June 19th, 2024 | 07:15 CEST

Opportunities upon opportunities: sell AI now! Nel ASA, Royal Helium, Plug Power, and BYD

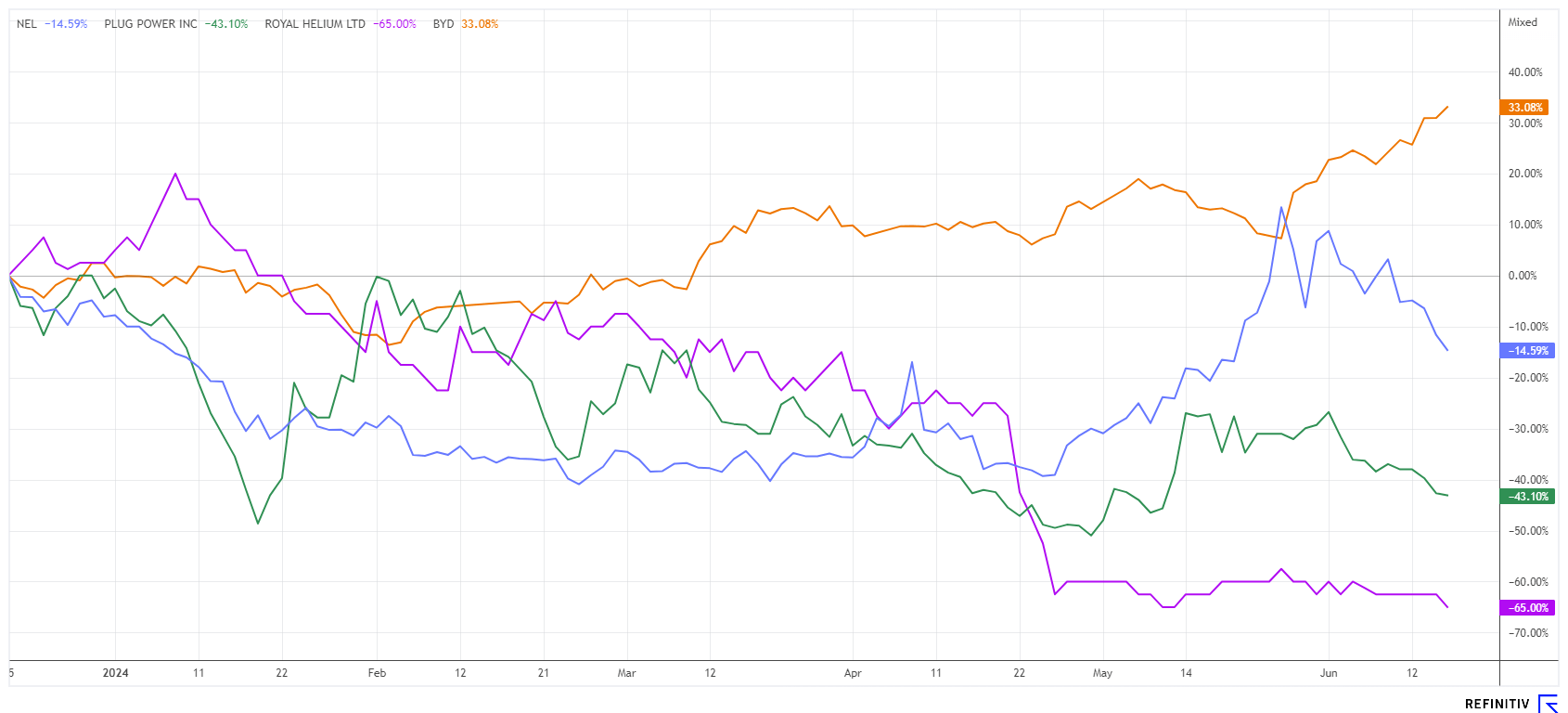

19,887 is the new record high of the NASDAQ 100 index. Dream returns from Nvidia, Apple, and Microsoft could accelerate the stock market's growth into the summer once again. This could also make the second quarter of 2024 a good month for equities, as the saying "Sell in May and go Away" does not seem to apply this year. However, there are plenty of lagging stocks with great potential. They are currently on one side, as the attraction of the "Magnificent Seven" is too strong. We take the euphoria as an opportunity to take a closer look at a few promising stocks.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , ROYAL HELIUM LTD. | CA78029U2056 , PLUG POWER INC. DL-_01 | US72919P2020 , BYD CO. LTD H YC 1 | CNE100000296

Table of contents:

"[...] We expect the first three wells to be drilled, cased, completed and tested by the second week of March [...]" Andrew Davidson, CEO, Royal Helium Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - Punitive tariffs in Europe, Warren Buffet sells again

Star investor Warren Buffett is hitting the sell button again. According to a recent Hong Kong Stock Exchange announcement, Berkshire Hathaway has sold 1.3 million shares worth just under USD 40 million, reducing Buffett's stake from 7.5 to 6.9%. Berkshire has already sold more than half of its original stake in 2022 and 2023. BYD already has a very strong market position in China and is endeavouring to expand its global market share ever more aggressively. It has been very successful so far, as all Chinese brands together sold 13.4 million new vehicles last year. The US manufacturers, on the other hand, only sold around 11.9 million units. However, both are well behind the Japanese manufacturers, who have traditionally sold a total of 23.6 million vehicles.

Last week, the EU Commission imposed the expected punitive tariffs of 17.4% on BYD imports. A few weeks earlier, the US Department of Commerce raised import duties on Chinese e-vehicles by 100%. Following the announcements, Goldman Sachs issued a research update on the Chinese technology group BYD and warned of negative effects. Nevertheless, with a sales increase of 20% in 2024, a P/E ratio of 18.5 is not too expensive. However, the share price is currently capped at around EUR 30 .

Royal Helium - Looking ahead after the capital increase

The shortage of raw materials around the globe also applies to technical gases. Western industrialized nations have now joined forces to secure procurement routes for strategically important metals. Special attention has been paid to the Canadian explorer Royal Helium Ltd (RHC), as its properties are located in the perfect commodity jurisdictions of Saskatchewan and Alberta. The Company controls over 4,000 sq km of promising helium concessions there, which it would like to exploit in the coming years. The chances are good, as the number of suppliers worldwide is very limited, especially as hardly any free material comes onto the market due to existing supply contracts. Canada has the fifth largest helium reserves in the world and is increasingly coming under the spotlight of international technology producers.

Following a major CAD 6 million capital raise, Royal Helium has engaged Progress Through Technology LLC (PTT) for the production ramp-up under a six-month contract. Operationally, the ramp-up is about fine-tuning and stabilizing production at the Steveville helium purification plant. PTT is a leading technical consultancy for plant life cycle optimization and is known for its expertise in the helium industry. The contractor is led by Brent Ziegler, who has 20 years of gas processing experience in technical roles at industry-leading companies.

RHC's share price is currently trading between CAD 0.07 and 0.09 with high turnover, valuing the Company at a very low EUR 17.5 million. However, the prospects for Royal Helium must be considered excellent in the current environment of fragile supply chains and the securing of North American raw material supplies. Once the financing has been digested, we believe that triple-digit share price gains are on the cards.

Nel ASA and Plug Power - This looks dangerous

The hydrogen protagonists Nel ASA and Plug Power are regularly part of our analysis. A few weeks ago, it seemed that Plug Power could finally take off with a guarantee line from the US Department of Energy (DOE). However, the public awarding of this backing is not yet a done deal. The Senator responsible, John Barrasso, who is also a member of the Committee on Energy and Natural Resources, recently initiated a special review of the awarding process. After temporarily trading at USD 5.05, the New York-based GreenTech experts have fallen significantly to USD 2.72. This means that the chart is broken again for the time being. For a medium-term breakout attempt, the price must sustainably surpass the USD 3.50 hurdle.

The pullback at Nel ASA was somewhat more pronounced, as the IPO of the filling station subsidiary Cavendish Hydrogen provided a boost. According to CEO Håkon Volldal, the spin-off aims to create two independent pure-play companies to later become market leaders in their respective fields. At the initial listing on June 12, the Company was valued at NOK 1.06 billion. However, the listing has so far been a disappointment, as the new hydrogen value has already halved within three trading days. In the last two days, it has rebounded by 25% but remains 30% below the initial listing price. This is not good publicity for the Nel share. Out of sympathy, the share has already dropped 30% since the end of May. Watch out: The level of EUR 0.50 to 0.53 has proven to be a reliable entry zone three times. Collect!

Determining the right time to exit high-tech stocks is difficult. Currently, all investors want these stocks, and bears regularly burn their paws. On the other hand, hydrogen stocks are in an extended technical bottom. With its gas reserves, the small Royal Helium is well-positioned for the de-globalization of raw material procurement.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.