December 4th, 2023 | 07:30 CET

COP28 Climate Summit in Dubai boosts uranium shares! Cameco, GoviEx Uranium, Siemens Energy and E.ON in focus

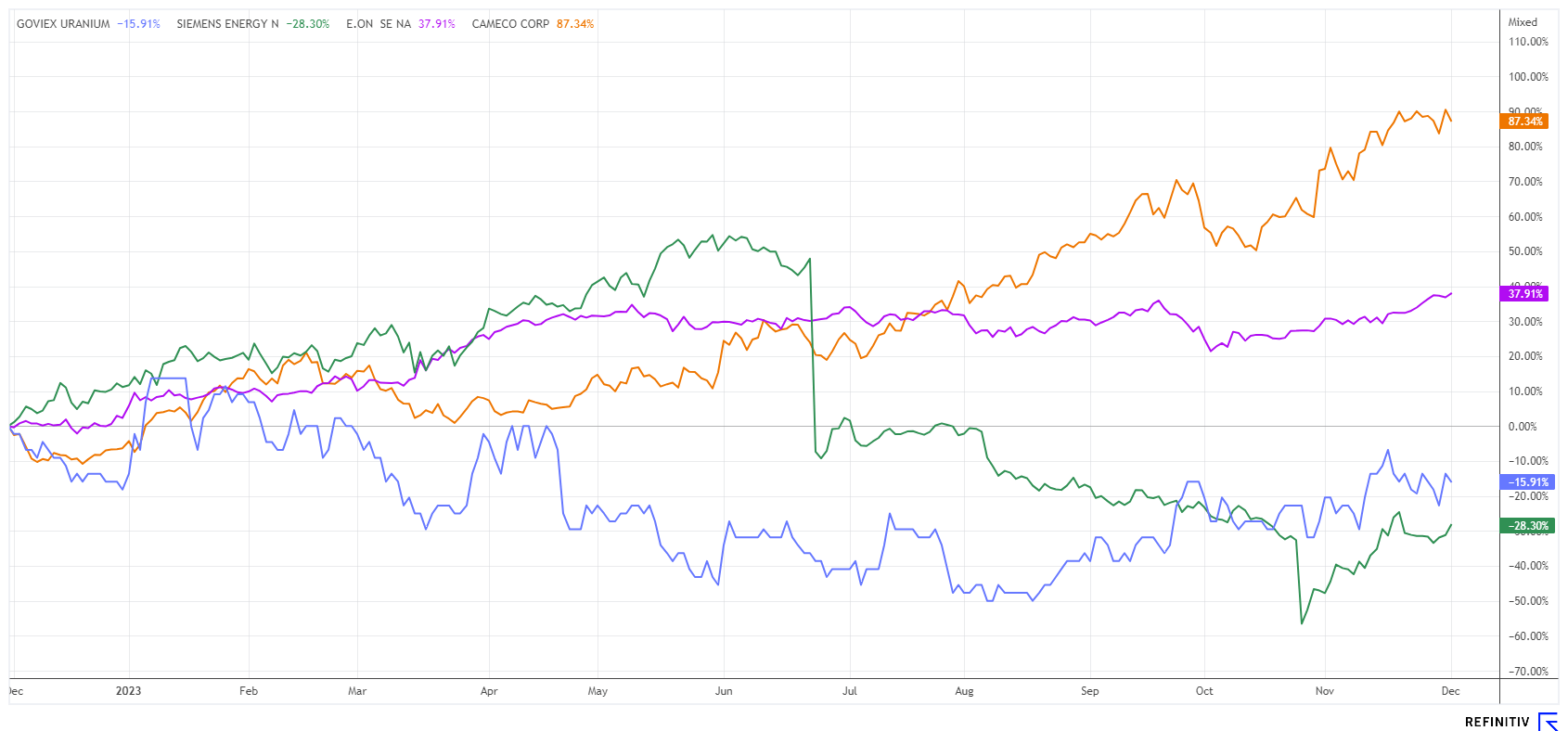

With a raised finger, Chancellor Scholz calls for a global shift away from fossil fuels in Dubai. Climate change remains "the great global challenge of our time". He is thus appealing to the almost 200 countries, which are holding energetic consultations until mid-December, to join in the energy transition formulated in Germany. Specifically, he proposed an agreement on two binding targets that are already consensus among the industrialized countries of the G20: One is to triple the expansion of renewable energy, and the other is to double energy efficiency - both by the year 2030. So far, more than 110 countries have agreed to expand green energy production at this rate. However, there is also the opposing party: around 20 countries want to almost triple their investment in nuclear energy. Where are the winners hiding?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

CAMECO CORP. | CA13321L1085 , GOVIEX URANIUM INC A | CA3837981057 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , E.ON SE NA O.N. | DE000ENAG999

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Siemens Energy - Safety and control technology for nuclear power plants

Despite the war in Ukraine, Siemens Energy continues to maintain business relations with the Russian state-owned company Rosatom. In particular, its involvement in a nuclear power plant project in Hungary continues to attract criticism. Nevertheless, the European Union is making an exception to the sanctions against the Russian energy sector. Unlike oil, gas and coal, there are still no trade restrictions in the nuclear industry. According to a report by the environmental protection organization Greenpeace, two Western companies in particular are benefiting from this: the French company Framatome and the now independent energy division of the German company Siemens.

Apart from any contempt for war, Siemens Energy is well within its rights to retain and even expand its core competence in nuclear energy technology. Secondly, nuclear energy will play an important role in the energy transition in Central Europe in the coming decades. And Siemens Energy is a provider that can offer the highest safety standards. In everyone's interest, it is therefore essential to strengthen German engineering in the country instead of torpedoing it. It is good to hear that Siemens Energy is adhering to its contracts with international partners without any ideological bias.

The share has come under pressure due to heavy burdens from the wind sector. The highly praised "alternative energy generation", such as wind power from the Spanish subsidiary Gamesa, is causing the Company to lose billions in the current year. However, the share has been gaining momentum over the past 3 weeks, leaving the deep valley of tears. We advised an entry at EUR 7.50, which is now showing a short-term profit of 50%. However, the story could really take off in 2024, as the prospects for modern energy technology are outstanding. Therefore, buy again in the EUR 10 to 11 range as a billion-dollar surplus beckons again in 2026. **The analysts on the Refinitiv Eikon platform expect an average target price of EUR 14.75. It is a good investment, as we believe the nuclear energy fantasy will soon be revived in Germany.

Therefore, consider buying again in the 10 to 11 EUR range, as a billion-dollar surplus is expected again in 2026. Analysts on the Refinitiv Eikon platform have an average price target of 14.75 EUR. A good investment, as we believe the nuclear energy excitement will soon revive in Germany."

GoviEx Uranium - Uranium in demand like never before

The price of uranium is rising and rising. It is no wonder as over 100 new reactors will be connected to the grid worldwide in the next 10 years. This will increase capacity by a full 25%. No one currently knows where all the uranium will come from. Production in 2022 stagnated at around 50,000 tons, with Kazakhstan supplying about 40%, followed by Canada and Namibia.

The Canadian explorer GoviEx Uranium is well distributed with its properties on the African continent, with deposits in Mali, Zambia and Niger. Due to the unrest in Niger, the Company is focusing primarily on Zambia. That is because the Muntanga project, like the property in Niger, already has a mining license. GoviEx is well positioned with its regulatory preparations to supply the coming uranium cycle. GoviEx is furthest along in Niger, where around 120 million pounds of U3O8 are stored. According to the World Nuclear Association, global demand is expected to grow to over 100,000 tons by 2035. There is even copper in Zambia, a metal that offers the greatest potential for the energy transition.

**The GXU share managed well through the "tax loss season" and gained a good 50% in the third quarter. Our purchases were at CAD 0.12 in August. At a current price of CAD 0.19, the African flagship projects are only valued at CAD 138 million, which will soon attract large corporations. GoviEx could become the "uranium play in 2024".

E.ON and Cameco - The shares run and run

Anyone thinking about energy supply in Germany cannot ignore E.ON. The internationally active Company has been saying goodbye to nuclear power for several years and is now focusing on supply-related infrastructure. Its top priority is a less polluted future and it is vehemently committed to the sustainable development of the energy world. With annual sales of EUR 8.85 billion in 2023, the Group will produce an estimated net profit of EUR 2.95 billion and pay a dividend of over EUR 0.50. With a performance of 38% in the last 12 months, the share is now one of the strongest stocks in the DAX 40 index. **The good chart technology suggests that the E.ON share can continue to climb towards EUR 13 if the resistance at EUR 12.33 can first be overcome.

The shares of Cameco, the world's largest uranium producer, are doing even better on the market. The standard stock from Canada has almost doubled since December 2022. Analytically, the strong upward trend is likely directly linked to the market share of uranium exports. After all, sales are expected to remain high at around CAD 3.2 billion over the next few years, but profits are expected to triple to EUR 1.3 billion by 2025, according to analysts. This is probably due to the strong uranium spot price, which climbed to a 15-year high of USD 81.40 last week. The analysts on the Refinitiv Eikon platform still have a consensus price target of CAD 68, but this will likely be raised soon due to the strong momentum in the uranium market.

The energy supply in Europe is likely to take a completely different shape compared to the rest of the planet. While a good half of the climate summit participants continue to rely on fossil fuels, there are even strong supporters of nuclear power. Germany aims to be clean and prefers to import its expensive electricity from abroad. Siemens Energy and E.ON present a good picture for investors who decide on their investments without ideological bias. The uranium giant Cameco is likely to continue its growth run, with GoviEx and its African projects cutting a fine figure in its slipstream.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.