April 7th, 2025 | 07:00 CEST

Trump tariff crash – Now is the time to pick the cherries! Steyr, Mutares, naoo AG, Deutsche Bank, and Commerzbank in focus

Donald J. Trump is making the world tremble. After he read out his list of punitive tariffs of 10 to 34% in the middle of the week, the international stock markets went into free fall. The DAX, DOW, and NASDAQ corrected by over 10% and closed at a daily low on Friday. The reason: China had imposed immediate countermeasures of 34%. A nightmare for consumers worldwide. Because on top of the inflation that has already manifested itself since Corona, there is now a further surge in prices that cannot be absorbed by anything. However, it will be costly for the Americans - they import over 70% of their goods abroad. The winners could be China and Europe if a free trade agreement is now agreed and the US is simply left out in the cold. Where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

STEYR MOTORS AG | AT0000A3FW25 , NAOO AG | CH1323306329 , DEUTSCHE BANK AG NA O.N. | DE0005140008 , COMMERZBANK AG | DE000CBK1001 , BAYER AG NA O.N. | DE000BAY0017

Table of contents:

"[...] We have built one of the largest land packages of any non-producer in the belt at over 440 sq.km and have made more than 25 gold discoveries on the property to date with 5 of these discoveries totaling about 1.1 million ounces of gold resources. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Steyr and Mutares – Hand in hand, downward

As late as March, Mutares and Steyr were the highlights of the Defense-Rally 2.0. After Steyr announced that it wanted to make strong inroads into the defense sector with acquisitions, there was no stopping the title. The share price shot up to EUR 380 in just one week. But then, free shares of Mutares AG hit the market. The major investor wanted to increase the free float and even obtained an easing of the agreed lock-up from their custodian bank. The Upper Austrian specialist engine manufacturer Steyr is currently exploring the market for external acquisitions. Following the approval of special loans in Germany, management expects rising defense budgets in other major European countries and high demand from international allies. Steyr Motors, headquartered in Steyr, produces high-performance engines, such as main propulsion units for military special vehicles, boats, and auxiliary units for battle tanks and locomotives. Products for military purposes now account for the majority of revenue. In 2024, revenues increased by 9.2% to EUR 41.7 million compared to 2023. At its peak, the market capitalization soared to a crazy EUR 2.2 billion. What nonsense! As a result, both Steyr and Mutares plummeted - by 90% and 40% respectively. Investors are now back down to earth. Due to a good portfolio positioning, Mutares is interesting in the medium term up to around EUR 28.50. Steyr is also growing steadily and should recover slightly in price.

naoo AG – The next steps are clearly defined

The Swiss company naoo AG recently presented itself to a large audience at the Munich Capital Market Conference (MKK) hosted by GBC. CEO Thomas Wolfensberger took the opportunity to explain the Company's business model in more detail. The innovative tech company operates a new social media platform and is thus competing with tech giants such as Meta Platforms, Microsoft, Tencent, and ByteDance. By exploiting the known weaknesses of large platforms, international programmers have launched a new type of social media platform that rewards the activity of its currently over 90,000 users. The decisive factors are valuable content and a new, detailed and personalized type of profile.

naoo incentivizes its users with a unique points system, and the "rewards" earned through activity can be exchanged for goods, services, or cash, depending on availability. At the end of March, the Company successfully acquired Kingfluencers AG at a very low transaction price in shares. The largest influencer agency in Switzerland was thus 87% integrated. The acquisition directly impacts the income statement, as Kingfluencers AG already generated revenues of around CHF 7 million in 2024 and continues to grow strongly. From an external perspective, this is a milestone for naoo, as it can now advertise advanced platform services on a large scale. The resulting synergies are expected to bring the group into profitability as early as 2025. The upselling to premium customers of Kingfluencers should enable a gradual expansion into the DACH region this year, potentially multiplying revenue potential. CEO Wolfensberger makes it clear that M&A will continue to be an important strategic pillar in the future. His mid-term goal is to reach more than 19 million active users.

Last week, the naoo share was trading in the range of EUR 13 to 17. The Swiss company is already planning an upgrade to the primary market in Düsseldorf. This would also make trading venues like Frankfurt and Tradegate accessible, significantly increasing daily liquidity. The story is just starting to take off, buy in now!

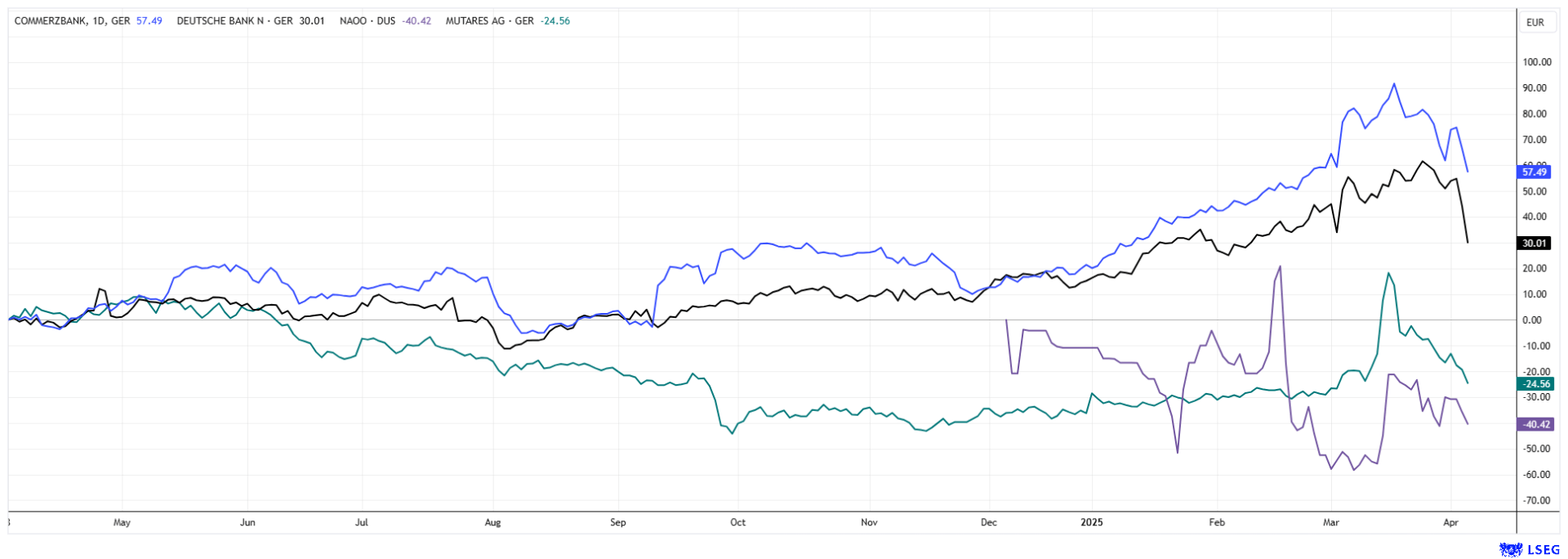

Deutsche Bank and Commerzbank – Double-digit crash

The shares of Deutsche Bank and Commerzbank were hit like a bolt of lightning. The reason: the imposition of tariffs could trigger an economic downturn and further fuel the already rising insolvency rates.

As a result, many investors once again pulled back, particularly in the economically sensitive banking sector. The European banking index plunged by 9% at its peak, and in the DAX, Deutsche Bank and Commerzbank stocks fell between 15 and 20% over the entire week.

Another point that weighs heavily on banks is that the real estate and infrastructure sector had just moved off the ground and was hoping for lower refinancing rates. However, central bankers now fear that inflation will continue to rise. This makes interest rate cuts in the coming months rather unlikely. After Donald Trump's sweeping tariff cut, the US Federal Reserve, represented by Jerome Powell, does not see good times dawning for the US. Investors should avoid the banking sector for the time being, especially since the segment has performed extremely well in recent months. Therefore, take profits calmly because if Trump makes good on his announcements, the correction is likely to continue!

The Trump crash was quite something. The DAX 40 index lost a full 2,500 points, and volatility jumped from 22 to 35% at times. It was a sell-off period on the NASDAQ, with popular stocks such as Nvidia losing 45% of their value in six weeks. The next few days are likely to be very exciting. As a second-tier stock, naoo AG was spared a correction because the Swiss company's growth model is convincing and will accelerate further with the integration of Kingfluencers AG.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.