May 23rd, 2024 | 08:15 CEST

More is not possible! 250% opportunities with TUI, Lufthansa, Royal Helium, and Plug Power

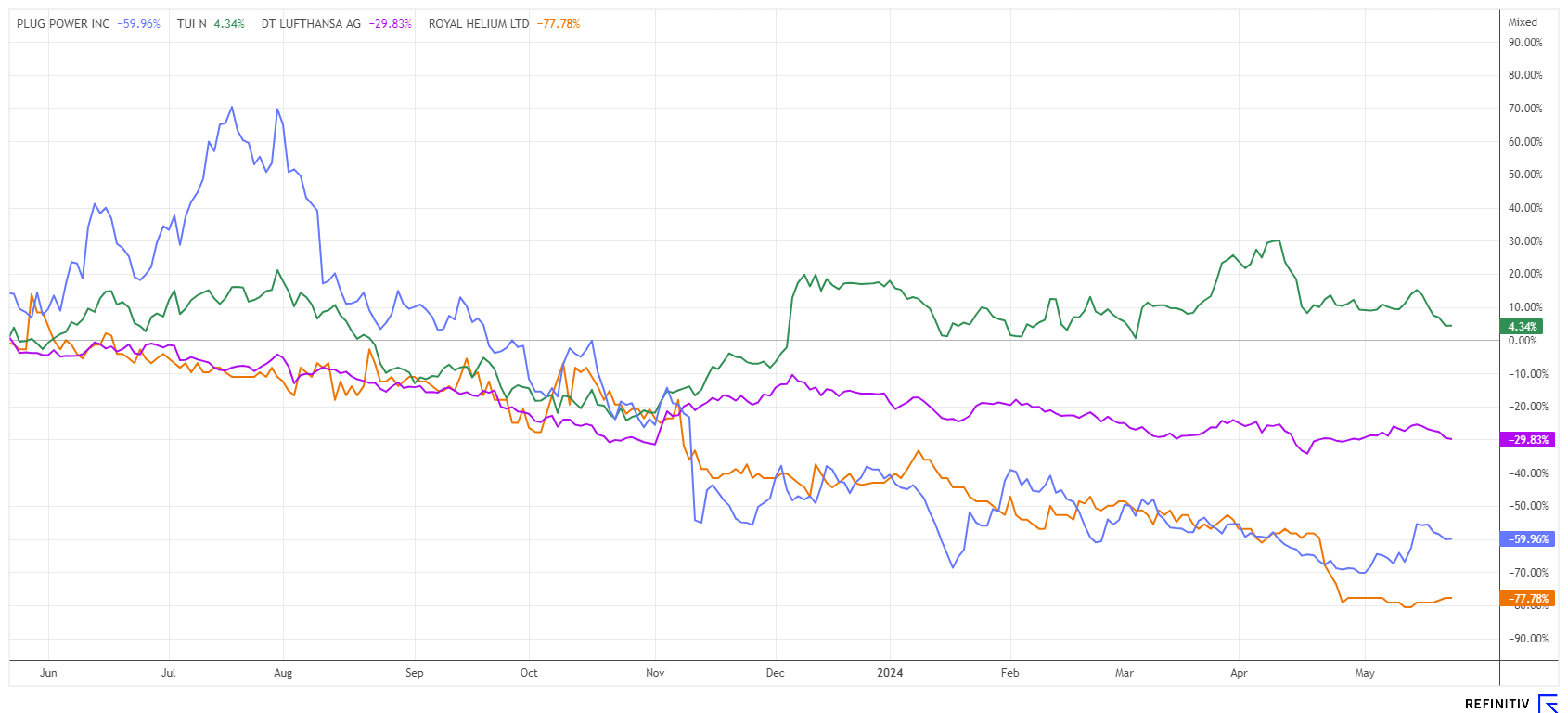

The stock market upswing is currently only being driven by a few stocks. In particular, stocks from the high-tech, artificial intelligence and defense sectors are making investors' hearts beat faster. However, as the upward trend matures, previously neglected stocks also come into focus. These include the tourism and travel specialists Lufthansa and TUI, which were supposed to take off after the COVID-19 pandemic. Similarly, Plug Power and Royal Helium have also recently fallen by the wayside. Investors should now closely examine where the potential is hidden because the next sector rotation could already be in the pipeline.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

LUFTHANSA AG VNA O.N. | DE0008232125 , TUI AG NA O.N. | DE000TUAG505 , ROYAL HELIUM LTD. | CA78029U2056 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] We expect the first three wells to be drilled, cased, completed and tested by the second week of March [...]" Andrew Davidson, CEO, Royal Helium Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

TUI and Lufthansa - Unjustly beaten down

After the pandemic years of 2021 and 2022, the travel market returned last year. The criticized companies Lufthansa and TUI even managed to almost completely repay the generous state aid thanks to a veritable economic boom last year. Investors are now looking spellbound at the share prices of the well-known protagonists - but after a strong rebound, doubts have set in.

The reason: Inflation and the high tariff adjustments have made the supply side extremely expensive, and now it has to be passed on to significantly reduced household budgets. The average cost of living in Germany has risen by around 40% due to the pandemic and war. Where the average consumer now has to cut back is in the luxury and travel sector. For providers, however, it is extremely important whether potential travellers only undertake one vacation a year and, in case of necessity, resort to their own car and the campground.

TUI, Europe's largest travel provider, carried out a major capital increase in the fall of 2023, almost doubling from a low of EUR 4.40 to EUR 8.00 by April. The share then corrected by a good 20% to EUR 6.35. With a P/E ratio of 6.3, the share is currently not particularly expensive. However, TUI was not able to present exorbitant booking figures with the last quarterly figures, and black figures are still a long way off. Although Lufthansa is still able to pass on the increased prices to a large extent, it is complaining about the almost doubling of costs for air traffic control and passenger checks since the pandemic. Nevertheless, the 2024 P/E ratio has fallen to around 5 at a price of EUR 6.47. The annual low of EUR 6.23 is also not far away. If the current problems are ignored, TUI and Lufthansa could become true top picks over the next 24 months.**

Plug Power - 1.6 billion guarantees for giga projects

What a rally and collapse in one trading week! With the announcement of a USD 1.66 billion guarantee package for the construction of 6 megawatt hydrogen power plants across the US, the top dog Plug Power surged by almost 100% from a standing start last week. However, on the same day, investors realized that the hydrogen specialist would first have to raise the necessary funds for the construction, as the Department of Energy (DOE) only wanted to secure the upcoming investments rather than finance them through. Investors quickly remembered the tight cash situation and sold the hot stock again. At the beginning of the week, the share price fell back below USD 3.00 after being over USD 5.00 in the previous week.

From a technical chart perspective, however, it should be noted that the renewed test of the lower reversal zone has now triggered a reversal signal. The probability of slightly rising prices and more consistency is now given again. The share is now only trading at a price/sales ratio of 2. However, according to estimates by analysts on the Refinitiv Eikon platform, anyone waiting for profits will have to wait until 2028. The share is not for the faint of heart due to its volatility.

Royal Helium - Forty Mile shows good concentrations

In addition to hydrogen, helium is also indispensable in industry. As a technical gas, it is in high demand from the fibre optics, computer and aerospace industries. It is also used as a coolant in nuclear power. Customers such as Linde, Airbus, NASA and SpaceX are on the order list, but there are only a few suppliers worldwide. The largest helium deposits on Earth result from the radioactive decay of underground uranium deposits, where the gas accumulates together with natural gas deposits. It is extracted exclusively from such layers. **Larger deposits can be found in the US and Canada. The global helium markets have recently been regarded as extremely opaque. At the beginning of 2022, the price of helium doubled worldwide due to shortages, and important experiments in research laboratories even had to be canceled due to helium shortages. Suppliers cut supply volumes by around 50%. The situation has since eased somewhat, but helium is still considered a critical raw material.

Canada's Royal Helium Ltd. is focusing on the exploration and development of a major helium production project. The Company controls over 400,000 hectares of promising land concessions and leases in southern Saskatchewan and southeastern Alberta. In 2024, the Company plans to complete and test existing wells on the Val Marie, Ogema and Steveville properties, and the new Forty Mile project in Alberta. In early May, licensing and permitting of the Forty Mile No. 1 helium exploration well in southeastern Alberta began. The project covers 7,000 acres and hosts a historic well that has already been tested in various horizons. Royal has completed seismic work and now has several defined drilling targets in various prospective horizons.

The Company raised CAD 6 million in a major capital increase in May. This will allow work to continue after licensing. Unfortunately, the placement has put some pressure on the share price. If you get in now, the share price is around CAD 0.08 to 0.10. However, nothing has changed in terms of project quality, so the current level has more than 250% potential compared to previous valuations. Very exciting!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.