Technology

Commented by Armin Schulz on January 28th, 2026 | 12:00 CET

In the eye of the commodities storm: How Aspermont, with its 190-year history, is becoming the data center of the mining industry

Gold is breaking records, copper is driving the energy transition, and critical raw materials such as rare earths are becoming a geopolitical currency. While investors are considering direct commodity investments, a company that has transformed itself into an indispensable architect of this new era is operating in the background: Aspermont. Once a traditional specialist publisher, the Company has quietly evolved into a data-driven control center for global mining. In a market characterized by resource nationalism and supply chain stress, reliable information is the most valuable commodity. Aspermont delivers just that, not as a cyclical player, but as a provider of critical infrastructure for decision-making. This transformation is complete, financially sound, and meets with a perfect environment.

ReadCommented by Armin Schulz on January 28th, 2026 | 07:05 CET

The next major battery story is not being written in China – it is being led by the TSMC clone, NEO Battery Materials

The tech revolution has a blind spot. While billions are being poured into the development of AI, advanced robotics, and autonomous systems, one fundamental problem often remains unresolved: energy storage. The performance of these high-tech devices is determined by their weakest component - and increasingly that component is the battery. China dominates the mass market, but a critical gap is emerging: namely, demand for flexible, high-performance, non-Chinese battery solutions. This is precisely the vacuum NEO Battery Materials is stepping into with an approach that mirrors the semiconductor industry.

ReadCommented by Stefan Feulner on January 26th, 2026 | 07:25 CET

NEO Battery Materials positions itself for the battery revolution

Artificial intelligence, autonomous systems, drones, and robotics are causing global energy demand to skyrocket. But this is precisely where the weak point of digitalization becomes apparent. Conventional lithium-ion batteries are reaching their physical limits in terms of charging time, energy density, and cost. NEO Battery plans to break through this bottleneck. With innovative silicon anode technology, the Company promises significantly higher capacities, ultra-fast charging, and massive cost advantages. Initial partnerships with major customers, concrete supply agreements, and the expansion of production capacities are fueling imagination and increasingly bringing the battery specialist into the focus of investors.

ReadCommented by Fabian Lorenz on January 26th, 2026 | 01:35 CET

BASF under PRESSURE! BUY RECOMMENDATIONS for BioNTech and WashTec shares!

Market leadership, increased efficiency, dividends, and share buybacks - all good reasons to buy WashTec shares. Analysts at M.M. Warburg share this assessment. Their earnings estimates for the coming years may even be too conservative. Unfortunately, nothing about BASF is conservative; rather, it is disappointing. The chemical company has once again failed to meet analysts' forecasts. Its strong free cash flow is based on lower investments, which is also not a good sign. How are analysts reacting? BioNTech is facing a groundbreaking year. Analysts see potential for share price growth. News from the bulging product pipeline is likely to have a significant impact on the share price.

ReadCommented by Nico Popp on January 23rd, 2026 | 07:15 CET

Revolution in agricultural chemistry: How MustGrow Biologics is benefiting from the plight of Bayer and Corteva

Global agriculture is at a historic turning point, driven less by a belief in technological progress than by regulatory necessity. For decades, global food security has been based on synthetic pesticides and fertilizers, but that era is rapidly coming to an end. Authorities from Brussels to California are tightening the screws and banning established active ingredients one after the other because their ecological collateral damage is no longer tolerated. For the agricultural giants, this poses an existential threat: their full warehouses are in danger of becoming worthless if they do not find effective biological alternatives quickly enough. In the current extremely hectic environment in industry, which is characterized by billion-dollar acquisitions and strategic alliances, new power structures are emerging. While Corteva Agriscience is aggressively buying market share with its chequebook and Bayer is pushing ahead with its portfolio restructuring, the Canadian company MustGrow Biologics has carved out a position that is considered the "sweet spot" in the industry. The Company is the technology partner whose active ingredients have already been validated and licensed by the market leaders.

ReadCommented by Nico Popp on January 23rd, 2026 | 07:05 CET

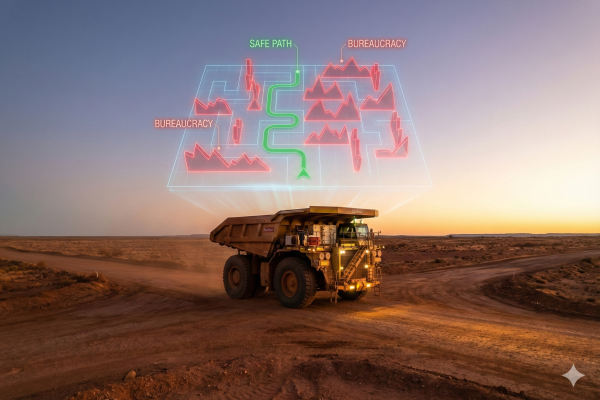

The battle for resources is being fought in the data room: How Aspermont Uses AI to Boost the Returns of Rio Tinto, Alamos Gold & Co.

It is the greatest paradox of the modern economy: while demand for copper, lithium, and rare earths is exploding due to trade wars and the insatiable appetite of the AI industry, building a new mine has never been more difficult. Large mining corporations are increasingly failing not because of geology, but because of bureaucracy, environmental regulations, and, in remote regions of the world, geopolitical pitfalls. In this new era, where a legally binding permit is often more valuable than spectacular drilling results, validated information is becoming the most critical resource in the commodities sector. Analyst firms such as McKinsey and the International Energy Agency (IEA) warn of a massive structural supply deficit, as the development of new mines in the West often requires more than a decade of legal wrangling. It is precisely in this area of tension that the Australian media and tech company Aspermont is positioning itself as the decisive problem solver. With a treasure trove of data spanning centuries of industrial history and a new alliance with industry giant Rio Tinto, the Company is transforming itself from a media company into a kind of "Google of mining" – offering investors an opportunity based on intelligence rather than luck.

ReadCommented by Carsten Mainitz on January 22nd, 2026 | 06:50 CET

Batteries as a crucial key technology: VW, NEO Battery Materials, and Hensoldt in a technological alliance

The global race for battery technologies and technological sovereignty is becoming significantly more intense. NEO Battery Materials is coming into focus with its market-ready, high-performance silicon anodes and the imminent ramp-up of mass production. The Canadian company is positioning itself as a Western alternative to Chinese-dominated supply chains, combining technological advantages with a compelling cost profile. At the same time, Volkswagen is under pressure to accelerate its e-mobility strategy in an increasingly fragmented and competitive global market. Hensoldt, meanwhile, is benefiting from the rapid expansion of drones, sensors, and security-related future technologies. Together, these three companies illustrate how closely capital markets, geopolitics, and industrial innovation are now intertwined.

ReadCommented by Armin Schulz on January 21st, 2026 | 08:25 CET

Evotec, A.H.T. Syngas Technology, Deutsche Telekom: Three stocks on the verge of a decisive turning point?

Germany's economy is at a crossroads. Its old strengths are crumbling, but this is precisely what opens up opportunities for companies that are strategically realigning themselves. The key to success is not simple adaptation, but a fundamental turnaround. Three decisive paths are emerging: disruptive innovation in the biotech industry, energy production and decarbonization, and the development of sovereign digital networks. Today, we take a closer look at three companies and analyze which stocks are on the verge of a turnaround: Evotec, A.H.T. Syngas Technology, and Deutsche Telekom.

ReadCommented by Armin Schulz on January 20th, 2026 | 07:30 CET

How to position yourself in time for the upcoming trend in 2026: Deutsche Bank, Finexity, and Coinbase in focus

The boundary between traditional and digital markets is disappearing. Driven by clear regulation and institutional engagement, tokenization is now reaching the mass market. This fundamental transformation is creating unprecedented efficiency and new asset classes. Those who understand how established financial giants and digital pioneers are shaping this wave will be able to identify early opportunities. We see Deutsche Bank as a German financial heavyweight, Finexity as a pioneer in digital assets, and Coinbase as a global crypto exchange – all key players in this new ecosystem.

ReadCommented by Fabian Lorenz on January 20th, 2026 | 07:15 CET

The dirty GOLD RISK! RZOLV Technologies with a billion-dollar opportunity and takeover fantasy!

With a price of around USD 4,600 per troy ounce, there is a gold rush atmosphere. But there is a risk that mine operators and authorities alike fear: cyanide. This highly toxic chemical is becoming key, especially for low-grade deposits that are now profitable again. It was also responsible for one of Europe's biggest environmental disasters. This is precisely where RZOLV Technologies comes into play. The Canadian company is working on a water-based, biodegradable leaching formulation that is intended to replace cyanide in existing plants – without expensive conversions and at low cost. The potential is enormous. If the upcoming industrial test is successful, the stock could move up to a new league and make RZOLV a hot takeover candidate.

Read