November 29th, 2024 | 07:00 CET

RWE, Globex Mining, Plug Power - Energy transition: Euphoria, disillusionment, and investment opportunities

The path to a sustainable energy supply is not linear but is characterized by successes, setbacks and surprising developments. Despite possible supply risks, the German energy giant RWE is posting record earnings of EUR 4 billion (EBITDA) and is a thorn in the side of the Federal Cartel Office due to its market dominance. With its "mineral bank" model, mining specialist Globex Mining proves how traditional commodity businesses can also develop sustainably. The mining sector faces a double challenge: on the one hand, the industry contributes massively to the increased carbon footprint, while on the other hand, it is indispensable for the energy transition, as the demand for metals for batteries and renewable energies is increasing dramatically. With over 252 projects and smart royalty rights, Globex Mining is growing continuously, and its enterprise value is increasing. Hydrogen pioneer Plug Power, on the other hand, is struggling with a significant 20% revenue drop despite ambitious growth targets. "Hope dies last," one thinks when considering the perseverance of Plug Power's management. Where do investment opportunities lie?

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

RWE AG INH O.N. | DE0007037129 , GLOBEX MINING ENTPRS INC. | CA3799005093 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We have already discovered 1.1 million ounces of gold on our 440 km2 flagship SMSZ Project and our stock market value is currently around USD 10.60 per troy ounce in the ground. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

RWE: Market dominance and extreme price jumps raise questions about security of supply

A dark lull in Germany in early November 2024 led to dramatic price spikes on the European Energy Exchange (EEX) in Leipzig. Within a few days, electricity prices shot up from EUR 30 to over EUR 800 per megawatt hour at times - more than five times the regular price. During this period, Germany had to import one-fifth of its electricity needs.

RWE CEO Markus Krebber warns of potential risks: Similar weather conditions in January could make it impossible for Germany to meet its electricity demand. The dark doldrums – a combination of calm winds and overcast skies – would bring renewable energy generation to a near standstill. Pragmatically, Krebber advises the population stock up on "warm blankets".

The German Federal Cartel Office is concerned about RWE's growing market position. Despite weakening due to the economic downturn, the Company retains its "structural market power" in power generation. The competition watchdogs are especially critical of the fact that RWE can predict its indispensable position at certain times and could theoretically influence prices as a result.

Operationally, RWE is developing strongly: in the first nine months, adjusted EBITDA reached EUR 4.0 billion, and adjusted net income was EUR 1.6 billion. The Company invested EUR 6.9 billion in further growth and is building 11.2 GW of new capacities.

Globex Mining: Royalty Partner O3 Mining to Start 8,000-metre Drill Program on Gold-Rich Casa Berardi Trend

The mining sector is benefiting from the green transformation. It is estimated that demand for raw materials for clean energy solutions will quadruple by 2040. The Canadian mining company Globex Mining demonstrates what sustainable corporate success looks like with its "Mineral Property Bank" strategy. Under the leadership of CEO Jack Stoch, who, together with management, holds 13.08% of the shares, the Company has built up a broadly diversified portfolio of over 252 projects. The business model is based on acquiring and enhancing resource projects through targeted exploration and intellectual input. The Company generates revenue through options, sales, and royalties, minimizing dependence on equity offerings and reducing risk for shareholders. This means that its commodities are so intelligently diversified that their value continues to grow steadily.

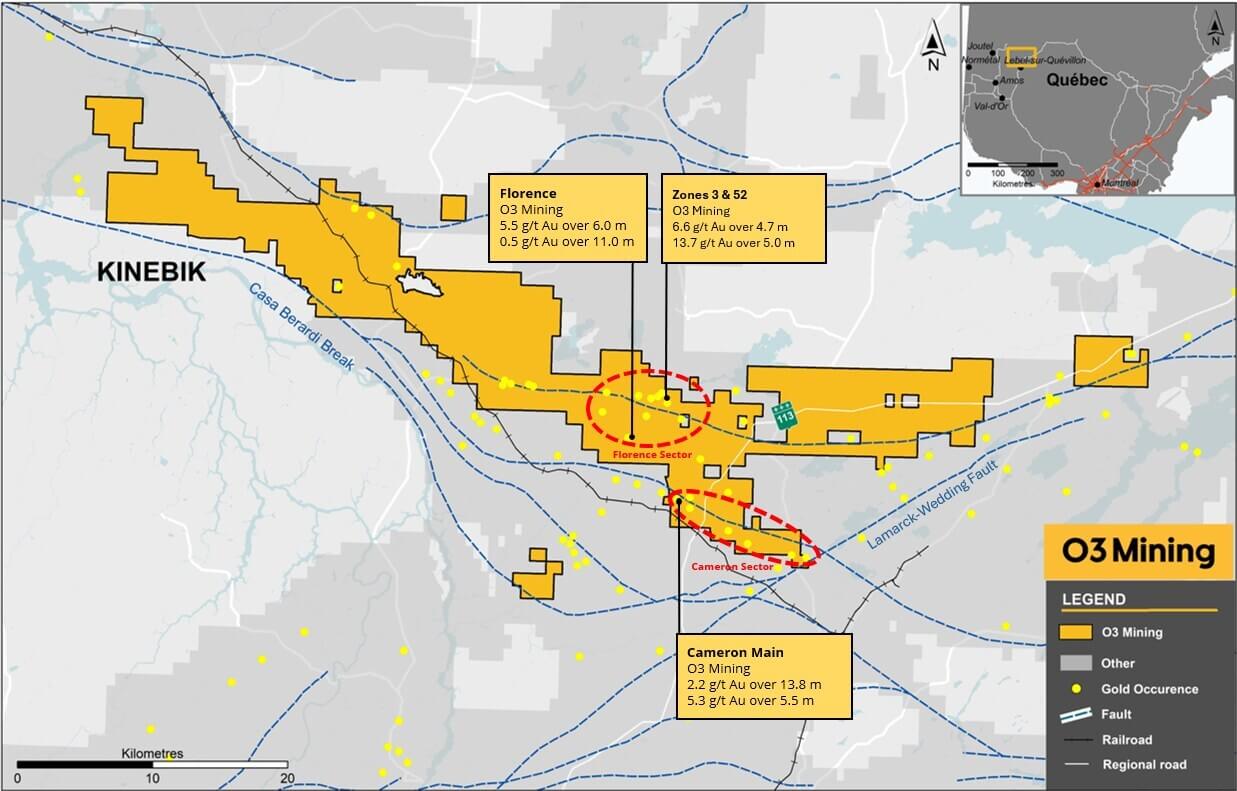

The recent development of the Kinebik project in Quebec underscores the effectiveness of the business model: O3 Mining has commenced an 8,000-meter drill program in the Cameron and Florence sectors. The project covers 55 km along the prolific Casa Berardi trend, which is home to five mining districts, including the world-class Casa Berardi deposit with more than 5 million ounces of gold.

Globex Mining secures smart royalty rights in Kinebik deal: The Company negotiated a 2.5% gross metal royalty on 104 claims and 1% on 52 claims. The sale of the 156 claims will generate CAD 2 million for the Company, divided into CAD 150,000 in cash and 1.18 million O3 Mining shares. This further strengthens Globex Mining's solid financial base.

With over CAD 25 million in cash and securities, Globex Mining operates debt-free. The focus on politically stable regions in Eastern Canada, Germany and the United States, as well as the low number of only 57.7 million shares issued, underscores the shareholder-friendly orientation.

Plug Power struggles with dramatic drop in fuel cell sales

Hydrogen specialist Plug Power continues to face significant challenges. In the third quarter of 2024, the Company recorded a significant revenue decline of 13% to USD 173.7 million. Particularly worrying is the slump in the core business: while hydrogen fuel sales increased by 54%, fuel cell sales plummeted by 26%.

In addition to weakening demand from major customers such as Amazon for forklift conversions, the Company is struggling with massive supply chain issues. In particular, hydrogen supply in North America is proving to be an Achilles heel. Moreover, Plug Power now has only USD 93.9 million in liquid funds, while over USD 1 billion is tied up and unavailable.

For the full year 2024, Plug Power expects revenues of between USD 700 and 800 million, representing a decline of around 20% compared to the previous year. The net loss in the third quarter amounted to USD 211.2 million – further evidence of the Company's ongoing financial difficulties.

Nevertheless, management is optimistic about the coming years. At the "Plug Symposium" in New York, the Company announced it would return to a growth trajectory as early as 2025. Revenue is then expected to be between USD 850 and 950 million. By 2030, Plug Power is targeting an average annual revenue growth of 30%, which should lead to annual revenues of USD 3.75 billion.

RWE presents itself as a robust energy giant with impressive financial strength. The EBITDA of EUR 4 billion, combined with a generous share buyback program, makes the Company a reliable anchor in the portfolio. However, the antitrust concerns cast a shadow over the otherwise flawless balance sheet. For conservative investors who value regular distributions, RWE remains a solid choice. Globex Mining impresses with its innovative "mineral bank" model and cleverly positions itself in the energy transition megatrend. The debt-free balance sheet with CAD 25 million in liquidity and a broadly diversified portfolio of 252 projects offers a solid risk buffer. On December 4, CEO Jack Stoch will be available to answer questions from interested investors at the 13th International Investment Forum. Click here to register. The combination of a solid business model and growth potential makes Globex Mining one of the most interesting options for risk-conscious investors. Plug Power is at a critical juncture. With only USD 93.9 million in liquid assets and a 20% drop in revenue, the Company finds itself in a precarious position. Despite its promising technology, Plug Power remains a highly speculative investment suitable only for very risk-tolerant investors. Globex Mining currently offers the best risk-reward profile: the Company combines an innovative business model with solid finances and benefits directly from the energy transition megatrend. The low debt and diversified portfolio provide a certain risk buffer.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.