November 29th, 2023 | 09:50 CET

DAX on record course, hydrogen sell-off! Plug Power, First Hydrogen, Nel ASA and Daimler Truck on the test bench

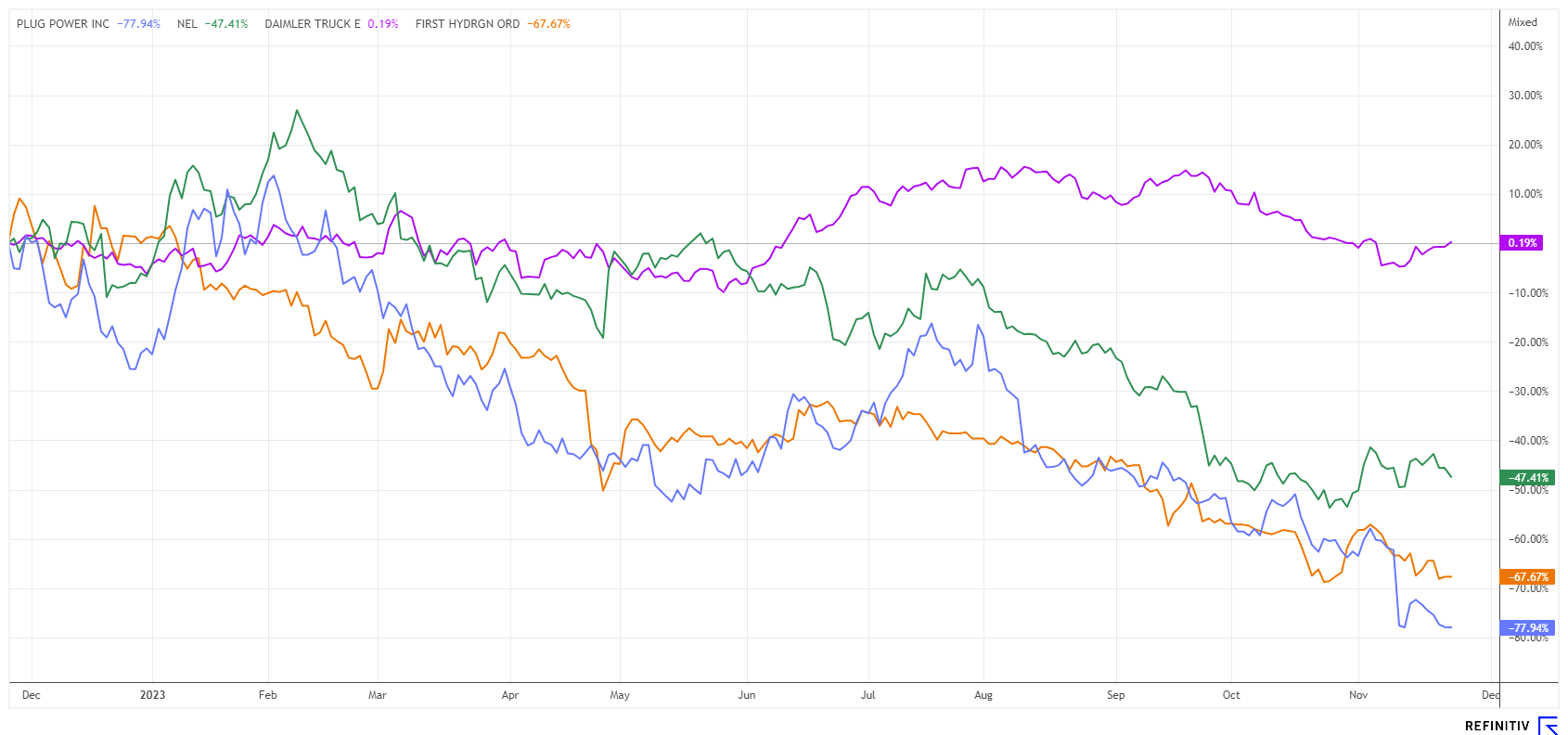

The DAX is soaring because most investors expect interest rates to fall. Based on the assumption of slower growth, investors are again focusing on cyclically sensitive stocks at the turn of the year. According to the expectation curves for ECB and FED interest rates, the first downward adjustments are already expected in Q2. The key factors here are the slight fall in inflation and the central banks' desire to cushion the potential downturn. Despite all the euphoria, the desire to buy is currently bypassing the hydrogen sector. Representatives of the sector are the stock market losers of 2023. Is there still a possibility of a quick rebound in 2024? We do the math.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , First Hydrogen Corp. | CA32057N1042 , NEL ASA NK-_20 | NO0010081235 , Daimler Truck Holding AG | DE000DTR0013

Table of contents:

"[...] dynaCERT's HydraGEN™ device offers a retrofit solution for diesel engines designed to protect the environment while providing economic benefits. [...]" Bernd Krueper, President & Director, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Daimler Truck - The success story in the transportation sector

The first practical, real-life test with hydrogen drives suitable for everyday use has been completed. With a range of over 1,000 km, Daimler Truck completed its maiden voyage with fuel cell technology, thus demonstrating a future model for the decarbonization of road transport in the 40-ton range. This marks the first milestone in the transformation and decarbonization of the transport sector. Daimler is making good progress towards series production but, at the same time, is calling in Berlin for the availability of a green energy infrastructure with competitive costs.

The Swabians are pursuing a consistent dual strategy with hydrogen and battery-powered vehicles. In the long term, Daimler Truck prefers liquid hydrogen, which has a significantly higher energy density, for H2-based drives. In daily road traffic, diesel still dominates Europe's roads today with a share of 98%. Widespread use of the new technology can only occur if H2 products are significantly cheaper and can be refueled easily. However, establishing the necessary infrastructure requires additional billions and will take years.

The Daimler Truck share is inexpensive at a current price of EUR 29.30. The estimates for 2024 indicate a P/E ratio of 7.1 and a dividend yield of 5.8%. Around 22 analysts on the Refinitiv Eikon platform expect an average 12-month price target of EUR 41.90 - representing a significant 43% potential gain after the recent correction.

First Hydrogen - Major hydrogen meeting in the UK

Canadian H2 technology company First Hydrogen Corp. is also performing well in the race, particularly with its light commercial vehicles (FCEV). On October 31, the Company held a track day at the Horiba Mira test site in the UK to test its hydrogen fuel cell-powered vehicles. Participants included some of Europe's largest logistics and transportation companies. The areas of application range from pure parcel delivery to supermarket distribution, with companies in healthcare, leasing, public utilities, and even mining taking a keen interest in these newcomers.

In addition to the visual impressions, the test drives were particularly convincing. These were preceded by technical presentations, inspections and explanations of the vehicle. The main focus of the visitors was on the potential development of zero-emission fleets, which make significant tax savings possible in Europe. This would significantly increase margins for operators in the highly competitive local delivery segment. Fortune Business Insights reports that the global electric vehicle market was worth USD 385 billion in 2022 and is expected to grow to around USD 1.6 billion by 2030. The transportation segment has a share of 27%.

CEO Balraj Mann stated: "We are excited to present our zero-emission FCEVs, which recently achieved a range of more than 630 km on a single refueling. They feature easy drivability and efficient powertrain technology that enables our FCEVs to carry large payloads." First Hydrogen anticipates that the UK government will use environmentally friendly transport vehicles as part of the nationwide implementation of the climate transition.

First Hydrogen's share price has recently been caught in the downward spiral of the entire H2 sector despite the Company having achieved all milestones thus far. We consider the punishment within the sector to be completely exaggerated and recommend building up or adding to existing positions. With a valuation of around EUR 72 million, the share is cheap compared to its peer group.

As part of the 9th International Investment Forum on December 5, 2023, CEO Energy Division Robert Campbell will address interested investors at 3:30 pm CET and provide an update on the Company. Click here to register free of charge.

Plug Power or Nel ASA - The fuse is burning!

The sell-off in blockbuster stocks in the H2 sector continues for now. The Plug Power share now points to losses of around 80% and reached a new 3-year low of EUR 3.04 in November. When investors will stop selling remains a mystery, as Plug recently reported increasing order intake and the profit achievement target was also confirmed for 2026. Just over 6 months ago, the share still had a price-to-sales ratio (P/S) of 7.5. Now, this ratio, based on expected revenues in 2024, has plummeted to 1.2. If CEO Andy Marsh's forecasts hold, the share is no longer too expensive.

Norwegian company Nel ASA is doing somewhat better. At EUR 0.635, the share is still a good 10% above its 3-year low. If we take the revenue estimates for 2024 of NOK 2.3 billion as a benchmark, the share is still valued quite ambitiously with a P/E ratio of 5 compared to the Americans. Inclined investors should, therefore, keep an eye on the EUR 0.45 to EUR 0.50 range. However, it is questionable whether the bet will pay off. Because in the annual cycle, the stock markets should now look optimistically to 2024 and slowly shake off existing doubts.

The hydrogen sector is still under heavy pressure. However, this could change soon, as stocks have already technically entered the oversold zone. This could lead to buybacks, especially at the turn of the year. Speculatively, First Hydrogen and Plug Power are highly interesting, while the standard stock Daimler Truck provides good fundamental arguments for buying.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.