Technology

Commented by Nico Popp on January 19th, 2026 | 07:25 CET

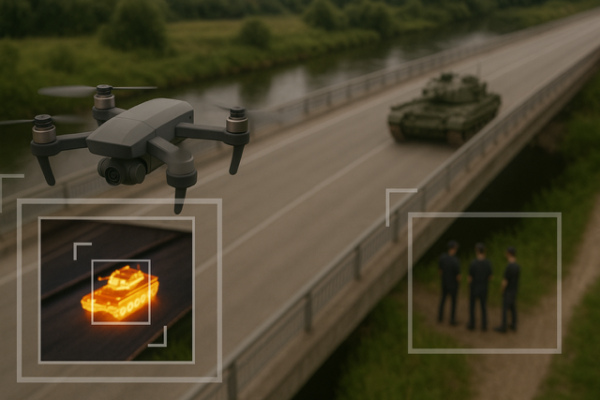

Armored steel meets swarm intelligence: Why Rheinmetall and Hensoldt must retool - and why NEO Battery Materials could become a hidden winner of the drone war

The war in Ukraine has shattered military doctrines that were considered irrefutable in NATO headquarters for decades within a matter of months. The shocking realization: even the most modern battle tank is an easy target for a drone that costs less than a tank of fuel for the colossus. We are witnessing a tectonic shift in warfare away from classic weapons such as tanks and howitzers toward asymmetric threats that are decided by software, sensors, and, above all, range. In this new environment, established defense giants such as Rheinmetall and Hensoldt must reinvent themselves to avoid becoming obsolete. But while these corporations are slow to turn their tankers around, NEO Battery Materials is positioning itself as an agile player at the critical interface of modern warfare: batteries for drone swarms, independent of Chinese supply chains.

ReadCommented by Nico Popp on January 19th, 2026 | 07:15 CET

The Netflix of car washing: How Mister Car Wash is reinventing the market, and WashTec is sounding the charge against Dover

The North American vehicle care market is currently undergoing a development that, in its radical consequences, is reminiscent of the transformation of the software industry ten years ago. The old model of weather-dependent individual car washes, where revenue falls when it rains, is being replaced by the predictable profitability of the "subscription economy." This trend is being driven by the phenomenal success of the US chain Mister Car Wash, which has proven that Americans are willing to sign up for a monthly subscription for clean cars, similar to streaming services. But this gold rush is putting massive technological pressure on gas station operators and independent car washes. They have to upgrade to stay competitive. In this battle for infrastructure supremacy, German hidden champion WashTec is now challenging US market leader Dover Corporation on its home turf. The Augsburg-based company supplies precisely the digital technology that enables the broader market to copy Mister Car Wash's successful model – and could thus shift the balance of power in the industry in the long term.

ReadCommented by Fabian Lorenz on January 19th, 2026 | 07:05 CET

Undiscovered energy stock for the AI boom! CHAR Technologies set for breakthrough in 2026!

In 2026, investors are once again rushing to buy energy stocks that are benefiting from the AI boom in the US. Bloom Energy, for example, has already exploded by over 50% in the early part of the year. However, with a value of USD 35 billion, the Company is anything but a bargain. CHAR Technologies is still an undiscovered gem in this sector. The Canadians produce coal and gas substitutes from waste materials. Research is no longer being conducted; instead, production is taking place on an industrial scale this year. The stock appears to be far too cheap and should take off in 2026.

ReadCommented by Armin Schulz on January 15th, 2026 | 07:15 CET

Lithium shortage grows: How BYD, NEO Battery Materials, and DroneShield are benefiting

A new era of scarcity is dawning. Lithium prices are skyrocketing. As lithium becomes the strategic oil of the 21st century, entirely new technologies are fueling the appetite for energy. Electric mobility, drones, robotics, and AI all have one thing in common: they are driving up demand for energy storage systems that need to be more powerful, more efficient, and simply more robust. In this race for what is arguably the most important resource of our time, what counts most is secure supply chains. Without them, the much-vaunted technology of the future will fall by the wayside. We take a look at three specific companies that are benefiting from the new technologies: BYD, NEO Battery Materials, and DroneShield.

ReadCommented by Fabian Lorenz on January 14th, 2026 | 07:35 CET

Fraunhofer Sounds the Alarm! Will Batteries Soon Be Scarce from China? NEO Battery Materials Offers an Alternative – Launching in 2026!

Fraunhofer is sounding the alarm with unusual clarity. Europe's largest research and innovation organization warns that China's new trade policy measures on battery technology pose a strategic risk. In extreme cases, an export ban could become a reality "in a very short time." What is particularly explosive is that Beijing is not only targeting batteries and preliminary products, but also the machines without which no cell factory can start up. This could not only slow down German car manufacturers' race to catch up in electromobility but also create bottlenecks in drones, robotics, and other emerging technologies. Battery suppliers from "Western" production, such as NEO Battery Materials, could benefit from this development. The Company's revolutionary technology is market-ready, with mass production set to begin in South Korea. NEO shares currently appear undervalued.

ReadCommented by Carsten Mainitz on January 14th, 2026 | 07:10 CET

With these data-driven and scalable business models, investors are on the winning side: Aspermont, Palantir, and SAP!

Data is a fundamental part of the economy and our everyday lives. Companies that not only collect data but can also systematically refine, monetize, and scale it are creating business models with enormous leverage. Palantir transforms fragmented information into decision-relevant intelligence for corporations and governments. SAP's software maps corporate data in real time and makes it usable. The often overlooked specialist Aspermont transforms data in the commodities sector into high-margin digital subscription models. All three companies are united by a scalable platform mindset. Where are the biggest opportunities?

ReadCommented by Armin Schulz on January 14th, 2026 | 07:00 CET

The resilient winners: How to play it safe with Almonty Industries, Rheinmetall, and Hensoldt

While stock markets are celebrating, a new economic era is quietly dawning. Driven by geopolitical power struggles, a relentless battle for critical raw materials, and the return of strategic state intervention, unexpected winners are emerging. These forces are reshaping tomorrow's investment landscape and elevating select companies into key strategic roles. The rise of Almonty Industries, Rheinmetall, and Hensoldt shows how investors can benefit from this historic shift.

ReadCommented by Stefan Feulner on January 13th, 2026 | 07:25 CET

D-Wave Quantum, Silver Viper, Tilray Brands – The year of decisions

2026 could be a year of major decisions for investors. Geopolitical tensions, fragile supply chains, and growing mountains of debt suggest that precious metals will remain at the top of institutional investors' shopping lists. At the same time, technological change is advancing. Quantum computing is evolving from a promise for the future to a key strategic technology, with noticeable momentum in research and investment. The cannabis industry also remains particularly exciting. After years of disappointment, there are increasing signs of a possible turnaround. Tilray Brands made its first mark with strong quarterly figures and improved cash flow.

ReadCommented by Armin Schulz on January 13th, 2026 | 07:05 CET

The big winners of the hunger for electricity: How you can profit with Super Micro Computer, American Atomics, and RWE

The world is facing an unprecedented energy dilemma. Electricity demand is skyrocketing due to AI and electrification, while at the same time, complete decarbonization must be achieved. This enormous conflict of objectives creates historic investment opportunities for companies that provide solutions for energy efficiency, base load power plants, and energy storage for renewable energy. Three companies are particularly in focus: Super Micro Computer, American Atomics, and RWE.

ReadCommented by Nico Popp on January 13th, 2026 | 07:00 CET

When the machines grind to a halt: Why Sandvik is trembling, and Almonty Industries is becoming a billion-dollar bet like MP Materials

The 2026 stock market year begins with a realization that is causing industrial producers worldwide to break out in a cold sweat: tungsten, one of the hardest and most heat-resistant metals, is sold out. What began with rare earths last year is now continuing with brutal severity for the material without which no armored steel can be hardened, no smartphone can vibrate, and - most importantly for the global economy - no industrial cutting tools can function. In this tense situation, Swedish industrial giant Sandvik is acting as the "canary in the coal mine" – the Company is signaling the situation on the tungsten market before all other market participants. Sweden's dependence on tungsten carbide is comprehensive. But while the industry struggles for security of supply, savvy investors are recognizing a historical parallel: the situation is the same as the rise of MP Materials in the rare earths sector. Almonty Industries, which owns the largest tungsten mine outside China, still trades at a fraction of MP Materials' valuation. Yet the Company is poised to become the West's tungsten monopolist.

Read