November 27th, 2023 | 07:00 CET

Turnaround Special: 60 billion financial hole - Not with us! TUI, Desert Gold, Bayer and Lufthansa - Get in now!

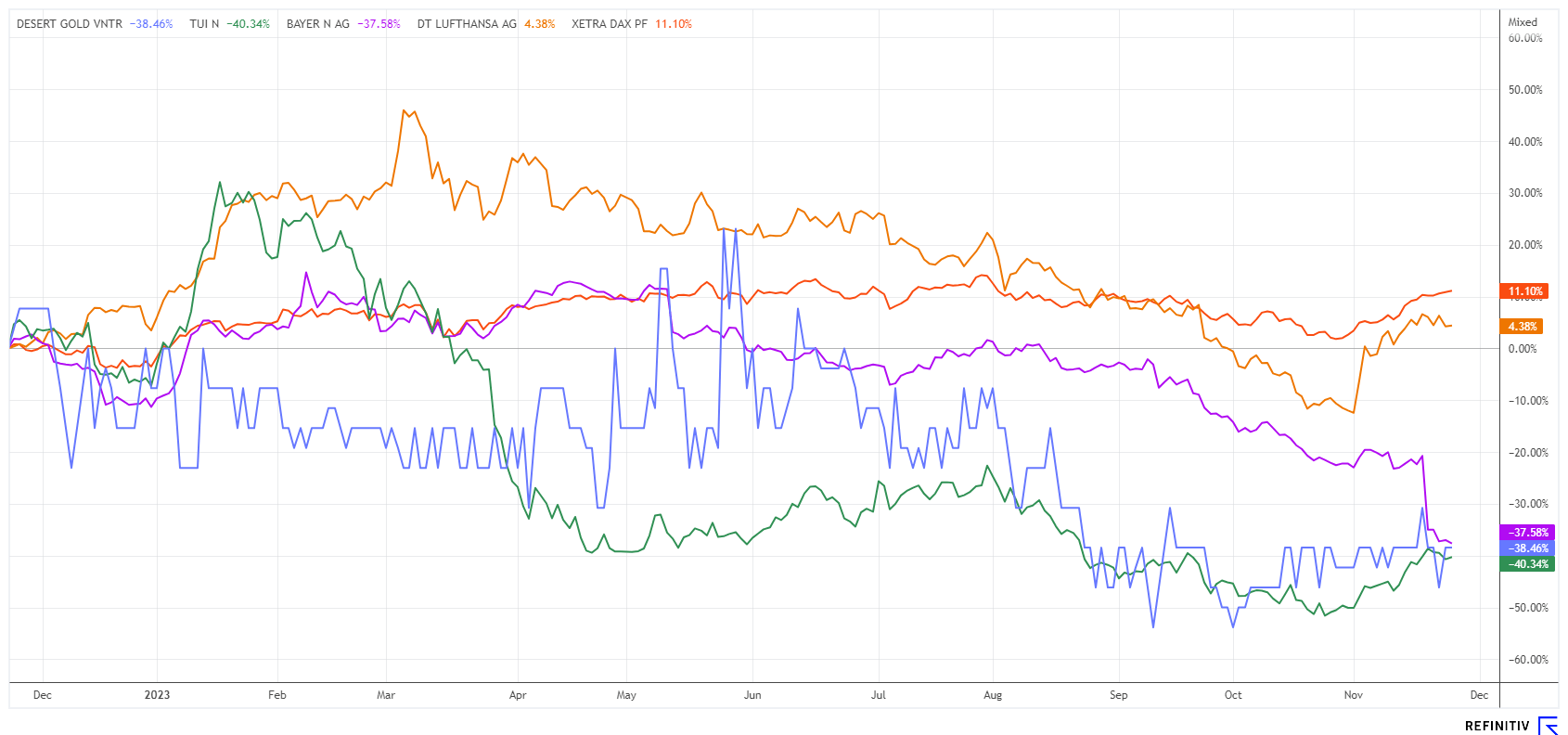

When the stock market is booming almost every day, it is easy to lose sight of the loss-makers of 2023. But it does not have to continue like this! The market regularly rotates through segments, so today's losers will soon be the winners again. This is already evident with TUI and Lufthansa, who are slowly emerging from the Corona shock. Bayer is halting a promising drug and still has to deal with legal disputes. The current situation and the rising gold trend speak in favor of Desert Gold. Let's take a look at the values of tomorrow.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

TUI AG NA O.N. | DE000TUAG505 , DESERT GOLD VENTURES | CA25039N4084 , BAYER AG NA O.N. | DE000BAY0017 , LUFTHANSA AG VNA O.N. | DE0008232125

Table of contents:

"[...] One focus will be on deposits near the surface. These would be good arguments for a quick production decision using the low-cost heap leaching method. [...]" Brodie Sutherland, CEO, Tocvan Ventures

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer - One kick down after another

This was truly terrible news: The Leverkusen-based company unexpectedly terminated a Phase III trial investigating asundexian in patients with atrial fibrillation and stroke risk prematurely. This decision is based on the recommendation of the Independent Data Monitoring Committee (IDMC) as part of the ongoing study monitoring. Asundexian was considered to be the successor to the blockbuster drug Xarelto. According to the IDMC, the efficacy of asundexian is inferior to that of the standard treatment.

Almost simultaneously, the Company was ordered to pay more than USD 1.5 billion to three former users of the weedkiller Roundup. The plaintiffs attributed their cancer diagnoses to the controversial product. The jury in federal court in Jefferson City awarded the victims a total of USD 61.1 million in compensatory damages and USD 500 million each in "punitive damages". Bayer believes the new form of punitive damages violates the US Constitution and is appealing.

The Q3 figures were also disappointing. At EUR 10.3 billion, total Group sales were recently on par with the same period of the previous year on a currency and portfolio-adjusted basis. However, nominally, there was an 8% decline in revenue. The Group posted a bottom-line loss of EUR 4.7 billion, with earnings before interest, taxes, depreciation and amortization (EBITDA) pre-exceptionals falling significantly by 31.3% to EUR 1.69 billion, mainly due to the Crop Science Division. CEO Anderson announced tough measures.

However, the Company is sticking to its forecast for the full year 2023, which was presented in July. Consider adding this German pharmaceutical pearl to your watchlist, as the Leverkusen-based company is currently trading based on 2025 estimates with a P/E ratio of 4 and a dividend yield of 6.8%. Initiating positions around EUR 32.70 would make sense in the medium term.

Desert Gold - A complete revaluation is imminent

Central banks have a record volume of gold purchases on their shopping list in 2023. Currently, 35% of the physical gold market is in the hands of central banks. This is shown by the statistics of the World Gold Council, as about 800 tons of the yellow metal were accumulated by the end of the third quarter. With an estimated annual production of around 3,650 tons, a good third could disappear into the vaults of central banks this year.

The Chinese central bank was by far the largest buyer in the first half of the year, with an increase of 103 tons, followed by Singapore with 73 tons and Poland with 48 tons. While the Polish central bank's buying motive is certainly also a response to the challenging geopolitical situation in Europe, China, in particular, is pursuing an exit strategy from the global currency, the US dollar. Technically, the gold price has recently moved above the USD 2,000 mark several times, and a sustained breakout could be on the cards in the coming weeks. In the current global political situation, greater attention must be paid to the political role of the BRICS countries. That is because the international shift away from the US dollar is tending to intensify as a result of the new conflict in the Middle East. An impending weakening of the dollar is often associated with an appreciation of gold.

Due to the strong inflationary spurts of recent years, some large mining companies are now focusing on relatively low-cost Africa, where there are still large near-surface resources and a mining environment with low operating costs. The Canadian explorer Desert Gold Ventures (DAU) has specialized in the Senegal-Mali-Shear Zone (SMSZ). This mining zone is the size of Germany and is currently operated by companies such as Barrick, B2Gold and Allied Gold. Production in the gold-rich area is likely to reach over 700,000 ounces by 2023. To keep production high, the local majors are already keeping an eye on interesting projects. That is because an acquisition is much cheaper than building new sites requiring approval. There is already reportedly interest in the Desert Gold properties. The last NI 43-101 technical report from 2022 indicates a total gold resource of around 1 million ounces with mineralization grades of 1.08 to 1.28 grams/tonne. The current share price of 0.04 values the project at only EUR 7.5 million and should quickly be history after the current "tax-loss season".**

TUI and Lufthansa - Tourism is back

TUI has recently been able to move upwards by a good 20% from its lows. However, there is still a great deal of skepticism among investors. Although the balance sheet has improved somewhat, the huge pension liabilities are still putting pressure on equity. The Group is now planning to expand its hotel portfolio from the current 424 to 600 hotels. The TUI Hotels & Resorts business segment, which has generated consistently positive results since mid-2022, is the focus of these expansion plans. In 2023, 41 new hotels were added to the growth pipeline, realized through a mix of investment partnerships and management and franchise agreements.

A key element of the growth strategy is the global hotel fund, which offers institutional investors the opportunity to invest in hotel properties operated by TUI Group. Unfortunately, the share has fallen back to EUR 5.65 after a nice rise to over EUR 6.00. 11 analysts rate TUI's future prospects favorably and see an average 12-month price target of EUR 8.75. One should keep an eye on the share again.

An even stronger buying signal comes from Lufthansa. With high demand, greater supply and consistently high ticket prices, the airline increased its margin from 11.8% to 14.3% after 9 months. It carried 38 million passengers from July to September, five million more than the previous year. With sales of EUR 10.3 billion and a net profit of EUR 1.2 billion, it achieved the best result in the Company's history. The share price does not yet reflect this situation. At a price of EUR 7.80, the airline is only 20% above its 52-week low of EUR 6.53 and still below book value. The current 2024 P/E ratio is a low 5.2, and the share is in the lower quartile of the long-term chart. Collect up to EUR 8.00.

In times of excessive debt, gold should regain strength. This is demonstrated by the latest chart, which shows several attempts to leave the USD 2,000 mark behind. Bayer is still struggling with bad news, and TUI and Lufthansa are trying to move forward after the severe losses during the coronavirus pandemic. Both stocks are trading near book value. Majors have already taken a keen interest in the highly undervalued Desert Gold. A complete revaluation is expected here in 2024.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.