forces lack EUR 6 billion to order new defense technology, a significant portion of which would come from Rheinmetall. However, what is missing in Berlin is money. On the Refinitiv Eikon platform, 15 out of 16 experts are still calling for a "Buy". However, the 12-month share price expectation is only EUR 420. It will be exciting to see what outlook CEO Armin Papperger will present on Thursday. Consider placing a stop at EUR 405 to secure profits in the medium term.**

Almonty Industries - Not much is missing now

Those investing in high-tech or GreenTech should not lose sight of the supply chains for strategic metals. Defense companies are also dependent on a stable supply situation for essential metals, as the manufacture of defense technology involves a whole basket of critical raw materials. Not least, the current wave in artificial intelligence is based on a high degree of technologization, which will spread to all countries in the coming years. Governments need a source of critical raw materials for their projects; otherwise, important infrastructure development work cannot take place.

The EU list of critical metals includes the highly heat-resistant tungsten. The Canadian company Almonty Industries owns four properties of this rare metal and is focused on increasing production. The revitalization of the Sangdong mine in South Korea, the largest property for the metal outside of China, is expected to be quite promising. Production is scheduled to start at the end of 2024, though minor delays remain. In addition to the existing debt financing of USD 75 million from KfW, the Company is still looking for suitable equity investors at the project level, as raising new funds should not further dilute shareholders.

Almonty has recently announced its entry into Level 4 of the Panasqueira mine in Portugal. Here, tungsten mining dates back to the late 1800s. With the development completed, Almonty is opening an exciting chapter in its mining history, as tungsten mining now takes place with significantly lower risks. A comprehensive scoping study has paved the way for this ambitious project, which will be advanced to ore resource confirmation and finalization of financing. After the expansion, an EBITDA margin of over 30% is expected, reflecting the financial viability and profitability of the project. A recent visit by the US Department of Commerce underscores the strategic importance of the Panasqueira mine in meeting global tungsten demand and highlights its central role in shaping the future of the industry. The Almonty share has plenty of air under its wings again, up a good 50% since September 2023. We believe the story should continue to run strong, as a series of good news can now be expected.

Renk Group and Hensoldt - What the analysts say

Investors in Rheinmetall should not lose sight of Hensoldt and the Renk Group. Trends often move with rotations through an entire industry. From a market perspective, it currently looks as if investors are shifting from the highly valued Hensoldt to Rheinmetall. In the case of Renk, it is not yet clear what the major shareholder, Triton, will do with its remaining 50%. The success of Renk's IPO is also attributed to the fact that two large investors were secured just before the listing. The tank manufacturer KNDS, a merger of the German military vehicle manufacturer Krauss-Maffei Wegmann and the French state-owned Nexter Defense Systems, acquired shares of just under 7% for EUR 100 million. The US fund management company Wellington Management, which is heavily involved in defense stocks, joined as an anchor shareholder after KNDS had committed and bought shares for EUR 50 million.

There are no analyst estimates for Renk yet, so the value fluctuates within a narrow range between EUR 24 and EUR 28. The experts on the Refinitiv Eikon platform are relatively unanimous regarding Hensoldt, as only 4 out of 8 studies still rate the stock as a "Buy". The average price target of EUR 31.1 is notably below the current price of EUR 34. Renk will report on the 2023 financial year on March 27. By then, the first analyst ratings will likely be available. From a technical chart perspective, all defense stocks are currently not performing well. Those who act cautiously may consider taking the accumulated profits.

The manufacture of defense technology requires a large number of strategic metals. Europe is attempting to address the supply chain situation with its procurement pacts, but geopolitical uncertainties complicate these efforts. Almonty Industries, as a supplier, is an important strategic partner in secure jurisdictions. The defense stocks Rheinmetall, Hensoldt, and Renk have yet to demonstrate whether further increases are possible.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.