Technology

Commented by Fabian Lorenz on December 8th, 2025 | 07:15 CET

RENK better than HENSOLDT? Risk at NOVO NORDISK! Billion-dollar opportunity with RZOLV Technologies!?

Is RENK's stock better than Hensoldt's? That is what analysts are saying. According to them, the transmission specialist is attractively valued at the current level. Hensoldt, on the other hand, is having problems converting its order backlog into revenue growth, leading to a significant reduction in its price target. In contrast, RZOLV Technologies shares have enormous upside potential. The Company aims to replace a toxic chemical used in gold extraction, thereby opening up a billion-dollar market. Development is nearly complete, and patents have been filed. In just a few months, RZOLV could become a hot takeover candidate. Meanwhile, takeovers currently appear to be a way for Novo Nordisk to replenish its drug pipeline, with the Danish company taking risks worth billions - Pfizer, take note.

ReadCommented by Nico Popp on December 8th, 2025 | 07:00 CET

Even in times of peace, these defense stocks have a future: NEO Battery Materials, Hensoldt, DroneShield

There is a lot at stake for Ukraine these days: Will there be a dictated peace, will the war continue, or is a long-term viable solution in sight after all? Some defense stocks have fallen in recent weeks. However, regardless of the current peace negotiations, it looks as if Europe in particular will have to invest heavily in military capabilities in the coming years. We explain why and present some exciting stocks.

ReadCommented by Nico Popp on December 4th, 2025 | 06:55 CET

How suppliers like Aspermont, CATL, and Continental turn the world's complexity into profit

"During a gold rush, don't sell shovels - sell treasure maps." In a world driven by technological disruption, geopolitical tensions, and the trend toward decarbonization, investors need to think one step ahead. Often, it is not the end manufacturers who benefit most, but the specialized suppliers and service providers operating behind the scenes. They take the complexity off their customers' hands – whether it is building an electric vehicle, optimizing tyre compounds, or deciding where to build the next billion-dollar mine. Those who understand this principle will find exciting options on the stock market right now. We present three companies.

ReadCommented by Armin Schulz on December 3rd, 2025 | 10:25 CET

The moat strategy promises success in your portfolio: An analysis of Palantir, RZOLV Technologies, and D-Wave Quantum

In today's stock market landscape, a sustainable competitive advantage determines exceptional returns. Real moats, whether through impenetrable software, new technologies, or revolutionary hardware, reliably shield sources of profit and regularly outperform the market. The search for such protective mechanisms leads to three pioneers who dominate their fields with technological supremacy: Palantir, RZOLV Technologies, and D-Wave Quantum.

ReadCommented by André Will-Laudien on December 2nd, 2025 | 07:05 CET

Selling pressure! Bitcoin slumps to USD 50,000? Caution with Strategy, Finexity, D-Wave, and Metaplanet!

Global financial systems are undergoing a period of rapid technological change. Time-critical calculations and enormous computing capacities are increasingly becoming the decisive factor in remaining competitive. When it comes to price discovery on electronic markets, technical connectivity and even the distance to the exchange's servers are now decisive factors in determining the best pricing on the markets. Algorithms can recognize when a large number of investors want to move in the same direction. State-of-the-art computer systems have long been executing trading decisions in fractions of a second, fundamentally changing the dynamics of the markets. At the same time, digital assets, blockchain architectures, and token-based platforms are creating a new ecosystem that is closely linked to these advances. However, an additional challenge is already looming: quantum computers. They pose the risk of making previously trustworthy networks vulnerable. How should investors position themselves?

ReadCommented by Armin Schulz on November 28th, 2025 | 07:15 CET

From data chaos to profit machine with AI: The blueprint from SAP, UMT United Mobility Technology, and Palantir

Artificial intelligence alone does not make for a successful economy of tomorrow. The real lever lies in seamlessly integrating the technology into existing processes and forging real competitive advantages from data. But that is precisely the crux of the matter. For many companies, this mammoth task is simply too big to tackle alone. They therefore urgently need external support, otherwise they will fall by the wayside. Accordingly, digital transformation using AI will remain a hot topic in the coming year. While many companies are still struggling with implementation, technology leaders such as SAP, UMT United Mobility Technology, and Palantir are already setting standards.

ReadCommented by Carsten Mainitz on November 28th, 2025 | 07:00 CET

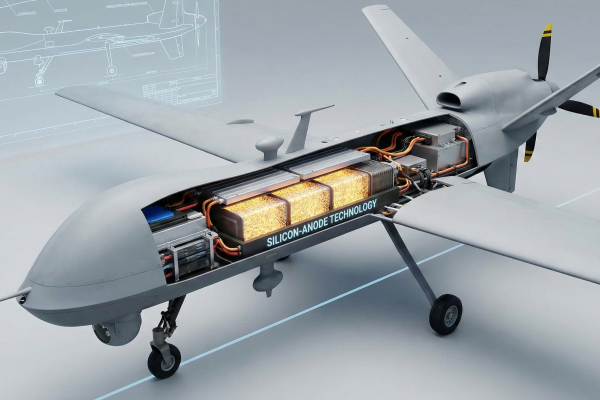

Attention! Major Updates from NEO Battery Materials, Xiaomi, and RWE

Geopolitics are once again dominating global headlines. A 28-point plan brokered by the United States aims to end the war between Russia and Ukraine and pave the way toward sustainable peace. Viewed soberly, an approaching end to the war puts pressure on defense stocks. One area that has gained significant importance due to the Ukraine conflict is drones. Battery technology is playing an increasingly important role here. However, the use of powerful batteries is also essential in many other areas, such as robotics. The still largely unknown NEO Battery Materials is delivering one positive update after another. How can investors benefit now?

ReadCommented by Fabian Lorenz on November 27th, 2025 | 07:15 CET

Plug Power poised for a 250% rally? Buy TKMS and Rio Tinto partner Aspermont shares?

Plug Power shares are not for the faint-hearted. This year, too, a spectacular rise was followed by a crash of over 50% within just a few weeks. But now, a positive analyst report is causing a stir. Is a gain of more than 250% really possible for the hydrogen specialist? Aspermont shares currently appear to be a real bargain. The figures for the fourth quarter were certainly convincing. And the business model, with its perhaps unique combination of artificial intelligence and raw materials, is only just getting started. And what is TKMS doing? The euphoria following the IPO has now faded. But analysts have now upgraded the stock and are recommending it as a "Buy".

ReadCommented by Carsten Mainitz on November 27th, 2025 | 07:05 CET

Everything is lining up! Take advantage of lower prices to enter Antimony Resources, RENK, and Hensoldt!

Is peace finally coming? Efforts to end the war between Russia and Ukraine have intensified significantly in recent days. But Russia remains the unknown factor. As a result, stock market volatility driven by shifting news or rumors is to be expected in the near future, especially for defense stocks. Setbacks offer investors opportunities to build up positions. In addition, special topics such as critical metals or raw materials that are indispensable for the defense industry and other key sectors remain attractive. This is where the undervalued Antimony Resources stands out.

ReadCommented by André Will-Laudien on November 26th, 2025 | 07:30 CET

Prices down on Black Friday? SAP and Palantir consolidate, UMT with a strong concept, Deutsche Telekom still cheap!

Nervousness is mounting - as seen in volatility indices, which have risen from 15 to just over 20. As is so often the case in the fall, uncertain forecasts for economic development are causing considerable fluctuations in the stock markets. This is because much remains unclear. Will Trump's tariffs have a positive effect on the US economy, or will courts roll everything back to its original state? How will the situation in Ukraine evolve? Will Germany manage the economic and societal turnaround? These are all reasons why it makes sense to start the new year with fewer stocks. Because, as always, January means back to square one – and a new game! We offer some tips for portfolio optimization.

Read