November 14th, 2023 | 07:30 CET

Rapid energy transition, metals remain in demand! JinkoSolar, Globex Mining, BYD and VW under scrutiny!

"Goodbye Hydrogen" - that is how investors in H2 stocks might title their investment success in 2023. On average, shares in the booming sector lost up to 85% in 2021. But the year is not over yet. Plug Power shares were hit hard last week, experiencing a sell-off of over 35% after the Q3 figures. The fundamental environment was ignored for many months, but now gravity is returning and sending overvalued stocks into the cellar. It is an environment for buyers willing to conduct some analysis. We help navigate the figures.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

JINKOSOLAR ADR/4 DL-00002 | US47759T1007 , GLOBEX MINING ENTPRS INC. | CA3799005093 , BYD CO. LTD H YC 1 | CNE100000296 , VOLKSWAGEN AG ST O.N. | DE0007664005 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

JinkoSolar - Good figures facilitate re-entry

The JinkoSolar share is currently showing noticeable upward price movements. The Chinese solar module producer has published its final results for Q3, once again reporting high sales and profit growth. The total output delivered rose to 22,597 megawatts, an increase of 108% compared to the previous year and a sequential increase of a good fifth compared to the previous quarter of 18,613 MW. Of this, 21,384 MW was attributable to solar modules and 1,213 MW to solar cells and wafers. JinkoSolar thus exceeded its own forecast and also surprised analysts. Sales increased by 63% to CNY 31.8 billion, and the gross margin was a solid 19.3%, compared to 15.7% in the same period of the previous year. Operationally, CNY 2.99 billion remained on the books, of which CNY 2.33 billion can be reported as net profit.

The Chinese company is benefiting from falling prices for polysilicon and strong order growth in the US. The Company now has around EUR 1.8 billion in its coffers. The necessary future investments can thus be financed in-house. The positive mood following the figures is now being joined by investor buybacks. The share, which was beaten down to EUR 24, was thus able to recover a rapid 40% from the bottom. For the yield-oriented investor, there is also a distribution of a good 4% on top.

Globex Mining - One deal after another

Jinko Solar is a clear beneficiary of the global energy transition. However, many countries still have a long way to go to convert their energy supply to alternative sources. Fortunately, for regions with abundant resources and renewable energy, such as Canada, the path seems more straightforward. Few areas on Earth can draw on such a wealth of resources as the North Americans. Globex Mining (symbol: GMX) is primarily active in Quebec and has been involved in exploration and development for more than 40 years, including its predecessor companies. For decades, CEO and founder Jack Stoch has been searching for interesting precious and industrial metal properties. His approach is both opportunistic and rational. When he discovers promising mineralizations that can be economically exploited, it is often not Globex Mining itself that does the digging. That is because Globex Mining's business model is based on the out-licensing of mining rights and the structuring of option deals. If actual production is eventually achieved, CEO Jack Stoch's holding company earns through royalty payments from the cooperation partner.

By mid-year, the investment portfolio comprised a total of 232 properties, and recently, there was again news about the Cerrado iron-vanadium project. Globex Mining had successfully secured an international bank as the Mandated Lead Arranger (MLA) through a tender process. In the course of project financing and the firm commitment of the Export Credit Agency (ECA), it is necessary to initiate an onboarding and appointment process for the financing partner. The appointment of the MLA is a crucial milestone for the subsequent project financing. The next phase will consist of a formal due diligence phase followed by a feasibility study before a binding offer can be made. Results of this are expected as early as the first quarter of 2024.

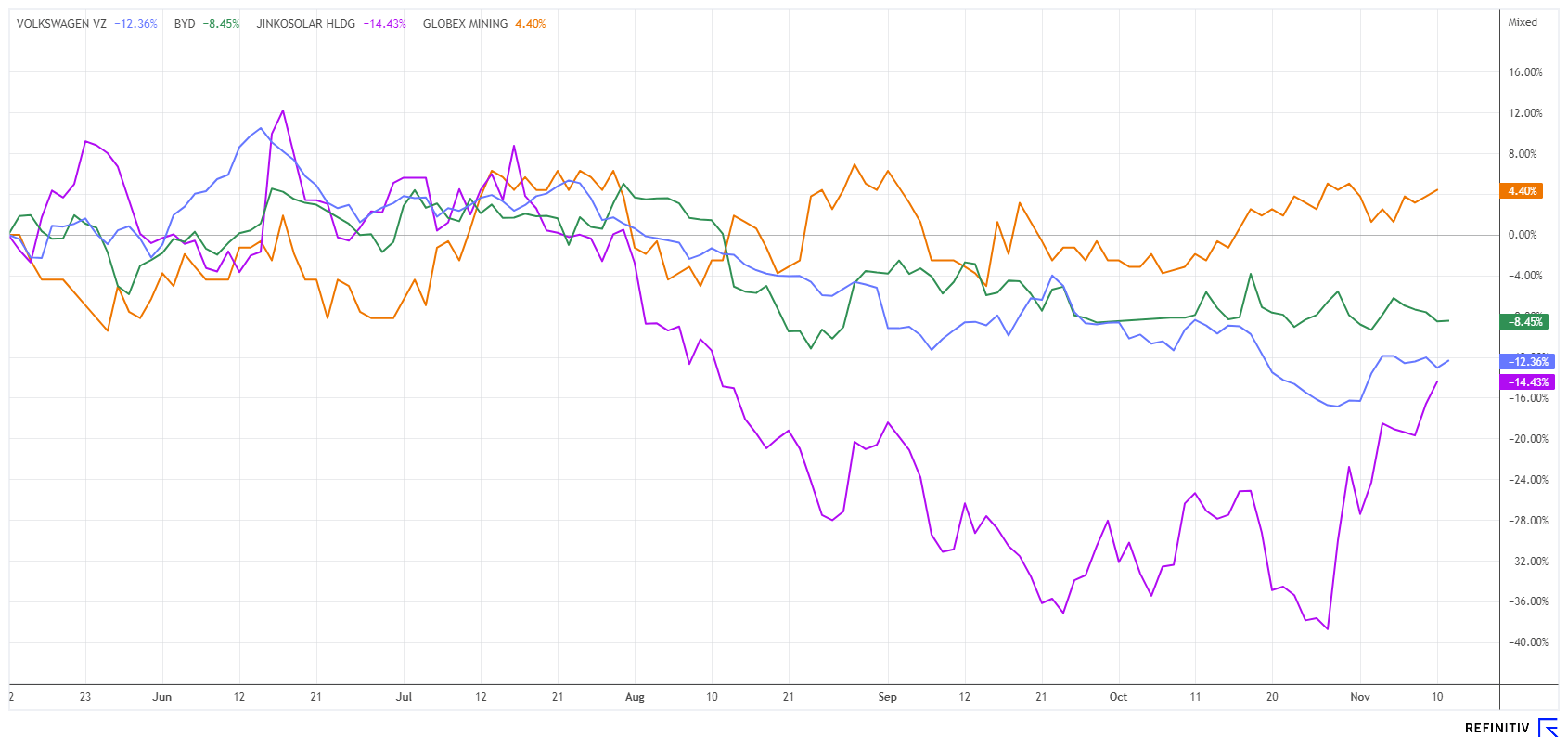

There are currently around 57.7 million GMX shares on a fully diluted basis. In the sell-off of small caps in the mining sector, the solidly positioned Globex Mining was even able to generate additional investor interest. The share price is far ahead of its peer group in terms of performance and is up 19.5% in the current year. If gold and silver also gain momentum due to the crisis, there will be no stopping Globex Mining.

BYD versus VW - The German automotive industry is losing market share

The performance of automotive shares worldwide lags behind the generally positive stock market sentiment. This is due to the inflation-induced increase in product prices and the weaker purchasing power of potential buyers of durable goods. While politicians are constantly propagating the climate turnaround, consumer power is suffering from the accompanying increase in the cost of all forms of mobility, be it rail, air or car. The situation worsens in the purchasing behaviour of the younger generation, which is notably reserved in the discussion on individual mobility. **Germany, in particular, as the former "Automotive Wonderland", may slowly be losing its status; the buyers of premium vehicles are definitely based abroad.

The international competitiveness of German vehicles has been extremely weak this year. Production costs are too high in Germany, heavily reliant on foreign suppliers, and the pricing strategy is no longer competitive. China is bringing its electric models onto the market earlier and at a more affordable price. BYD, Nio and other manufacturers are following Tesla's example and are already conquering European showrooms. At this year's IAA Mobility in Munich, the manufacturer BYD booked an exhibition space twice the size of the German market leader, Volkswagen.

While BYD has recently posted strong figures, VW is losing its leading position in Asia. Over the last 12 months, VW's stock has lost a substantial 27%, while BYD has gained nearly 24%. At EUR 89 billion, the Chinese company has already outstripped Volkswagen's market value by a factor of 1.5. We can only hope that the Wolfsburg-based company brings the EUR 20,000 dream electric car of new CEO Oliver Blume to market as quickly as possible. In a direct comparison of the shares, VW stands out with a 2024 P/E ratio of 3.5 and a dividend payout of over 8% compared to BYD's P/E ratio of 22 and a dividend of 0.7%. However, both stocks have limited prospects for significant gains in a looming recession.

The stock market gives and takes. A significant amount of money was lost, for example, in the hydrogen sector. But other Greentech projects are also faltering, as governments are currently urgently looking for private investors. However, these are difficult to find in a recession. In our comparison, Globex Mining impresses with high value stability, and JinkoSolar is on its way up. Automotive stocks VW and BYD are in a neck-and-neck race for the favor of electric mobility customers. VW appears to be more favorable in analytical terms, but the internal problems are likely far from over.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.