November 20th, 2023 | 07:10 CET

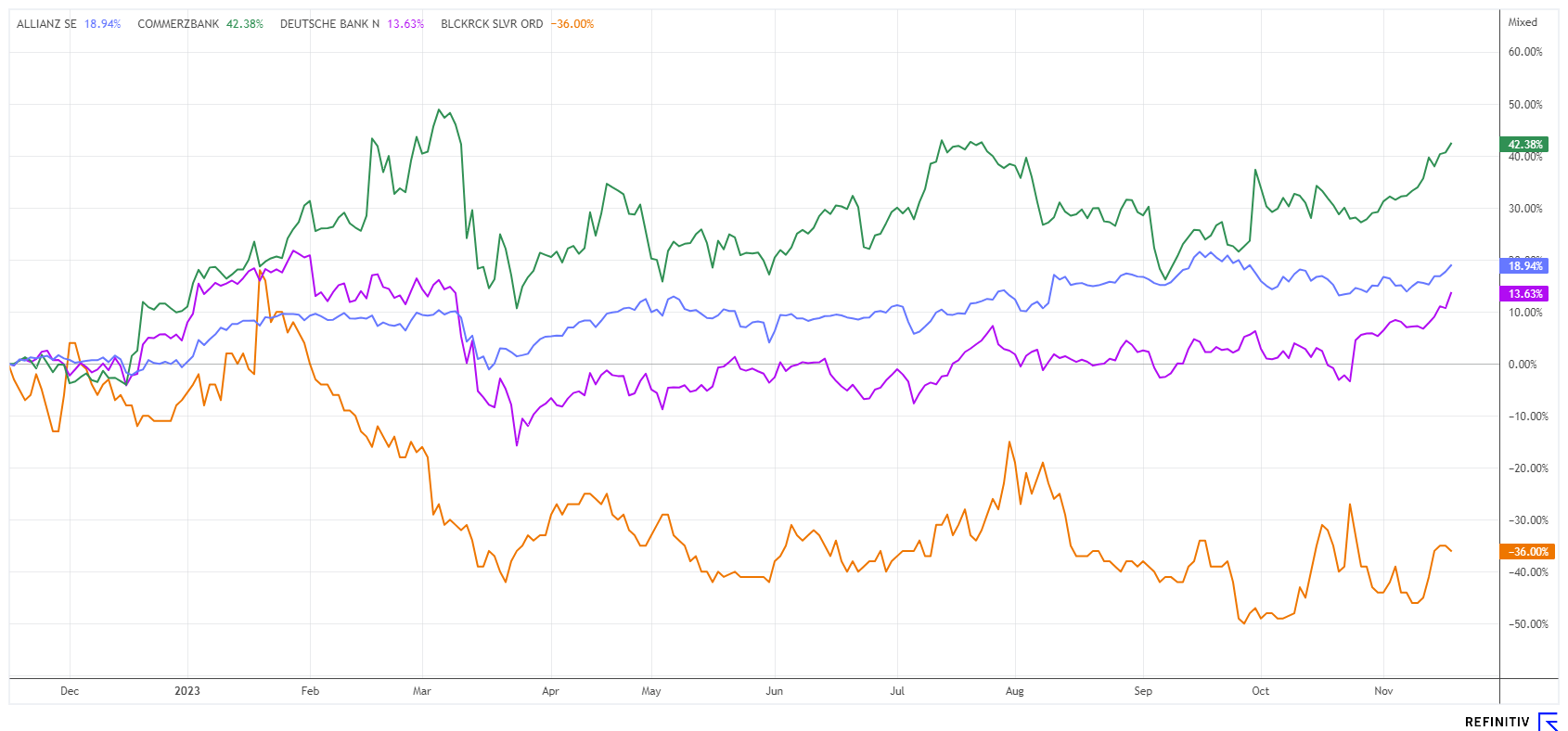

Furious debt mania, a thorough portfolio check is necessary! Allianz, Blackrock Silver, Deutsche Bank and Commerzbank in focus!

From one high to the next - it is not just equities that are booming in Europe, the US and China; it is mainly debt. First Corona, then Ukraine, now Israel - there is no end to the flood of borrowing. Armaments are now being financed on credit, while the accompanying recession is draining the coffers. Real estate is becoming a hot topic: New builds are hardly affordable for families, and old buildings are swallowing up thousands of euros in green-tinted renovation costs. The Federal Constitutional Court has now put a retroactive stop to the creative spending culture in Berlin, and a new budget plan is necessary. Keeping a clear head as an investor in this environment is challenging. We look at the opportunities in the financial sector, but perhaps precious metals will also be the anchor that saves the day.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

ALLIANZ SE NA O.N. | DE0008404005 , DEUTSCHE BANK AG NA O.N. | DE0005140008 , Blackrock Silver | CA09261Q1072 , COMMERZBANK AG | DE000CBK1001

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Allianz - On course despite natural disasters

With a turnover of EUR 134 billion, the Allianz Group is the largest European insurance company, just ahead of AXA. In a global comparison, the Munich-based company is in third place behind the US group United Health and the Chinese Ping An Insurance. In the "Forbes Global 2000" ranking, the insurer and asset manager is in 37th place in 2023 - Hats off!

However, size alone does not protect in all weather conditions, as the effects of climate change and the associated natural disasters are causing high costs for the Allianz Group. In the third quarter, total losses amounted to just under EUR 1.3 billion, a fourfold increase compared to the previous year. In particular, storms, heavy rain and hail in Germany, Slovenia, Austria and Italy dragged down profits. The highest costs were incurred in Germany with almost EUR 600 million and Italy with a good EUR 400 million. Despite these extraordinary burdens, operating profit only fell by a manageable 15% to EUR 3.5 billion, as the investment area was fortunately stable in an environment of sharply rising interest rates.

The management is therefore sticking to its targets for the year. These include a planned operating profit of EUR 13.2 to 15.2 billion and stable revenue. After the first 9 months, the operating result has already reached almost EUR 11 billion, so there is no need to take excessive risks. Analysts are giving the stock a thumbs up, with DZ Bank giving it a "Buy" rating with a 12-month price target of EUR 260. UBS reacted after a detailed assessment of the reporting season of European insurers and raised its price target from EUR 246 to EUR 250, while Chevreux also remains positive with an upgrade from EUR 270 to EUR 290. Berenberg takes the cake among all analysts with a "Buy" rating and a target price of EUR 309. According to experts, there is still plenty of room for the Allianz share price to rise.

Deutsche Bank and Commerzbank - Analysts are now becoming optimistic

The quarterly figures for the German financial industry have also been convincing of late because, as with the insurance companies, results in the investment business are on the rise. And then there is the exploding interest margin! While banks have struggled to generate income in the absolute interest rate depression of the last 5 years, they can now charge real premiums on loans again. The digital transformation is already having a medium-term effect and is significantly reducing administrative costs.**

Nevertheless, the banking business does not guarantee profits in the medium term. Investors have to contend with incalculable and sometimes abstract risks in the current geopolitical environment. The global real estate bubble of 2018 to 2021 still harbours considerable risks, and write-downs in loan portfolios are likely to increase significantly, especially in Germany, given the stuttering economy. A renewed financial crisis due to exploding global debt could appear on the horizon at any time.

Nevertheless, the positive votes for the local banks predominate. The experts on the Refinitiv Eikon platform see an average 12-month price target of EUR 12.85 for Deutsche Bank and EUR 14.60 for Commerzbank. Both institutions are already paying out dividends of over 4% again and are trading at a 2024 P/E ratio of around 5. German financial stocks have rarely been valued more favorably.

Blackrock Silver - More than 100 million ounces of silver identified

Of course, investors still have reservations about financial stocks. The experience of the last financial crises is too deep-rooted. However, both fears and risks can be comfortably mitigated in portfolios. The magic word is diversification. In other words, if you do not put all your eggs in one basket and spread your investments, you significantly reduce your average risk. Precious metal investments are also suitable for conservative investors. They serve to preserve value in the long term and have so far been able to cushion losses in purchasing power well. The more speculative option of gold and silver investments is offered through so-called explorer stocks, which search for hidden ore deposits through test drilling. This process is sometimes capital-intensive, depends heavily on geological expertise and requires a little luck.

The Canadian explorer Blackrock Silver seems to have done its homework. The Company has now filed its most recently updated Mineral Resource Estimate (MRE) totaling 570,000 ounces of gold and 47.74 million ounces (Moz) of silver or 100.04 Moz silver equivalent (AgEq) in the form of a NI 43-101 report with the Securities and Exchange Commission. The report contains an increase of 135% compared to the previous year's estimate for the Tonopah West property. Mineralization above 200 grams of silver per tonne (AgEq) is essential for industrial production. If this so-called cut-off grade is used as a benchmark, this results in a total resource of 6 million tons for extraction in lower-cost open pit mining. The updated MRE is based on a structural reinterpretation of the Victor and DPB areas and the inclusion of new drilling information from the Northwest Step Out target.

In addition to its gold and silver project portfolio, the Company has a lithium discovery with the Tonopah North project, which has been optioned to a large lithium exploration group. With its projects, Blackrock can captivate both precious metal enthusiasts and those interested in strategic metals. Now that is appealing! The Blackrock Silver share is currently in high demand again with increased turnover and, with a current price of CAD 0.33, has impressively left its lows of CAD 0.25 behind it. Interested commodity investors should take advantage of the traditional Canadian tax optimization period for a speculative entry. The "bonanza discoveries" shown are unlikely to become much cheaper.

The margin in the interest rate business is back! While financial securities have already been able to expand their margins in the lending business significantly, there is now also a better environment for new investments in the fixed-income segment, especially for institutional investors. Those who have managed to reduce their bond holdings during the interest rate depression are now on the winning side. Blackrock Silver is convincing with its latest resource report and should outperform the silver market in the medium term.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.