November 21st, 2023 | 07:15 CET

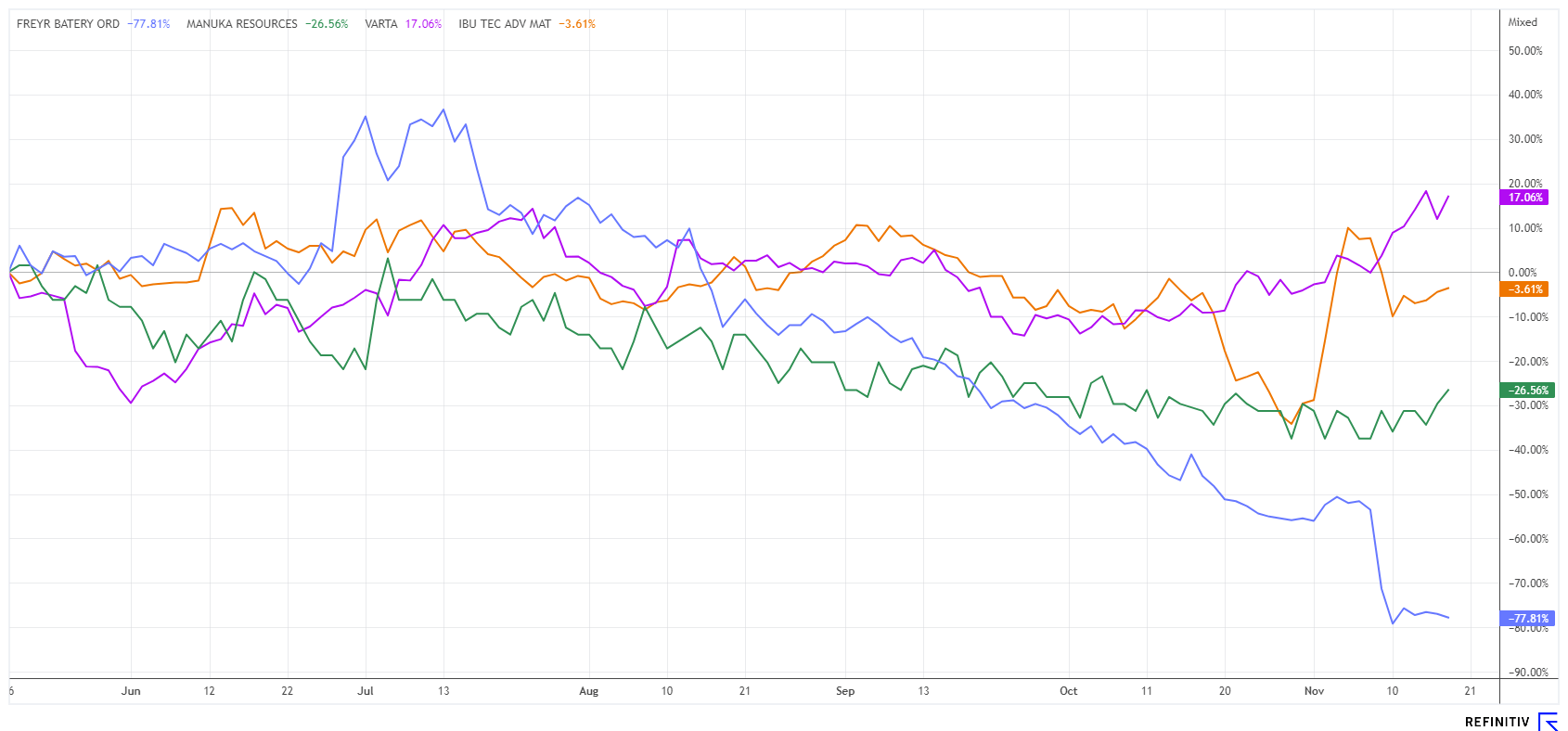

Attention: New battery technology in demand! Freyr Battery, Manuka Resources, Varta and IBU-tec in focus

Despite all ecological reservations, the electrified future is advancing. In an effort to combat climate change, politicians have decided on the complete electrification of the future. The plan to entirely displace fossil fuels will lead many countries into a new economic dimension that will outperform conventional economies for a long time. However, a beautiful, new world must be economically affordable. This requires significant technological advancement and a tremendous amount of money for the transformation; ideological thinking helps little in this regard. Central Europe, in particular, is an importer of raw materials and energy and is a long way from setting world-changing parameters. However, since everything has already been decided in Berlin, millions of batteries and stationary energy storage systems are now needed for the green transformation. The key here is access to the critical metals of the future. These strategic decisions are being evaluated in the stock market. It is worth doing the math.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

Freyr Battery | LU2360697374 , Manuka Resources Limited | AU0000090292 , VARTA AG O.N. | DE000A0TGJ55 , IBU-TEC ADV.MATER. INH.ON | DE000A0XYHT5

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

FREYR Battery - Technology share in downward mode

Founded in 2018, the Luxembourg-based holding company FREYR Battery has Norwegian roots. FREYR offers a clean Nordic solution for the rapidly growing global demand for high-density, environmentally friendly and competitive battery cells for stationary energy storage, electromobility and marine applications. The Company merged with publicly listed Alussa Energy Acquisition Corp. in 2021 and raised an additional USD 850 million via a PIPE transaction. Further capital increases brought in a good USD 400 million, and the start-up is currently building its first gigafactory at its main site in Mo i Rana, Norway.

"As a company, we need to significantly accelerate our efforts to reduce CO₂ emissions over the next 10 years. Electrification and batteries are an important part of the solution and represent one of the market's most exciting and sustainable growth vectors", said CEO and FREYR co-founder Tom Einar Jensen. Sounds good - yet the shares of the future-oriented company have become a money-burning machine in 2023. The start-up's shares fell from a high of around EUR 15 at the beginning of the year to just EUR 1.48. This is another sad example for investors in the Greentech sector. It takes years and billions to set up a functioning battery production facility of the latest design. If FREYR wants to come up with three locations, there is still a long way to go in terms of refinancing.

Although the Q3 figures were in line with expectations, the outlook caused the share price to halve within just 24 hours. For this year, the Company expects sales of USD 3 million, which will be offset by a loss of USD 128 million. Things are not likely to get much better next year, either. Revenues are expected to reach USD 52 million, but the estimated loss could go well over USD 200 million. Investors, therefore, need deep pockets, a lot of patience and a firm belief in the future.

Manuka Resources - You cannot get more forward-looking than this

For those with their eye on the raw material requirements for future-oriented energy technologies, there is no getting around secure jurisdictions. The Pacific region of Australia and New Zealand offers proximity to Asian high-tech companies and, above all, political and legal security as a supplier of critical metals. The West has already firmly included the region in its strategic supply planning, and hundreds of Australian mining projects over the next 5 to 10 years speak to this. Manuka Resources Limited, based in the Cobar Basin, New South Wales, not only owns two highly prospective projects in gold and silver with historic production but is also positioning itself in the critical metals sector with the acquisition of the South Taranaki Bight project completed in 2022. Of interest is the vast deposit of vanadium, which is increasingly coming into focus as a new metal for battery production.

Manuka presented plans at its Annual General Meeting that suggest that the projects will be implemented quickly. The Mt Boppy mine has been operating with positive cash flow since Q2 2023, and operations will reach a depth of 500 meters in the fourth quarter. Other gold deposits exist at the McKinnons, Mt Boppy South, Birthday, Hardwicks and Canbelego properties. However, investors are focusing on the Taranaki VTM project in New Zealand. The mining license for the exploitation of 3.2 billion tons of rock has already been granted. The final approvals from the New Zealand government are still pending, and around USD 50 million has been invested in the project to date.

Looking ahead to 2027, Manuka could become an iron, vanadium and titanium supplier with Taranaki. With this property, Manuka has an asset in its portfolio that could drive up the Company's valuation significantly if the relevant regulatory approvals are announced. The Manuka share is currently traded between AUD 0.04 and 0.05 in Australia and is also listed in Frankfurt. Historically, over USD 100 million has already been invested in the projects, making the current market capitalization of EUR 14 million extremely low. Manuka should, therefore, already be on the M&A list of more prominent investors. It is highly interesting from a speculative point of view.

Varta and IBU-tec - The comeback beings

Among the German battery companies are Varta and IBU-tec. Varta is considered a technology forge for battery solutions, while IBU-tec, as a specialty chemicals company, possesses expertise ranging from wet chemical syntheses to thermal process engineering with processes for drying or calcination. Since 2022, IBU-tec, as a specialist in the production of battery materials, has been researching the potential of sodium solid electrolyte batteries together with partners in the KeNaB-ART project (ceramic-based sodium battery with beta aluminate for applications above room temperature). The aim is to develop a high-performance powder for use as a cathode material.

CEO Jörg Leinenbach shared his visions at the Munich Capital Market Conference. As the only European manufacturer of LFP cathode material, the Company already has contracts with international automotive and commercial vehicle manufacturers for the development of new LFP technologies. The sales forecast therefore sounds very promising. After EUR 62 to 64 million in 2023, it should be around EUR 100 to 130 million by 2025. After its correction, the share offers good potential again, from just under EUR 26 to EUR 22. The share is trading at a price/sales ratio of 1 over the next two years. There are virtually no analyst opinions on IBU-tec, but the Company should be kept on the watchlist.

The Varta share has now completed a 12-month correction phase. The announced cost-cutting measures and the accompanying restructuring are already taking effect. After 9 months, sales have returned to EUR 554 million and adjusted EBITDA is positive at EUR 22.6 million. Based on the current development, the Company confirms its annual forecast for 2023, which suggests sales of around EUR 820 million and adjusted EBITDA of between EUR 40 million and EUR 60 million. The share turned around at EUR 20 and continues its expected recovery to over EUR 23. **However, analysts remain skeptical and do not trust the stock. Goldman Sachs and Warburg are voting "Sell" with 12-month price targets of EUR 16 and EUR 17, respectively. Continue to stock up and raise the stop-loss limit to EUR 20.50!

Greentech stocks were the top losers of 2023. Looking at the oversold charts, the question for 2024 now arises: where to next? After all, interesting projects are already a year ahead and have aroused public interest. This could accelerate the investment curve and increase the valuations of many projects. FREYR Battery will likely continue burning money, while the situation at Varta and IBU-tec appears to be easing. With a view to future battery generations, Australian Manuka Resources is highly interesting.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.