July 3rd, 2025 | 07:15 CEST

Microcap revolutionizes the building materials industry: Does Argo Living Soils hold the key to billion-dollar revenues?

Sustainable construction has been a growing trend for some time. As early as the late 1970s, regulations in Germany required builders to insulate properties according to specific standards. Since then, standards have continued to rise steadily. In some cases, this has become a cost issue – especially when older buildings must be brought up to modern energy efficiency standards. For some time now, the focus has also shifted to the building materials themselves. Materials such as cement and concrete are considered particularly energy-intensive and therefore anything but CO2-neutral. This is precisely where innovative technology comes in. A billion-dollar market is emerging.

time to read: 3 minutes

|

Author:

Nico Popp

ISIN:

ARGO LIVING SOILS CORP | CA04018T3064

Table of contents:

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

Sustainable building materials are set to be the next big thing

According to experts at Fortune Business Insights, the market for sustainable building materials is expected to grow from USD 474 billion in 2024 to around USD 1.2 trillion by 2032. This corresponds to an annual growth rate of 11.9%. Other market researchers share this view: Mordor Intelligence forecasts an annual growth of 9.7% between 2024 and 2029. Analysts have identified climate legislation, such as the European Green Deal, and the general rise in awareness of climate neutrality as the driving forces behind this trend.

In addition to the traditionally highly regulated Europe, the US and Asia are also particularly sought-after markets for sustainable building materials. Although regulations are less strict in the latter region, high construction activity and urbanization are ensuring robust demand for innovative building materials. So far, growth has primarily come from residential real estate, but as reported by Fortune Business Insights, green building materials are increasingly being used in commercial and infrastructure projects as well.

Building material companies are desperately searching for green solutions

In view of these growth prospects, the building materials industry is divided into two camps: pioneers such as Heidelberg Materials already offer solutions in some niche markets. Other companies are desperately trying to gain a foothold with innovative building materials. The use of graphene and other nanomaterials appears particularly promising. Within industry, references are made to up to 50% reductions in CO2 emissions and improved material properties. Market researchers at the IMARC Group estimate that the global graphene market will be worth USD 7.8 billion by 2033. This corresponds to an annual growth of around 39%, with a large proportion of this coming from the construction industry.

Argo Living Soils delivers graphene for the building materials industry for the first time

The young company Argo Living Soils is particularly strong in the use of graphene as a building material and will change its name to Argo Graphene Solutions due to its great prospects. Argo focuses on sustainable concrete, cement, and asphalt. Intensive studies are currently being conducted on both building materials in collaboration with partners. Argo's goal is clear: the Company aims to create scalable solutions and offer them to industry. On the way to achieving this, the Company announced its first success at the beginning of the week and has ordered 1,000 litres of high-purity graphene from an industrial customer to use in the production of concrete.

"This agreement is a milestone for Argo as we integrate state-of-the-art graphene oxide technology into our sustainable building materials," said Scott Smale, President and CEO of Argo. "The partnership with a respected global leader in graphene production strengthens our ability to offer high-performance, environmentally friendly concrete, cement and asphalt products to the North American market. Our goal is to develop marketable products for the North American market immediately and to work on EU certification to expand sales in Germany and the EU market."

Does Argo hold the holy grail for the green revolution in the building materials industry?

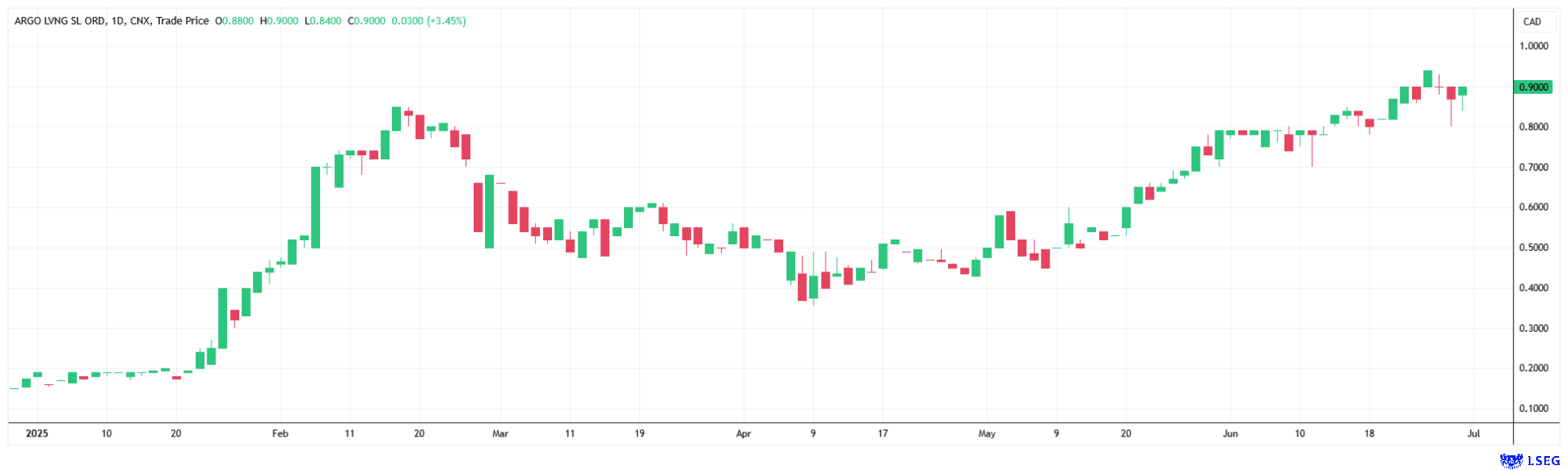

Argo Living Soils' share price has rewarded the Company's strategic shift towards low-carbon building materials, rising by more than 300% over the past six months. The market capitalization is still only a modest EUR 10 million. If the use of graphene in building materials confirms the benefits already shown in studies, Argo could become a sought-after supplier to the building materials industry. The global infrastructure maintenance backlog, the billions being invested in infrastructure in Germany and other regions, and the increasing pressure to act in the wake of climate change and high energy costs all speak in favor of Argo's business model. The share is speculative, but the Company could also become a takeover candidate - several building material manufacturers worldwide are looking for green solutions.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.