April 3rd, 2024 | 07:35 CEST

HelloFresh about to be taken over? Bayer for the anti-cyclical investor! Altech Advanced Materials convinces: Opportunities with turnaround stocks!

Bayer shares gained around 7% last week. Is this the turnaround after the stock reached a multi-year low? The Altech Advanced Materials share is also working on an upward trend. The German battery hopeful has published a promising feasibility study. Their stationary storage systems are significantly more profitable than, for example, Tesla's MegaPacks. HelloFresh shareholders have been brought back to reality in recent weeks. After a decline of almost 80% in 6 months, is the share now ripe for a turnaround? Could there even be a takeover?

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

HELLOFRESH SE INH O.N. | DE000A161408 , BAYER AG NA O.N. | DE000BAY0017 , ALTECH ADV.MAT. NA O.N. | DE000A31C3Y4

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Altech Advanced Materials: Feasibility study for stationary storage systems is convincing

Next-generation battery technology is crucial to the success of electromobility and the energy transition. The German company Altech Advanced Materials AG is working on improving storage solutions. In future, the Company aims to offer coated silicon (project: Silumina Anodes) to increase the performance of electric vehicle batteries. A pilot plant has already been built in Saxony. Letters of intent for the supply of battery materials have also been signed with German and US car manufacturers and battery producers and based on the convincing feasibility study, planning for a large-scale production facility is underway.

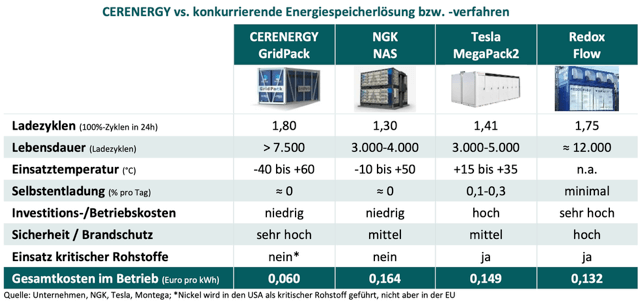

With solid-state batteries for grid storage solutions, Altech even has its sights set on a second billion-dollar market. A feasibility study was recently published for the planned CERENERGY® battery plant with an annual production capacity of 120 MWh, which was also convincing. According to the calculations, the total operating costs of the sodium chloride solid state CERENERGY® battery - consisting of common salt, nickel and ceramic - amount to EUR 0.06/kWh over the entire service life and are therefore significantly lower than those of conventional lithium-ion batteries. With the MegaPack2 from the Tesla Musk Group, for example, they are EUR 0.149/kWh and therefore more than twice as high.

The economic data in the study is also impressive, resulting in an annual sales potential of EUR 106 million at full capacity utilization. The EBITDA margin is expected to be a proud 47%, and the annual free cash flow before taxes is EUR 51 million. This results in a net present value (NPV) of EUR 169 million. The sales potential certainly exceeds this first production facility with a capacity of 120 MWh.

The expected profitability of the CERENERGY® project is very promising, and the joint venture partners Altech Advanced Materials AG, Altech Batteries Ltd, and Fraunhofer will now enter the financing phase of the project.

Bayer: Nothing speaks for rising share prices, or precisely that?

Are Bayer shares ready for a turnaround? After the multi-year low of below EUR 26 in mid-March, a countermovement would be anything but a surprise. Last week, there was at least a first sign of life from the share when it gained over 7% in just a few days. The reason for this was the IPO of Boundless Bio in the US. Around a year ago, Bayer acquired a stake in the Company, which specializes in the development of innovative therapeutics against extrachromosomal DNA (ecDNA). At the successful IPO last Thursday, Boundless Bio was valued at USD 356 million. Bayer holds a stake of around 6.6%. However, this will have no lasting impact on Bayer shares. And the Leverkusen-based company itself is not currently providing any positive impetus for rising share prices. The breakup of the Company is off the table for the time being. However, it remains unclear where the capital for growth financing will come from - among other things, to upgrade the manageable pharmaceutical pipeline. It is clear that legal disputes will continue. Even analysts have recently expressed little hope. Following a positive study on the active ingredient elinzanetant, JP Morgan published an update and left its recommendation at "Neutral". The target price is EUR 34. It is still too early to assess the revenue potential of the drug against menopausal symptoms.

HelloFresh: Will takeover speculation lead to a turnaround?

Looking at the share price, HelloFresh shares are also a turnaround candidate. However, after the disastrous quarterly figures and the collapse of the medium-term margin forecast, a lot of confidence has been destroyed, and real operational impetus is needed. Analysts have consistently reduced their share price targets in recent weeks. Most recently, Societe Generale reduced the fair value of HelloFresh from EUR 12 to EUR 7.20. The share is currently trading at around EUR 6.50. Six months ago, it was still trading at over EUR 30.

Could takeover speculation perhaps lead to the share's turnaround? The magazine "Börse Online" recently pointed out such a scenario. The Company still maintains a strong and interesting market position. In addition, HelloFresh's market capitalization would now only correspond to 0.15 times its annual revenue.

There are good reasons for Altech Advanced Materials' share price to rise. The Company is well on the way to addressing two billion-dollar markets in the future. Additionally, it has strong partners on board, so it does not have to finance the production facilities alone. The share should take off at the latest with positive financing news. For Bayer, only significant pessimism seems to support rising prices. On the other hand, the market position and low revenue valuation at HelloFresh could spark takeover fantasy, but whether investors want to speculate on this is another question.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.