January 19th, 2024 | 07:45 CET

Total sell-off in hydrogen! Nel ASA, Manuka Resources, Plug Power - Find the 300% pearl now

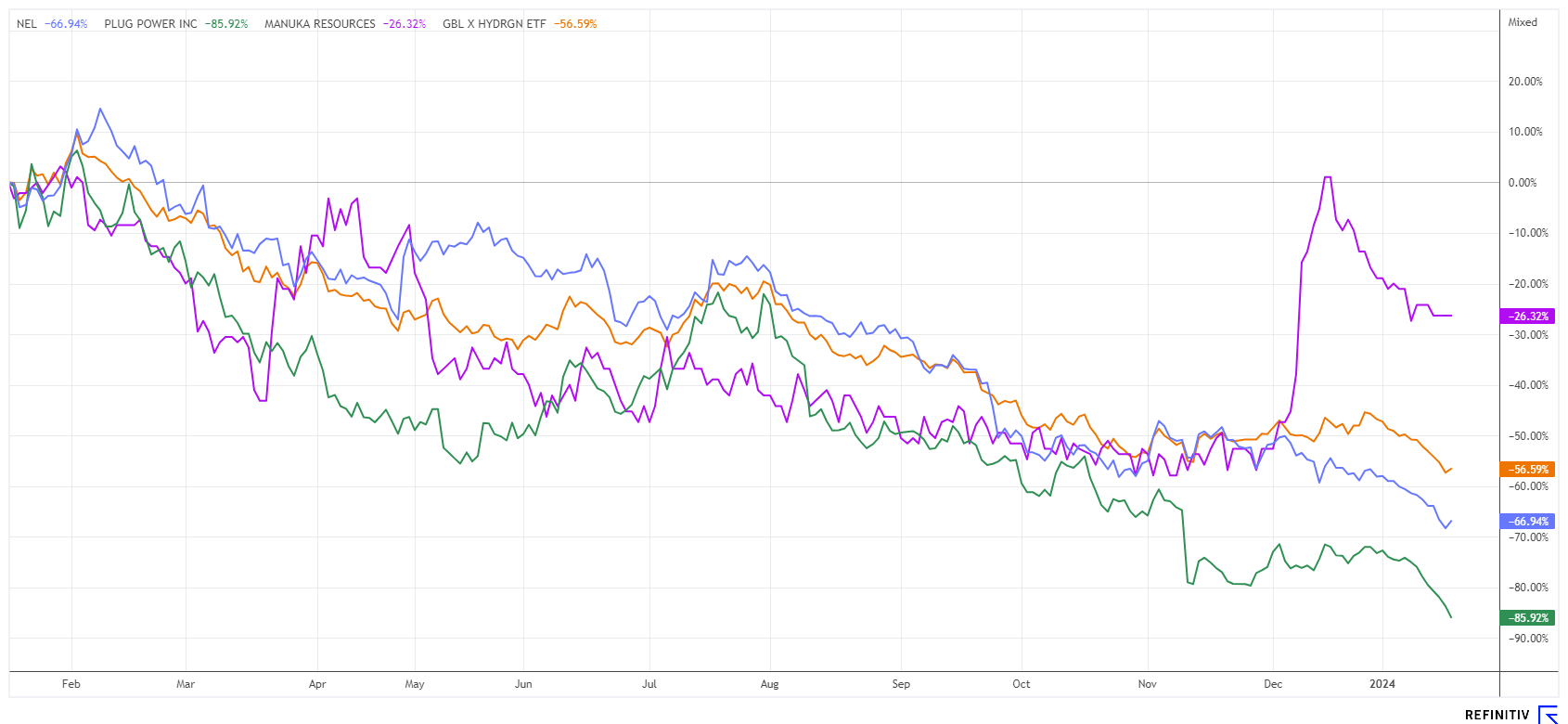

The topic of hydrogen has been put on the back burner for the time being. Although the COP28 conference in Dubai showed a broad consensus on reducing greenhouse gases and avoiding fossil fuels, the OPEC countries, in particular, insist on their traditional right to continue tapping into the abundant oil wells. The observers conclude that everything remains the same; each does what it does best. The transformative idea of saving the world is collectively present, but if it can be solved with nuclear energy, then nuclear reactors will be built. This also highlights how the green-dominated traffic light policy on environmental issues is perceived internationally: Teachings from Germany are only smiled at. The topic of hydrogen was politically launched in Europe and has been traded on the stock exchange as a "world energy savior" since 2019; now, investors are sitting on a 90% loss. Is there still hope?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , Manuka Resources Limited | AU0000090292 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We will trigger indirect creation of 1,665 new jobs nationwide, while directly employing 300 staff - 270 operational and 30 administrative. [...]" Dennis Karp, Executive Chairman, Manuka Resources Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power - In free fall

Now it has happened. Long predicted by us, the revaluation of the Plug Power share, which has been overpriced for three years, is now taking place. There is probably no other stock on the Western stock exchanges that has built up so much fantasy and then been crushed again in such a short time. CEO Andy Marsh is largely responsible for the debacle, as he had created a dream valuation of over USD 20 billion with his sunny outlook and then had to row back sharply in 2022 and 2023.

The share price has lost another 50% in 2024 alone, and since the high in 2020, it has fallen by a cumulative 95%. Many investors are wondering if this is enough now. Perhaps not quite, because yesterday, a rumor emerged that Plug Power wants to fill its ailing cash position with a "Market Placement" of USD 1 billion. In this process, the shares will be placed by the mandated investment banks without dilution protection, no matter the cost. It could, therefore, go significantly lower once the capital increase has been completed. However, most of the stop-loss lines have probably already been reached. **The share is, therefore, an ultra-hot one!

Many traders are likely already having fun, but for us, the share remains a watch position until the capital raising process is completed. If the estimates from Refinitiv Eikon are reasonably accurate, the price/sales ratio in 2024 would be around 1. And if hydrogen does become a viable alternative technology at some point, the share could turn very strongly positive again. Investing a toe in the water at 95% down would only be wrong at present if Plug Power actually has to pull the plug.

Manuka Resources - The sails are set

Far away from hydrogen technology or alternative energies, the focus in faraway Australia and New Zealand is on the exploitation of gold and silver. The greatest leverage lies in a vanadium-iron-titanium deposit acquired in 2022 near the coast of New Zealand. Vanadium is highly prized as a future battery and energy storage metal. According to current estimates, several million tons of ore-bearing rock are on the seabed, which could be mined in as little as 2-3 years. The medium-term plans are currently receiving a boost from the change of government in New Zealand. The new prime minister is from the conservative party and is friendly towards mining and industry. Christopher Luxon aims to develop the country's growth forward and, if necessary, change environmental laws in order to be able to rejoin the game in certain areas.** Against the background of strategic sources of supply, the Western industrialized countries, in particular, are pleased about the growing raw material exporter from the Far East.

Manuka is currently producing gold again from the historic Mt Boppy mine and can thus provide itself with operating cash flow. The surpluses can be used to finance further exploration until the green light comes from Wellington. Investors can still bet favorably on this event, as the share recently consolidated from AUD 0.10 to AUD 0.07 and is currently only valued at around AUD 39 million. If the vanadium becomes a fixed component of the plans, the share price will rise rapidly, as conservatively calculated present value models indicate values in excess of AUD 500 million.

Nel ASA - Analysts turn their thumbs down

Among regular reporters, we have been very cautious about hydrogen stocks in recent months. The euphoria has been over since mid-2022, so the key question now is how long the sell-off will last and how deep it will go. From an analytical point of view, the valuation ratios have improved considerably, but the ratios are not yet in the range of justifiable buy levels.

But there are hopeful signs: Analysts who have held on to their positive votes for months are now turning to the sell side in droves as if they could not have guessed the sector trend months ago. Last week, analyst Lacie Midgley of Panmure Gordon & Co. lowered her price target to NOK 12.70 as part of an existing "Buy" recommendation. Expert Martin Huseby Karlsen from DNB Markets is narrowing the negative list downwards, voting "Sell" with a price target of NOK 4.00. On Refinitiv Eikon, most analysts have not yet awakened, with the average target price still at a shaky NOK 9.30.

Yesterday, the share fell to a low of NOK 5.08 but was at least able to rise again to NOK 5.42 by close. This marks the lowest level since the Corona crash in 2020. A ray of hope: With a market capitalization of EUR 800 million, the P/S ratio has at least reached around 4 - it had been over 25 at its high. Unfortunately, no significant new orders have been reported for several months. Fundamentally, the share is, therefore, still not really cheap, but with an assumed growth rate of 50% p.a., these are no longer astronomical. As of the end of September 2023, the Company had approximately EUR 335 million in cash, which is sufficient for at most two quarters. At present, only investors who can tolerate high volatility should act, while medium-term investors should wait for stabilization.

GreenTech stocks are starting the new year 2024 with a share price debacle. It is not yet possible to say whether the current discounts of up to 50% are the last word. Courageous investors are betting on upcoming government decisions, which could mean a quick turnaround for both Manuka Resources and hydrogen stocks. We are staying close to the ball here.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.