January 7th, 2026 | 08:00 CET

Stock market frenzy: Silver, high-tech, AI, or Bitcoin? 100% opportunities with Strategy, Finexity, Metaplanet, and TeamViewer

It is not exactly easy to keep a clear head as an investor at the moment. Political shortages of strategic metals, ever-new geopolitical flashpoints, and an enormous burden on Western households are weighing on the minds of stock investors. The fact that "long only" is becoming a profitable thesis in this environment is now a permanent novelty. Historically, after substantial upturns of more than 20%, there have always been periods of consolidation. However, these are no longer visible, and every day of waiting costs returns. Whether silver, copper, AI, or high-tech stocks, the hard-won fixed-income returns in the 2% range have already been wiped out since the beginning of the year. But there is one exception: if we consider the crypto market as an alternative to currencies and stocks, it has been on a noticeable hiatus since fall 2025. But in recent days, there has been a spring awakening here as well. We are looking for current opportunities!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

STRATEGY INC | US5949724083 , FINEXITY AG | DE000A40ET88 , METAPLANET INC | JP3481200008 , TEAMVIEWER AG INH O.N. | DE000A2YN900

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Finexity – Exciting key role in tokenized investments

Hamburg-based Finexity AG focuses on special markets outside the well-known main arenas. Nevertheless, the Company is dynamically developing into a leading platform for tokenized private market investments and is consistently expanding its presence in the alternative capital market. With over 250 listed securities and more than 84,000 registered investors, the Company is one of the pioneers of digital real asset investments. An important growth step is the international market entry, including in Dubai, where, for the first time, a regulated German security offers private investors access to exclusive luxury real estate in the United Arab Emirates. At the same time, fund structures for institutional investors are being created, which are to be introduced from 2026. CEO Paul Hülsmann sees this as a decisive impetus for the global expansion of the issuance and trading business. In addition, Finexity is working on establishing a regulated real-time trading infrastructure and is strengthening its position through the acquisition of Effecta GmbH.

Another milestone has now been reached within the savings bank ecosystem: Sachwert Invest GmbH, a subsidiary of Sparkasse Bremen, is acquiring the MiFID II-compliant investment brokerage platform developed by Finexity. This software will remain connected to the existing OTC trading venue. Finexity will thus remain integrated as an infrastructure and development partner in the long term and will take over support and further development. The aim is to achieve even deeper technical integration into the IT and process landscape of the savings banks and a broad rollout within the association. Customers can already manage private market investments directly in the Sparkasse's internet branch. This creates seamless interaction with traditional securities. Finexity's technology covers all steps from onboarding to settlement digitally. At the same time, the OTC trading venue infrastructure remains independent and forms the basis for the planned application for a DLT-TSS license. Finexity will also receive a mid-six-figure euro amount from the transaction. With a market capitalization of just under EUR 5 million, this is a good return deal for the Hamburg-based company. Finexity has long been regarded by market participants as a leading infrastructure partner for digital real asset investments. In an environment of volatile markets, this alternative access to assets is becoming increasingly important for investors. Very exciting!

Strategy and Metaplanet – A buy again after bottoming out?

Turning to the crypto side, committed sector investors are once again focusing on the highly volatile stocks Strategy and Metaplanet. Strategy has long been regarded as a pioneer among Bitcoin treasury companies, but the phase in which the stock traded at a significant premium to its net asset value appears to be over. Critics such as Peter Schiff question the sustainability of the financing model, as Strategy relies heavily on high-yield preferred shares, creating a leveraged structure that could prove vulnerable during periods of market stress. Nevertheless, co-founder Michael Saylor remains unwavering in his Bitcoin-centric strategy and dismisses concerns about liquidity or refinancing risks. Despite substantial price losses in 2025, the Company announced the purchase of an additional 1,283 Bitcoin worth USD 116 million at the beginning of 2026. This increased total holdings to more than 673,000 BTC, which were historically purchased at an average price above USD 75,000. At the same time, Strategy boosted its cash reserves to over USD 2.2 billion to meet upcoming financial obligations. The billion-dollar Q4 loss - does not appear to have dampened the mood among decision-makers. New year, new luck!

Metaplanet pursues a similar Bitcoin-centric model, but also relies on yield strategies with options to generate ongoing revenue. The Japanese company increased its BTC holdings by 4,279 to 35,202 by the end of 2025, while reporting a sharp rise in revenues from its Bitcoin derivatives business. This cash flow component on an option writer basis is intended to cushion volatility and make Metaplanet less dependent on market cycles. Nevertheless, the share price temporarily slipped below the calculated value of its Bitcoin holdings. In recent days, however, sentiment has improved markedly, with the stock rebounding from around EUR 2.2 to EUR 2.8. Metaplanet remains tightly correlated with Bitcoin, with the added caveat that the stock does not trade on weekends. Highly speculative, but intriguing for risk-tolerant investors.

TeamViewer – Quite a beating

The shares of the Göppingen-based software company TeamViewer did not have a good end to the year. First, it had to revise its growth forecasts twice in a row, which ultimately even affected the expected figures for 2026. Then the Norwegian sovereign wealth fund sold a large number of shares, and finally, the hedge funds Qube Research and Two Sigma also increased their short positions to 1.72% and 1.30% of outstanding shares, respectively. This reinforces negative medium-term sentiment for the Company, which has been in a downward cycle for more than two years. Despite all the doom and gloom, TeamViewer was able to increase its operating margin in Q3 and is pushing ahead with its transformation into a digital workplace and AI provider. Overall, management is seeing growing customer acceptance of AI-based solutions, which signals long-term growth potential. The problem remains the 1E acquisition, which will still require a considerable amount of integration effort. After several revisions, analysts now estimate revenues of EUR 764 million and EUR 791 million for 2025 and 2026, respectively, which is still above the EUR 671 million from 2024. Expectations were clearly much higher, but with an expected P/E ratio of 5.8 and prices around EUR 5.65, a large part of the downside risk now appears priced in. 8 of 18 analysts on the LSEG platform expect a 12-month average target of EUR 10.86. That is almost double!

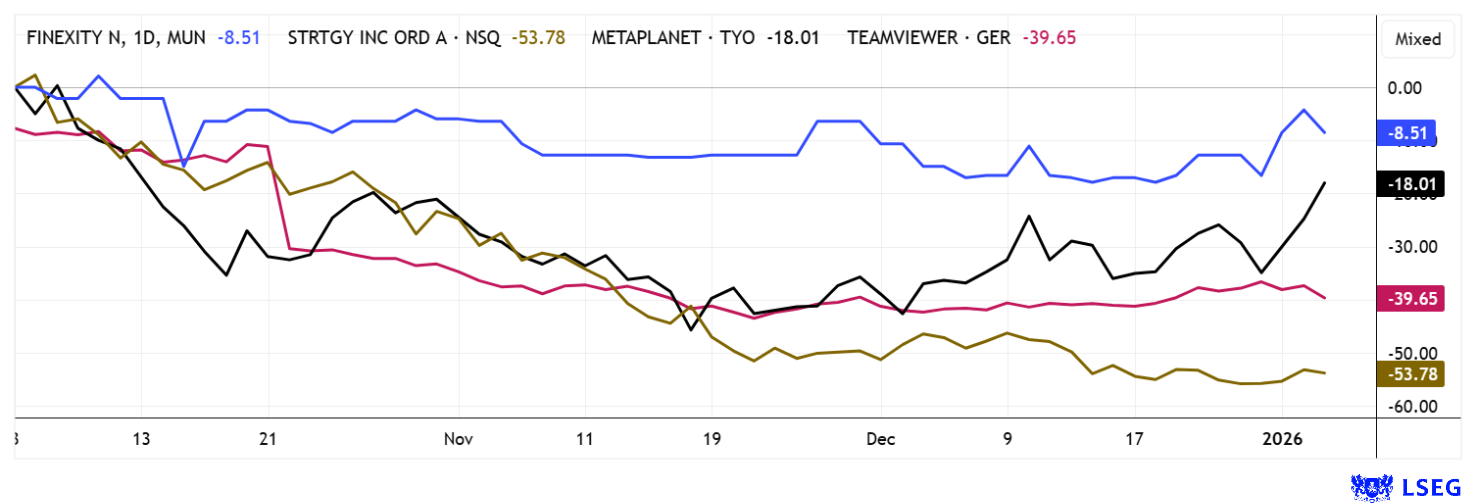

Strategy and Metaplanet are representative of all crypto stocks in the investor spotlight. Of course, these stocks have also taken a beating in the consolidation environment of the last three months. TeamViewer has had several disappointing outlooks and earnings revisions and has been punished accordingly. Finexity AG's comparatively low market capitalization could still be an obstacle, especially for institutional investors. However, there are now enough investors interested in tokenized assets. Growth potential, therefore, appears structurally supported.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.