RIO TINTO PLC LS-_10

Commented by Nico Popp on February 25th, 2026 | 07:05 CET

The 'Apple moment' of strategic metals! How Almonty Industries is securing Western sovereignty and emulating Glencore and Rio Tinto

The mining industry is going through a phase that could be described as the 'Apple moment' of strategic metals. Similar to how Apple ushered in a new technological era two decades ago by combining proprietary hardware and closed software architecture, Almonty Industries now occupies a key position for NATO's industrial and military sovereignty. While the public focus has long been on digitalization, critical raw materials are now moving to the center of the geopolitical power architecture. In this context, tungsten has become as indispensable to the modern defense and semiconductor industries as the operating system is to smartphones.

ReadCommented by Armin Schulz on February 5th, 2026 | 08:20 CET

The Next Commodity Price Surge: How Rio Tinto, Globex Mining, and Glencore Are Positioned for the Supercycle

Commodity markets are undergoing a historic turning point. While precious metals are shining as safe havens, the energy transition continues to drive lithium demand. But the real pressure point lies in critical raw materials such as antimony or tungsten, whose supply is extremely strained due to geopolitical conflicts. This fragmentation of the supercycle is creating unique opportunities for strategically positioned companies. Three key players are ready to benefit: Rio Tinto, Globex Mining, and Glencore.

ReadCommented by Stefan Feulner on January 27th, 2026 | 07:05 CET

Alamos Gold, DRC Gold, Rio Tinto – Gold, silver, and metals poised for another surge

Gold and silver are racing from one high to the next, sending a clear signal to the markets. What was long considered a short-term flight to safety is increasingly becoming a structural trend. Exploding government debt, persistent inflation risks, and a fragile geopolitical situation are increasing the need for investors worldwide to hedge their bets. In this environment, industrial metals and strategic commodities are coming into focus alongside traditional precious metals. Supply bottlenecks, geopolitical dependencies, and rising demand due to the energy transition and digitalization suggest that 2026 could be another profitable year not only for gold and silver but for the entire commodities sector.

ReadCommented by Nico Popp on January 23rd, 2026 | 07:05 CET

The battle for resources is being fought in the data room: How Aspermont Uses AI to Boost the Returns of Rio Tinto, Alamos Gold & Co.

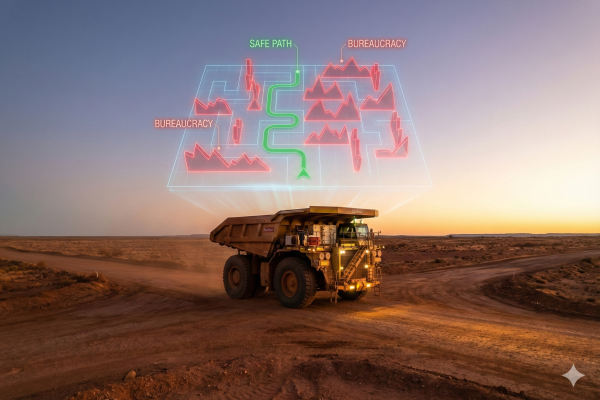

It is the greatest paradox of the modern economy: while demand for copper, lithium, and rare earths is exploding due to trade wars and the insatiable appetite of the AI industry, building a new mine has never been more difficult. Large mining corporations are increasingly failing not because of geology, but because of bureaucracy, environmental regulations, and, in remote regions of the world, geopolitical pitfalls. In this new era, where a legally binding permit is often more valuable than spectacular drilling results, validated information is becoming the most critical resource in the commodities sector. Analyst firms such as McKinsey and the International Energy Agency (IEA) warn of a massive structural supply deficit, as the development of new mines in the West often requires more than a decade of legal wrangling. It is precisely in this area of tension that the Australian media and tech company Aspermont is positioning itself as the decisive problem solver. With a treasure trove of data spanning centuries of industrial history and a new alliance with industry giant Rio Tinto, the Company is transforming itself from a media company into a kind of "Google of mining" – offering investors an opportunity based on intelligence rather than luck.

ReadCommented by Armin Schulz on January 22nd, 2026 | 07:15 CET

Geopolitics as an opportunity: How to profit now with BYD, Pasinex Resources, and Rio Tinto

The rules of the global economy are being rewritten. It is no longer market forces alone that determine the course of events, but geopolitical strategies and the battle for critical resources. In this new geo-economy, the ability to assert oneself in a politically driven cycle determines success or failure. Three companies are exemplary on this front line and reveal the concrete opportunities and risks: electric mobility pioneer BYD, zinc producer Pasinex Resources, and mining giant Rio Tinto.

ReadCommented by André Will-Laudien on January 13th, 2026 | 07:40 CET

Silver +200% - Gold doubles! Time for acquisitions? Barrick, B2Gold, Desert Gold, Glencore, and Rio Tinto in focus!

The geopolitical situation brings new uncertainties every day. Most recently, markets reacted strongly to news around the removal of Venezuelan President Maduro, and now massive unrest in Iran has been added to the mix! Commodity prices are galloping against the backdrop of fragile supply chains and the formation of Eastern and Western power blocs with conflicting interests. While the US is formulating its expansionist agenda towards Greenland and Canada, China is responding with further export restrictions. This is exacerbating the situation even further and driving up the prices of silver to USD 85 and gold to over USD 4,600. Both established mines and promising projects are coming into focus, and takeover rumors are circulating once again. How are investors supposed to keep track of all this? We are happy to help.

ReadCommented by Stefan Feulner on August 26th, 2025 | 07:15 CEST

Freeport-McMoRan, Desert Gold Ventures, Rio Tinto – Investing in the future

What happens after Jackson Hole? Following Federal Reserve Chairman Jerome Powell's speech, which boosted the markets with the prospect of possible interest rate cuts later this year, Nvidia's earnings report on Wednesday will take center stage this week. Any disappointment could cause recent gains to vanish into thin air. Meanwhile, the price of gold remains stable and, after a brief sideways movement, could take off to new heights.

ReadCommented by Armin Schulz on August 6th, 2025 | 07:05 CEST

Interest rate poker and commodity chess: Deutsche Bank, Globex Mining, and Rio Tinto in focus

Geopolitical tensions are the new market standard, not the exception. Trade conflicts are escalating globally, tariffs are becoming a chess game over commodities and influence, and military shifts are destabilizing supply chains. At the same time, central banks are hesitating to cut interest rates despite lower inflation, keeping the pressure high. In this turbulent environment, an understanding of macroeconomic forces determines profit or loss. Those who read the signs will find opportunities. Which of these three players—Deutsche Bank, Globex Mining, and Rio Tinto—offers potential?

ReadCommented by Nico Popp on May 29th, 2025 | 07:30 CEST

"Best-in-Class" – How sustainability generates returns: Rio Tinto, Barrick Gold, and Power Metallic Mines

Large commodity companies such as Rio Tinto and Barrick Gold regularly had to listen to criticism at their annual general meetings: Activist shareholders and investors with a long-term focus called for greater sustainability. And not without reason: In 2020, mining was responsible for 4 to 7% of greenhouse gas emissions. A lot has happened since then. Regulatory requirements and investment principles, such as the "Best-in-Class" approach, reward innovators in the field of sustainability. We explain how ESG can boost returns in mining.

ReadCommented by Armin Schulz on April 30th, 2025 | 07:05 CEST

The new gold rush: Barrick Gold, Globex Mining, and Rio Tinto are forging the supply chains of tomorrow

Global markets are trembling: trade wars are tearing supply chains apart, raw materials are becoming weapons, and gold is shining as the savior in times of crisis. With a record high of over USD 3,500 per ounce, the precious metal is taking centre stage - driven by inflation, geopolitical shock waves, and greedy central banks. Yet, in the background, a new power dynamic is taking shape: companies that are not only developing deposits but also forging the future of resource security. This is where it will be decided who pulls the strings in the chaos of trade blockades – and who becomes a pawn. Three players are suddenly in the spotlight: Barrick Gold, Globex Mining, and Rio Tinto.

Read