April 26th, 2024 | 07:00 CEST

HelloFresh, First Hydrogen, Amazon: Growth in the Courier, Express, and Parcel industry

The courier, express, and parcel industry (CEP) is a true growth engine. CEP companies currently employ almost 260,000 people, more than 50% more than ten years ago. Consumers worldwide are increasingly opting for direct deliveries to their homes, whether for food or retail orders. The food company HelloFresh is benefiting from this. The figures from the first quarter of 2024 impress analysts and investors alike. Increasing delivery traffic in cities needs new solutions. This is where First Hydrogen comes into play. The Company focuses on hydrogen-powered commercial vehicles for urban deliveries. The advantage of First Hydrogen's vans is their unbeatable range of over 600 km with just a single refueling. Amazon is also scaling up its food delivery services. In the US, they are enticing Prime subscribers to take advantage of delivery benefits for groceries. This is not at all popular in Europe and violates many consumer laws. We provide the details.

time to read: 6 minutes

|

Author:

Juliane Zielonka

ISIN:

HELLOFRESH SE INH O.N. | DE000A161408 , First Hydrogen Corp. | CA32057N1042 , AMAZON.COM INC. DL-_01 | US0231351067

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

HelloFresh continues to grow: Ready meals and strategic expansion strengthen position

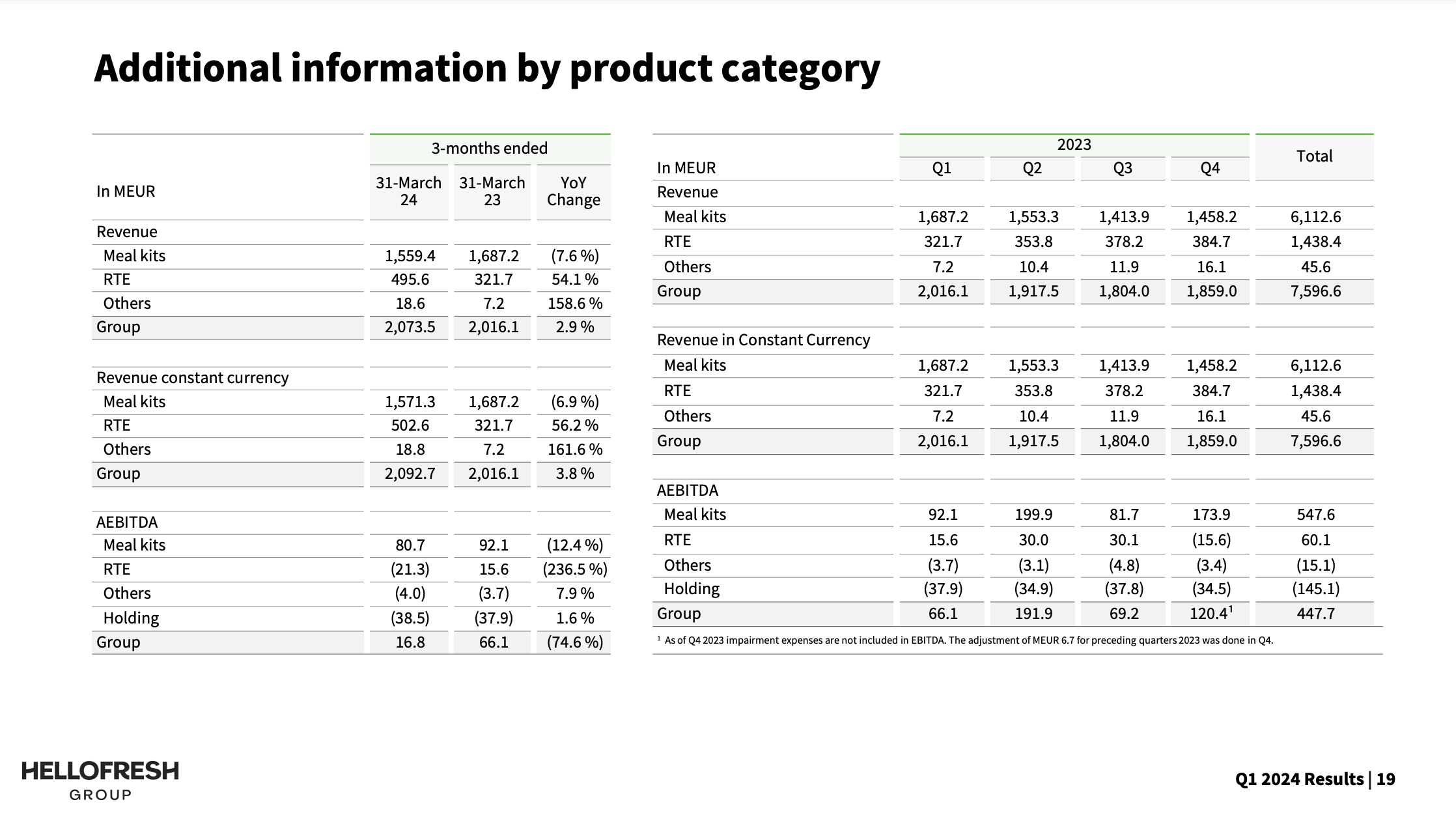

The German food delivery company HelloFresh published its latest quarterly results yesterday. Despite the decline in orders for meal boxes and increased spending on the up-and-coming ready meals business, the results are giving investors cause for optimism. Adjusted core earnings before interest, taxes, depreciation and amortization (AEBITDA) in the first quarter of 2024 amounted to EUR 17 million, corresponding to a margin of 0.8%, according to the Company presentation. Turnover increased by 3.8% to EUR 2.09 billion.

CEO Dominik Richter emphasizes that the Company aims to retain customers in the current financial year. The Group recorded a continued expansion of the Average Order Value (AOV) by 6.5% in EUR. In North America, the increase amounted to 7.1%, while internationally, it was 5.1%. The increase in AOV was mainly driven by the rapid expansion of ready-to-eat (RTE) meals in North America and a combination of higher-quality premium meals and selective price increases in the international segment.

"After tripling our sales of meal kits from 2019 to 2022, there has been a temporary decline recently. Nevertheless, our strategic goal of diversifying sales is paying off very well. Our ready meals product category is growing quickly, and our own brand, "Factor", is one of the fastest-growing consumer brands in North America, which more than compensates for the decline in meal box sales. Ready meal revenues now account for a quarter of the Company's total sales, and we expect this to continue to grow going forward. As part of this strategy, we have recently announced launches in additional European markets, following on from the success of previous launches in the US, Australia and Canada," continues Richter.

Management reiterates its guidance for 2024 to close with sales growth of 2% to 8% on a constant currency basis and AEBITDA of EUR 350 million to EUR 400 million. Analysts were positively surprised by the results and described the quarter as a good start for HelloFresh's future. The shares rose by 1.1% on the same day.

First Hydrogen revolutionizes inner-city logistics with hydrogen-powered commercial vehicles

The trend for more and more households to have ready meals or meal boxes delivered to their homes rather than spending time in the supermarket is prompting innovative companies such as First Hydrogen. Food parcels have to get from A to B, and so the logistics sector is growing along with home deliveries, especially in urban areas.

Deficits in urban planning mean that the logistical requirements of urban delivery traffic are not sufficiently taken into account. According to a Fraunhofer study commissioned by the German Federal Ministry of Transport, electric commercial vehicles make a significant contribution to improving air quality, as local exhaust emissions are avoided. However, only around 50-60% of transportation can be carried out electrically, as the range of the vehicles is limited. The almost silent operation of the vehicles is particularly advantageous for night deliveries. However, the impact on traffic is marginal, as electric vehicles take up the same traffic space as vehicles with combustion engines.

Range is a high priority for First Hydrogen Corp. The Company, which has sites in Vancouver, Montreal and London, is developing hydrogen-powered light commercial vehicles (FCEVs) in partnership with AVL Powertrain and Ballard Power Systems Inc. These are currently being tested in fleet operations in the UK. First Hydrogen is also planning to build a green hydrogen production facility and vehicle assembly plant in Shawinigan, Quebec.

In a recent trial with the Wales & West Utilities gas distribution network, the Company's FCEV covered more than 2,000 km in four weeks, driving up to 189 km per day in some of South Wales' coldest conditions. The FCEV demonstrated its ability to tackle demanding tasks without compromising on performance or range. This is the significant advantage over conventional electric vehicles. First Hydrogen vehicles are easy to handle, quick to refuel and achieve an impressive range of 630 km on a single refueling. For companies like HelloFresh or Amazon, First Hydrogen's technology can become the means of choice for inner-city delivery traffic.

Amazon's aggressive advance in food deliveries meets regulatory hurdles in Italy

HelloFresh is facing direct competition in North America from top dog Amazon. The new grocery delivery subscription offers Prime members unlimited grocery deliveries in more than 3,500 cities and towns in the US for USD 9.99 per month. Prime members can save themselves a trip to the supermarket and receive fresh goods at home from Whole Foods Market, Amazon Fresh and the various local grocery and specialty retailers on Amazon.com from an order value of USD 35.

However, not everyone is happy with the business practices of Amazon. In Europe, the Italian competition authority fined two Amazon subsidiaries a total of EUR 10 million this week for alleged unfair business practices. Amazon had "significantly restricted consumers' freedom of choice" by automatically presetting a "subscribe and save" option on its website for a wide range of products, says the supervisory authority. This includes grocery deliveries from Amazon Fresh.

In this way, consumers are more likely to opt for regular deliveries rather than one-off purchases. If Amazon has understood one thing, it is the buying psychology of its users.

"The preset regular purchase behavior encourages consumers to buy a product regularly - even without an actual need - and thus limits their freedom of choice," the authority explained in a statement. However, Amazon has challenged the decision and announced that it will appeal against it.

Customers benefit every day from the Subscribe and Save program by saving money and time on regular deliveries of items they routinely use, which the Company justified in an email statement. However, it appears that some consumers are being misled by the one-click savings subscription measures.

HelloFresh reports a solid quarter despite a decline in cooking box orders and increased spending on ready meals. Investors react positively to the results. Adjusted EBITDA was EUR 17 million in the first quarter of 2024, and revenue increased by 3.8% to EUR 2.09 billion. The expansion into the ready meals business is paying off, accounting for around a quarter of total sales. More and more households are opting for delivery services. For First Hydrogen, this is a further incentive to launch a particularly long-range model on the market in the form of a hydrogen-powered commercial vehicle. The first tests in Great Britain are convincing. A range of 630 km with just a single refueling, and in different weather conditions, makes the FCEV stand out from conventional electric vehicles in terms of performance. The future of CEP industry logistics could reach the next level with First Hydrogen. Even though regulatory hurdles in Italy have resulted in a EUR 10 million fine for Amazon for alleged unfair business practices in grocery deliveries, the Company's aggressive push in North America is evident with its new grocery delivery subscription for Prime members. What gets delivered needs a transportation company. And transportation companies need reliable vans that can withstand stop-and-go traffic, especially in urban areas. The trend towards food deliveries is unstoppable. This makes solid technologies such as the hydrogen drive of First Hydrogen vehicles all the more important in this context.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.