Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Commented by André Will-Laudien

Commented by André Will-Laudien on October 2nd, 2023 | 07:45 CEST

CO2 Certificates - The Solution for Climate Change? Nel ASA, Klimat X, Ballard Power and Plug Power in the analysis check!

The transition to a sustainable climate cannot be solely funded by the public. Success depends on private initiatives. It is, therefore, all the more important that inventiveness and entrepreneurial energy in this critical economic sector are also rewarded and promoted. In May 2022, the European Union launched REPowerEU, a billion-dollar program on how to shape the energy future. At the time, hydrogen accounted for less than 2% of energy consumption in Europe and was mainly used to manufacture chemical products such as plastics and fertilizers. The European Commission has proposed producing about 10 million tons of renewable hydrogen by 2030 and importing another 10 million tons to reduce climate-damaging gases. Climate innovations are evaluated differently on the stock market, and we will focus on some key players.

ReadCommented by André Will-Laudien on September 28th, 2023 | 08:05 CEST

Attention: Extended correction - Buy the right stocks now! Bayer, Viva Gold, TUI, and BASF are on the list!

Higher inflation and rising interest rates - this connection should be clear to investors. The interest rate level in Germany has moved from negative territory to 2.77% in the 10-year range, but stocks continued to rise cheerfully. The party led to all-time highs of 16,528 points in July, but the fundamental situation of the companies deteriorated in parallel. Only after repeated warnings from the US Federal Reserve did the explosive NASDAQ also enter a correction. And it continues. Yesterday, the CEO of US investment bank JPMorgan, Dimon, warned that the world may not be prepared for 7% capital market interest rates. He and Dr. Jens Erhardt, the CEO of the asset management company DJE, warn of stronger setbacks on the stock markets. Some stocks have already undergone a strong correction. Here is a brief overview.

ReadCommented by André Will-Laudien on September 27th, 2023 | 08:05 CEST

The high-tech gold rush on the Nasdaq is waning: BYD, Manuka Resources, and Infineon remain on the buy list

For those investing in green or high-tech sectors, keeping an eye on the supply chains of raw materials is crucial. After all, in times of geopolitical upheaval, nothing seems more important to the industry than securing its foreign sources of critical resources. The EU and the US have already responded by adding several metals to the list of strategic elements. For the capital markets, too, the fight against global warming has become an issue that cannot be ignored. We focus on successful protagonists that can enhance any portfolio.

ReadCommented by André Will-Laudien on September 26th, 2023 | 07:45 CEST

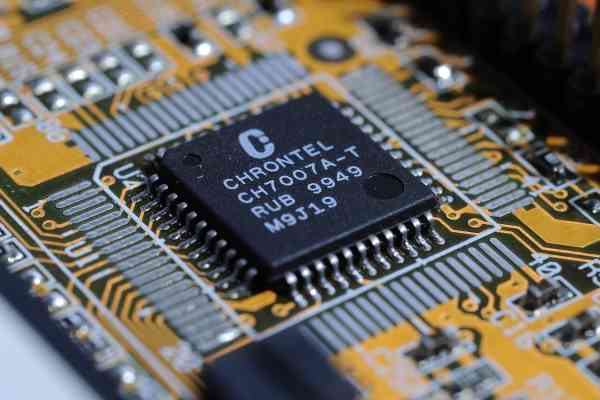

Artificial Intelligence in Sellout! Nvidia, Defense Metals, ARM Holdings - Nothing works without rare earths!

After long bull market movements, the stock market usually tends to rotate sectors, or the market enters a general consolidation. In the former case, investors can profit by reallocating their assets while exploring new investment opportunities. In the latter case, all stocks come down, and the capital market generally suffers from a change in sentiment and corrects recently exaggerated valuations. In the case of the new megatrend of Artificial Intelligence (AI), the stock market seems to sense a great need for correction. As if by magic, the blockbuster stock Nvidia rose by 250% in just 9 months. However, it has already retraced nearly 20% from its peak. Where do the opportunities lie for investors?

ReadCommented by André Will-Laudien on September 25th, 2023 | 08:35 CEST

Make a return instead of sitting on the sidelines! Nel ASA, Desert Gold or Nikola Motors - Who belongs on the buy list?

Despite the bull market, the hydrogen sector is feeling the global investment slump, not to mention precious metals. Once again, the US Federal Reserve has issued warnings on the inflation front, but this time, after 11 consecutive hikes, it has not turned the interest rate screw. The refinancing rate remains at 5.5%, but the accompanying wording has greatly unsettled the markets. Capital market rates shot up, reaching a whopping 4.55% for 30-year US Treasury bonds - the highest level in 10 years. We take a look at values that have fallen sharply. Where can adequate yields be expected?

ReadCommented by André Will-Laudien on September 22nd, 2023 | 07:20 CEST

Recalculation! These are the bare figures: TUI, Saturn Oil + Gas, Deutsche Bank - Buy prices non-stop!

Companies do not always have good figures in their baggage. Analysts listen very carefully to the words of those in charge. Often, it is only a minor sentence that changes entire valuations. TUI is slowly approaching pre-COVID figures. Saturn Oil & Gas must backtrack slightly because of substantial forest fires in Alberta, and Deutsche Bank aims to finalize the Postbank project in 2023. All three stocks offer good buying opportunities because the long-term prospects are quite convincing.

ReadCommented by André Will-Laudien on September 19th, 2023 | 08:05 CEST

Hydrogen on sale! Here is the alternative: BYD, Altech Advanced Materials, BASF, Volkswagen

While the IAA Mobility ended with satisfied faces, it did not bring good vibes to local automotive stocks. More than 500,000 visitors attended to be convinced of innovations for a climate-friendly future. Half of the 750 exhibitors came from abroad, and 109 nations were represented. However, those who went with the expectation of finding major breakthroughs were disappointed. The familiar lithium-ion battery still dominates with over 95% usage. Industrially viable alternatives, however, are already in the development stage. Those who think ahead are opting for modern battery concepts.

ReadCommented by André Will-Laudien on September 18th, 2023 | 06:30 CEST

Unbelievable! Hands off AI, biotech in rebound! Bayer, Defence Therapeutics, Morphosys

The big fall decline is now over. It is always a difficult time, but the so-called "Triple Witching" went relatively smoothly this time. The European Central Bank (ECB), in its first interest rate meeting after the summer break, decided to raise key rates by another quarter point to 4.00%, up from the previous 3.75% in July. At the same time, it lowered its inflation forecast for 2025 and the outlook for economic growth in the Eurozone for the years 2023 to 2025. Economic risks are increasing, but inflation remains the determining factor for interest rates. Expectations that the US Federal Reserve (FED) will announce an interest rate pause at its next meeting on Wednesday have boosted confidence. Last week's big losers were the recently favoured AI stocks Nvidia, Microsoft and C3.ai. However, the biotech sector has recently started to climb again. Where are the opportunities for investors?

ReadCommented by André Will-Laudien on September 14th, 2023 | 09:05 CEST

Artificial Intelligence in practice? Nvidia, NorCom, Palantir - The next 100% with Big Data

The stock market is not a one-way street. Investors are trying to ride the wave of "Artificial Intelligence" (AI), and corresponding stocks such as C3.ai, Nvidia, Microsoft, or Palantir are performing well in 2023. A new megatrend is underway here, which, according to experts, will continue for several years. However, because of the high valuations in the entire sector, it is worth taking an analytical look. After all, no one knows how long the AI boom will continue to generate decent returns on the stock market. Opportunity-rich stocks still exist in the second and third tier. We are taking a closer look.

ReadCommented by André Will-Laudien on September 13th, 2023 | 08:45 CEST

IAA Mobility - There is more to come! Pressure on Volkswagen, BYD and Power Nickel increases

The IAA Mobility closed its doors over the weekend. It was supposed to exude glitz and glamour, but the spark in the field of e-mobility doesn't seem to be flying, and sales figures are declining in Germany. There were only a few real innovations in Munich, but at least progress is being made with e-bikes. More than half of the 750 exhibitors came from abroad, a fact that the German automotive industry is feeling more and more. The Chinese manufacturer BYD presented five models, which will soon be launched in Germany. They are in direct competition with Volkswagen's ID range. Where do the opportunities lie for investors?

Read