January 20th, 2026 | 07:15 CET

The dirty GOLD RISK! RZOLV Technologies with a billion-dollar opportunity and takeover fantasy!

With a price of around USD 4,600 per troy ounce, there is a gold rush atmosphere. But there is a risk that mine operators and authorities alike fear: cyanide. This highly toxic chemical is becoming key, especially for low-grade deposits that are now profitable again. It was also responsible for one of Europe's biggest environmental disasters. This is precisely where RZOLV Technologies comes into play. The Canadian company is working on a water-based, biodegradable leaching formulation that is intended to replace cyanide in existing plants – without expensive conversions and at low cost. The potential is enormous. If the upcoming industrial test is successful, the stock could move up to a new league and make RZOLV a hot takeover candidate.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

RZOLV TECHNOLOGIES INC | CA76091C1032

Table of contents:

"[...] We quickly learned that the tailings are high-grade, often as high as 20 grams of gold per tonne; because they are produced by artisanal miners, local miners who use outdated technology for gold production. [...]" Ryan Jackson, CEO, Newlox Gold Ventures Corp.

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

A billion-dollar opportunity: The dirty secret behind the gold rush

The gold rush is back. The price per troy ounce is over USD 4,600. The industry is bursting with energy and investing billions in the development of new deposits. But as shiny as the precious metal may be, gold production remains a dirty business. Even low-grade projects are now profitable again. However, these projects require the use of large amounts of chemicals, primarily cyanide, to separate the rock from the gold. The use of sodium cyanide is costly and involves significant risks. It is one of the most potent poisons in the world. A single accident can destroy entire regions and ruin a gold producer. The dam breach at a gold mine in Romania in 2000 is considered one of the biggest environmental disasters in Europe. Over 1,400 tons of fish died as a result of the cyanide slurry leak, and a river system, including the Danube, was poisoned. Such projects are correspondingly risky, if they are approved at all. Anyone who can offer the gold industry an alternative to cyanide stands to earn billions. That is precisely what RZOLV Technologies is working on.

Water-based, biodegradable, and cheaper alternative to cyanide

The volume of the cyanide market is estimated at almost USD 3 billion. Mining is by far the largest consumer. RZOLV Technologies has been researching a safe alternative to sodium cyanide for years. The Canadians have developed a water-based, leaching formulation designed to extract precious metals and critical minerals from ore, offering a significantly safer alternative to sodium cyanide. It is biodegradable and operates in closed-loop systems. The process is patent pending. Also important for mine operators: the RZOLV solution is designed to be compatible with existing facilities. As a result, mining companies do not need to invest in new infrastructure, but can integrate the solution into current processing flows. RZOLV Technologies appears to be entering the final phase of development. Tests conducted by the renowned testing service provider SGS, along with additional external evaluations, have delivered positive results.

Recent tests are convincing

The latest test results are once again promising. A few days ago, RZOLV Technologies announced that independent SGS laboratory test results had yielded gold recovery rates of up to 98.7%, comparable to those achieved with traditional cyanide-based processes. A key advantage is that the RZOLV formulation appears to be cost-competitive with cyanide. This means that its use not only protects the environment, but also the operating budgets of gold producers.

Industrial testing and potential acquisition

The next step for RZOLV Technologies is to conduct a 100-ton pilot test in Arizona. To finance this, the Company went public last October and raised CAD 2.85 million. If this industrial-scale test proves successful, the cyanide alternative could move toward mass production or be licensed out. Or will things turn out quite differently? A complete takeover by a chemical company would come as no surprise. In any case, the current valuation may make the Company appealing to strategic investors, though any such development remains speculative.

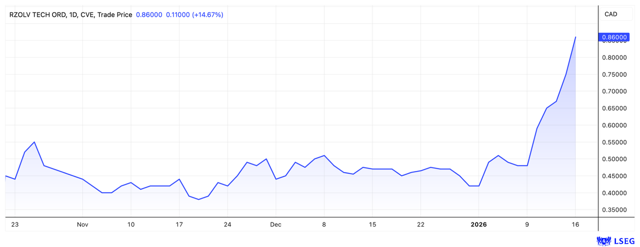

Conclusion: Price potential remains high

The market potential for RZOLV is huge. It took a while for the stock to be discovered, but it finally took off in January and is now also traded on the Frankfurt Stock Exchange. With a market capitalization of around CAD 50 million, the price potential still appears to be high.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.