January 5th, 2026 | 07:30 CET

Double-digit start to 2026 for Plug Power, Nel ASA, CHAR Technologies, and thyssenkrupp nucera

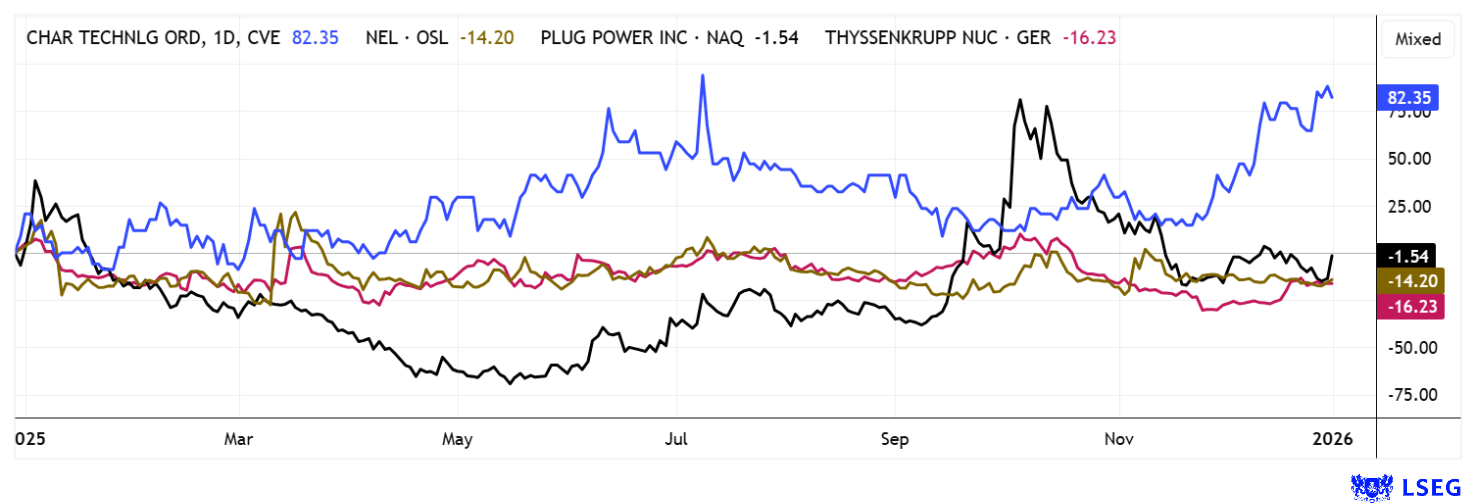

Things are continuing as they ended in 2025: high volatility, challenging circumstances, and political upheaval. Now the guns are speaking again, because there is no peace in Ukraine after all, putting defense stocks back at the top of the shopping list. However, after years of decline, investors are now venturing back into the alternative energy sector. Since the hydrogen boom in 2021, the industry's protagonists have lost up to 90% of their share price value. So why not venture back into an area where money has not flowed for a long time? Biomass specialist CHAR Technologies is a newcomer on the scene. The rally started here in 2025 and is likely to continue. thyssenkrupp nucera is also worth a look. After being spun off from the Duisburg-based group, the lights appear to be green!

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , NEL ASA NK-_20 | NO0010081235 , CHAR Technologies Ltd. | CA15957L1040 , THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

thyssenkrupp nucera – An opportunity for patient energy transition investors

Germany has a seat at the table when it comes to hydrogen. thyssenkrupp nucera is regarded worldwide as a specialist in large-scale industrial electrolysis plants and is therefore a key technology supplier for green hydrogen. The Company brings decades of chemical and plant engineering expertise to an emerging billion-dollar segment. Although revenue and order intake declined in the past fiscal year, the Company still managed to turn a profit on an EBIT basis. Net profit was around EUR 5 million, which is considered a respectable performance despite challenging conditions.

Management emphasizes that cost structures have improved and investments are now clearly focused on future technologies. CFO Stefan Hahn, who has been in office for just three quarters, points to his stable financial management and conservative risk management. For the current year, nucera is talking about a transition year with lower revenue and earnings close to zero. This is due to delayed investment decisions by major customers in the steel and refinery industries. As a result, the order base will remain thinner than hoped for in the short term.

However, the outlook is conciliatory. In the medium to long term, the Company is considered one of the beneficiaries of government support programs and European hydrogen initiatives. The majority of analysts on the LSEG platform rate the stock positively and see significant recovery potential to around EUR 10.77, a good 20% upside potential above the last price. Investment bank RBC can even imagine EUR 15. Exciting!

CHAR Technologies – Clean energy from biomass on the way

Although it has been relatively inconspicuous so far, Canadian cleantech company CHAR Technologies is demonstrating that innovative approaches can pay off. The approach: biomass is converted into renewable energy sources and biocarbon using a novel high-temperature pyrolysis technology. It is in the right place at the right time, as demand for low-carbon energy solutions is growing worldwide, not least due to the energy requirements of cloud and AI data centers. CHAR is excellently positioned as a provider of industrially scalable alternatives to coal and natural gas.

The launch of the first commercial plant in Thorold is significant, as it marks the Company's transition from the pilot phase to a recurring revenue model. Forestry residues are used to produce biochar as a fuel for the steel industry and renewable gases that can be marketed via existing networks. Through partnerships along the entire value chain, CHAR reduces key risks such as raw material availability, infrastructure, and off-take agreements. ArcelorMittal and the Canadian Dofasco subsidiary are among its industrial partners and investors. At the same time, CHAR works with forestry-related organizations that secure sustainably available biomass. A modular expansion concept enables decentralized, easily integrable plants in regions close to raw materials.

This reduces transport costs and strengthens regional value creation.

Biocarbon is also available in pellet form and can elegantly replace fossil carbon in energy-intensive industries. Particularly relevant to ESG is the fact that waste streams are reduced by up to 90%, which saves costs and reduces emissions. CHAR thus combines waste recycling, energy production, and climate protection in an industrially applicable process. A demonstration project for the destruction of PFAS pollutants has been completed in Baltimore, and the data is now being evaluated. This application could develop into a second strong pillar, as the disposal of such substances is an unresolved environmental problem worldwide. Another major project is Lake Nipigon, which is scheduled to enter the construction phase in 2026, for which biomass is already being collected at the site. Close cooperation with infrastructure specialist BMI Group remains particularly important. BMI Group has not only invested in Thorold, but is now also advancing the clean energy project at the former Espanola paper site together with CHAR.

The Canadian government is supporting such projects as part of its decarbonization strategy for 2050. CEO Andrew White emphasizes that CHAR is now finally growing into the role of a manufacturing company. The launch of the first plant is expected to generate predictable revenue and cash flows in the medium term. The modular technology remains scalable, which facilitates expansion into regions close to raw materials. The stock has recently started trading in Frankfurt, with a still manageable market capitalization of CAD 41 million. If the planned rollout is successful, CHAR Technologies could become an attractive takeover target for larger energy or industrial groups. A good setup for a year of strong growth with an M&A kicker for risk-conscious investors.

IIF moderator talking to CEO Andrew White about the current strategy in 2026.

https://youtu.be/NM6RiILMS-k?si=w8rN1wpgE_-6stTG

Nel ASA versus Plug Power – Who currently holds the better cards?

Hopefully, the 90% disaster has been digested. Plug Power and Nel ASA both symbolize the hopes and the great disillusionment in the global hydrogen sector. While Plug Power was once celebrated as the market leader for PEM electrolysers in the US, the stock is suffering from political headwinds and multiple capital increases after a nearly 90% correction. The new US administration is once again focusing more on fossil fuels with its "Drill Baby Drill" policy, which is significantly slowing down investment in green hydrogen. But all is not lost yet. Plug Power is currently struggling with the USD 2 mark, and on Friday, the New Yorkers once again attempted a breakout towards USD 2.30. Opinions remain divided: only 7 out of 25 analysts on the LSEG platform are positive and calculate an average price target of USD 2.76. At least!

Nel ASA from Norway is also operating in a challenging environment, but is benefiting more from the EU's subsidy policy in Brussels, with more long-term infrastructure programs. Compared to Plug, Nel's capital requirements appear more controlled, with cash reserves still amounting to NOK 1.76 billion as of September 30. After a seven-year development program, the board has given the green light for the expansion of production in Herøya, Norway. The focus is on the new "pressurized alkaline" technology, whose prototypes have proven to be market-leading in terms of efficiency, according to the Company. CEO Håkon Volldal's primary goal with this measure is cost leadership. A modular container design that no longer requires costly building envelopes is intended to further reduce hydrogen production costs to such an extent that projects become profitable even without massive subsidies.

Both companies are facing delayed investments from industry, but Nel's strategic positioning as a technology partner for large projects remains relatively stable. Plug Power, on the other hand, also has to contend with a loss of confidence in the capital market, which is hampering its recovery. For investors, this means that Nel ASA is currently the more defensive hydrogen stock, while Plug Power offers a more speculative comeback scenario.

The stock market is off to a volatile start in the new year. Alternative energy producers such as CHAR Technologies and thyssenkrupp nucera are back in the spotlight. Nel ASA and Plug Power have also posted double-digit gains at the start of the year, potentially signaling a long-awaited turnaround. Investors are still sitting on losses of up to 90% since the hydrogen boom of 2021.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.