July 11th, 2024 | 06:45 CEST

Mega rally on the cards - 500% plus is likely too low an estimate! Evotec, Desert Gold, Cogia, VCI Global, and Lufthansa

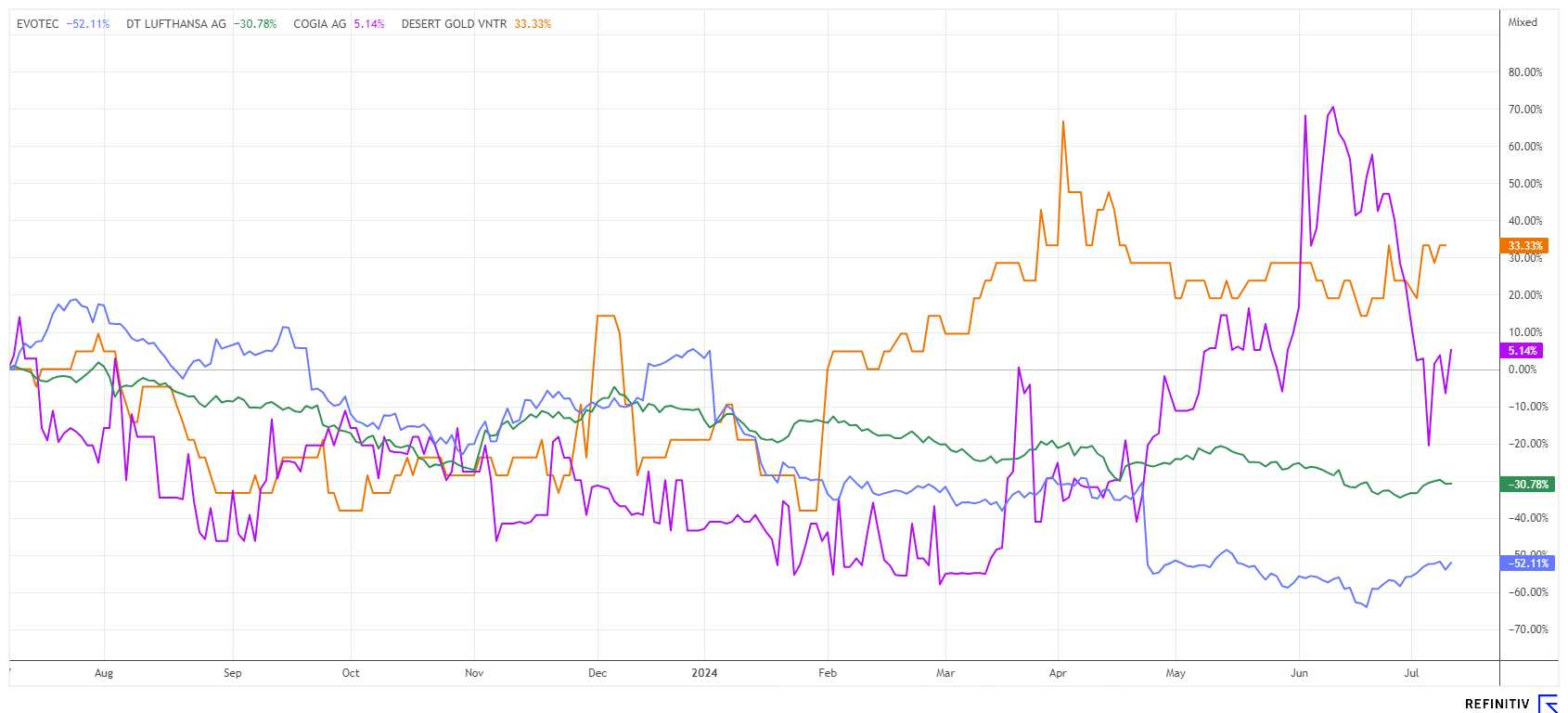

The stock market keeps rising and rising - this much is revealed by the ever-new highs of prominent indices such as the NASDAQ 100, S&P 500, or the Nikkei index. However, a closer look reveals some inconsistencies. For example, only 6% of all traded stocks are currently reaching new highs, while over 70% of all listed stocks have fallen since the beginning of the year. In short, global liquidity is aggregated in just a few blockbuster stocks, with the rest being left behind. Such bubbles already occurred in 1999, 2007, and 2015, followed by a 25% to 50% correction. When exactly this will happen, no one knows, but the party is likely to continue for a while due to high liquidity. Gold and silver are in the process of forming interesting breakout formations. Now is the time to pick the cherries!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , DESERT GOLD VENTURES | CA25039N4084 , Cogia AG | DE000A3H2226 , VCI GLOBAL LIMITED | VGG982181031 , LUFTHANSA AG VNA O.N. | DE0008232125

Table of contents:

"[...] Troilus has the potential to be an entire gold belt. All of our work to date points to this, and each drill hole makes the picture we have of the Troilus project much clearer. [...]" Justin Reid, President and CEO, Troilus Gold Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec - Now all that is left is the technical breakout

We have reported often on the Hamburg-based biotech company Evotec in recent days. Since the cyber attack and the dishonest machinations of ex-CEO Werner Lanthaler, the share price has struggled to get back on track. However, several news items would justify a higher valuation. Evotec has entered into a multi-year partnership with the US pharmaceutical giant Pfizer with the aim of advancing drug discovery. The deal could be lucrative for the Hamburg-based company. Under the terms of the agreement, Evotec and Pfizer will initially focus on early research and discovery in the areas of metabolic and infectious diseases. The major research work will take place at Evotec's facilities in France, with potential milestone and licensing payments on success. Christian Wojczewski, the new CEO, has been at the helm of Evotec since the beginning of July and must demonstrate success. At EUR 9.75, the share price is now waiting for the technical breakout line above EUR 10. Collect!

Desert Gold - Steep upward trend with the upcoming drill results

Precious metals were on the sidelines for a long time, but they were able to send out significant signs of life last week. Gold reached a new all-time high of USD 2,385, while its little brother silver rapidly climbed back above the USD 31 mark. In times of geopolitical uncertainty and constant inflation, precious metals represent a haven of security. After all, gold has been able to shine with a return of 8% per annum since the 1990s. Due to the various crashes, equities only managed to achieve this with a timing-optimized investment strategy.

Africa has been a continent of precious metals and commodities for several hundred years. Huge potential lies dormant there in important metals and minerals. Traditionally, the connection to Western investors has been a guarantee for investments on the continent. For several years, the Canadian explorer Desert Gold Ventures has focused on the Senegal Mali Shear Zone (SMSZ). Here, 1 million ounces of gold have already been identified close to surface. Investors are currently awaiting further drill results, which should be received shortly. CEO Jared Scharf and his management team are confident they will soon bring potential strategic partners on board to conduct the pre-feasibility study and finance the Heap Leach plant. The study will determine the viability of mining the oxide and transitional mineral resources at the Barani East and Gourbassi West gold deposits. If all goes according to plan, production could start in the second half of 2025. The exploration activities of major mining companies such as Barrick, B2 Gold, and Allied Gold in the region could also be a catalyst for Desert Gold's success. For their part, they are constantly looking for mine expansions and can easily finance further drilling from their cash flow. Bright prospects for the still-small Desert Gold. Currently, one can enter at around CAD 0.07, but strategic investors may need to pay well over 10 cents. The potential in the event of a takeover is as much as 1,500%.

Cogia and VCI Global - The deal of the year

Yesterday, there was more news from Cogia and VCI Global Ltd (VCIG). Last week, the two companies signed an agreement to acquire all rights to the crypto messenger "Socializer" for the equivalent of around USD 3.5 million. Now comes the news that they have set up a joint venture in the field of AI and secure communication solutions. We introduced VCI Global earlier this week as a diversified business and technology consulting service provider. They earn good money with capital market-related consulting services for international IPOs. If a listing works, high fees and investment income beckon.

The new joint venture is AiSecure Limited and is 70% owned by VCIG and 30% by Cogia. AiSecure will receive 100% ownership of VCIG's recently acquired messenger, "Socializer". Operationally, Cogia AG will take over the management and further software development, particularly the integration of generative AI into the secure messenger solution. The goal is to position AiSecure for a potential NASDAQ listing within 12 to 18 months. This partnership combines Cogia's long-standing expertise in artificial intelligence, big data, and secure communication solutions with VCIG's expertise in business strategy and technology consulting. Through VCIG's international presence in Malaysia, China, Singapore, the US, and the UK, Cogia plans to significantly expand the global user base of the future AiSecure Messenger platform. There is talk of more than 5 million users.

Cogia AG, based in Frankfurt, is a pioneer for innovative solutions in the areas of secure communication, AI-based products, customer experience management, web and social media monitoring, text mining, and open-source intelligence. Yesterday, the Frankfurt-based company's shares traded at EUR 0.45, up around 13% on the previous day. This means that Cogia is currently valued at only EUR 1.5 million. VCI Global is relatively stable on the Nasdaq at USD 0.55 and has been tradable in Frankfurt for two weeks. Calculated over 12 to 18 months, Cogia is definitely a 500 percenter; the train is just starting to roll. With a speculative eye, VCI Global should not be overlooked either.

Lufthansa - If EUR 6 falls, the cap will fly off

We recently drew attention to the special chart situation at Lufthansa AG. The share price has already tried twice in recent days to break through the EUR 6 mark. Unfortunately, these technical breakout attempts have so far failed. Although UBS has reiterated its "Buy" rating with a target of EUR 12.30, there was, unfortunately, a major downgrade yesterday. According to analyst Conor Dwyer from Morgan Stanley, the market for air travel remains weak, and there are hardly any signs of a recovery among all European airlines. Domestic German flights are disappointing, down 50% compared to 2019 levels. People are apparently listening to the constant red-green noise from Berlin and are reducing their flight activities in favour of the climate. The US investment experts are voting "Underweight" with a price target of EUR 6.50. This is how quickly climate protection turns into falling share prices. The EU's legal investigations into the government's Coronavirus aid in summer 2020 are also back on the agenda. Therefore, stay on hold for the time being, where there is smoke, there is usually fire.

High-tech stocks are hitting new highs on the price chart every day. Meanwhile, gold and silver are quietly making their way up. Desert Gold has already seen some positive movements, with the spring drilling results now pending. We see Evotec and Lufthansa as classic turnaround stocks. Both stocks have the potential to double.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.