March 27th, 2024 | 08:30 CET

Watch out: DAX record chase! Automotive stocks in the fast lane: Mercedes-Benz, Globex Mining, VW and Tesla

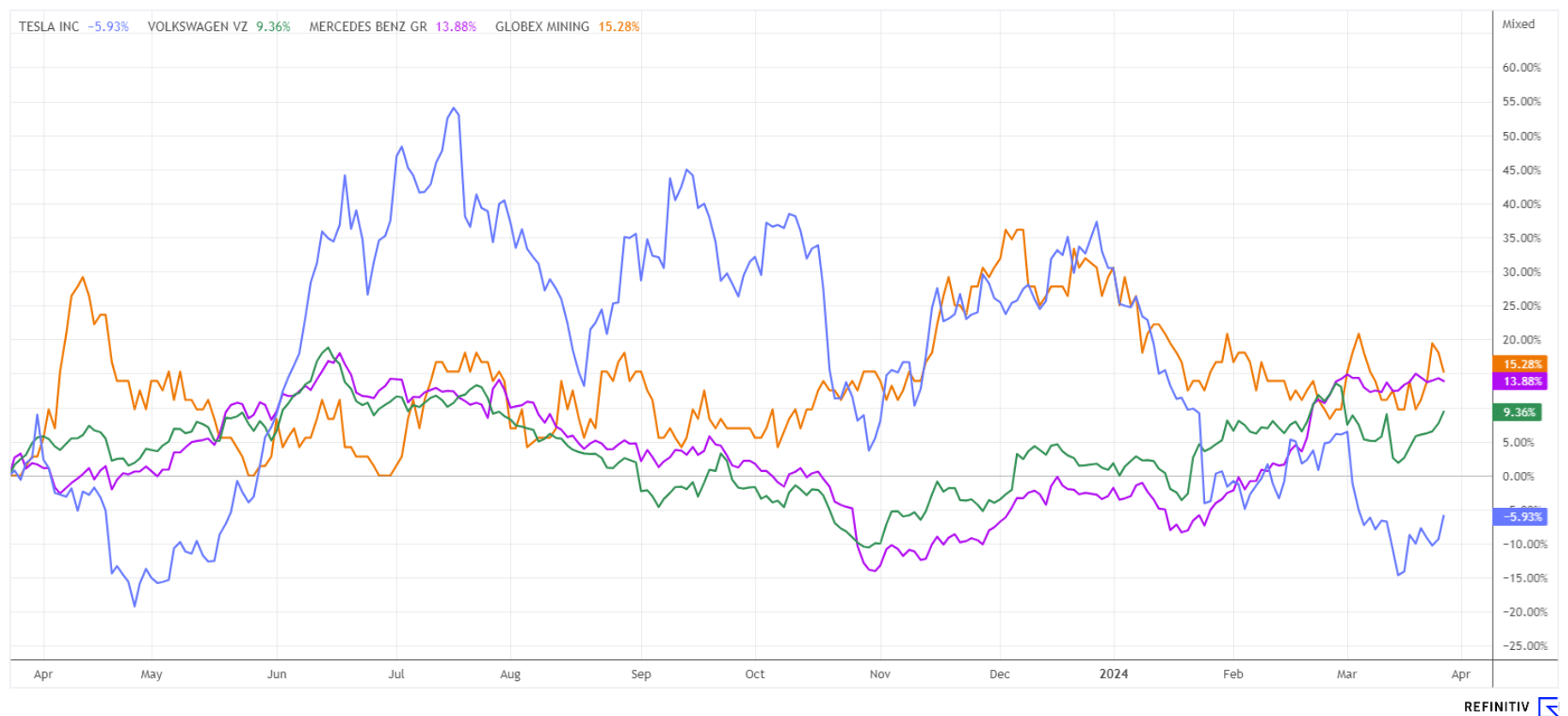

The DAX 40 index is chasing from one high to the next, surpassing the 18,400 mark yesterday. In addition to artificial intelligence, it is primarily high-tech and defense stocks that are moving the market. The automotive stocks are still in the doldrums, as an expected decline in GDP also means smaller household budgets. Nothing is worse for the industry than the postponement of new car purchases until next year. The stockpiles are getting bigger, and dealers are plunging into desperate discount battles. However, the market is changing noticeably. Currently, there are clear buying candidates; we analyze the current situation.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

MERCEDES-BENZ GROUP AG | DE0007100000 , VOLKSWAGEN AG ST O.N. | DE0007664005 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , GLOBEX MINING ENTPRS INC. | CA3799005093 , TESLA INC. DL -_001 | US88160R1014

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Tesla Motors - High valuation, many risks

Those who bet on Tesla at the beginning of the year are lagging far behind - no wonder, as the share was always fundamentally too expensive and then the German environmental bonus was discontinued at the turn of the year. At the same time, Chinese manufacturer BYD increased its presence in Europe and is making life difficult for the Californians. After a significant correction of 40% from around EUR 250 to EUR 150, the value is currently attempting to stabilize. On the news front, e-mobility manufacturers are currently receiving a lot of criticism, as many promises could not be kept. The overall calculation only works out for people with enough time for charging and shorter distances. For owners of combustion engines, this is not a new point; they simply order a new model.**

Fundamentally, a closer look should be taken at the Tesla share as, according to experts on the Refinitiv Eikon platform, the P/E ratio based on the 2024 estimates is a staggering 59. The expected revenues of USD 109 billion are by no means guaranteed. However, a 5-fold sales valuation is very highly-priced. From a chart perspective, a recovery to EUR 200 is conceivable, after which the final downward wave should start. Only 17 of 49 analysts still give the share a "Buy" rating. Exercise caution and follow the momentum; the value is under pressure.

Globex Mining - New gold projects in Arizona

Gold is back on the buy list. It is time for us to focus again on the Canadian explorer and asset manager Globex Mining (GMX) from Quebec. The stock has seen a clear stabilization over the last 12 months and is number 1 on our peer list. The Company and its predecessor companies have more than 40 years of exploration and development behind them. They are adding new properties in Arizona to the portfolio, which already includes over 230 properties. These new additions consist of 24 unpatented lode claims totaling an area of 200.67 hectares in Mohave County in northwestern Arizona.

The property, called the Salt Spring Project, hosts a large number of gold-bearing quartz veins, small historic mining operations and other deposits. Gold was discovered in the district in the early 1870s, with the majority of production before 1932 coming from the El Dorado, Excelsior, Golden Rule and Cyclopic mines. Globex has already completed initial field work, including geologic mapping, and has taken a total of 70 rock samples. Anyone who knows CEO and founder Jack Stoch knows that there will be some success stories coming out of Arizona in the next few months. It would be great if the shares could continue to replicate the positive trend in precious metal prices as well as they have done because, from a technical perspective, gold is set to break out above USD 2,200. There are currently around 57.7 million GMX shares on a fully diluted basis. After a low of around CAD 0.68 in 2023, the share price rose to CAD 0.98 by November. The Company is currently in a holding pattern at around CAD 0.86. With around CAD 20 million in cash and a lavish project list, Globex Mining is one of the most interesting stocks on Canada's explorer list. The share could easily reach old highs of CAD 1.50 to 2.00 again in 2024.

Mercedes and Volkswagen - The pearls of the German automotive industry

Moving away from Tesla and towards the German premium manufacturers Mercedes-Benz and Volkswagen. Currently, both companies only sell 1 in 12 vehicles as electric vehicles; in 2023, it was significantly more. In the meantime, there is even a mental shift back to combustion engines from the board members because, after all, they would still be able to develop an entire model series by 2035. Of course, this goal is not being widely publicized. However, the German driver's favourite child was not developed as a battery vehicle but has an audible and mature engine with at least 4 cylinders.

The current undervaluation of e-mobility, such as Tesla and BYD, could be significantly reversed in the next 3 to 5 years, especially as Mercedes and VW only have 2024 P/E ratios of 6.3 and 4.4, respectively. In terms of sales, the valuation is also 10 times more favourable than that of Tesla. Mercedes, for example, has a price/sales ratio of 0.5, while VW even has a ridiculous 0.3. The attractive pricing is topped off by dividend yields of 6.7% and 6.4%, respectively. The distributions are now due in April, which is a nice post-Easter gift to loyal shareholders who hold their shares until then or even buy more. Active investors should not be surprised if Mercedes-Benz and Volkswagen outperform Tesla shares by a full 100% over a two-year period.

Interesting times have dawned on the stock markets. While Tesla and BYD are undergoing significant corrections, the German premium manufacturers Mercedes-Benz and Volkswagen are slowly gaining momentum. Globex Mining is also very stable and highly interesting in light of significantly higher expected precious metal prices.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.