January 19th, 2023 | 11:16 CET

The market for electricity storage to pick up speed by 2030: RWE, Nordex, Altech Advanced Materials

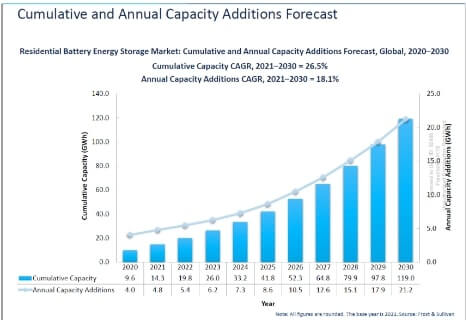

Being in on the action from the start is the dream of many investors. Imagine: Having bought shares of Amazon or Alphabet decades ago - you could also get rich with BYD over the decades. But there are new opportunities. By 2030, stationary energy storage will be the next big thing. Electricity grids must be stable, and energy from renewable sources must be stored for this purpose. Recently, RWE brought new giant batteries online and is planning much more. For some companies, enormous opportunities are emerging.

time to read: 3 minutes

|

Author:

Nico Popp

ISIN:

RWE AG INH O.N. | DE0007037129 , NORDEX SE O.N. | DE000A0D6554 , Altech Advanced Materials AG | DE000A31C3Y4

Table of contents:

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

RWE: Electricity storage in the Gigawatt range by 2030

An electricity storage facility with 117 MW of power and 128 MW of capacity recently went online at two sites on the border between North Rhine-Westphalia and Lower Saxony. Now the giant battery, which relies on lithium-ion technology, is to be coupled with hydroelectric power plants operated by RWE along the Moselle River to make the grid more stable. It could increase grid stability by 15%, according to RWE. Such solutions also make sense around wind farms. Last Sunday, grid operators in Baden-Württemberg called on private citizens to postpone non-essential activities, such as drying laundry, by a few hours. The reason: In the north, the wind was blowing strongly, and wind turbines were throwing the German power grid out of balance. Otherwise, electricity would have had to be purchased in the south to keep the grid in balance.

Nordex: Where to go with wind power?

In the future, wind turbine manufacturers such as Nordex will also have to consider storage solutions. Until now, so-called pumped storage power plants, which work with water, have been used primarily in Germany. The fact that wind power will gain in importance is shown by positive order data from Nordex in the first weeks of the new year. The Company, responsible for around one-third of the turbines connected to the grid in Germany in 2022, is still well positioned in its home market. Nevertheless, order intake declined in 2022. Although Nordex itself argues with a base effect in the wake of a significant order for 1 GW in 2021, Nordex's brilliant rally is likely to come to an end for the time being. However, if things progress operationally, the stock can pick up speed again.

Altech Advanced Materials: High praise from the scientific community

The high-growth industrial company Altech Advanced Materials offers even greater leverage than Nordex. The Company is a specialist in all aspects of coating anodes with aluminum oxide and is already working with major industrial companies in this area. According to the Company, the technology has what it takes to make lithium-ion batteries more powerful. That expertise is likely what led to Altech getting the chance to enter into a joint venture with the Fraunhofer Institute last year around solid-state sodium-alumina batteries. According to Fraunhofer Institute Director Prof. Dr Alexander Michaelis, the technology has numerous advantages: First, the basic materials for the batteries are cheap and available. Second, the battery is non-flammable and, therefore, safe. In addition, the technology is suitable for numerous applications, as modules with an output of 10 kW can be flexibly connected to form storage systems.

"The market for energy storage is growing very strongly and is gaining in importance, especially in light of current events. The background to this is the high demand for renewable energies, but these can only be generated at certain times," explains Uwe Ahrens, director of Altech Advanced Materials. According to Prof. Michaelis, the fact that the joint venture with the renowned Fraunhofer Institute came about at all is due to the great expertise at Altech. The scientist, a specialist in inorganic non-metallic materials, is also impressed by the hands-on approach and "agile work" of the Company, which is currently building a pilot plant with a capacity of 100 MWh in Saxony. The fact that the shares of Altech Advanced Materials are well positioned in two growth areas at once with e-mobility and battery storage can be seen in the share price - there is no sign of a crisis at Altech. As the research portal researchanalyst.com writes, investors should keep an eye out for the launch of the announced pilot plant as the next target.

In order to profit from the growth in the field of centralized electricity storage, investors need to look very closely. While companies like RWE are investing heavily in this area, they still have significant "legacy assets" in the form of fossil business in their corporate portfolios. Company results have also been volatile again and again recently. Things look better at Nordex, but the market's concern about low margins is still not off the table here. Altech Advanced Materials does not yet have to deal with such operational problems - here, it is a matter of convincing customers. If this succeeds, the share should have further potential. Investors should closely follow any news about the production plant in Schwarze Pumpe.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.